Religare Care Elite – Review, Features and Benefits

It is difficult to foresee costs related to medical treatment. What if we require a huge ready cash in a medical emergency? Do we have this much cash readily available with us? In such a scenario one must buy good health insurance to back such kind of financial uncertainties in critical times. Religare Health Insurance’s Care Elite Plan is one such breather. With loads of valuable benefits and inbuilt features, it is a positive way to keep oneself and family members reassured at all times.

Features of this policy –

- Lifelong maturity age

- No maximum age bar

- No limit on ICU charges

- Lifelong Renewability

- No claim bonus is also available in this policy

- The premium can be paid Monthly, Quarterly, and Half-Yearly

- 30 days waiting period for any illness except injury

- Tax benefit on premiums paid u/s 80D of Income Tax Act, 1961.

Benefits of this policy –

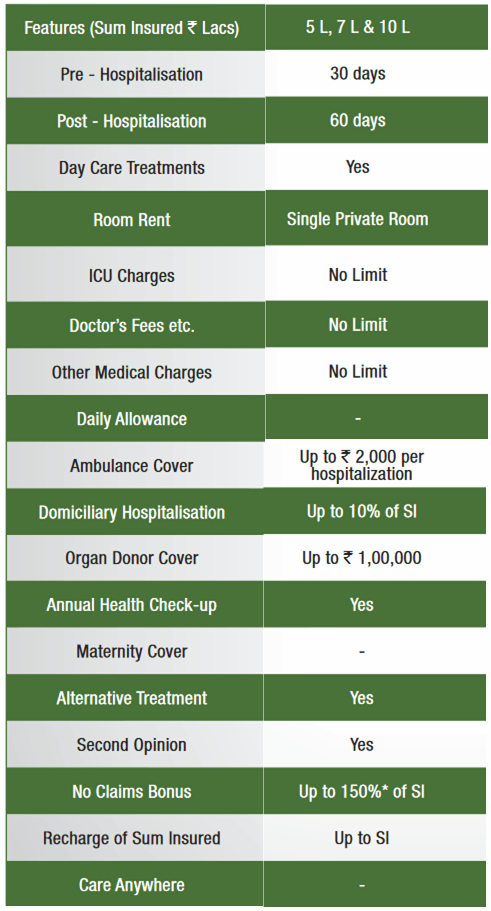

Before we get in the details about the benefits under this policy. Let us see a pictorial representation of the benefits. For a detailed description of the benefits, please refer to the policy wordings. Please note that the Religare Care Health Insurance has various variants. This review only talks about the Religare Care Elite Health Insurance Policy.

- In-Patient Hospitalization – If the insured is admitted to the hospital for in-patient care which is medically necessary, for a minimum period of 24 hours, then the insurer will pay, maximum up to Sum Insured, for the medical expenses incurred by the insured at the hospital – from room charges, nursing expenses and intensive care unit charges to surgeon’s fee, doctor’s fee, anesthesia, blood, oxygen, operation theatre charges which forms a part of hospitalization.

- Day Care Treatment – Some surgeries don’t necessarily require hospitalization stay for more than 24 hours. It may happen that the surgery underwent is minor or of intermediate complexity. In this case the insurer will pay for all such daycare treatments as per Annexure-I (page 33 onwards) to Prospectus, maximum up to Sum Insured.

- Pre-Hospitalization Medical Expenses – At times Investigative tests, consultation fees, and medication can be quite financially draining. This policy will cover the medically necessary expenses (maximum up to Sum Insured) incurred by the insured for a period of 30 days immediately before the date of your admissible hospitalization, provided the insurer will not be liable to make payment for any pre-hospitalization medical expenses incurred before the Policy Start Date.

- Post-Hospitalization Medical Expenses -The expenses don’t end once the insured is discharged from the hospital. There might be follow-up visits to the doctor, a medication that is required and sometimes even further confirmatory tests. In such a case, the insurer will also cover the medically necessary expenses (maximum up to Sum Insured) incurred by the insured for a period of 60 days immediately after the discharge from the hospital.

- Ambulance Cover – Getting medical attention as soon as one requires is very important, especially in an emergency. This policy will pay up to a specified amount per hospitalization, for expenses that the insured has incurred on an ambulance service offered by the hospital or any service provider, in an emergency situation.

- Organ Donor -This policy will also pay a specified amount for medical expenses incurred by the insured towards their organ donor while undergoing organ transplant surgery. Pre-Hospitalization and Post Hospitalization Medical Expenses will not be payable with respect to the donor.

- Second Opinion – If the insured of the policy is suffering from a serious illness (namely Benign Brain Tumour, Cancer, End-Stage Lung Failure, Coma, Stroke, Major Organ Transplant, Paralysis, Major Burns & Total Blindness etc….) and feel uncertain about the diagnosis or wish to get a second opinion within India from a doctor on your medical reports for any other reason, the insurer will arrange one for the insured person, free of cost, without any impact on Sum Insured amount. This second opinion is available to every Insured Person, once for each Major Illness / Injury per Policy year.

- Alternative Treatments – At times it happens that with conventional medical treatment some alternative therapies also help in the process of recovery. Therefore, the insurer is ready to pay a specified amount for medical expenses incurred by the insured towards in-patient admission in a Government Hospital or in any Institute recognized by the Government which administers treatment related to the disciplines of medicine namely Ayurveda, Unani, Sidha and Homeopathy.

- Annual Health-Check Up – To all the insured persons who are covered under this policy on a cashless basis, the company will provide an annual health check-up at the impaneled Network hospitals in India. This Benefit will be available only once during a policy year per Insured Person.

- Domiciliary Treatment – If the insured is not in a condition to go to the hospital or if there is no bed vacant in the hospital and the patient needs utmost care, then under this benefit the insurer will pay a specified amount for medical expenses incurred during the treatment at home, as long as the treatment is for more than 3 consecutive days. Pre and Post Hospitalization Medical Expenses will not be paid in respect of a claim made under this policy.

Exclusions under this policy –

There are various exclusions under this policy. For complete list of exclusions under this policy, please refer to the Exclusion List under this policy.

|

|

|

|

|

|

Documents required for filing a claim –

A list of documents will change as per the benefits under various variants. Listed down are the common documents that will be required at the time of claim the policy. For the entire list under various variants, please refer to the policy wordings (page 15, sub-section 6.5 onwards).

|

|

|

|

|

|

|

|

|

|

|

|

Can I cancel the policy if I didn’t like its terms and conditions?

Yes, the policyholder can cancel the policy on disagreement with the terms and conditions of the policy within 15 days from the receipt of the Policy document stating the reason for the policyholder’s objection. This period is called Free-Look Period.

If no claim has been made under the Policy, then the insurer will refund the premium received after deducting proportionate risk premium for the period on cover, expenses for medical examination and stamp duty charges if any.

Conclusion –

So, by now you know each and every important detail about this policy. Do let me know if I have missed any important points in the comment section. Please feel free to ask any doubts regarding this policy.