LIC Jeevan Saral Plan (Table 165) – Review, Benefits & Features

LIC Jeevan Saral is a very special kind of endowment plan from LIC. The policy offers various benefits like flexibility in choosing the premium, tenure of the policy, tax benefits, loyalty additions, various riders and is aimed at investors who would like to get guaranteed returns from their investment.

Also, unlike other LIC policies, this policy also gives back the premium amount along with sum assured on death. One can choose the premium on a monthly, quarterly, half-yearly or yearly basis as per their convenience.

Features of LIC Jeevan Saral (Table number 165)

- In this plan, your sum assured is equal to 250 times the monthly premium. So, if your premium is Rs 5,000 per month, your sum assured will be Rs 12.5 lacs.

- Sum assured along with loyalty addition money if the policyholder survives the entire term of the policy

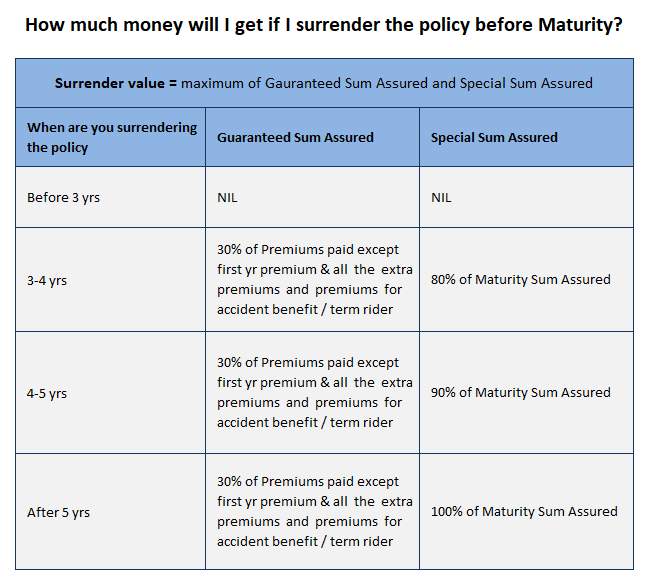

- No money will be paid for the first 3 yrs. (one cannot surrender the policy before 3 yrs. completes). Also, the policy will acquire a surrender value from 4th yr. on-wards, subject to terms & conditions.

- One can enjoy the loyalty additions benefits from this policy only when the policy is continued for a minimum of 10 yrs.

- Under this policy, the policyholder is free to choose the premium amount along with the tenure of the policy.

- If the policy is surrendered after 5 yrs., there won’t be any surrender penalty

- One gets a complimentary extended risk cover for an additional year after 3 yrs premium payment.

Eligibility Criteria of this policy –

- No minimum age required at the time of maturity, whereas 70 yrs. is the maximum maturity age

- Individuals who fall under the age group of 12-49 years have to pay a premium of Rs 250 per month

- Individuals who fall under the age group of 50-60 years have to pay premium of Rs 400 per month

- The minimum and maximum policy term are 10 yrs. and 35 yrs.

- The minimum entry age of the insured is 12 years whereas the maximum entry age is 60 yrs.

- This policies sum assured is at least 250 times of monthly premium

- One can pay a maximum of Rs. 10,000 as monthly premium.

Documents required for buying this policy –

- Application form with accurate medical details

- Address Proof

- Other KYC documents such as Aadhaar Card, Pan Card, Passport

- Age proof

- Depending upon sum assured, a medical test may be required in some cases

Various Benefits of this policy –

Death Benefit – How much will I get if die before my policy term?

In case one dies before the maturity period, the family (nominees) of the policyholder will get the following things

- Sum Assured

- All the premiums paid, minus the first-year premium

- Also, any premiums for additional riders taken + loyalty additions will also be deducted

Survival Benefit – How much will I get on the Maturity of policy?

In case one dies before the maturity period, the family (nominees) of the policyholder will get the following things

- Sum Assured

- Loyalty Addition

Riders Available under Jeevan Saral

Apart from the base policy, one can also add some extra benefits in this plan (called RIDERS) by paying an extra premium. Under this plan, 2 riders are available

Rider 1 – Term Rider

If one wants to increase their sum assured by a big margin, one can opt for a term rider (which is just like a term plan), which will give a big boost to your sum assured amount.

Rider 2 – Accidental Death and Disability Rider

If one wants to cover the risk of accidental death or disability, one can opt for this rider. So, even if one loses some body part or is unable to work after an accident, they will get certain benefit from this policy.

Surrender Benefit –

It is a benefit that one gets on surrendering the policy. One can get the guaranteed surrender value of the policy only when the policy has completed 3 years. Once the policyholder receives the surrender value, the policy will terminate and no benefit can be extracted from that policy.

Income Tax Benefit of LIC Jeevan Saral

This policy comes under 80C benefits. So all the premiums you pay for this policy will be exempted up to Rs 1,50,000 per year. Also, one does not have to pay any tax on maturity withdrawals or on death (Section 10D)

Is there any loan facility available in this policy?

Loan facility is available under this policy

What all is not included in the policy?

If the policyholder commits suicide within one year of taking policy then the LIC Jeevan Saral Policy will become void and the insurer will be not liable to pay any claim to the nominee of the policyholder.

Can I revive my policy if it has lapsed?

Yes, the policy can be revived within 2 years of the first unpaid premium. In order to revive the policy, one has to pay the outstanding premium along with any interest.

Video Review of the Policy –

Conclusion –

So, by now you all know each and every detail of the policy. if you feel that I have missed out on any important point, then please highlight in the comment section. Do Let me know If this article has helped you to choose the best Life insurance policy also if you have any question you can put it across in the comment section.

Hello Sirs,

I have jeevan saral policy from 2013. I pay yearly Rs. 60050/-.and i have paid premium last 10 years

I want to surrender the policy. How much amount can be received after surrender.

Approx 4-5 lacs I guess

I had bought plan 165 (Jeevan Saral) in 2009 at the age of 27. policy term was for 15 years, it will be matured in 2024. The instalment amount was 6065/ half year (12130 yearly). will you please help me to the returns amount after maturity. policy will be matured in 2024.

I

I am not clear what help are you looking for ? You want to invest that money which you will get from maturity?

i want to surrender my jeevan saral ploicy . it has been 9 years & few months . which would be best time to surrender the policy . i donot want to lose money

You need to check what is the surrender value and in your situation will it make sense to invest that and future premiums to gain more than the maturity value.

Manish

What is the average rate of return of a Jeevan Saral policy on maturity of 11 yrs,21 yrs and 31years

I think it shall come in range of 3-5%

Someone enquired from me who is NRI and had taken the policy some 12 years back while holding status of NRI on the advice of his LIC agent whether eligible to hold such policy till maturity( 35 year plan) or not and if not, whether to surrender the policy or continue. In case of surrendering policy, if required then will there be any tax liability.

Would highly appreciate if someone could tell for sure whether NRI is eligible to take this Jeevan Saral policy or the policy is meant only for Indian Resident. Also request if someone can tell where to raise this query if definitive answer is not known

Yes, NRI can take these policies.. but its not suggested from investment point of view as these policies return is quite low like 4-5% max!

thank u very much for the response. U r right that there is no point NRI to take policies here in India but his LIC Agent failed to explain this and w/o giving a thought, he invested.

would appreciate if u could suggest whether advisable to surrender the policy after completing 12 years and would be any tax liability.

thanks once again.

No tax liability!

Just surrender the policy!

I have six polices each with 6005/- premium since June, 2009. I brought it when I was 37 years.. Policy term is 33 years.

Should I surrender them and go for LIC’s online term plan?

It costs me 13983. For 50L SA, 15 years term. I need up to 15 year term only.

Yes, better go for a term plan ..

Surrender it after 10 years

I had a plan 165 LIC June, 2013 sum of RS. 3032/- half yearly. I have deposited total amount 42480/- aprox. 7 year (14 installment). i want to know how much whatever i will get total amount with bonus. i will asked at LIC office for surrnderd value they give me a quotation which have amount only 34669/-

Yes, that’s the amount you will get back if they are saying so !

My polici surnder velyu

Polici nomber 854661767

Jeevan saral

Hello, We won’t be able to help you with this query. Kindly ask your agent.

Thank You

Anuradha

How much total amount I will get after completion of Policy 15 years (per month 510/- premium)

Hello Ms. Pushpa, We won’t be able to help you with this query. Kindly contact LIC. Thank You

Anuradha