HDFC Life Guaranteed Pension Plan – Review, Features and Benefits

HDFC Life Guaranteed Pension Plan is a non-participating deferred pension plan that offers assured benefits on death or at vesting. The product offers guaranteed additions that are added every year and lump sum vesting addition payable at vesting. The plan is ideal for individuals who seek to plan for their retirement to get guaranteed returns on their invested corpus for post-retirement income.

Features of this Policy –

- Guaranteed Additions of 3% of sum assured get accrued for each completed policy year

- A lump sum Vesting Addition payable at vesting

- Premium payment term of 5, 7 and 10 years

- Policy term ranging from 10 to 20 years

- This pension & retirement plan in India can be taken only on a single life basis

- Guaranteed death benefit equal to total premiums paid to date accumulated at 6% per annum

Benefits of this Policy –

a) Guaranteed Additions –

Guaranteed Additions will be 3% of Sum Assured on vesting for each completed policy year.

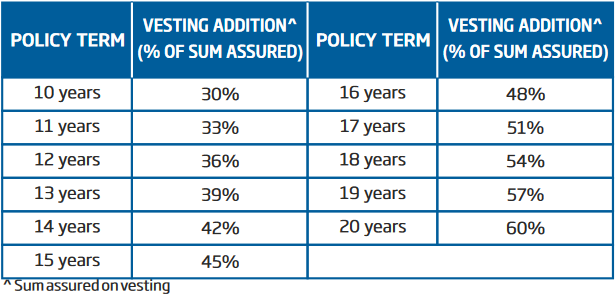

b) Vesting Addition –

Vesting Addition shall vary by policy term and is given below –

c) Vesting Benefit –

On survival till the vesting date and on full payment of premiums due throughout the premium paying term, you will receive a sum of –

- Sum Assured on vesting

- Guaranteed Additions

- Vesting Addition

On the date of vesting the policyholder shall be allowed –

To commute up to 60% and utilize the balance amount to purchase an immediate annuity or deferred annuity from us at the then prevailing annuity rates subject to the point.

To purchase an immediate annuity or deferred annuity from another insurer at the then prevailing annuity rates to the extent of percentage, stipulated by the authority, currently 50%, of the entire proceeds of the policy net of commutation. In case the proceeds of the policy on vesting are not sufficient to purchase a minimum annuity, such proceeds of the policy may be paid to the policyholder as a lump sum.

d) Death Benefit –

On the death of the life assured the company would pay to the nominee the Assured Death Benefit of total premiums paid to date accumulated at a guaranteed rate of 6% per annum compounded annually. The minimum level of the death benefit at all times will be 105% of the premiums paid.

Your nominee has an option to utilize the death benefits, fully or partly, for purchasing an immediate annuity from us. However,the nominee or beneficiary shall be given an option to purchase annuity from any other insurer at the then prevailing annuity rate to the extent of percentage, stipulated by the Authority, currently 50%, of the proceeds of the policy net of commutation.

Alternatively, your nominee can withdraw the entire death benefit as a lump sum. Please note the guaranteed rate of 6% p.a. on the premiums paid to date is applicable only for the purpose of calculating death benefit and not for vesting benefit.

Total Premiums Paid means a total of all the premiums received, excluding any extra premium, any rider premium, and taxes.

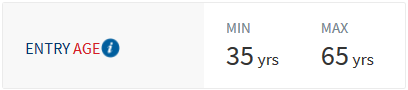

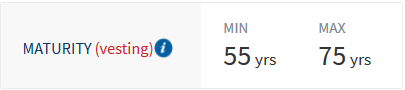

Eligibility Conditions of the Policy –

Is there any grace period in the policy –

Grace Period is the time provided after the premium due date during which the policy is considered to be in-force with the risk cover. This plan has a grace period of 30 days for yearly, half-yearly, and quarterly frequencies from the premium due date.

The grace period for monthly frequency is 15 days from the premium due date. The policy is considered to be in-force with the risk cover during the grace period without any interruption. If there is a valid claim under the policy during the grace period then the company shall still process the claim.

What is the lapse period in the policy?

In the event of non-payment of the premium due under the policy within the grace period, the policy will lapse if the policy has not acquired a surrender value. The risk cover will cease and no benefits will be payable in case of lapsed policies. The policyholder has an option to revive their lapsed policy.

What is Paid-Up Policy?

If you stop paying premiums after the policy has acquired a surrender value, your policy will be made paid-up at the end of the grace period.

Once a policy becomes paid-up –

The Paid-Up Sum Assured shall be the Sum Assured on vesting multiplied by the ratio of the premiums paid to the premiums payable under the policy.

- Guaranteed Additions accrued to the policy shall continue to remain attached. No further Guaranteed Additions shall accrue in the future.

- Vesting Addition shall be calculated based on the Paid-Up Sum Assured.

The death benefit for a paid-up policy shall be premiums paid, accumulated at a guaranteed rate of 6% per annum. The minimum level of death benefit at all times will be 105% of the premiums paid.

The vesting benefit for a paid-up policy shall be the aggregate of the following –

- Paid-Up Sum Assured

- Guaranteed Additions (accrued before the policy became paid-up)

- Vesting Addition (calculated based on the Paid-Up Sum Assured)

Note – The policyholder has the right to revive their paid-up policy.

Can I revive my lapsed policy?

The policyholder can revive their lapsed/paid-up policy within the revival period subject to the terms and conditions of the company. For the revival, the policyholder will need to pay all the outstanding premiums and interest on the outstanding premiums and applicable taxes.

The current rate of interest for revival is 9.5% p.a. A charge of Rs 250 shall be levied for processing the revival. The revival period shall be of five years from the due date of the first unpaid premium and before the expiry of the Policy Term. Once the policy is revived, the policyholder is entitled to receive all contractual benefits.

Can I surrender my policy?

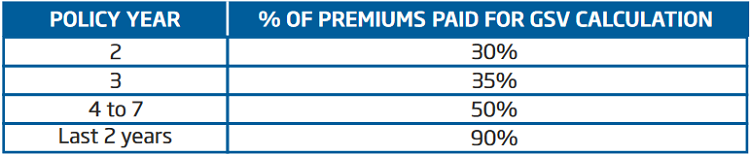

It is advisable to continue your policy in order to enjoy full benefits of your policy. However, the company understands that in certain circumstances policyholder may want to surrender their policy. The policy will acquire a Guaranteed Surrender Value (GSV) provided The First 2 years’ premiums have been paid The GSV shall be the aggregate of the following –

- Percentage of total premiums paid as specified below

- The surrenders value of the accrued Guaranteed Additions.

After the seventh policy year, the percentage of premiums paid for GSV calculation shall be interpolated such that it smoothly progresses from 50% at the end of the seventh policy year to 90% two years before vesting. For GSV of Guaranteed Additions refer to the Terms & Condition section.

Depending on the prevailing market conditions, the Company may pay a higher surrender value in the form of a Special Surrender Value (SSV). On surrender, the amount will be paid to the policyholder.

Can I cancel the policy if I didn’t like its terms and conditions?

If the policyholder doesn’t like the terms and conditions of the policy, then the policyholder can return the policy to the company within 15 days from the receipt of the policy and 30 days in case the policy is sold through distance marketing. This period is known as the Free Look Period.

Is there any tax benefit under this policy?

The contributions made towards the premiums of this policy can be tax-deductible as per Section 80CCC and the received benefits can fall under Section 10(10A).

Exclusion under this Policy –

There no exclusion under this policy.

Conclusion –

So, by now you know each and every important detail about this policy. Do let me know if I have missed any important points in the comment section. Please feel free to ask any doubts regarding this policy.

my agent says you cannot take full fund value of this policy even after 5 years.he says only 1/3 i will get please help me and guide.

Check out the policy document. It must be mentioned there.