HDFC Life Sanchay Plus – Review, Features and Benefits

When we achieve some milestones in life, we feel that we have accomplished something in life. We cannot be ignorant of the fact that these milestones often come up with some added responsibilities, expenses and also some burden of any unavoidable circumstances. We all want to ensure that we and our family doesn’t face any financial difficulty. So, we tend to plan it out. We tend to plan for key life stages such as marriage, parenthood, retirement, etc.

Life Insurance plan can help one achieve such goals whilst safeguarding the family’s future against the unforeseen events. HDFC has come up with a life insurance policy named “HDFC Life Sanchay Plus”, which is a non-participating, non-linked, savings insurance plan that offers guaranteed returns for oneself and their family.

Features of this policy –

- Guaranteed benefits – Rest assured of the returns

- Tax benefits as u/s 80C and 10(10D) of Income Tax Act, 1961.

- Flexibility – Guaranteed benefits as a lump sum or as regular income.

- Life-Long Income option – Guaranteed income till age 99 years.

- Long Term Income option – Guaranteed Income for a fixed term of 25 to 30 years.

- Optional Rider benefit to enhance your protection coverage on payment of additional premium.

Policy Variants with its benefits –

This policy comes with 4 variant options. Let us have a look at these variants with their benefits –

A) Guaranteed Maturity Option – This option offers guaranteed benefit payable as a lump sum on maturity.

- Maturity Benefit – The maturity benefit is equal to Guaranteed Sum Assured on Maturity plus accrued Guaranteed Additions. Where, Guaranteed Sum Assured on Maturity is the total Annualized Premium payable under the policy during the premium payment term.

- Death Benefit – If the policyholder dies during the policy term, then the nominee shall be paid death benefit equal to Sum Assured on Death + Accrued Guaranteed Additions. Once the death benefit is paid to the nominee, the policy will terminate and no further benefit will be paid.

Sum Assured on Death is the highest of the following –

- 10 times the Annualized Premium, or

- 105% of Total Premiums paid, or

- Guaranteed Sum Assured on Maturity, or

- An absolute amount assured to be paid on death, which is equal to the Sum Assured.

B) Guaranteed Income Option – This option offers maturity benefit in the form of Guaranteed Regular Income for a fixed term of 10 or 12 years.

- Maturity Benefit – This benefit is payable in the form of Guaranteed Income for fixed term of 10 or 12 years upon payment of all due premiums and policyholder surviving the policy term.

Please note – If the policyholder dies during the Pay-out Period, then the nominee shall continue to receive the Guaranteed Income as per Income Payout Frequency & benefit option chosen till the end of pay-out period. Guaranteed Sum Assured on Maturity shall be the present value of future pay-outs, discounted at a rate of 9% p.a.

- Death Benefit – If the policyholder dies during the policy term, then the death benefit equals to Sum Assured on death shall be payable to the nominee. Once the death benefit is paid to the nominee, the policy will terminate and no further benefit will be paid. Sum Assured shall be equal to the applicable Death Benefit Multiple times the Annualized Premium.

Sum Assured on Death is the highest of the following –

- 10 times the Annualized Premium, or

- 105% of Total Premiums paid, or

- Premiums paid accumulated at an interest of 5% p.a. compounded annually, or

- Guaranteed Sum Assured on Maturity, or

- An absolute amount assured to be paid on death, which is equal to the Sum Assured

C) Life-Long Income Option – This option offers maturity benefit in the form of Guaranteed Regular Income up to the age of 99 years and the return of total premiums paid at the end of the pay-out period.

- Maturity Benefit – Maturity benefit is payable in the form of a guaranteed income up to age 99 years and a return of total premiums paid** at the end of the pay-out period upon payment of all due premiums and policyholder surviving the policy term.

Please note – If the policyholder dies during the Pay-out Period, then the nominee shall continue receiving Guaranteed Income as per Income Payout Frequency & benefit option chosen till the end of Pay-out Period. Guaranteed Sum Assured on Maturity shall be the present value of future pay-outs, discounted at a rate of 9% p.a.

** Total premiums paid** are returned at the end of the Pay-out period, irrespective of survival of the policyholder during the Pay-out Period.

- Death Benefit – If the policyholder dies during the policy term, then the death benefit equal to Sum Assured on Death shall be payable to the nominee. Once the death benefit is paid, the policy will terminate and no further benefits will be payable. Sum Assured shall be equal to the applicable Death Benefit Multiple times the Annualized Premium.

Sum Assured on Death is the highest of the following –

- 10 times the Annualized Premium, or

- 105% of Total Premiums paid, or

- Premiums paid accumulated at an interest of 5% p.a. compounded annually, or

- Guaranteed Sum Assured on Maturity, or

- An absolute amount assured to be paid on death, which is equal to the Sum Assured

D) Long Term Income option – This option offers maturity benefit in the form of Guaranteed Income for a fixed term of 25 or 30 years and return of total premiums paid at the end of the pay-out period.

- Maturity Benefit – This option offers a benefit of guaranteed income for a fixed term of 25 or 30 years and a return of total premiums paid** at the end of the pay-out period upon payment of all due premiums and the life assured surviving the policy term.

Please note – If the policyholder dies during the Pay-out Period, the nominee shall continue receiving Guaranteed Income as per Income Payout Frequency & benefit option chosen till the end of the Pay-out Period. Guaranteed Sum Assured on Maturity shall be the present value of future pay-outs, discounted at a rate of 9% p.a.

** Total premiums paid** are returned at the end of the Pay-out period, irrespective of survival of the Life Assured during the Pay-out Period.

- Death Benefit – If the policyholder dies during the policy term, the death benefit equal to Sum Assured on Death shall be payable to the nominee. Once the death benefit is received by the nominee, the policy will terminate and no more benefits will be payable. Sum Assured shall be equal to the applicable Death Benefit Multiple times the Annualized Premium.

Sum Assured on Death is the highest of the following –

- 10 times the Annualized Premium, or

- 105% of Total Premiums paid, or

- Premiums paid accumulated at an interest of 5% p.a. compounded annually, or

- Guaranteed Sum Assured on Maturity, or

- An absolute amount assured to be paid on death, which is equal to the Sum Assured

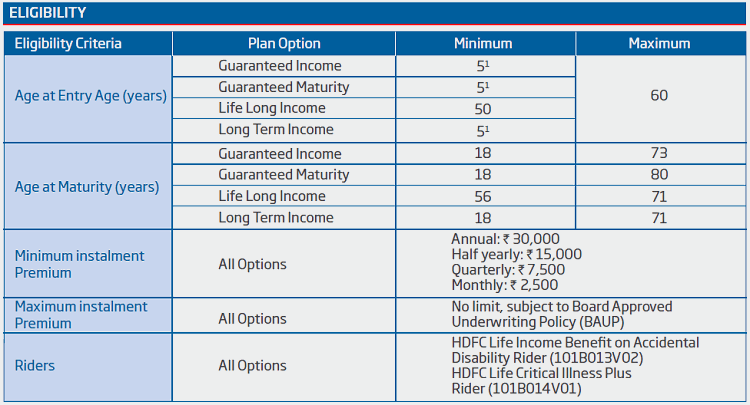

Eligibility Conditions of the policy –

Unlike other HDFC Policies, this policy also has some eligibility conditions. Let’s have a look at them –

1 means that risk cover starts from the date of commencement of policy for all lives including minors. In case of a minor life, the policy will vest on the policyholder on the attainment of age 18 years. All the ages mentioned above are age last birthday.

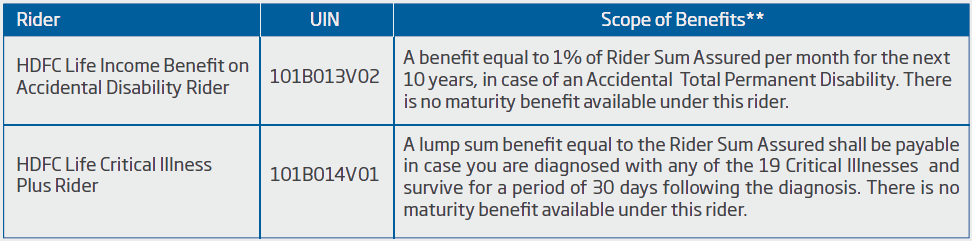

Rider options in this policy –

Rider option is also available in the policy, so as to enhance the protection of the policyholder. Let’s have a look at these rider options –

Conclusion –

So, by now you know each and every important detail of this policy. Now it up to you to decide whether this policy is apt for you or not. Do let me know if I have missed any important points in the comment section. Please feel free to ask any doubts regarding this policy.

What is currently the best policy to get a long term (25years) guaranteed monthly income?

You can go with a pension plan in that case..it will be for lifetime!