LIC Jeevan Shiromani (Table 847) – Review, Features and Benefits

LIC’s Jeevan Shiromani plan offers a dual benefit of protection and savings. This policy is specially designed for High Net-worth Individuals. Financial support for the family in case of unfortunate death of the policyholders is provided during the policy term. If the policyholder survives at specified duration during the policy term, then Periodic payments shall also be paid.

And a lump sum payment to the surviving policyholder at the time of maturity will be paid. In addition, this plan also provides for payment of a lump sum amount equal to 10% of the chosen Basic Sum Assured on the diagnosis of any of the specified Critical Illnesses.

Features of this policy – (Table 847)

- Dual Benefit of protection and savings

- The premium can be done either monthly, quarterly, half-yearly and annually.

- Inbuilt Critical Illness Rider

- 3 Rider Benefits

- One can receive paid up as soon as the policy completes 1 full year of premium paid.

- One can surrender the policy after completing 1 yr provided the premium has been paid.

- The loan facility is available against this policy.

- Policy Term – 14 yrs, 16 yrs, 18 yrs and 20 yrs

Benefits of the policy –

a) Death Benefit:

- On death during the first five years: If the policyholder dies during 1st 5 years, then the nominee will receive Death Benefit as “Sum Assured on Death” + accrued Guaranteed Addition.

- On death after completion of five policy years but before the date of maturity: If the policyholder after completion of 5 yrs of policy, then the nominee will be paid “Sum Assured on Death” and + accrued Guaranteed Addition + Loyalty Addition.

Where “Sum Assured on Death” is defined as the highest of –

- 10 times of annualized premium; or

- Sum Assured on Maturity as defined in 1. c) below; or

- Absolute amount assured to be paid on death, i.e. 125% of Basic Sum Assured.

This death benefit shall not be less than 105% of all the premiums paid as on date of death

b) Survival Benefit:

If the policyholder survives to each of the specified duration during the policy term, provided all

due premiums have been paid, then a fixed percentage of Basic Sum Assured shall be payable.

The fixed percentage for various policy terms is as below:

- For policy term 14 years:

30% of Basic Sum Assured on each of the 10th and 12th policy anniversary. - For policy term 16 years:

35% of Basic Sum Assured on each of 12th and 14th policy anniversary. - For policy term 18 years:

40% of Basic Sum Assured on each of the 14th and 16th policy anniversary. - For policy term 20 years:

45% of Basic Sum Assured on each of the 16th and 18th policy anniversary.

c) Maturity Benefit –

If the policyholder survives till the end of the policy term, the policyholder will get “Sum Assured on Maturity” + accrued Guaranteed Additions and Loyalty Addition, provided all due premiums have been paid.

Where “Sum Assured on Maturity” is as under:

- 40% of Basic Sum Assured for policy term 14 years

- 30% of Basic Sum Assured for policy term 16 years

- 20% of Basic Sum assured for policy term 18 years

- 10% of Basic Sum assured for policy term 20 years

d) Inbuilt Critical Illness Benefit –

i) Lump-sum Benefit – If the claim is admissible, then the Inbuilt Critical Illness Benefit, equal to 10% of Basic Sum Assured shall be payable.

ii) Second Medical Opinion -The policyholder has the option of taking 2nd medical opinion through the available healthcare providers, internationally or through reputed hospitals in India or through specialist doctors available in different places depending on the arrangement in this regard by the Corporation. This facility shall be available only once during the policy term with no extra cost.

iii) Option to delay the payment of premium(s) – When a claim under inbuilt Critical Illness Benefit is admitted, the policyholder will have an option to delay the payment of premiums falling due within 2 years from the date of admission of Critical Illness claim under the policy (including rider premiums). The delay of premiums shall be allowed for 2 years from the date of admission of Critical Illness claim and subsequent premiums, if any, shall be payable on their due dates. No interest shall be charged from the policyholder for delayed premiums within the period of such delays.

List of Illnesses covered under Critical Illness benefit –

In total there are 15 illnesses which are covered under LIC Jeevan Shiromani’s critical illness benefit. Let’s have a look at them –

|

|

|

|

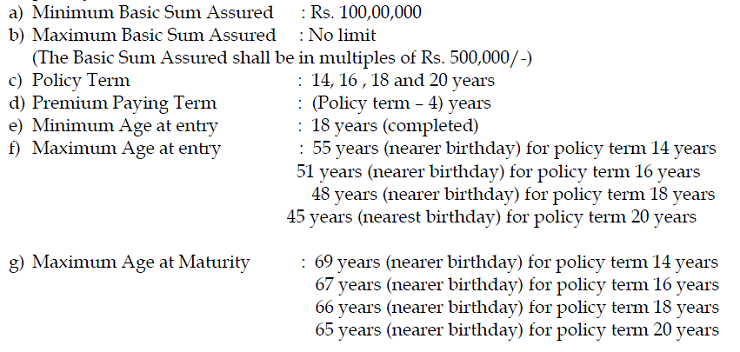

Eligibility Conditions of LIC Jeevan Shiromani Policy –

Every policy has some or the other eligibility conditions. This policy also has some eligibility conditions. Let’s have a look at these conditions –

Rider Benefits –

There are 3 rider benefits in this policy. Let us know more about them –

a) LIC’s Accidental Death and Disability Benefit Rider –

This rider can be opted within the premium paying term of the Base plan provided the outstanding premium paying term is at least 5 years. If the policyholder opts for this rider, then the Accident Benefit Rider Sum Assured will be payable as lumpsum along with the death benefit under the base plan. If the policyholder gets any disability due to accident (within 180 days from the date of accident), an amount equal to the Accident Benefit

Sum Assured will be paid in monthly installments spread over 10 years.

b) LIC’s Accident Benefit Rider –

This rider can opt within the premium paying term of the Base plan

provided the outstanding premium paying term is at least 5 years. The benefit cover under

this rider shall be available during the premium paying term.

c) LIC’s New Term Assurance Rider –

This rider is available at the inception of the policy only. The benefit cover under this rider shall

be available during the policy term.

Can the lapsed policy be revived?

Yes, A lapsed policy can be revived within 2 consecutive years from the date of the first unpaid premium by paying all the due premium together with interest (compounding half-yearly). Revival of rider(s), if opted for, will be considered along with the revival of the Base Policy, and not in isolation.

Can I surrender my 1 yr old policy?

Yes, If the policy is active and 1 full yr premium has been paid then the policy can be surrendered and the policyholder will receive its surrender value.

Can I take a loan against this policy?

The loan can be taken against the policy provided the policy has acquired a surrender value. Any outstanding loan along with interest shall be recovered from the survival benefits or claim proceeds at the time of exit. The maximum loan as a percentage of surrender value shall be as under:

- For paid-up policies – up to 80%

- For active policies – up to 90%

Can I return the policy if I didn’t like its terms and conditions?

Yes, If the policyholder doesn’t like the terms and conditions of the policy, then the policy can be returned within 15 days from date of receipt of the same to the Corporation stating the reason of objections. These 15 days is called the Free Look Period.

Exclusions in the policy –

This policy will be considered invalid in terms of Suicide. Let’s see 2 cases –

- If the policyholder (whether sane or insane) commits suicide at any time within 12 months from the date of commencement of risk, the Corporation will pay only 80% of the premiums paid excluding any taxes, extra premium and rider premium(s) other than term assurance rider, if any, provided the policy is active. The corporation will not entertain any other claim.

- If the policyholder (whether sane or insane) commits suicide within 12 months from date of revival, an amount which is higher of 80% of the premiums paid till the date of death (excluding any taxes, extra premium and rider premium(s) other term assurance rider, if any) or the surrender value shall be payable. The Corporation will not entertain any other claim under this policy.

Video Review of the Policy –

Conclusion –

As you all have come to know every detail about this policy, now it is up to you all to decide if this policy falls under your set criteria of good policy or not. Do let us know your views regarding this review. If you have any doubts regarding this policy then please let us know in the comment section.