Aditya Birla Sun Life Insurance Child’s Future Assured Plan – Review, Features and Benefits

As a parent, the center of our universe is always our children. Everything revolves around them. However, the increasing cost of inflation, education and other uncertainties may upset our dreams for your child. What if a life insurance plan ensures that your aspirations for your child are never compromised?

“ABSLI Child’s Future Assured Plan”, is a life insurance savings plan, which offers Assured Benefits to take care of the important milestones in our child’s life – Education and Marriage. You can also plan to receive funds in the future for your child’s education or a grand wedding.

In case of an unfortunate event, the remaining premiums will be waived off. So, you rest assured that the key milestones of your child’s future are secured with a guarantee even in your absence.

Features of this policy –

- The plan offers complete financial security.

- This policy has the flexibility to save for Child Education, Marriage, or for both the life goals.

- Worry-free goal achievement through Policy Continuance Benefit.

- Flexibility to choose from various Pay terms and Policy Terms.

- Option to avail of Enhanced Insurance Cover.

- Option to enhance your risk cover with an appropriate rider option.

- The policyholder can get 20% extra on each benefit as & when due as loyalty addition.

- All benefits are fully guaranteed and safe from market volatility.

Benefits of this Policy –

a) Assured Benefits –

This plan offers the policyholder, Assured Benefits to fund their child’s key milestones. The policyholder can choose one of the following options at inception to receive Assured Benefits. The chosen assured benefit option cannot be changed during the term of the policy. The options are as follows –

i) Education Milestone Benefit –

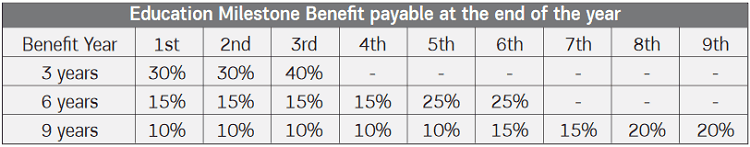

Under this option, Assured Benefit will be paid in annual installments over the chosen Education Benefit period on policy anniversary preferably when a child attains age between 15 yrs to 21yrs, to take care of a child’s educational expenses. Policyholders can choose the Education Benefit Period of 3 ,6, or 9 years at inception. Once chosen it cannot be changed. The Education Milestone Benefit as a percentage of Sum Assured will be payable as per the table below.

ii) Marriage Milestone Benefit –

This option offers guaranteed lump sum payout at the end of the policy term. It offers the option to schedule commencement of the lump sum pay-out when the child attains age between 24yrs to 32yrs, to take care of the child’s marriage expenses.

iii) Education and Marriage Milestones Benefit –

This option offers to avail both benefits (Education and Marriage) under one policy. Education Benefit will be paid as per Education benefit period of 3, 6 or 9 years opted by the Policyholder at inception. Marriage Milestone Benefit will be paid in a lump sum at maturity.

Under this option, Policyholder will have the choice to receive 100% or 150% or 200% of the Sum Assured as assured benefit for Marriage Milestone under this plan option.

Deferral of Assured Benefits –

The policyholder will have the flexibility to defer any of the Assured Benefit payment by 1, 2 or 3 years. The company will enhance the deferred pay-out by 6.0% p.a. Once the pay-out is deferred, you cannot change it thereaſter.

b) Assured Benefit Payment Term –

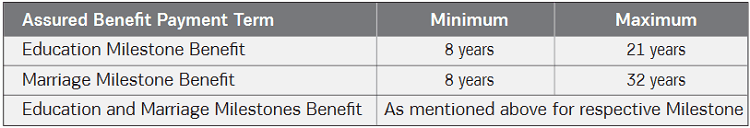

The Assured Benefit payment term is the term since policy inception when the first installment of the assured benefit becomes due for payment. This benefit payment term should at least be 3 years higher than the Premium Payment Term.

For Education and Marriage Milestone Benefit option the payment term for the Marriage Milestone Benefit should always be up to or beyond the due date of the last installment payment of the Education Milestone Benefit. The minimum and maximum payment term is as mentioned in the table below –

c) Loyalty Addition Benefit –

We will enhance each Assured Benefit payable to you, by 20% as Loyalty Addition at the end of Premium Payment Term, provided you have paid all due installment premiums.

d) Maturity Benefit –

The Maturity Benefit shall be the amount of Assured Benefit payable at the end of the Policy Term.

e) Death Benefit –

In the event of the death of the Life Insured during the Policy Term, Nominee will receive the death benefit as follows –

- Assured Benefits as per the option chosen by you shall be paid on their respective due dates; plus

- Any excess amount of Sum Assured on Death over the discounted value of the Assured Benefits payable in the future will be paid immediately as lump-sum.

- All future installment premiums shall be waived off

Alternatively, Nominee can also opt for immediate payment of death benefit. In this case, higher of Sum Assured on Death or discounted value of all future Assured Benefits, discounted @ 8% per annum, will be paid in a lump sum and the policy will be terminated.

Where,

- “Sum Assured on Death” during the entire Policy Term is the maximum of 10 times the Annualized Premium or 105% of Total Premiums paid.

- “Annualized Premium” shall be the premium amount payable in a year chosen by the policyholder, excluding the taxes, rider premiums, underwriting extra premiums, and loadings for modal premiums, if any.

- “Total Premiums paid” means a total of all the premiums received, excluding any extra premium, any rider premium, and taxes.

The minimum death benefit shall always be the Sum Assured on Death. Assured benefit pay-outs will also include loyalty addition

f) Enhanced Insurance Cover –

This option allows Policyholders to enhance death coverage and receive a lump sum amount to take of immediate financial needs, in event of life insured’s death during the policy term. The policyholder can choose coverage equal to 50% or 100% or 200% of the Sum assured. An additional premium will be payable for availing this option.

In the event of Death, Nominee will also have the option to opt for Staggered payment with fixed Annual or Monthly Income.

g) Rider Benefit –

For added protection, the policyholder can enhance their insurance coverage for the rider policy term by adding the following riders for a nominal extra cost.

- ABSLI Accidental Death and Disability Rider

- ABSLI Critical Illness Rider

- ABSLI Surgical Care Rider

- ABSLI Hospital Care Rider

- ABSLI Waiver of Premium Rider

- ABSLI Accidental Death Benefit Rider Plus

Policyholder can opt for either ABSLI Accidental Death and Disability Rider or ABSLI Accidental Death Benefit Rider Plus but not both.

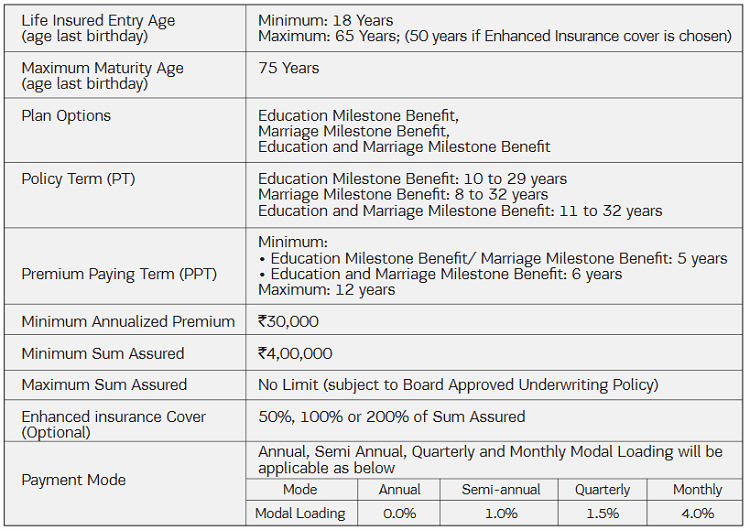

Eligibility Criteria of the Policy –

Can I surrender my policy?

The policyholder can surrender the policy once their policy acquires a surrender value aſter all due premiums for at least two full policy years are paid. The surrender value payable will be the higher of Guaranteed Surrender Value or Special Surrender Value. The Guaranteed Surrender Value shall be a percentage of total premiums paid less than the assured benefit already paid to the Policyholder/ Nominee.

The Guaranteed Surrender Value will vary depending on the year the policy is surrendered. Your policy will also be eligible for a Special Surrender Value. Special Surrender Value is not guaranteed and may be revised by Company. The policy shall be terminated once the Surrender Value is paid.

Can I take a loan against this policy?

The policyholder can take a loan against their policy once it has acquired a Surrender Value. The minimum loan amount is Rs. 5,000 and the maximum up to 85% of your surrender value. The company shall charge interest on the outstanding loan balance at a rate declared by the company on June 1st of every calendar year which is 1% plus the base rate of the State Bank of India.

Any outstanding loan balance (including unpaid interest) will be recovered by the company from policy proceeds due for payment and will be deducted before any benefit is paid under the policy. For active policies, the company shall intimate you to give you an opportunity to repay all or part of your outstanding loan balance in order to continue your policy uninterrupted. If you do not repay the loan or fail to respond to the notice, the company shall have the right to terminate the policy.

Can I cancel the policy If I didn’t like its terms and conditions?

The policyholder has the right to return their policy to the company within 15 days (30 days in case the policy is purchased through Distance Marketing) from the date of receipt of the policy, in case he/she is not satisfied with the terms & conditions of your policy.

The company shall refund the premium paid once they receive a written notice of cancellation (along with reasons thereof) together with the original policy documents. The company may reduce the amount of the refund by proportionate risk premium for the period of cover and expenses incurred by us on medical examination and stamp duty charges while issuing your policy.

Is there any Grace Period in this policy?

If the policyholder is unable to pay their premium by the due date, they will be given a grace period of 30 days (15 days in case of monthly mode). During this grace period, all coverage under their policy will continue. In case of death during the grace period, the company will not recover the unpaid premium due from the death benefit payable.

If the policyholder does not pay their premium within the grace period, the following will be applicable –

- In case you have not paid premiums for two full years, then all benefits under your policy will cease immediately.

- In case you have paid premiums for at least two full years, then your policy will continue on a Reduced Paid-Up basis.

Can I revive my lapsed policy?

The policyholder can revive their lapsed policy for its full coverage within five years from the due date of the first unpaid premium by paying all outstanding premiums together with interest as declared by the company on June 1st of each calendar year and by providing evidence of insurability satisfactory to us. Once the policy is revived, your benefits shall be restored to their full value.

When can my policy terminate?

Your Policy will terminate at the earliest of the following reason –

- The date of payment of the surrender value; or

- The date of payment of the last instalment of the Assured Benefit; or

- The date of settlement of Death Benefit; or

- The date on which the revival period ends after the policy has lapsed if fewer than two full year’s instalment premiums have been paid; or

- The date on which the outstanding loan amount exceeds the surrender value as mentioned in the Policy Loan section.

- The date on which we receive a free look cancellation request.

Exclusion under the Policy –

Suicide Exclusion –

In case of death of Life Insured due to suicide within 12 months from the Policy Issue date or from the date of revival of the policy, as applicable, the amount described in the Death Benefit provision will not be payable.

In such circumstances, the company shall refund the premiums paid (excluding applicable taxes) since the date of inception of the policy till the date of death or the company shall pay the Surrender Value available as on the date of death, whichever is higher to the Nominee or beneficiary of the Policyholder, provided the Policy is in force.

Conclusion –

So, by now you know each and every important detail about this policy. Do let me know if I have missed any important points in the comment section. Please feel free to ask any doubts regarding this policy.