LIC Cancer Cover (Table 905) – Review, Benefits and Eligibility

LIC’s Cancer Cover is a non-linked, regular premium payment health insurance plan which provides fixed benefit in case the policyholder is diagnosed with any of the specified Early and/or Major Stage Cancer during the policy term, subject to certain terms and conditions. LIC Cancer Cover Policy can be purchased offline as well as online.

This policy has two benefit options which the policyholder can choose at the time of purchasing the cancer cover plan. The rate of premium will vary as per the plan selected by the policyholder. The benefit options are as follows –

| OPTION 1

Level Sum Insured – The Basic Sum Insured shall remain unchanged throughout the policy term. |

OPTION 2

Increasing Sum Insured – The Sum Insured increases by 10% of Basic Sum Insured each year for the first five years starting from the first policy anniversary or until the diagnosis of the first event of Cancer, whichever is earlier. |

Benefits Payable of the Policy –

These are the benefits which will be payable to the policyholder during the policy term provided the policy is active –

A) Early Stage Cancer – Benefits payable on the first diagnosis of any one of the specified Early Stage Cancers, provided the same is admissible are –

- Lump-sum benefit – 25% of Applicable Sum Insured shall be payable.

- Premium Waiver Benefit – Premiums for next three policy years or balance policy term whichever is lower, shall be waived from the policy anniversary coinciding or following the date of diagnosis.

B) Major Stage Cancer – Benefits payable on the first diagnosis of the specified Major Stage Cancer, provided the same is admissible are –

- Lump-Sum – 100% of Applicable Sum Insured less any previously paid claims in respect of Early Stage Cancer shall be payable.

- Income Benefit – In addition to above lump-sum benefit, Income Benefit of 1% of Applicable Sum Insured shall be payable on each policy month following the payment of Lump Sum, for a fixed period of next ten years irrespective of the survival of the policyholder and even if this period of 10 years goes beyond the policy term. In case of death of the policyholder while receiving this Income Benefit, the remaining pay-outs, if any, will be paid to the nominee of the policy.

- Premium Waiver Benefit – All the future premiums shall be waived from the next policy anniversary and the policy shall be free from all liabilities except to the extent of Income Benefit as specified above.

Documents required for the purchase of policy –

The documents required for purchase of LIC Cancer Cover Plan are as follows –

| Identity Proof – Any government ID like Aadhaar card, Pan card, Voter card, driving license etc. | Bank Details – Cancelled cheque |

| Income Proof – Salary slip of last 3 months or CA certified balance sheet | Age Proof – School leaving certificate, birth certificate |

| Residential Proof – Electricity, phone bill | Nominee Details – ID card and residential proof If asked |

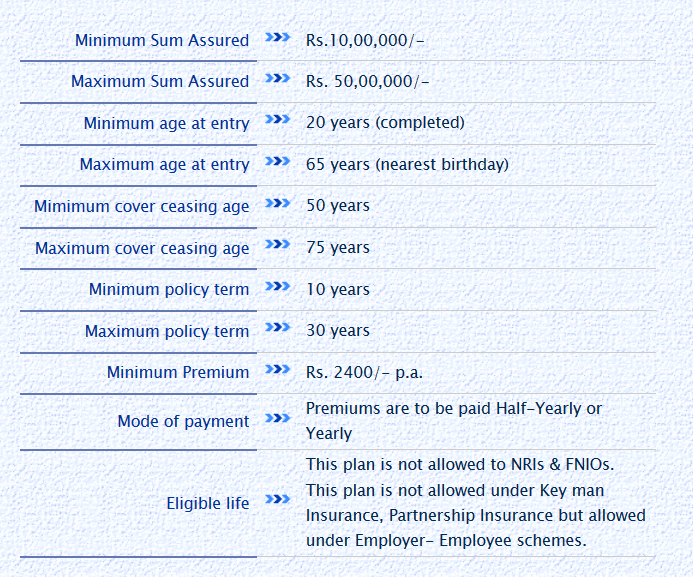

Eligibility Criteria of this policy –

Like other policies, LIC Cancer Cover also has some eligibility conditions. Let us have a look at them –

Is there any waiting period in the policy?

Yes, there is a waiting period in the policy. A waiting period of 180 days will apply from the date of issuance of policy or date of revival of risk cover, whichever is later, to the first diagnosis of any stage cancer. “Any stage” here means all stages of Cancer that occur during the waiting period.

No benefit shall be payable if any stage of Cancer occurs before expiry of 180 days from the date of issuance of policy or date of revival and the policy shall terminate.

The survival period of the policy –

There is a 7-day survival period in the policy, If the policyholder is diagnosed with any of the early-stage cancer or major stage cancer. No benefit shall be payable if the Life Assured dies within a period of 7 days from the date of

diagnosis of any of the specified Early Stage Cancer or Major Stage Cancer. The 7 days survival period includes the date of diagnosis.

When can the policyholder pay the premium?

The policyholder can pay premiums regularly during the policy term at yearly or half-yearly mode. A grace period of one month but not less than 30 days will be allowed for both yearly and half-yearly modes.

Can the policy be revived if it has lapsed?

Yes, a lapsed policy can be revived within a period of two consecutive years from the date of the first unpaid premium and before the date of maturity, on submission of proof of continued insurability to the satisfaction of the Corporation provided all the due premiums have been paid together with interest (compounding half-yearly) at such rate as fixed by the Corporation from time to time.

Is there any paid-up value, surrender value or loan facility against this policy?

LIC Cancer Cover Policy shall not acquire any paid-up value and surrender value. The loan facility will also not be provided against this policy.

Can I return the policy if I am not satisfied with it’s terms and conditions?

If the policyholder is not satisfied with the “Terms and Conditions” of the policy, then the policyholder may return

the policy to the Corporation within 15 days (30 days if policy is purchased Online) from the date of receipt of the policy bond stating the reasons of objections. This period is known as a free look period.

On cancellation of the policy, the corporation shall return the amount of premium deposited after deducting the proportionate risk premium for the period on cover, (shall not be applicable during the waiting period) and charges for stamp duty.

Exclusions in the policy –

If the below-covered conditions resulting directly or indirectly from any of the following causes, then the corporation shall not be liable to pay any of the benefit under this policy and the policy will stand canceled. Let us see these causes –

- Any pre-existing condition.

- If the diagnosis of a Cancer was made within 180 days from the Date of issuance of policy or date of revival of risk cover whichever is later.

- For any medical conditions suffered by the policyholder or any medical procedure undergone by the policyholder if that medical condition or that medical procedure was caused directly or indirectly by Acquired Immunodeficiency Syndrome (AIDS), AIDS related complex or infection by Human Immunodeficiency Virus (HIV).

- For any medical condition or any medical procedure arising from the donation of any of the policyholder’s organs.

- For any medical conditions suffered by the policyholder or any medical procedure undergone by the policyholder, if that medical condition or that medical procedure was caused directly or indirectly by alcohol or drug (except under the direction of a registered medical practitioner).

- For any medical condition or any medical procedure arising from nuclear contamination; the radioactive, explosive or hazardous nature of nuclear fuel materials or property contaminated by nuclear fuel materials or accident arising from such nature.

Video Review of the Policy –

Conclusion –

So, by know you are well versed with the important details of the policy. Now it’s up to you to decide if this policy is suitable for you or not. Do let me know if I have missed any important point in the comment section. Please feel free to ask any doubts regarding this policy.

Dear Sir,

Kindly Send me details of cancer cover plan table age, amount insured amount