ICICI Pru Easy Retirement (Single Premium) – Review, Features and Benefits

ICICI Prudential Easy Retirement SP plan is a single premium unit-linked insurance plan, which is specially designed to take care of post-retirement income.

The policy basically helps to build the corpus as per policyholder’s risk appetite, with a single premium once for the entire tenure, and reap the benefits during the income phase, through any of the vesting age option.

Features of this Policy –

- It builds your retirement corpus as per your risk appetite

- It protects your savings from market downturns through an Assured Benefit

- You can pay the premium only once and get regular pension post-retirement

- You can also invest any available money into the policy in the form of Top-ups

- At retirement, choose from the available annuity options as per your needs and get regular income •

- Avail tax benefits on premiums paid and receive up to 60% of the accumulated value on retirement date as a tax-free lump sum.

Benefits of this Policy –

a) Assured Benefit –

On vesting, i.e. maturity, you will be entitled to the Assured Benefit or Fund Value, whichever is higher. Alternatively, you can choose to postpone your vesting date.

- Assured Benefit = 101% X (Sum of Single Premium and Topups, if any).

b) Death Benefit –

a) In the unfortunate event of the death of the Life Assured, the nominee, or in the absence of a Nominee the legal heir, will receive the Guaranteed Death Benefit or the Fund Value, whichever is higher, unless money is in the PDP Fund.

- Guaranteed Death Benefit = 105% of the(Sum of single Premium and Top-ups, if any received up to the date of death.)

b) In the unfortunate event of the death of the Life Assured, while money is in the PDP Fund, the PDP Fund Value shall be payable to the nominee.

c) Surrender Benefit –

If the policyholder wants to surrender the policy before completing 5 years, then the insurance cover will cease and the fund value net of any discontinuance charge will be transferred to the Discontinued Policy Fund. The Discontinued Policy Fund will be credited with a minimum interest rate of 4% p.a. and the proceeds from this will be payable after the fifth policy anniversary.

In case of death of the Life Assured during this period, only the accumulated fund value will be payable to the nominee. If the policyholder surrenders the policy after completion of 5 policy years, then the insurance cover will cease and your fund value including top-up value shall be paid immediately and the policy would be terminated.

d) Loyalty Addition –

On completion of the sixth policy year and on completion of every policy year thereafter, there will be a guaranteed Loyalty Addition, provided the money is not in the PDP Fund. This will be equal to 0.25% of the average daily total Fund Value over the preceding 12 months. These Loyalty Additions will reduce the effective Fund Management Charge for your policy as illustrated below –

The guaranteed Loyalty Additions mentioned above will be allocated between Easy Retirement SP Balanced Fund and Easy Retirement Secure Fund in the proportion of the values of total units held in each fund at the time of allocation. Loyalty Additions will be made by the allocation of extra units. Loyalty Additions shall not be taken back under any circumstances.

e) Top Up –

You can invest any available money in the form of Top-ups in this policy provided the money is not in the Pension Discontinued Policy Fund. The provision to pay Top-ups will be available up to five years prior to your original or postponed vesting date. The minimum amount of Top-up is Rs 2000.

This value is subject to change from time to time as per the rules of the Company, subject to prior approval from the (IRDAI). You will have the flexibility to invest Top-ups in Easy Retirement SP Balanced Fund and Easy Retirement Secure Fund in any proportion of your choice. Treatment of Top-ups will be in accordance with applicable regulations, guidelines, and circulars.

f) Pension Booster –

On completion of the tenth policy year and on completion of every fifth policy year thereafter, there will be a guaranteed Pension Booster. This will be equal to 2% of the average daily total Fund Value over the preceding 12 months.

The guaranteed Pension Boosters mentioned above will be allocated between Easy Retirement SP Balanced Fund and Easy Retirement Secure Fund in the proportion of the values of total units held in each fund at the time of allocation. Pension Boosters will be made by the allocation of extra units. Pension Boosters shall not be taken back under any circumstances.

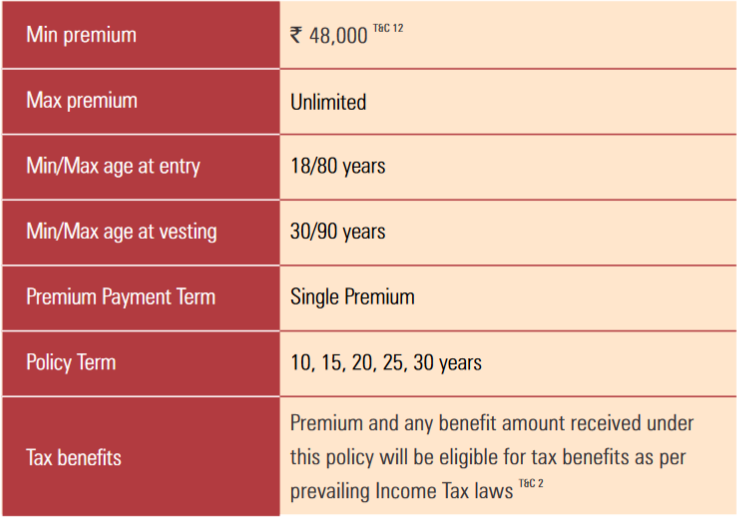

Eligibility Criteria of the Policy –

Is Switching allowed in the policy?

You have the option to switch units between Easy Retirement SP Balanced Fund and Easy Retirement Secure Fund as and when you choose, depending on your financial priorities and investment outlook. The minimum switch amount is Rs 2000.

How my policy will be treated while my money is in the PDP Fund?

While money is in the PDP Fund –

- Assured Benefit and Guaranteed Death Benefit will not apply

- A Fund Management Charge of 0.5% p.a. of the PDP Fund will be made. No other charges will apply.

- From the date monies enter the PDP Fund till the date they leave the PDP Fund, a minimum guaranteed interest rate declared by IRDAI from time to time will apply. The current minimum guaranteed interest rate applicable to the PDP Fund is 4% p.a.

At the end of the lock-in period, You will be entitled to the PDP fund value.

Charges under the policy –

a) Premium Allocation Charge –

There is no premium allocation charge for the Single Premium. All Top-ups are subject to Premium Allocation Charges of 2%.

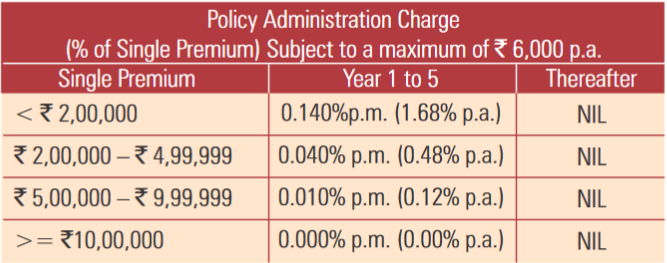

b) Policy Administration Charge –

This charge will be a percentage of the Single Premium and will be levied every month for the first five policy years. Policy Administration Charge is capped at Rs 6,000 per annum. These charges will be made by redemption of units. The Policy Administration Charge will be as set out below –

c) Switching Charges –

Four free switches are allowed every policy year. Subsequent switches will be charged at Rs 100 per switch. Any unutilized free switch can not be carried forward to the next policy year. These charges will be made by redemption of units

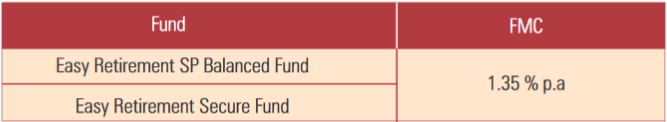

d) Fund Management Charge (FMC) –

The following fund management charge will be adjusted from the NAV on a daily basis. This charge will be a percentage of the fund value –

Can I can the policy if I didn’t like its terms and conditions?

The Free look period will not be applicable to policies sourced under the Tied category.

For the Standalone category, if the insured is not satisfied with the terms and conditions of this policy, the insured can return the policy document to the Company with reasons for cancellation within 15 days or 30 days (if the policy is purchased through distance marketing). This period is known as the Free Look Period.

On cancellation of the policy during the free-look period, the insured shall be entitled to an amount which shall be equal to non-allocated premium plus charges levied by cancellation of units plus Fund Value at the date of cancellation less stamp duty expenses under the policy. The policy will terminate on payment of this amount and all rights, benefits, and interests under this policy will stand extinguished.

Are there any partial withdrawals in the policy?

This policy does not allow partial withdrawals.

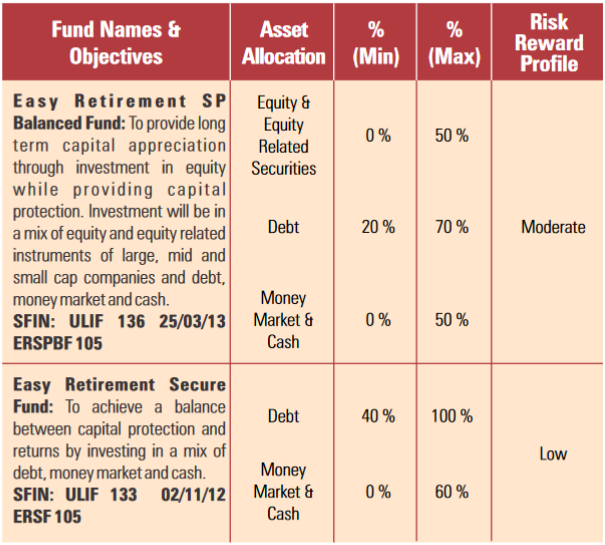

How will your funds be invested in the policy?

ICICI Pru Easy Retirement SP allows you the choice of two fund options. You can switch between these funds using our switch option. The details of the funds are given in the table below –

How does a mix of equity and debt beat inflation?

Inflation is the rate at which the price of goods and services increases over a period of time. For example, the price of a particular item has increased from Rs 200 in 2018 to Rs 350 in 2020.

To gain from your investments, your savings should grow at a rate higher than the inflation rate.

In order to get better returns in the long run, it is advisable to have equity exposure. Equity markets are subject to short-term market volatility. However, the effect of market volatility is negligible in the long term.

Below is an example of how investing in a mix of equity and debt can help in building your savings,

If 60% of your money was invested in the equity market and 40% in the debt market in the last 12 years, your investment would have grown by around 12% on an annualized basis. This growth would have helped you stay ahead of the inflation rate of about 7.7% in the same period.

How much Assured Benefit will I get?

In case your Fund Value at maturity is less than the sum of premiums paid by you, the Assured Benefit ensures that you receive 101% of all the sum of premiums paid by you and top-ups if any. You can utilize this benefit amount only as per the available options. There are two options available with this plan:

- You can commute up to one-third of the benefit amount available on the termination of the policy, or to the extent allowed under the Income Tax Act. The balance amount can be used to purchase an immediate annuity plan offered by ICICI Prudential

- Purchase a single premium deferred pension product offered by ICICI Prudential with the entire amount.

Alternatively, you can choose to postpone your vesting or maturity date. This means you can change the date from which you want your regular income to start. You can postpone the vesting date as many times as you want, provided your age is below 55. As a result, your money is protected as the company returns your invested money regardless of market ups and downs.

For example, if you invest Rs 1,00,000 every year for 5 years, the company guarantees to return a minimum sum of Rs 5,05,000.

Which funds can I invest in with ICICI Pru Easy Retirement SP?

- Easy Retirement SP Balanced Fund – Here, your money is invested in a mix of equity and debt to ensure balanced returns.

- Easy Retirement Secure Fund – Your money is invested in a mix of debt, money market and cash investments to achieve a balance between protection and returns, to guard it against any unforeseen market falls, thereby adding to your savings.

How does this policy work?

ICICI Pru Easy Retirement SP has two phases –

i) Accumulation Phase – In this phase, you need to pay the premium only once to accumulate funds for your retirement while enjoying the safety net of an Assured Benefit. You may also invest any available money into the policy in the form of Top-ups.

ii) Income Phase – You can exercise one of the following options at the time of vesting –

- Regular Income – Purchase an annuity with the accumulated value and receive regular income.

- Commutation Plus Regular Income – Receive lump sum amount up to one-third of the accumulated amount and the balance can be used to buy the annuity.

- Postponement of vesting age – Flexibility to change the pay-out date, provided s/he is below 55 years.

- Invest in a single premium deferred pension product – Use the accumulated amount to purchase Invest in a single premium deferred pension product

How much Pension Booster will I receive?

On completion of the tenth policy year, the Pension Boosters will be added for every subsequent fifth policy year provided at least five years’ premiums have been paid. It will be equal to 2% of the average daily total Fund Value of the previous 12 months.

How much premium can I pay?

You can pay a minimum of Rs 48,000. There is no upper limit on the premium that you can pay.

At what age can I start this plan?

You can start this plan from the age of 35. The maximum age should not be more than 80 years

When will my pension start?

Your pension, also called the regular pay-out, can start from the minimum age of 45 years. But, the maximum age should not exceed 90 years.

How many years do I have to pay premiums for?

You have to pay the premium only once, at inception, for this policy.

How long does the policy last?

You can choose your policy to last either 10, 15, 20, 25, or 30 years.

Exclusion under the policy –

Suicide Clause –

If the Life Assured, whether sane or insane, commits suicide within 12 months from date of commencement of this policy, the policy will terminate and only the Fund Value is available on the date of intimation of death will be payable to the claimant.

Any charges other than Fund Management Charges and guarantee charges, if any, recovered subsequent to the date of death shall be added back to the fund value as available on the date of intimation of death. No other benefit will be paid under the policy. The policy will terminate and all rights, benefits, and interests under this policy will stand extinguished.

Conclusion –

So, by now you know each and every important detail about this policy. Do let me know if I have missed any important points in the comment section. Please feel free to ask any doubts regarding this policy.