Aditya Birla Sun Life Insurance Savings Plan – Review, Features and Benefits

We all work so hard to fulfill every commitment towards our loved ones, be it quality education or a vacation etc…. To achieve every goal and secure our family’s well-being we need to protect our savings from our life’s uncertainties.

So its time to be relaxed because the Aditya Birla Sun Life Insurance has come up with “The Aditya Birla Sun Life Insurance Savings Plan” which can help you achieve this by enabling you to save regularly and grow your savings steadily over time. It is now time to give your loved ones peace of mind and the promise of a secure financial future to meet their needs.

Features of this Policy –

- Flexibility to choose the Sum Assured based on your protection and savings needs.

- Flexibility to choose the policy term and the premium paying term.

- Additional Sum Assured payable in case of accidental death.

- Guaranteed Additions1 for the first 5 policy years.

- Tax Benefits under Section 80C, 80D & Section 10(10D) of the Income Tax Act 1961.

- Boost your savings by bonuses starting from the first policy year.

Benefits of this Policy –

a) Guaranteed Additions –

Guaranteed Additions of 40 per thousand Sum Assured will be added to your policy at the end of each policy year during the first 5 years; provided all due premiums have been paid.

b) Death Benefit –

In the unfortunate event of the death of the life insured during the policy term, the company shall pay the following death benefit to the nominee –

- Guaranteed Death Benefit (Sum Assured on Death); plus

- Accrued Guaranteed Additions; plus

- Accrued regular bonuses as on date of death; plus

- Terminal Bonus; if any

Guaranteed Death Benefit is higher of Sum Assured or 10 times the Annualized premium payable throughout the premium paying term. The annualized premium shall be the premium amount payable in a year chosen by the policyholder, excluding the taxes, rider premiums, underwriting extra premiums, and loadings for modal premiums, if any.

In the event the life insured dies due to an accident, we shall pay to nominee an additional amount equal to the sum assured as chosen at the policy inception. If the life insured is different from the policyholder, the company shall pay the above death benefit to the policyholder. The policy shall be terminated once the death benefit is paid.

c) Maturity Benefit –

In the event that the life insured survives until the end of the policy term, the company shall pay the following:

- Sum Assured, plus

- Accrued regular bonuses, plus

- Terminal Bonus if any

- Accrued Guaranteed additions, plus

The policy shall be terminated once the maturity benefit is paid.

d) Auto Cover Continuation –

In case of premiums for two policy years have been paid in full and you miss paying any subsequent premium, the full death benefit shall continue for a period of two successive years (auto cover continuation period) from the due date of the first unpaid premium even though the policy is in Reduced Paid-Up status.

During the auto cover continuation period, the additional amount payable in case of accidental death shall cease, the accrued Guaranteed Additions and bonuses till the due date of the first unpaid premium shall be payable on death and no further bonus or Guaranteed Additions shall accrue in the policy.

e) Reduced Paid-Up Benefits –

If you discontinue paying premiums after having paid premiums for at least two full years, then your policy will not lapse but will continue on a Reduced Paid-Up basis. Under Reduced Paid-Up, the insured will be paid an RPU Guaranteed Benefit equal to your Sum Assured and accrued Guaranteed Additions reduced in proportion to the premiums actually paid to the total premiums payable during the policy term and shall be payable on death and maturity.

The additional amount payable in case of accidental death shall cease. Your accrued bonuses up to the due date of the first unpaid premium will not be reduced; however, any bonus payable for the policy year of premium discontinuance shall be reduced proportionately to the unpaid premiums in that policy year. There will be no further accrual of Guaranteed Additions and bonuses.

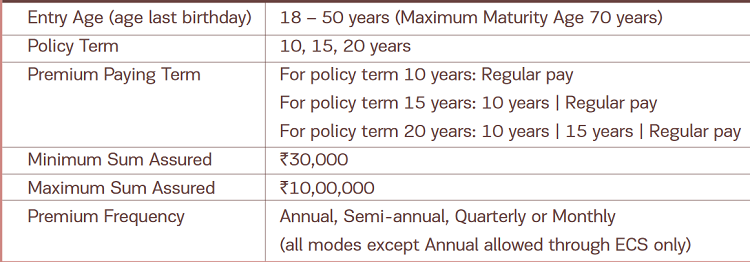

Eligibility Criteria of the Policy –

Is there any provision in the policy where I can surrender the policy?

Your policy will acquire a surrender value after all due premiums for at least 2 full policy years are paid. The Guaranteed Surrender Value is a percentage of Total premiums paid plus the surrender value of accrued guaranteed additions and accrued regular bonuses.

The Guaranteed Surrender Value will vary depending on the premium paying term and the year the policy is surrendered. Your policy will also be eligible for a Special Surrender Value. The surrender value payable will be the higher of Guaranteed Surrender Value or Special Surrender Value.

Note – The policy shall be terminated once the Surrender Value is paid.

Can I take a loan against this policy?

Yes, one can take a loan against the policy once it has acquired a surrender value and provided the life insured is alive. The minimum loan amount is Rs.5,000 and the maximum is 85% of your surrender value.

The company shall charge interest on the outstanding loan balance at a rate declared by the company from time to time based on then prevailing market conditions. Any outstanding loan balance will be recovered by the company from policy proceeds due for payment and will be deducted before any benefit is paid under the policy.

If your outstanding policy loan balance equals or exceeds the surrender value of your policy at any time, when your policy is in reduced paid-up status, then the policy shall be terminated without any value.

Can I return the policy if I didn’t like its terms and conditions?

Yes, you can return the policy within 15 days (30 days in case the policy issued under Distance Marketing) from the date of receipt of the policy. This 15 day period is known as the Free Look Period.

The company will then refund the premium paid once when they receive a written notice of cancellation (along with reasons thereof) together with the original policy documents. The company may deduct proportionate risk premium for the period of cover and expenses incurred by the company on medical examination and stamp duty charges while issuing your policy.

Is there any provision of the grace period and reinstatement in the policy?

If you are unable to pay your premium by the due date, you will be given a grace period of 30 days (15 days for monthly mode). During this grace period, all coverage under your policy will continue.

If you do not pay your premium within the grace period, the following will be applicable –

- In case you have not paid premiums for two full years, then all benefits under your policy will cease immediately.

- In case you have paid premiums for at least two full years, then your policy will continue on a Reduced Paid-Up basis.

You can also reinstate your policy for its full coverage within five years from the due date of the first unpaid premium by paying all outstanding premiums together with interest as declared by the company from time to time and by providing evidence of insurability satisfactory to the company. Upon reinstatement, your benefits shall be restored to their full value.

When can my policy terminate?

Your policy will terminate at the earliest of the following –

- The date of settlement of the death benefit;

- The date of payment of the surrender value, if any; or

- The date of payment of the maturity benefit; or

- The date on which the RevivalPeriod ends after the policy has lapsed if fewer than two full years of premium have been paid

- The date when outstanding loan value exceeds the surrender value for reduced paid-up policies.

Exclusions under the Policy –

a) Suicide Exclusions –

The company will pay the premiums paid till date or surrender value available on the date of death, if higher in the event the life insured dies due to suicide, within 12 months from the date of commencement of risk under the policy or from the date of revival of the policy, as may be applicable provided the policy is in force or active.

b) Accidental Death Benefit Exclusion –

The insured shall not be entitled to any benefits for the death of the Life Insured directly or indirectly due to or caused, occasioned, accelerated or aggravated by any of the following –

- Death as a result of any disease or infection other than directly linked with an accident.

- Attempted suicide or self-inflicted injury while sane or insane.

- Participation of the insured person in criminal, illegal activity, or unlawful act with criminal intent.

- Taking or absorbing, accidentally or otherwise, any intoxicating liquor, drug, narcotic, medicine, sedative or poison, except as prescribed by a registered medical practitioner.

- Nuclear Contamination; the radioactive, explosive, or hazardous nature of nuclear fuel materials or property contaminated by nuclear fuel materials or accidentss arising from such nature.

- Entering, exiting, operating, servicing, or being transported by any aerial device or conveyance except when on a commercial passenger airline on a regularly scheduled passenger trip over its established passenger route.

- Engaging in or taking part in professional sport(s) or any hazardous pursuits, including but not limited to, diving or riding or any kind of race; underwater activities involving the use of breathing apparatus or not; martial arts; hunting; mountaineering; parachuting; bungee jumping.

- War, terrorism, invasion, the act of a foreign enemy, hostilities (whether war be declared or not), armed or unarmed truce, civil war, mutiny, martial law, rebellion, revolution, insurrection, riot or civil commotion, strikes. War means any war whether declared or not.

- Service in the armed forces in time of declared or undeclared war or while under orders for warlike operations or restoration of public order.

- Accident occurring while or because the Insured is under the influence of Alcohol or Solvent abuse or taking of drugs, narcotics or psychotropic substances unless taken in accordance with the lawful directions and

- Any injury incurred before the effective date of the cover.

Conclusion –

So, by now you know each and every important detail about this policy. Do let me know if I have missed any important points in the comment section. Please feel free to ask any doubts regarding this policy.