ICICI Pru1 Wealth – Review, Features and Benefits

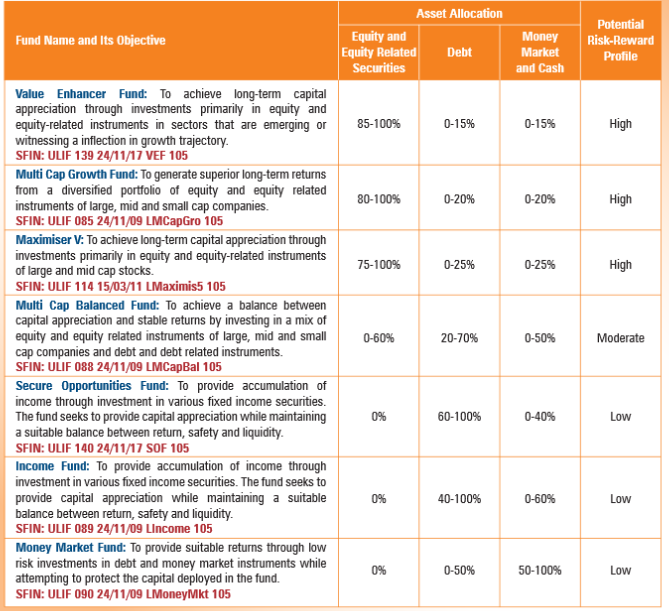

ICICI Pru1 Wealth is more than a life insurance plan. With just a single premium payment, you can get 100% of your money invested in funds of your choice. You get 7 fund choices i.e. 3 equity funds, 3 debt funds and 1 balanced fund and can switch between these funds anytime, at no extra cost.

This plan gives you the potential for better returns by investing in the market, while protecting your family with life cover. You will also get tax benefits on premium paid and benefits you receive.

Features of this Policy –

- Invest only once and enjoy benefits for an entire policy term.

- 100% amount invested in a wide range of funds.

- Choice of 7 funds (3 equity, 3 debt, 1 balanced).

- Life cover to protect your loved ones.

- Tax benefits up to Rs 46,800 u/s 80(C) and 10(10D).

- Get rewarded with wealth boosters as a percentage of the premium paid at the end of your policy term.

- Protect your wife and children financially even if you are not around with MWP Act.

- You can make free switches between your funds to earn more from your investments.

7 Fund option of the Policy –

Benefits of this Policy –

a) Death Benefit –

In the unfortunate event of the death of the Life Assured during the term of the policy the following will be payable to the Nominee, or in the absence of a Nominee the Legal heir.

- Death Benefit = A or B or C whichever is highest

Where,

- A = Sum Assured including Top-up Sum Assured if any

- B = Fund Value including Top-up Fund Value, if any

- C = Minimum Death Benefit

Minimum Death Benefit will be 105% of the single premium and top-up premiums if any received up to the date of death.

b) Maturity Benefit –

On maturity of the policy, you will receive the Fund Value including Wealth Booster and Top-up Fund Value, if any. You have the option to receive maturity benefit either as a lump sum or as a structured payout using Settlement Option.

c) Wealth Booster –

The company will allocate extra units at the end of the policy term, provided monies are not in the DP fund. Wealth Booster will be 2.50% of the single premium for 5-year policy term and 2.75% of single premium including top-up premiums less partial withdrawals if any for 10-year policy term.

Wealth Booster will be allocated among the funds in the same proportion as the value of total units held in each fund at the time of allocation. The allocation of Wealth Booster units is guaranteed and shall not be revoked by the Company under any circumstances.

d) Settlement Option –

You will have an option to receive the Maturity Benefit as a lump sum or as a structured payout using Settlement Option.

- With this facility, you can opt to get payments on a yearly, half-yearly, quarterly or monthly (through ECS) basis, over a period of one to five years, post maturity.

- The first payout of the settlement option will be made on the date of maturity.

- At any time during the settlement period, you have the option to withdraw the entire Fund Value.

- During the settlement period, the investment risk in the investment portfolio is borne by you.

- Only the Fund Management Charge and mortality charge, if any, would be levied during the settlement period.

- You may avail the facility of switches as per the terms and conditions of the policy. Partial withdrawals are not allowed during the settlement period.

- On payment of the last instalment of the settlement option, the policy will terminate and all rights, benefits and interests under the policy will be extinguished.

- In the event of the death of the Life Assured during the settlement period, Death Benefit payable to the nominee as a lump sum will be –

Death Benefit during the settlement period = A or B whichever is highest of the following –

Where,

- A = Fund Value including Top-up Fund Value, if any

- B = 105% of total premiums paid On payment of Death Benefit, the policy will terminate and all rights, benefits and interests under the policy will be extinguished.

e) Partial Withdrawal Benefit –

Partial withdrawals are allowed for a Policy term of 10 years after the completion of five policy years. You can make an unlimited number of partial withdrawals as long as the total amount of partial withdrawals in a year does not exceed 20% of the Fund Value in a policy year. The Fund Value will be as at the beginning of the policy year. The partial withdrawals are free of cost.

The following conditions apply on partial withdrawals, they are as follows –

- Partial withdrawals are allowed only after the first five policy years.

- Partial withdrawals are allowed only if the Life Assured is at least 18 years of age.

- For the purpose of partial withdrawals, the lock-in period for the Top-up premiums will be five years or any such limit.

- Partial withdrawals will be made first from the Top-up Fund Value, as long as it supports the partial withdrawal, and then from the Fund Value built up from the base premium.

- Partial withdrawal will not be allowed if it results in the termination of the policy.

- The minimum value of each partial withdrawal is Rs 2,000.

f) Top Up Benefit –

You can invest any surplus money as Top-up premium, over and above the base premium, into the policy.This feature is available only for a policy term of 10 years. The following conditions apply on Top-ups –

- The minimum Top-up premium is Rs 2,000.

- Your Sum Assured will increase by Top-up Sum Assured when you make a Top-up. Each top-up premium will be treated as Single Premium payment for determining Top-up Sum Assured.

- Top-up premiums can be paid any time except during the last five years of the policy term, subject to underwriting.

- A lock-in period of five years would apply for each Top-up premium for the purpose of partial withdrawals only.

- At any point during the term of the policy, the total Top-up premiums paid cannot exceed the base premium of the policy.

- The maximum number of top-ups allowed during the policy term is 99.

g) Increase or Decrease of Policy Term –

- If the policyholder’s policy term is 5 years, then they can choose to increase their policy term to 10 years, subject to underwriting, by notifying the company.

- The decrease in policy term is not allowed.

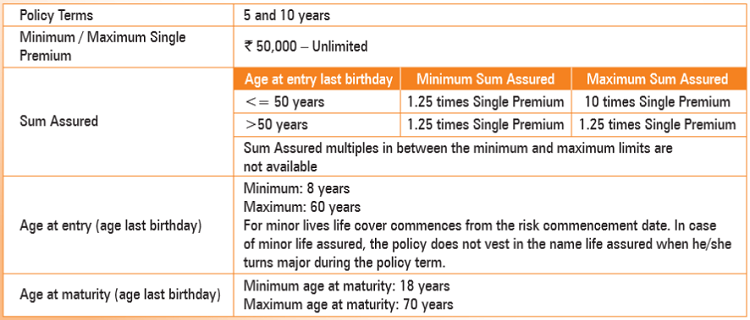

Eligibility Criteria of the Policy –

Can I surrender the policy?

If the policyholder surrenders during the first five policy years, then the policyholder will receive, the Fund Value including Top-up Fund Value, if any, after deduction of applicable Discontinuance Charge shall be transferred to the Discontinued Policy Fund (DP Fund). The policyholder or their nominee, as the case may be, will be entitled to receive the Discontinued Policy Fund Value, on the earlier of death or the expiry of the lock-in period.

Currently, the lock-in period is five years from policy inception. On surrender after completion of the fifth policy year, the policyholder will be entitled to the Fund Value including Top-up Fund Value, if any. No surrender penalty will be levied and policy surrender will extinguish all rights, benefits and interests under the policy.

Treatment of the policy while monies are in the DP Fund –

While monies are in the DP Fund –

- Risk Cover and Minimum Death Benefit will not apply.

- A Fund Management Charge of 0.50% p.a. of the DP Fund will be made. No other charges will apply.

- From the date monies enter the DP Fund till the date they leave the DP Fund, a minimum guaranteed interest rate declared by IRDAI from time to time will apply. The current minimum guaranteed interest rate applicable to the DP Fund is 4% p.a.

Can I cancel the policy if I didn’t like its terms and conditions?

If the policyholder is not satisfied with the terms and conditions of this policy, the policy can be returned with the policy document to the Company for cancellation with reasons within i. 15 days or 30 days (if the policy is purchased through distance marketing) from the date it is received. This period is known as the Free-Look Period.

On cancellation of the policy during the free-look period, the policyholder shall be entitled to an amount which shall be equal to Fund Value at the date of cancellation less stamp duty expenses under the policy, proportionate risk premium and expenses borne by us on medical tests, if any

The policy will terminate on payment of this amount and all rights, benefits and interests under this policy will stand extinguished.

Automatic Transfer Strategy –

Automatic Transfer Strategy(ATS) helps eliminate the need to time your investment by giving you the benefit of rupee cost averaging. If this option is chosen, you can invest all or some part of your investment in Income Fund or Money Market Fund and transfer a fixed amount in regular monthly instalments into any one of the following funds –

- Maximiser V,

- Multi-Cap Growth Fund or

- Value Enhancer Fund

There would be no additional charges for ATS. The following conditions apply to ATS –

- The minimum transfer amount under ATS is Rs 2,000.

- This transfer will be done in equal instalments in not more than 12 monthly instalments.

- ATS would be executed by redeeming the required number of units from fund chosen at the applicable unit value and allocating new units in the destination fund at the applicable unit value.

- At inception, you can opt for a transfer date of either the first or fifteenth of every month. If the date is not mentioned the funds will be switched on the first day of every month. If the first or the fifteenth of the month is a non-valuation date, then the next working day’s NAV would be applicable

Charges under the Policy –

a) Premium Allocation Charges and Policy Administration Charges –

In this policy, there are no premium allocation and policy administration charges in this policy.

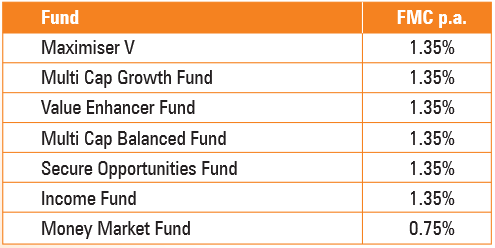

b) Fund Management Charge (FMC) –

The following fund management charges will be applicable and will be adjusted from the NAV on a daily basis. This charge will be a percentage of the Fund Value.

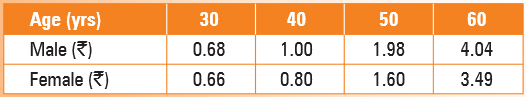

c) Mortality Charges –

Mortality charges will be levied every month by the redemption of units based on the Sum at Risk. The sum at Risk will be the highest of the following –

- Sum Assured (including Top-up Sum Assured, if any),

- Fund Value (including Top-up Fund Value, if any),

- Minimum Death Benefit

Less

- Fund Value (including Top-up Fund Value, if any)

Indicative annual charges per thousand life cover for a healthy male and female life are as shown below –

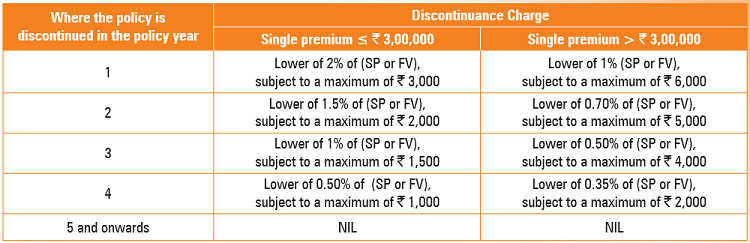

d) Discontinuance Charges –

Discontinuance Charges are described below in the chart.

- SP – Single Premium

- FV is the Fund Value on the Date of Discontinuance

No discontinuance charge is applicable for Top-up premiums.

FAQs –

What is the premium payment option in ICICI Pru1 Wealth plan?

ICICI Pru1 Wealth is a single premium payment life insurance plan that allocates 100% of your investment amount in the funds of your choice while providing a life insurance cover. So, pay just once and enjoy the benefits for the long term!

What are the policy terms available in ICICI Pru1 Wealth plan?

ICICI Pru1 Wealth has two policy terms i.e. 5 & 10 years. You can choose the policy term which will support your plans to achieve your financial goals.

How much premium do I have to pay?

The premium for ICICI Pru1Wealth starts at Rs 50,000/- per annum. There is no limit on the maximum investment amount.

What are unlimited free switches between funds?

The policyholder can switch units from one fund to another depending on your financial priorities and investment outlook as many times as you want. This benefit is available to you without any charge. The minimum switch amount is Rs. 2,000.

What is the risk of investment in the unit of funds?

The policyholder should be aware that the investment in the units is subject to the following risks –

- ICICI Pru1 Wealth is a Unit-Linked Insurance Policy (ULIP) and is different from traditional products. Investments in ULIPs are subject to investment risks.

- The investments in the funds are subject to market and other risks and there can be no assurance that the objectives of the funds will be achieved.

- The premium paid in unit-linked insurance policies are subject to investment risks associated with capital markets and debt markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions.

- The past performance of other funds of the Company is not necessarily indicative of the future performance of these funds.

- The funds do not offer a guaranteed or assured return.

Exclusion under the Policy –

Suicide Exclusion –

If the Life Assured, whether sane or insane, commits suicide within 12 months from the date of commencement of the policy, only the Fund Value, including Top-up Fund Value, if any, as available on the date of intimation of death, would be payable to the Claimant.

Any charges other than Fund Management Charges and guarantee charges, if any, recovered subsequent to the date of death shall be added back to the fund value as available on the date of intimation of death.

Conclusion –

So, by now you know each and every important detail about this policy. Do let me know if I have missed any important points in the comment section. Please feel free to ask any doubts regarding this policy.