HDFC SL YoungStar Super Premium – Review, Features and Benefits

We all want to save more and more from our salary because we want to give best future to our kids. And when it comes to children’s insurance plans it helps build savings so that over time there is enough to finance for our child’s education, marriage, house, or car etc…

“HDFC SL YoungStar Super Premium” is a unit-linked insurance plan (ULIP) designed to accumulate savings for our child’s future, even in your absence.

Features of this Policy –

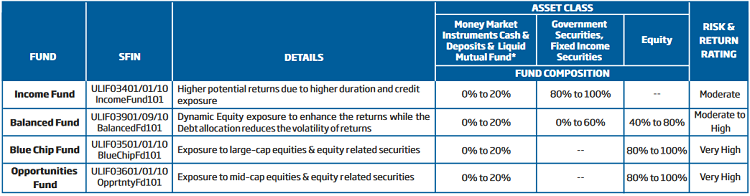

- The policyholder has the flexibility to choose from 4 funds to suit your risk appetite. They are Income Fund, Balanced Fund, Blue-chip Fund and Opportunities Fund.

- The policyholder has the flexibility to select premium amount – no ceiling on maximum premium

- This policy also has the flexibility to select tenure of 10, 15 – 20 years

- It also has the flexibility to select the Sum Assured.

- There will be yearly payments to your family in case of your unfortunate demise.

- There are flexible Benefit Payment Preferences – Save Benefit or Save-n-Gain Benefit.

- One cannot take any loan against this policy.

- You can also customize the policy suited for your child with the premium, Sum Assured, and the plan option of your choice.

- The policyholder can also manage their investment fund(s) either by switching across fund options or re-directing future premiums into a different fund option.

- Hassle-free policy issuance on the basis of a Short Medical Questionnaire eliminating tedious medical tests.

- Tax benefits on premium paid under sections 80C and 10(10D) of the Income Tax Act 1961.

- Paying premiums is convenient with access to multiple modes– credit card, internet banking, cheque, auto-debit facility.

Choose from 4 Funds Option –

As this policy is a unit-linked plan; the premiums the policyholder pays in this plan are subject to investment risks associated with the capital markets. The unit prices of the funds may go up or down, reflecting changes in the capital markets. So, to balance your level of risk and return, making the right investment choice is very important and you are responsible for the choices you make.

The available funds give you the potential for the following –

- Higher but more variable returns; or

- Lower but more stable returns over the term of your policy

Your investment will buy units in any of the following 4 funds designed to meet your risk appetite. All the investment funds available to this plan will be available to you. All units in a particular fund are identical. The past performance of any of the funds is not necessarily an indication of future performance. Unit prices can go up and down.

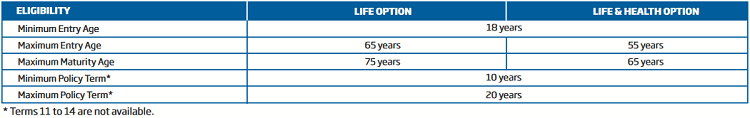

2 Plan Options in this Policy –

- Death Benefit – by choosing the Life Option

- Death Benefit + Critical Illness Benefit – by choosing the Life & Health Option

Benefits of this Policy –

a) Benefit Payment Preference –

i) Save Benefit – In case of unfortunate death of the parent or a critical illness

- Sum Assured is paid to the beneficiary (child)

- No need to pay any further premiums as we will pay 100% of the future premiums

- On maturity, the fund value is again paid to the beneficiary

ii) Save-n-Gain Benefit – In case of unfortunate death of the parent or a critical illness

- Sum Assured is paid to the beneficiary (child)

- No need to pay further premiums as we will pay 50% of the future premiums towards the policy and 50% of the premiums to the beneficiary on the premium due date

- On maturity, the fund value is paid to the beneficiary

b) Maturity Benefit –

On MaturityYour policy matures at the end of the policy term you have chosen and all your risk covers cease. You may redeem your balance units at the then prevailing unit price and take the fund value.

c) Death Benefit –

In case of your unfortunate demise during the policy term, the benefit will be payable to your beneficiary solely based on the Benefit Payment Preference (Save Benefit or Save-n-Gain Benefit) chosen by you. The minimum death benefit will be at least 105% of the total premiums paid. On a claim, all-risk covers will cease and the Unit Fund will continue to be invested.

The beneficiary will not have the right to request for any partial withdrawal, fund switch, premium redirection, settlement option, surrender, etc. He will only be entitled to receive the fund value at the end of the original policy term. Any Critical Illness Cover terminates immediately.

d) Critical Illness –

In case you are diagnosed with any of the critical illnesses covered before the end of the policy term, the benefit payable will be determined solely based on the Benefit Payment Preference(Save Benefit or Save-n-Gain Benefit) chosen by you. The Death Benefit Cover terminates immediately. On a claim, all risk covers will cease and the Unit Fund will continue to be invested.

The beneficiary will not have the right to request for any partial withdrawal, fund switch, Premium redirection, settlement option, surrender, etc. He will only be entitled to receive the fund value at the end of the original policy term.

e) Partial Withdrawal Benefit –

You can make lump sum partial withdrawals from your funds after 5 years of your policy provided –

- The minimum withdrawal amount is Rs 10,000.

- After the withdrawal and applicable charges, the fund value is not less than 150% of your original regular premium.

- The maximum amount that can be withdrawn throughout the policy term is 300% of the original regular premium.

- The partial withdrawals shall not be allowed which would result in termination of a contract.

Eligibility Criteria of the Policy –

Can I cancel the policy if I didn’t like its terms and conditions?

If the policyholder doesn’t like the terms and conditions, then he/she has the option of returning the policy to the company stating the reasons thereof, within 15 days and 30 days (in case the policy is bought by distance marketing) from the date of receipt of the policy. This period is known as the Free Look Period.

On receipt of your letter along with the original policy documents, the company shall arrange to refund you the value of units allocated to you on the date of receipt of request plus the unallocated part of the premium plus charges levied by cancellation of units, subject to deduction of the proportionate risk premium for the period on cover, the expenses incurred by us on medical examination and stamp duty.

A policy once returned shall not be revived, reinstated, or restored at any point in time and a new proposal will have to be made for a new policy.

Can fund choices be changed?

You can change your investment fund choices in two ways. They are as follows –

- Switching – You can move your accumulated funds from one fund to another available fund anytime.

- Premium Redirection – You can pay your future premiums into a different selection of available funds, as per your need.

Can discontinued policies be revived?

The policyholder has the option to revive a discontinued policy within three consecutive years from the date of the first unpaid premium, subject to our underwriting policy.

i) The revival of a Discontinued Policy during lock-in Period –

a) You can revive the policy restoring the risk cover, along with the investments made in the segregated funds as chosen by you, out of the discontinued fund, less the applicable charges as in sub-section(b) below, in accordance with the terms and conditions of the policy.

b) At the time of revival –

- All due and unpaid premiums which have not been paid shall be payable without charging any interest or fee.

- Policy administration charge and premium allocation charge as applicable during the discontinuance period shall be levied. Guarantee charges, if applicable during the discontinuance period, shall be deducted provided the guarantee continues to be applicable. No other charges shall be levied.

- The discontinuance charges deducted at the time of discontinuance of the policy shall be added back to the fund.

ii) The revival of a Discontinued Policy after lock-in Period –

a) You can revive the policy restoring the original risk cover in accordance with the terms and conditions of the policy.

b) At the time of revival –

- All due and unpaid premiums under the base plan which have not been paid shall be payable without charging any interest or fee. The policyholder also has the option to revive the rider.

- Premium allocation charge as applicable shall be levied. The guarantee charges shall be deducted if the guarantee continues to be applicable.

- No other charges shall be levied.

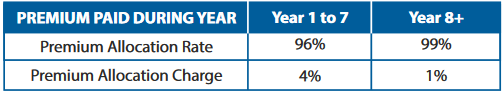

Charges under the policy –

a) Premium Allocation Charge – This is a premium-based charge. After deducting this charge from your premiums, the remainder is invested to buy units. The remaining percentage of your premium that is invested to buy units is called the Premium Allocation Rate and depends on the year of allocation.

The Premium Allocation Charge is guaranteed for the entire duration of the policy term. The Premium Allocation Rate and Premium Allocation Charge are given in the table below –

b) Fund Management Charge (FMC) – The daily unit price already includes our fund management charge of only 1.35 % per annum, charged daily, of the fund’s value. The fund management charge for the Discontinued Policy Fund is 0.50% p.a.

c) Policy Administration Charge – A Policy Administration Charge of 0.25 % per month of the original annual premium will be deducted monthly and will increase by 5% per annum on every policy anniversary, subject to a maximum charge of 0.4% of the annual premium or Rs 500, per month, whichever is lower. This charge will be taken by canceling units proportionately from each of the fund(s) you have chosen.

d) Mortality & Other Risk-Benefit Charge – Every month the company will levy a charge for providing you with the death cover or critical illness cover (which includes the Sum Assured plus the value of the future premiums payable) as chosen, in your policy.

The amount of the charge taken each month depends on your age and level of cover. This charge will be taken by canceling units proportionately from each of the fund(s) you have chosen.

Exclusion under the Policy –

a) Suicide Exclusions – In case of death due to suicide within 12 months from the date of commencement of the policy or from the date of revival of the policy, as applicable, the nominee or the beneficiary of the policyholder shall be entitled to the fund value, as available on the date of intimation of death.

Further, any charges other than FundManagementCharges(FMC) and guarantee charges recovered subsequent to the date of death shall be added back to the fund value as available on the date of intimation of death

b) The company will not pay Critical Illness Benefits if the critical illness has occurred within 6 months of the date of commencement or date of issue or date of revival of the policy whichever is later. The company may not pay Critical Illness Benefits if they do not receive a duly completed claim form within 3 years of the illness, disability, operation, or other circumstances giving rise to the claim.

c) The company will not pay Critical Illness Benefits if the critical illness is caused directly or indirectly by intentionally self-inflicted injury or attempted suicide, irrespective of mental condition, pregnancy, or childbirth or complications arising therefrom.

d) The company will not pay Critical Illness if the critical illness is caused directly or indirectly by any of the following –

- Alcohol or solvent abuse, or the taking of drugs except under the direction of a registered medical practitioner

- War, invasion, hostilities(whether war is declared or not), civil war, rebellion, revolution, or taking part in a riot or civil commotion.

- Taking part in any flying activity, other than as a passenger in a commercially licensed aircraft.

- Taking part in any act of a criminal nature.

Conclusion –

So, by now you know each and every important detail about this policy. Do let me know if I have missed any important points in the comment section. Please feel free to ask any doubts regarding this policy.

If child die then what is the process

One has to inform the company and file a claim with them

Give them the claim form, along with death certificate and some other KYC docs

Manish

Sir please tell me that after 5 years my money back me but how much

Policy document has to be looked at.. to comment on that