HDFC Life Easy Health (Critical Illness) – Review, Features and Benefits

We all know the famous phrase, “Health is Wealth”. every aspect of our life depends on our good health, whether it is a career, job or family life. As our environment is rapidly advancing to a different era, there is a lot of change in our lifestyle. Change in our lifestyle has led to various health conditions, thus imposing an extra financial burden on the family. Health Insurance plays a very crucial role to ensure that you have financial stability even if you get diagnosed with a critical illness.

Keeping the various health conditions in mind, HDFC has developed a health insurance product and med-claim policy for family, parents as well as individuals known as “HDFC Life Easy Health Plan – Critical Illness” which will provide a lump sum amount if the policyholder is hospitalized or undergo any Surgical Procedure or is diagnosed with Critical Illness.

Features of this policy –

- Comprehensive, fixed benefit, health insurance plan and med-claim policy for a family that provides coverage against Critical Illness, Surgeries & Hospitalization.

- Flexibility to choose between Daily Hospital Cash Benefit Option, Surgical Benefit Option, Critical Illness Benefit.

- If the policyholder is diagnosed with any one of the 18 critical illnesses, then a lump sum amount will be payable.

- If the policyholder goes for under any of the 138 surgical procedures mentioned in the policy, then a lump sum amount will be payable to the policyholder.

- Daily Hospital Cash Benefit in case of hospitalization with HDFC Life Easy Health Plan.

- The policyholder has the flexibility to pay a regular or single premium.

- A policyholder can get tax benefits u/s 80D of Income Tax Act, 1961.

- The policyholder is not required to go any medical test to avail of this policy.

Benefits of this policy –

A) Daily Hospital Cash Benefit –

If the policyholder gets hospitalized, due to any injury, sickness or disease, then the policyholder will receive 1% of Sum Insured as Daily Hospital Cash Benefit if admitted in Non-ICU room and 2% of Sum Insured if admitted in ICU room. The lump-sum amount will be payable at the end of stay in the Hospital for each and every completed and continuous hospitalization for more than 24 hours.

Daily Hospital Cash Benefit will be payable for a maximum of 20 days per year in case the policyholder is admitted in Non-ICU room and 10 days per year if admitted in ICU rooms. Daily Hospital Cash Benefit will be payable subject to a maximum of 60 and 30 days if admitted in Non-ICU and ICU rooms, respectively during the entire policy term.

B) Surgical Benefit –

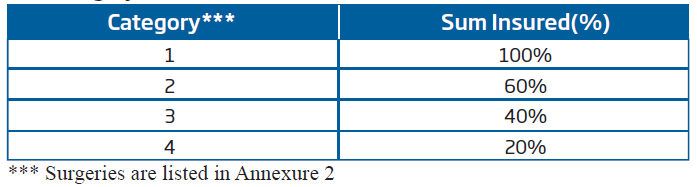

This benefit will be payable to the policyholder if the policyholder has to undergo any of the 138 surgeries mentioned in Annexure 2, provided the surgery is done by a qualified surgeon for a surgical operation and performed at a hospital due to injury or sickness for surgical procedures advised by an independent medical practitioner, and then policy is in force during the policy term. In case you have to undergo surgery during the policy term, the benefit payable shall be ascertained on the basis of the Category of the Surgery as shown below:

The policyholder can make multiple claims up to a maximum of 100% of Sum Insured during the policy term. One cannot claim for the same surgery more than once. There is a waiting period of 60 days from the date of commencement or reinstatement of the cover, whichever occurs later, except where such expenses are incurred for treatment of a condition caused by an Accident.

C) Critical Illness Benefit –

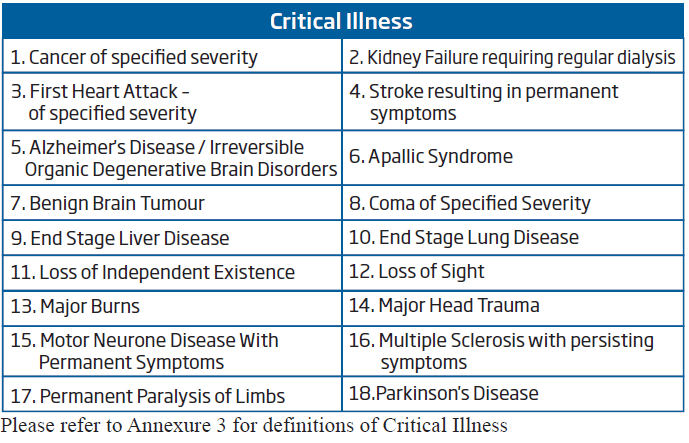

If the policyholder is diagnosed with any of the 18 Critical Illness, then a lump sum benefit equal to 100% of Sum Insured will be payable, provided the policyholder survives a period of 30 days following the diagnosis of any of the below mentioned Critical Illness –

Critical Illness Benefit will be payable only once during the entire policy term. If the diagnosis is made within the policy term and the survival period crosses the endpoint of the policy term, then a valid claim arising as a result of such a diagnosis shall be considered. There is a waiting period of 90 days for Critical Illness Benefit from the date of commencement or reinstatement of the cover, whichever occurs later except in cases where the Critical Illness occurs as a result of an Accident (e.g., Major Head Trauma).

Is there any death, maturity benefit or loan facility in this policy?

This policy doesn’t offer any death benefit, maturity benefit or loan facility in this policy.

If I surrender the policy, Can I get the surrender value?

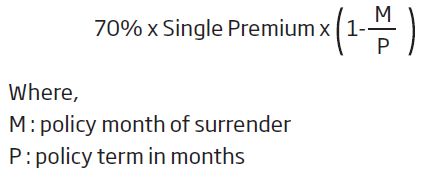

In the case of Regular Premium paying policies, no surrender value is payable whereas, in the case of Single Premium paying policies, surrender benefit payable shall be as follows:

Can the lapsed policy be revived?

Yes, if the policy has lapsed and the policyholder wants to revive the policy then the revival of policy is possible. Revival of policy is possible within 2 consecutive years from the date of the first unpaid premium. The following conditions will apply in case of revival of the policy –

- All pending premium should be immediately paid along with any interest that is advised by HDFC. The current interest rate used for revival is 10.5% p.a.

- Any agreement to revive or reinstate would be subject to satisfactory evidence of good health.

Can I avail of any tax benefit against this policy?

Yes, one may be eligible for tax benefits u/s 80D of the Income-tax Act 1961. The maximum deduction that can be claimed currently is Rs 55,000 (Inclusive of additional deduction of Rs 30,000 in case of insurance on the health of the parent(s) who are senior citizens).

Documents required while claiming the policy –

The claims must be submitted along with following documents in original –

- Duly filled and signed claim form in original

- Copy of Policy document (self-attested copy)

- Claimant’s residence and identity proof (For all claims greater than Rs 1 lacs)

- Canceled personalized cheque or copy of the first page of passbook in case of non-personalized cheque

- Discharge Summary (self-attested copy)

- Final Hospital Bill (self-attested copy)

- Self-declaration of 30-day survival

- Operating Theatre Notes (for Surgical Cash benefit)

- Medical records (self-attested copies)

• Consultation notes

• Laboratory reports

• X-Ray and MRI films

Can I cancel the policy if I didn’t like its terms and conditions?

In case the policyholder does not agree to any of the terms and conditions, the policyholder has an option to return the policy within 15 days from the date of receipt of the policy document to the company stating the reasons. If the policy is purchased through Distance Marketing (i.e. not face to face) then the policy can be returned within 30 days from the date of receipt of the policy document.

Conclusion –

So, by now all of you know each and every detail of this policy. Now it’s up to you all to decide whether this policy will satisfy your requirements or not. If you have any doubt regarding this policy, they please let us know in the comment section.