Aditya Birla Sun Life Insurance Wealth Aspire Plan – Review, Features and Benefits

Aditya Birla Sun Life Insurance Wealth Aspire Plan is a unit-linked life insurance plan that ensures us that we fulfill our responsibilities without any trouble by empowering us with a personalized wealth creation plan. It helps us accumulate substantial financial corpus using its wealth features and allows you to fulfill your duties by securing the future of your loved ones.

Features of this Policy –

- The flexibility to choose from 2 plan options to suit your aspirations

- The flexibility to choose from a wide range of policy terms

- The flexibility to choose from a wide range of premium paying terms

- The flexibility to choose from 4 investment options to suit your investment needs

- The flexibility to add top-ups whenever you have additional savings

- The flexibility of partial withdrawals to meet any emergency fund requirements

4 Investment Options –

a) Smart Option –

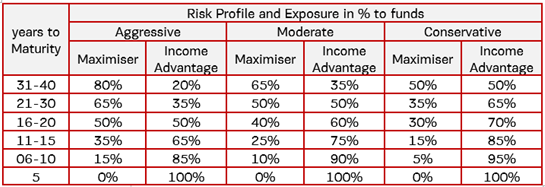

- Structured as per your maturity date and risk profile

- Basic Premium invested under two segregated funds – Maximiser = an equity fund and Income Advantage = a debt fund

- BSLI will manage & administer the investments on your behalf

- Allocation turns conservative as the maturity date approaches to protect accumulation

The proportion invested in Maximiser (an equity fund) will be according to the schedule given below – the remaining amount will be invested in Income Advantage (a debt fund) –

b) Systematic Transfer Option –

- Safeguards your wealth against the market volatilities

- Available only if you have opted for annual mode

- Basic premium (net of premium allocation charge) shall be first allocated to Liquid Plus fund option

- Thereafter monthly 1/12th or Weekly 1/48th of the allocated amount shall be transferred to up to 4 segregated fund(s) of your choice viz. Enhancer, Creator, Maximiser, Multiplier, Super 20, Value & Momentum and Capped Nifty Index and MNC as per the investment proportion for the chosen funds.

- Monthly transfers to your chosen segregated fund(s) will take place monthly on 1st, 8th, 15th or 22nd of the month as selected by you

- It helps to mitigate any risk arising from volatility and averages out the risks associated with the equity market, reducing the overall risk to your portfolio

c) Return Optimiser Option –

- Enables you to take advantage of the equity market

- Protect your gains from the future market volatility and create a more stable sequencing of investment returns

- Basic premiums (net of allocation charges) are invested in Maximiser fund

- It will be tracked every day for each policyholder for a pre-determined upside movement of 10% or more over the net invested amount (net of all charges).

- When the gain from the Maximiser fund reaches 10% or more of the net invested amount, the amount equal to the appreciation will be transferred to the Income Advantage fund at the prevailing unit price.

- This ensures that your gains are protected from any future market volatilities.

- If the gain is less than the pre-determined upside movement of 10%, no transfers will be made.

d) Self-Managed Option –

- Gives you access to our well-established suite of 16 segregated funds viz Liquid Plus, Income Advantage, Assure, Protector, Builder, Enhancer, Creator, MNC, Magnifier, Maximiser, Multiplier, Super 20, Pure Equity, Value & Momentum, Capped Nifty Index, Asset Allocation.

- Complete control on how to invest your premiums

- Full freedom to switch from one segregated fund to another

- Diversify your risk, by allocating your premium in varying proportions amongst the 16 segregated funds.

- Full flexibility to redirect future premiums by changing your premium allocation percentages at any time.

Benefits of this Policy –

a) Death Benefit –

i) Classic Option –

In the unfortunate event the life insured dies while the policy is in effect, we will pay to the nominee/policyholder the greater of –

- Basic Fund Value as on date of intimation of death; or

- Basic Sum Assured

In addition, the company will also pay the greater of –

- Top-up Fund Value as on date of intimation of death, if any; or

- Top-up Sum Assured The Basic Sum Assured will be reduced to the extent of partial withdrawals made during the two-year period immediately preceding the death of the life insured from the Basic Fund Value.

However, the death benefit after partial withdrawals shall never be less than Annualized Premium multiplied by 10. At all times, if the policy has not been discontinued, the Death benefit shall never be less than 105% of total basic premiums and top-up premiums paid up to the date of death reduced to the extent of partial withdrawals made both from the basic fund value and top-up fund values, during the two year period immediately preceding the death of the life assured.

In the case where the death of the Life Insured takes place prior to the risk commencement date, only the basic premiums paid (excluding GST, if any) shall be payable as the Death Benefit. Where a policy is issued on a minor life, the policy will vest in the life insured after attainment of majority of the life assured.

ii) Assured Option –

In the unfortunate event, the life insured dies while the policy is in force, the company shall pay immediately to the nominee the Basic Sum Assured plus Top-up Sum Assured if any. The death benefit shall never be less than 105% of total premiums paid to date. The policy will not terminate once this death benefit is paid to the nominee and it continues till the policy maturity date. On the continuation of the policy –

- Risk cover ceases immediately.

- Future installment premiums shall be paid by us when due to be paid.

- Policy Fund Value will remain invested in the segregated funds and as per investment option existing at the time of death of the Life Insured

- Guaranteed Additions, when applicable shall be added to the Policy Fund Value as and when due.

- All policy charges shall be deducted as and when due, except mortality charge.

- Top-up premiums, partial withdrawals, surrenders, switch between investment options, segregated fund switch, or any premium redirection by the nominee is not allowed.

Maturity benefits shall be paid to the nominee. The Death Benefit shall always be determined as of the date we receive intimation of death of the Life Insured. For a paid-up policy no future installment premium s shall be paid by the Company on death of the Life Insured

b) Maturity Benefit –

At the end of the policy term, and provided the policy is still in force, the company shall pay you the Maturity Benefit. The Maturity Benefit shall be the Basic Fund Value plus the Top-up Fund Value as of that date.

c) Surrender Benefit –

In case of emergencies, the insured can surrender their policy to us anytime during the policy term. Any such surrender will be treated according to the Policy Discontinuance section.

- For Classic Option – In case of death of the life insured, if Life Insuredis different from the policyholder, the proposer/policyholder will receive the policy proceeds.

- For Assured Option – Life Insured and the policyholder has to be the same and the nominee will receive the policy proceeds.

d) Guaranteed Additions –

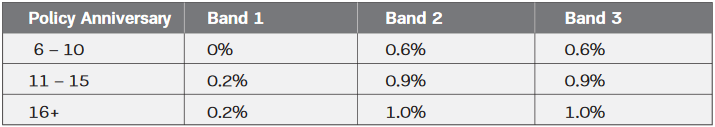

The company shall add the following Guaranteed Additions to their Policy Fund Value while the policy is still in force –

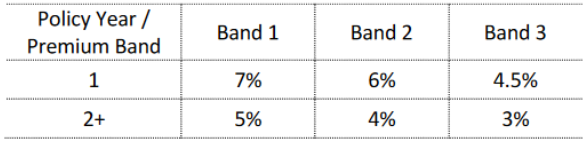

a) On 6thPolicy Anniversary (11thPolicy Anniversary for Band 1) and every Policy Anniversary thereafter, Guaranteed Addition as a percentage of the average Fund Value in the last 12 months is as follows :

b) On 10th Policy Anniversary and on every 5thPolicy Anniversary thereafter, Guaranteed Addition is

- Premium Band 1 – 2% of BasicPremiums paid in last 60 months

- Premium Bands2 & 3 – 2.5% of BasicPremiums paid in the last 60 monthsThe average Policy Fund Value shall be the sum of the Policy Fund Value after each Monthly Processing Date in the last 12 policy months, all divided by 12.

e) Rider Benefit –

For added protection, ABSLI Wealth Aspire Plan can be enhanced by the following riders for a nominal extra cost –

i) ABSLI Accidental Death Benefit Rider Plus –

In the unfortunate event of the death of the life insured due to an accident within 180 days of the occurrence of the accident, we will pay 100% of the rider sum assured to the nominee. Also, the company will refund the premiums collected after the date of Accident till the date of death, with interest as declared by us from time to time, along with death benefit payable.

ii) ABSLI Waiver of Premium Rider –

In case of the following conditions –

- The policyholder becomes completely disabled due to an illness or accident.

- The policyholder is diagnosed with any of the specified critical illnesses.

- Death of the policyholder (only if other than the Life Insured)

The company will fund all the future due to premiums and all the other benefits will remain unaffected. This benefit is applicable only once during the entire premium paying term.

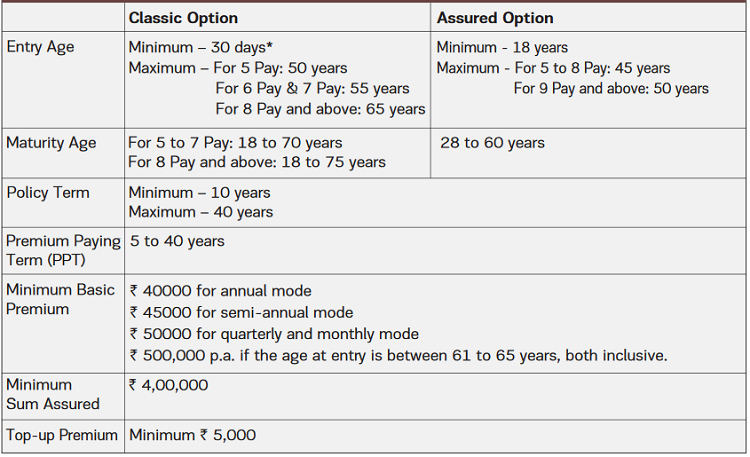

Eligibility Conditions in the Policy –

Is there any grace period in the policy?

If you are unable to pay the installment premium by the due date, you will be given a grace period of 30 days (15 days in case the premium is paid monthly) to make the payment of due installment premium without incurring any penalty, during which time all the benefits will continue inclusive of the risk cover and deduction of charges.

If the company does not receive the entire due installment premium by the end of the grace period, the provisions explained in Policy Discontinuance will apply.

Is partial withdrawal allowed in this policy?

You are allowed to make unlimited partial withdrawals any time after –

- Five complete policy years or

- Life insured attaining the age of 18 whichever is later.

The partial withdrawals shall first be adjusted from Top-up Fund Value (except any top-up premiums paid in the previous five years immediately preceding the date of withdrawal); if any. Once the Top-up Fund Value is exhausted, partial withdrawals would be adjusted from Basic Fund Value. The top-up sum assured will remain unchanged after any withdrawal from the top-up fund value. The minimum amount of partial withdrawal is Rs. 5,000.

You are required to maintain a minimum Basic Fund Value of one basic premium chosen plus any top-up premiums paid in the previous five years immediately preceding the date of withdrawal. The total amount of partial withdrawal during a policy year shall not exceed 25% of the total Policy fund value at the beginning of the policy year.

Can I cancel the policy if I didn’t like its terms and conditions?

The insured will have the right to return their policy to the company within 15 days (30 days in case the policy issued under Distance Marketing) from the date of receipt of the policy, in case you are not satisfied with the terms & conditions of your policy. This period is known as the Free Look Period.

The company will pay the Policy Fund Value plus non allocated premiums plus all Charges levied by the cancellation of Units once the company receives your written notice of cancellation (along with reasons thereof) together with the original policy documents. The company will reduce the amount of the refund by the proportionate risk premium and expenses incurred by us on medical examination of the Life Insured and stamp duty charges.

Is there any revival period in the policy?

You can revive your policy within the revival period of three years from the discontinuance date. To revive the policy, you must pay all due and unpaid basic premiums till date and provide us with evidence of insurability satisfactory to us with respect to the Life Insured.

The effective date of the revival is when these requirements are met and approved by us. On the effective date of the revival, the company shall follow the approach as mentioned in the Policy Discontinuance Section.

What is policy paid-up in the policy?

Under the paid-up status, the policy will continue until the end of the revival period with the following modification –

Basic Sum Assured shall be reduced in proportion to the installment premiums actually paid to the total installment premiums payable during the premium paying term. Mortality charges will be deducted for the reduced sum at risk and other policy charges will remain unchanged.

Under Assured Option, future installment premiums, if any, shall not be paid by the company, in event of the death of the Life Insured. If the policy is not revived before the end of the revival period, the policy shall terminate as per the Policy Discontinuance Provision

When can my policy terminate?

Your policy will terminate at the earliest of the following –

- The date when there is complete withdrawal as per Policy Discontinuance Provision; or

- The date the Policy Fund Value becomes zero; or

- The date of settlement of the Death Benefit under Classic Option; or

- The date of payment of the Surrender Value, if any; or

- The date when the Maturity Benefit is paid

Can I take a loan against this policy?

No loan is allowed to be taken against this policy.

Is there any tax benefit under this policy?

Tax benefits on premium paid under Section 80C and Section 10(10D) of the Income Tax Act, 1961, subject to fulfillment of the other conditions of the respective sections prescribed therein.

Policy Charges –

a) Premium Allocation Charge –

Premium Allocation Charge (as a percentage of the premium paid) is deducted from the Basic Premium and top-up premium when paid and before it is allocated to the segregated fund/s. This charge is guaranteed to never increase. A premium allocation charge of 2% is levied on any top-up premium when paid. The premium allocation charge on –

b) Fund Management Charges –

Fund Management Charge (as a percentage of the Net Asset Value) is deducted by adjusting the daily Net Asset Value of each segregated fund. The company reserves the right to change this charge for any segregated fund at any time subject to a maximum of 1.35% per annum and prior IRDAIapproval.

The current fund management charge on –

- Liquid Plus, Income Advantage, Assure, Protector, and Builder is 1.00% per annum.

- Enhancer, Creator, Capped Nifty Index, Asset Allocations 1.25% per annum.

- Magnifier, Maximiser, Multiplier, Super 20, Pure Equity, Value & Momentum, MNCs is 1.35% per annum.

- Linked Discontinued Policy Fund is 0.50% per annum.

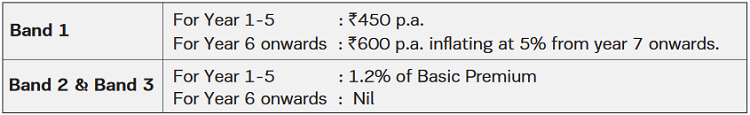

c) Policy Administration Charges –

The policy administration charge is deducted at the start of eve policy month by canceling units proportionately from each segregated fund you have at that time. The charge as per premium bands is as shown below, subject to a maximum of Rs 6,000 p.a.

d) Switching Charges –

This charge is deducted from your Basic Fund Value in case you request for switching between investment options or Segregated FundSwitch. The company currently charge Rs. 50 per request and reserve the right to increase this charge at any time in the future, subject to a maximum of Rs. 500 per request and prior IRDAIapproval.

e) Partial Withdrawal Charge –

This charge is deducted from your Basic Fund Value in case you request for a partial withdrawal. The company currently charges Rs. 50 per partial withdrawal and reserve the right to increase this charge at any time in the future, subject to a maximum of Rs. 500 per request and prior IRDAIapproval.

f) Miscellaneous Charge –

This charge is deducted from your Basic Fund Value in case you request for a premium redirection. Currently, the company charge Rs.50 for each request. They reserve the right to change this charge at any time subject to a maximum of Rs.500 per request and prior IRDAIapproval.

Exclusion under the policy –

Suicide Exclusion –

In case of death due to suicide within 12 months from the date of commencement of the policy or from the date of revival of the policy, as applicable, the nominee or the beneficiary of the policyholder shall be entitled to the Policy fund value, as available on the date of intimation of death.

Conclusion –

So, by now you know each and every important detail about this policy. Do let me know if I have missed any important points in the comment section. Please feel free to ask any doubts regarding this policy.