HDFC life Super Savings Plan – Review, Benefits and Eligibility

HDFC Life Super Saving Plan is a regular premium paying with profit endowment plan. The plan provides financial protection against untimely demise throughout the policy term along with the flexibility to choose the policy term.

What are the key features of this plan?

- Flexibility to choose a policy term for 15 to 30 years

- Insurance coverage throughout the policy term

- Double sum assured in case of accidental death

- Maturity benefits with reversionary bonuses and terminal bonus

What this product offers?

It offers an opportunity to participate in the profit of the participating funds of the company by way of bonuses payable to you at the time of maturity or on death.

How HDFC life Super Savings Policy is so ideal for a lay man ?

Plan is ideal for meeting the long-term goals such as –

- Child’s education

- Child Marriage

- House

- Retirement

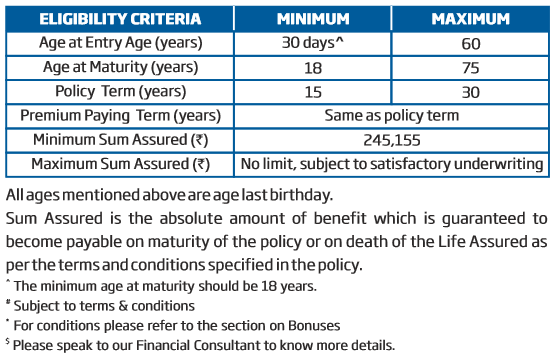

Eligibility for this policy –

HDFC life Super Savings Policy can be taken only on a single life basis. Following are the eligibility details of the policy –

Documents required for availing the policy –

-

KYC Documents

- Address Proof

- Medical history

- In some cases, medical test is required based on the age of the policy holder

Benefits of this plan –

- Maturity Benefit – The holder of this policy will receive maturity benefit such as sum assured + accrued simple reversionary bonuses + interim bonus + terminal bonus only and only if the holder of the policy makes full payment of the premium due throughout the policy term till the maturity date.

- Accidental Death Benefit – This benefit can be received only and only if the assured age is above 18 years on the date of death. To receive the benefit, the accident death must be caused between 9o days of bodily injury. Policy will terminate on the payment of death benefit.

- Death Benefit – If all premium due are paid, then the nominee of the policy holder will receive the higher of following :

- 10 x annualized premium

- Sum assured

- 105% of all premiums paid till date

- accrued simple reversionary bonuses + interim bonus + terminal bonus

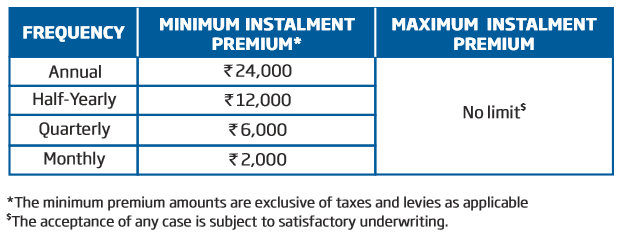

How much premium one needs to pay in this policy?

One can choose premium as per there requirements but it can be paid only either annually, half yearly, quarterly and monthly. Detailed description as follows –

Can I get loan or any tax benefit under this policy?

Tax benefit u/s 80C the Income Tax Act, 1961 is available to individual and HUFs for the premiums paid. One can get loan of from this policy only when the policy has acquired the surrender value. One can get maximum 80% of the surrender value as a loan.

What all are excluded from the policy?

- In case of death due to suicide, within 12 months from the date of inception of the policy, the nominee of the policy holder shall be entitled to 80% of the premium paid.

- No accidental death benefit will be provided if the death happens if following ways –

- Intentionally self-injury or suicide, irrespective of mental condition.

- Alcohol or solvent abuse, or taking of drugs except under the direction of any medical practitioner.

- Any criminal activity and intent.

- Taking part in any flying activity other than any passenger in commercialized aircraft.

- War, Invasion, Hostilities, Revolution etc…..

- Taking part in any dangerous hobby or race unless to by us in writing

Important terms of the policy –

- Grace Period – It is a time provided after due date during which the policy is considered to be in force with the risk covered. This policy has a grace period of 30 days for yearly, half yearly and quarterly frequency but 15 days for monthly frequency from premium due date.

- Lapsation – If the premium is not paid under the due date within the grace period, then the policy will lapse if it has not acquired a guaranteed surrender value. No benefits and risk cover will be provided on the lapse of the policy.

- Paid-Up – If your policy has acquired a guaranteed surrender value and you stop paying premiums, then your policy will be made paid-up at the end of the grace period.

- Guaranteed Surrender Value – It is a value which one gets on surrendering the policy. One can get the guaranteed surrender value of the policy only when the policy has completed 3 years. Once the policy holder receives the surrender value, the policy will terminate and no benefit can be extracted from that policy.

- Revival Period – It is that period where one can revive the lapsed or paid-up policy within the revival period. Revival Period is subject to change as per regulations but currently it is 2 years. For revival of the policy one needs to pay the outstanding premium with interest as well as the revival charges.

Video Review of the Policy –

Conclusion –

So, by now all of you know each and every details of this policy. Now it’s up to you all to decide whether this policy will satisfy your requirements or not. If you have any doubt regarding this policy, they please let us know in the comment section.