HFDC Life YoungStar Udaan – Child Plan – Review, Features and Benefits

Every Parent wants to ensure that no financial hurdle should stop their kid from dreaming as high as clouds. We never want our kids to face the same financial hurdle as we did in our childhood. We always want best for our child, irrespective of our finances.

HDFC has come up with, HDFC Life YoungStar Udaan, a traditional participating insurance plan. This plan is ideal for parents who wish to make provision for academic expenses that occur prior to a college education. Specific goals like college fees or marriage expenses etc, all miscellaneous and extra-curricular expenses that occur during college/school can be taken care off with this insurance plan.

Features of this policy –

- This policy is a participating endowment and money-back plan with multiple options.

- Premiums can be paid either monthly, quarterly, half-yearly and annually.

- 3 maturity benefit options that will help you match key milestones of your child’s aspirations.

- There is Insurance coverage throughout the policy term by paying premiums for a limited period.

- This policy is available with a Short Medical Questionnaire (SMQ) based underwriting#.

- This policy comes with Tax Benefit u/s 80C and Sec 10(10D) of Income Tax Act 1961.

- Under Classic Waiver Option, all future installment premiums will not be required to be paid.

- Boost your pay-outs with Guaranteed Additions (GA)* accruing in the first 5 years of your policy which will be payable at maturity.

- This policy comes with the flexibility to choose your policy term from 15 to 25 years as per your child’s future needs.

- Flexibility in premium paying terms allows you to plan better for the various goals of your child. One can choose to pay a premium within these terms – 7 years, 10 years and policy term minus 5 Years.

Benefits of this policy –

Maturity Benefit Option –

One can choose from the 3 maturity benefit options at inception based on financial goals for their child. These options are of 2 types namely –

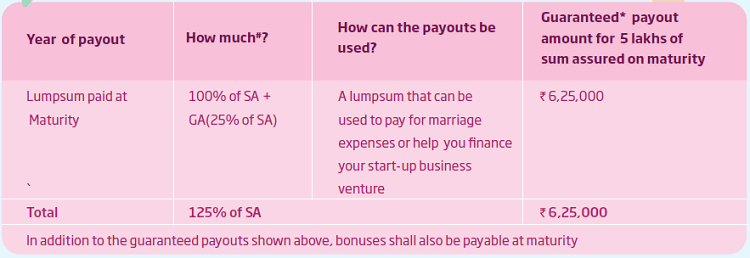

- Endowment Option – In this option, a lump sum is paid at maturity. This option is termed as ASPIRATION which is explained in detail below.

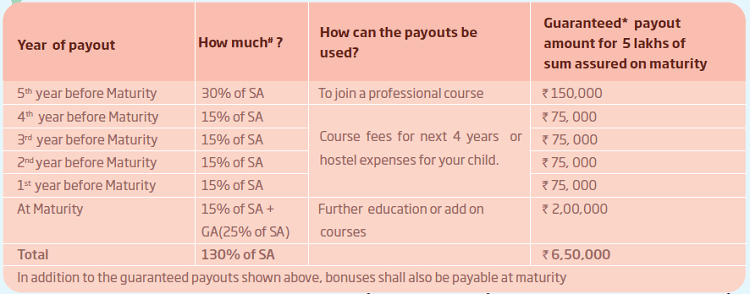

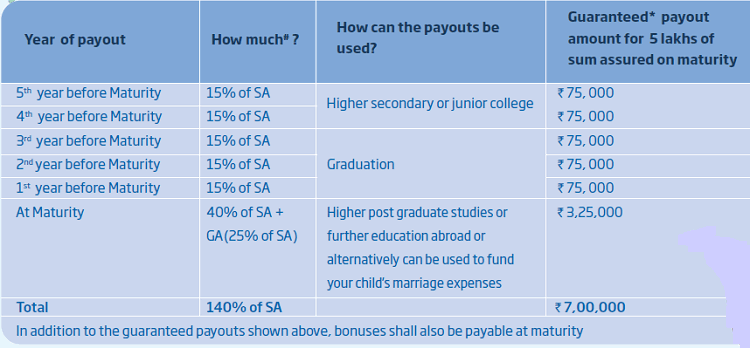

- Money-back Options (2nd and 3rd Option) – This is a money-back option where pay-outs are offered in the last 5 years before maturity. These options are termed as ACADEMIA and CAREER which are explained in detail below.

A) Aspiration Option (Option 1) – This option is instant support to provide for the larger responsibilities of life.

B) Academia Option (Option 2) – This option is the planned and perfectly timed investment for your child’s education need.

C) Career Option (Option 3) – This option is an added advantage to kick start your child’s career.

The pay-outs will be as a percentage of sum assured on maturity and are guaranteed at inception of the policy depending upon the maturity benefit option chosen.

Death Benefit Option –

One can choose the death benefit options as per one’s requirements which can enhance the protection element in the policy and also help in planning better. On the death of the policyholder on or before the Maturity date and provided all due premiums have been paid, the Death Benefit payable will be as specified below –

A) For Classic Death Benefit option –

The death benefit shall be the higher of:

- Sum Assured on Death

- 105% of Premiums paid

In addition, accrued guaranteed additions, accrued reversionary bonuses, interim bonus (if any) and terminal bonus (if any) would be payable. Where the Sum Assured on Death shall be the higher of:

- Sum Assured on Maturity

- 10 times the annualized premium for entry age, up to 50 years and 7 times annualized premium for entry age greater than 50 years.

The policy will terminate with no further benefits payable.

B) For Classic Waiver Death Benefit option –

The death benefit shall be the higher of:

- Sum Assured on death

- 105% of premiums# paid

Where the Sum Assured on Death shall be the higher of:

- Sum Assured on Maturity

- 10 times annualized premium for entry age up to 50 years and 7 times annualized premium for entry age greater than 50 years.

In addition, all future outstanding premiums under the policy will not be required to be paid. The policy will continue with the pay-outs as scheduled. The policy continues to participate in profits even after the death of the life assured. On the death of the life assured after the commencement of survival benefits under Academia and Career maturity benefit options, the Death Benefit payable shall not be reduced by the survival benefits already paid.

Eligibility Conditions of this policy –

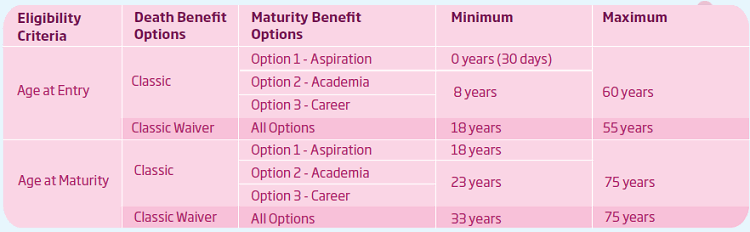

Based on the maturity benefit options and death benefit options one can assess their eligibility in buying this plan. The age limit of HDFC Life Youngstar Udaan – Child Plan is as follows:

- All the ages mentioned above are age last birthday. The minimum entry age and the policy term selected shall be such that the maturity age limits are met.

- Sum Assured on Maturity/Death is the absolute amount of benefit which is guaranteed to be payable in the form of survival benefit/Death Benefit during the policy term as per the terms and conditions specified in the policy.

Is there any bonus attached to the policy?

i) Simpler Reversionary Bonus – This Bonus would be declared at the end of each financial year. The same will be expressed as a percentage of the Sum Assured on maturity. Once it is added to the policy, the bonus is guaranteed to be payable either on death or on maturity, whichever is earlier for Classic Death Benefit Option and only on maturity for Classic Waiver Death Benefit Option, provided all due premiums are paid.

The Reversionary Bonus would depend on the actual experience with respect to the investment return, expenses, mortality, tax, etc. It would be declared keeping in mind a long-term view of expected future experience. In case of death or surrender during the inter-valuation period, the policy will be eligible to receive the interim bonus based on the bonus rates declared by the company.

ii) Terminal Bonus – A Terminal Bonus may be added to a policy. This bonus enables the company to pay a fair share of the surplus at the end, based on the actual experience over the policy term and allowing for the reversionary bonuses already attached. Terminal bonus is not a guaranteed benefit as it depends on the actual future experience.

Can I get a loan against this policy?

Yes, the policyholder can get a loan against this policy only if the policy has acquired the surrender value. The policyholder can get a policy loan up to 80% of the surrender value of the policy subject to applicable terms and conditions. The terms and conditions are stated below:

- The loan will only be given on an in-force policy.

- The policyholder should be at least 18 years of age at the time of requesting the loan.

- The loan amount will be subject to a maximum of 80% of the surrender value.

- Before any benefits are paid out, loan outstanding together with the interest thereon will be deducted and the balance amount will be payable.

- Where the loan outstanding including interest exceeds 90% of the surrender value for a reduced paid-up policy, then the policy will be foreclosed and the policyholder will be paid the surrender value less loan outstanding including interest.

- An in-force or fully paid-up policy shall not be foreclosed for non-re-payment of loan.

Is there any Grace Period in this policy?

Yes, there is a grace period in this policy. Grace Period is the time provided after the premium due date during which the policy is considered to be in-force with the risk cover. This policy has a grace period of 30 days for yearly, half-yearly and quarterly frequencies from the premium due date. The grace period for monthly frequency is 15 days from the premium due date.

If a valid claim arises under the policy during the grace period, but before the payment of due premium, then the company shall still honor the claim. In such cases, the due but unpaid premium will be deducted from any benefit payable.

Can a lapsed policy be revived?

Yes, a lapsed policy can be revived within 2 years from the date of the first unpaid premium subject to the terms

and conditions specified by the company from time to time. For the revival, the policyholder will need to pay all the outstanding premiums, interest on the outstanding premiums and taxes and levies as applicable. The processing fee for revival of the policy will be Rs 250. Once the policy is revived, you are entitled to receive all contractual benefits.

Can the policy be surrendered?

Yes, the policy can be surrendered. The policy will acquire a Guaranteed Surrender Value (GSV) provided 2 full years of premium has been paid for premium payment term of lesser than 10 years and 3 full years of premium have been paid for premium payment term of 10 years and above.

Are there any exclusions in the policy?

Suicide Clause –

- If the policyholder commits suicide, within 12 months from the date of inception of the policy, then the nominee of the policyholder shall be entitled to 80% of the premiums paid, provided the policy is in-force.

- If the policyholder commits suicide, within 12 months from the date of revival of the policy, the nominee of the policyholder shall be entitled to an amount which is higher of 80% of the premiums paid till the date of death or the surrender value as available on the date of death.

Can I cancel the policy if I didn’t like its terms and conditions?

Yes, the policyholder can cancel the policy if the policyholder is not satisfied with the terms and conditions of the policy. The policy can be canceled within 15 days from the date of receipt of the policy. This cancellation period is called the Free-look period.

If the policies are purchased through distance marketing (i.e. insurance policies sold over the telephone or the internet or any other method which does not involve face-to-face selling) then the cancellation period will be 30 days. On receipt of your letter along with the original policy documents, we shall arrange to refund you the premium, the premium paid will be refunded after deducting the proportionate risk premium for the period on cover, the expenses incurred by the company on medical examination if any and stamp duty.

Conclusion –

So, by know you are well versed with the important details of the HDFC Life Youngstar Udaan – Child Plan. Now it’s up to you to decide if this policy is suitable for your better future of your child or not. Do let me know if I have missed any important points in the comment section. Please feel free to ask any doubts regarding this policy.