Aditya Birla Sun Life Insurance Guaranteed Milestone Plan – Review features and Benefits

Nothing is more important than the happiness of our family members. We all work very hard so that we earn and strive to fulfill everything our loved ones wish for. In today’s unpredictable times, having our family’s future and dreams secured is very essential.

Now it is time to build the future of our family members. Aditya Birla Sun Life Insurance Company has come up with “The Aditya Birla Sun Life Insurance Guaranteed Milestone Plan” that recognizes the value of our family’s happiness. Now, protection for your family is guaranteed, even in your absence.

Features of this Policy –

- Fully guaranteed benefits on death or maturity

- Guaranteed Additions that boost your corpus year on year

- Enhance your cover with appropriate riders

- Option to cover your spouse by choosing Joint Life Protection

- Tax Benefits under Section 80C, 80D & Section 10(10D) of the Income Tax Act 1961

Benefits of this Policy –

a) Death Benefit –

- For Single Life –

In case of the unfortunate demise of the life insured during the policy term, the Sum Assured on Death will be paid to the nominee in 10 equal annual installments.

Sum Assured on Death will be highest of –

- Sum Assured as an absolute amount to be paid on death; or

- 105% of the total premiums paid up to the date of death; or

- 10 times of the Annualized Premium

“Total Premiums Paid” means a total of all the premiums received, excluding any extra premium, any rider premium, and taxes.

On acceptance of the death claim, the company shall pay immediately the first annual installment of the Sum Assured on Death along with the excess amount, if any, of Sum Assured on maturity plus accrued Guaranteed Additions over the Sum Assured.

If the date of acceptance of the death claim is one year or more after the date of death, the first payment made shall include all installments due up to the date of acceptance. In case, the nominee would like to get a lump sum payment instead of the annual installments, the company will pay the discounted value of the outstanding annual installments as a lump sum. The discounted value currently shall be calculated using an interest rate of 8.75% per annum.

In the case where the death of the Life Insured takes place prior to the risk commencement date, only the premiums paid to date (excluding applicable taxes) shall be payable as the Death Benefit. The insured can only opt for either ABSLI Accidental Death and Disability Rider or ABSLI Accidental Death Benefit Rider Plus.

- For Joint Life –

Under this option, two lives i.e. you (primary life insured) and your spouse (secondary life insured) are covered under the same policy and also jointly own the policy. The sum assured applicable for your spouse shall be equal to 20% of your applicable sum assured. The insured can opt for this option at the inception of the policy subject to the attained age of primary life insured & secondary life insured is less than or equal to 50 years.

No rider can be chosen under this option and this option cannot be discontinued except due to the unfortunate demise of either of the lives who are insured.

i) The unfortunate death of the primary life insured prior to the secondary life insured –

- The death benefit shall be paid in annual installments to the spouse (secondary life insured) and the same can be chosen a lump sum payment as explained above.

- Seconda life insured will become the sole policyholder and receive the maturity benefit.

- Life cover for the secondary life insured will continue without any future premiums to be paid.

- On subsequent death of the secondary life insured during the policy term, the applicable death benefit shall be paid to the nominee as a lump sum. On the maturity date, the maturity benefit shall be paid to the nominee.

ii) The unfortunate death of the secondary life insured prior to the primary life insured –

- The applicable death benefit shall be paid immediately to the prima life insured as a lump sum.

- Prima life insured will become the sole policyholder. The policy will continue with all benefits (including the insurance cover on prima life insured) with premiums to be paid when due. Maturity benefit shall be paid to the prima life insured on the maturity date.

- On subsequent death of the prima life insured during the policy term, the applicable death benefit shall be paid to the nominee in annual installments and the same can be chosen as lump sum payment as explained above. On the maturity date, the maturity benefit shall be paid to the nominee.

iii) The unfortunate death of both the prima and secondary life insured together –

- The applicable death benefit for the respective lives insured shall be paid to the nominee – annual installments for the death benefit of prima life insured and a lump sum for the death benefit of secondary life insured respectively

- The policy will continue without any future premiums to be paid and on the maturity date, the maturity benefit shall be paid to the nominee.

b) Maturity Benefit –

In the event the life insured survives to the end of the policy term, the company shall pay to you the following –

- Sum Assured on maturity plus

- Accrued Guaranteed Additions

Sum Assured on maturity is the amount which is guaranteed to become payable on maturity of the policy, in accordance with the terms and conditions of the policy and is equal to Total Premiums Paid.

c) Guaranteed Additions –

Guaranteed Additions will accrue on monthly basis to the policy on each policy month till maturity; provided all due premiums have been paid and shall be payable in event of the death of the life insured or policy maturity whichever is earlier.

Guaranteed Additions per annum shall be determined based on the premium amount the insured commits to pay, premium band, the sum assured, the entry age of the life insured, Joint Life Protection option, and policy term chosen.

In the case of the Joint Life Protection option, the Guaranteed Additions shall accrue on the sum assured applicable for the prima life insured and shall be payable on policy maturity.

d) Rider Benefit –

For added protection, the insured can enhance their insurance coverage during the policy term by adding following riders for a nominal extra cost –

- ABSLI Accidental Death and Disability Rider

- ABSLI Critical Illness Rider

- ABSLI Surgical Care Rider

- ABSLI Hospital Care Rider

- ABSLI Waiver of Premium Rider

- ABSLI Accidental Death Benefit Rider Plus

Note – Riders are not available for Joint Life Protection Option. They can only opt for either ABSLI Accidental Death and Disability Rider or ABSLI Accidental Death Benefit Rider Plus.

e) Reduced Paid-Up Benefit –

If the insured discontinues paying premiums after having paid premiums for at least two full years, then their policy will not lapse but continue on a Reduced Paid-Up basis.

Under Reduced Paid-Up, Sum Assured, Sum Assured on Death, on maturity shall be reduced in proportion to the premiums actually paid to the total premiums payable during the policy term. Guaranteed Additions shall not be reduced and remain attached to the policy. No new guaranteed additions will accrue to the policy.

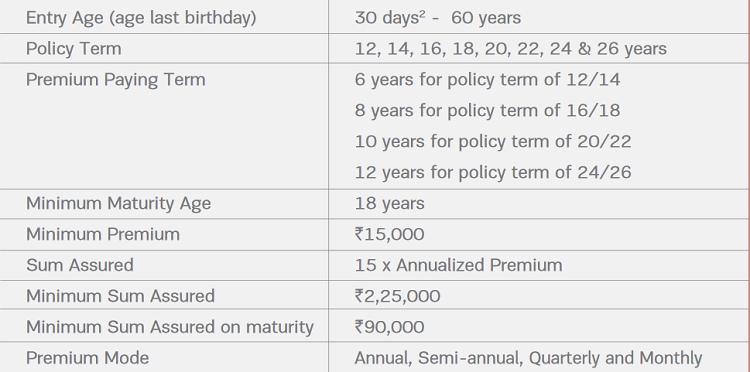

Eligibility Criteria of the Policy –

Am I allowed to surrender my policy?

Yes, the policy can surrender the policy only when the policy acquires a surrender value after all due premiums for at least two full years have been paid.

The Guaranteed Surrender Value shall be a percentage of Total Premiums Paid plus the percentage of accrued Guaranteed Additions. The Guaranteed Surrender Value will vary depending on the year the policy is surrendered.

Your policy will also be eligible for a Special Surrender Value. The surrender value payable will be the higher of Guaranteed Surrender Value or Special Surrender Value. The policy shall be terminated once the Surrender Value is paid.

Can I take a loan against this policy?

Yes, the policyholder can take a loan against their policy once the policy has acquired a surrender value. The minimum loan amount is Rs 5,000 and the maximum up to 85% of your Surrender Value.

The company shall charge interest on the outstanding loan balance at a rate declared by the company which is equal to the base rate of the State Bank of India. The current loan interest rate is 9.30% per annum. Any outstanding loan balance will be recovered by the company from policy proceeds due for payment and will be deducted before any benefit is paid under the policy.

If the outstanding policy loan balance equals or exceeds the surrender value of your policy at any time, then the policy shall be terminated without value.

Can I return the policy if I didn’t like its terms and conditions?

Yes, the policyholder can return the policy within 15 days (30 days in case of Distance Marketing) from the date of receipt of the policy.

The company will refund the premium paid once they receive in writing, a notice of cancellation (along with reasons thereof) together with the original policy documents. The company will deduct the proportionate risk premium for the period of cover and expenses incurred by the company on medical examination and stamp duty charges while issuing the policy.

Is there any grace period and revival of the policy possible?

If the insured is unable to pay their premium by the due date, then they will be given a grace period of 30 days. During this grace period, all coverage under your policy will continue. If the insured does not pay their premium within the grace period, the following will be applicable –

- In case you have not paid premiums for two full years then all benefits under your policy will cease immediately.

- In case you have paid premiums for at least two full years then your policy will be continued on a Reduced Paid-up basis.

The insured can also revive their policy for its full coverage within five years from the due date of the first unpaid premium by paying all outstanding premiums together with interest as declared by the company from time to time and by providing evidence of insurability satisfactory to us. Upon revival, your benefits shall be restored to their full value.

When can my policy terminate?

Your policy will terminate at the earliest of the following –

- The date of settlement of Death Benefit (applicable in case of single life policy and not for Joint Life policy); or

- The date of payment of the Surrender Value; or

- The date of payment of Maturity Benefit; or

- The date on which the Revival Period ends after the policy has lapsed if fewer than two full-year Installment Premium has been paid; or

- The date of early termination of the policy by the policyholder before the Policy acquires any paid-up value; or

- The date on which the outstanding loan amount exceeds the surrender value.

Exclusion under the Policy –

Suicide Exclusion –

The company will pay the total premiums paid till date or surrender value available on the date of death, if higher in the event the life insured dies due to suicide, within 12 months from the date of commencement of risk under the policy or from the date of revival of the policy, as may be applicable provided the policy is in force or active.

For Joint Life Protection, the suicide exclusion described above applies in the event of an earlier death of either the Primary Life Insured or the Secondary Life Insured and the policy is terminated.

Conclusion –

So, by now you know each and every important detail about this policy. Do let me know if I have missed any important points in the comment section. Please feel free to ask any doubts regarding this policy.

My ABSLI Guaranteed Milestone plan Policy No. 007563414 , I have entered in this policy on May 2018. Yearly premium amount is Rs.3,13,500/- I have paid the premium for two years I.e. 2018 & 2019 I did not pay the premium during 2020. Now I want to surrender the policy due to emergency. If I surrender the policy during May 2021 How much amount will I receive as surrender value .

After 2 yrs of payments, the policy acquires the surrender value, which is in your case. So just talk to the customer care of the company, they will share the surrender value to you!

Manish

You have missed the IRR point in this plan which is important as per return on investment ROI.

Else the information shared is really excellent.

The IRR works to around 4.51%, it does not take into consideration the underwriting charges and any other charges levied.

The amount which we will get on maturity/death will be taxable??

No, it will not be ..