New Mutual Funds Charges from ICICI

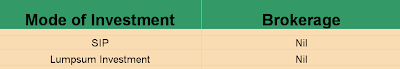

ICICIDirect has revised its brokerage charges for Mutual funds Investments . Some time back SEBI abolished mutual funds entry load , In this post we will see the new charges by ICICIDirect and analyse if its good or bad . The new revised charges look good to me . In case you don’t know what […]

What is Direct Tax Code and How does it impact common person

There is going to be some really big changes in Taxation laws if “Direct Tax Code” comes into existence year 2011. There are some big changes proposed in the Draft which if implemented will be the biggest ever change in Tax laws and will impact people in a big way. Let us see what are […]

Question and Answers , Part 2

This is second post for answers to Questions asked to me in “Ask a Question” Section . The First Part of Question Answer section is Here . This section has questions and answers related to topics like GOLD , Real Estate , Term Insurance , Mutual Funds , “hiding Information from Insurance Company” . See […]

What is IRR and XIRR and how to Calculate it

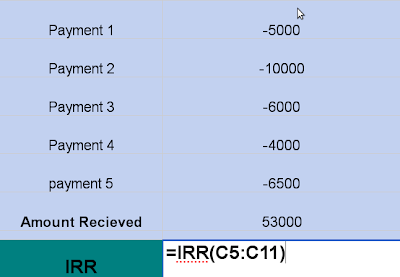

How do you calculate your returns when you every year you invest different amount and at the end you receive your Money back? Suppose your invest 5000, 10000, 6000, 4000 and 6500 in 5 yrs and Get 53,000 at the end of 5 yrs then what is your Return? It’s 17.4%. The concept is called […]

Financial Planning and Stock Market Seminar in Bangalore

We had a Free session on Personal Finance and Stock Market Basics on last Sunday , 2nd Aug . There were total of 17 participants , I talked about Basics of Investing and Insurance principles along with a live case study , where I proved why one of the participant was severely underinsured , I […]

Why to open a PPF account in India

PPF i.e. Public provident fund is the most recommended long term investment tool offered by Central government of India for Indian resident employees. In this article we will see why one should open a PPF account even if one does not need it or have no intention of putting his money in Debt. It may […]

Question and Answers , Part 1

You might have noticed that I started “Ask a Question” Section on my blog where anyone can ask any query to me, I will try my best to answer the questions, but please don’t expect instant reply. I am sharing the answers here for some questions asked by readers, this will help others to gain […]

Why people don’t buy Term Insurance?- Analysis of a case study on Indian people’s mindset

“We have no desire to make anybody look like a blithering idiot, but we do love it when they do. “– Stephen Colbert. One of the reasons why most people do not take Term Insurance is because “They don’t get anything back at the end”. In this article, I will show you why this is […]

How Builders are Not keeping their Promises in Real Estate

Deepak Shenoy came up with a very nice article on How Builders are not keeping there promises while delivering the Residential Properties. He shares his views on Why it does not make sense to buy Real estate currently at idiotic prices level currently . He also links to another article of this where he compares […]

ULIP charges restricted to 3% by IRDA

Does God Exist? I don’t know, but IRDA surely does!!! And hence finally it has acted as GOD to the investors 🙂 . On 22nd July, IRDA capped the ULIP charges at 3%. Let us see in this article how this will affect Investors and the implications on Investments and Insurance Sector as a whole. […]