Retirement Planning

Retirement is a long journey, make sure its planned well and worthwile to live.

5 reason why plan for Retirement?

- Life Expectancy is Rising

- No good Social Welfare by Govt

- High Healthcare costs in old age

- Depending on your children is unfair

- Best time to fulfill lifelong aspirations

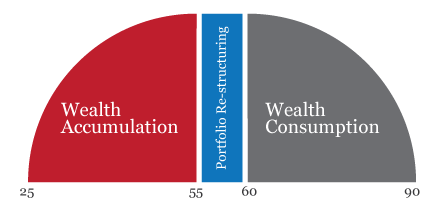

Wealth Accumulation

From age 25 - 50 yrs of your life, you need to focus properly on how to accumulate enough wealth which can sustain your next 35-40 yrs of life.

Unless this is strong, next 35-40 yrs will be disaster. If you have not been an early starter, then you need to seriously consider planning for your pre-retirement investments.

Portfolio Restructuring

Its important to make changed in your portfolio around 55 yrs of age, when you are few yrs away from your retirement at 60.

This is important because by the time you retire, your portfolio should be designed in a way to take care of your post retirement life.

Wealth Consumption

Retirement is a long journey of 35-40 yrs now in India. Gone are the days, when people used to live for just 10-15 yrs. Now your wealth should be managed properly which can give you desired income and should be available long enough in life.

If you plan to fail on this, imagine what happens if you out live your wealth?

Your Retirment Corpus should be 300X of your monthly Expenses

As a thumbrule you should have atleast 300 times your monthly expenses at the time of your retirement to live comfortably for next 30-35 yrs as per your desired lifestyle.

You need to plan for inflation in Retirement

Over time, your retirement expenses will go up. If your monthly expenses at retirement is 100 units per month (1200 units per year), then by the time you reach 90 yrs, it will be 10X

You can live for atleast 30 yrs if you have sufficient Corpus

Your Retirement corpus will eventually finish in 30-35 yrs time because over time your expenses will rise and eat up your corpus. Unless you have sufficient planning, your retirement might be a disaster.

Your kids are NOT your Retirement Plan

Do you want to depend on your children for your survival in retirement phase?

Do you want to keep wondering who will pay for all your expenses?

Do you always want others to look at you as BURDEN?

If the answer is NO, then start your Retirement Planning NOW !

4 things we Promise you!

Regular Income Generation

You will get planning on how to generate regular inflation adjusted income till your retirement phase

Tax Optimization

Your investment planning will be done in such a way that there is minimal income tax levied on your income

Good Return (with Safety)

We will suggest you the best possible way you can grow your money over time, so that it does not get exhausted soon

Quality Support

Our team is always available to serve you with any requirement you have. We also give you regular updates on your portfolio and performance

Testimonials from our Clients

However, my real story started when I came in contact with Jago Investor team. I contacted them first in October 2014 by searching on net.

Their financial health check up is a systematic approach to know where we stand today...After thoroughly going through all my so-called investments, they made many changes, made me stop bank FDs, old SIPs, Insurance policies & what not...and they devised a new financial plan for me.

I had been following JagoInvestor blog since 2 years and I knew I needed help.

My financial health check was an expected eye opener.

Eventually after a lot of calls and discussions when my first SIP was set up - i was further relieved. Now every month - I feel as eager to see my SIP deducted from my account, as much as I await my salary 🙂

They held my hand through the entire process, explaining each and every small detail, helping me creating goals, told me what I was doing wrong (made me sell the ULIP - that was a difficult frog to swallow ! ) and designed my investment plan.

I started out ambitiously, moving nearly 40% of my income into SIP's.

I've been doing it for a lot tole more than a year now, and it's been fabulous. In a year when the markets haven't moved much, we managed a decent growth of nearly 20 %

And even though my investments were not going to be that substantial, I did not see any discrimination in handling of my portfolio by the team.

Lastly I would like to say that the Jago Investor team is always available to you. I really appreciate their prompt responses in any given scenario.