Last 10 yrs returns of various Equity mutual funds (category wise)

POSTED BY ON August 22, 2022 NO COMMENTS

Most mutual fund investors get lost in the world of various equity fund categories like Large cap, Flexi-cap, midcap, small-cap, focused funds, multi-cap, and whatnot.

Do investors keep wondering which category will provide the best returns over the long term? And in real life I have also seen most of the investors out of their ignorance compare the fund return with the Sensex or nifty as thats the most easily benchmark to compare (example – market double ho gaya, but mera fund to utna accha nahi performance kar raha)

So here is what I did

I downloaded 9 equity categories mutual funds from advisorkhoj.com and sorted them on the basis of the last 10 yrs’ returns and found out how much a one-time investment of Rs 10 lacs became in value terms. In this period Sensex went from 17700 levels to 60,000 (this journey is just a single data point from 19th Aug 2012 to 19th Aug 2022, which I know is a biased data point, but that’s when I am writing the article, so whatever is the situation,I am doing it). This turned out to be approx 12.98% CAGR return and Rs 10 lacs became 33.94 lacs.

Before I go into charts and data, let me admit that this is not the “right” analysis as such and with some flaws. However, it reflects how many novice investors look at data. Some important disclaimer and important points I must share before you e-lynch me in the comments section for my stupidity.

Disclaimer and Important Points

- This post is simply the data presentation of the data and not some analysis of which is the better or bad funds.

- The article simply tells you about what has happened in the past and does not predict anything about the future.

- Mutual fund SEBI categorization was done on October 6, 2017, but the fund performance data was taken before that, so a lot of funds are not in true sense the midcap, or large and midcap, etc, but we are simply taking them as it is, because that’s the current situation.

- Not all funds categories were fixed from start. some funds exchanged hands from one category to another and their mandate was also changed. But we will let it be for creating the charts

- Some very famous funds are not part of this analysis as they have not completed 10 yrs.

- While the fund benchmark is different for each category, I am simply creating a simple comparison of which funds have at least created more wealth than Sensex.

Funds Category considered

- Large Cap Funds

- Large and Midcap Funds

- Midcap Funds

- Small Cap Funds

- Multicap Funds

- Focused Funds

- ELSS Funds

- Flexicap Funds

- Index Funds

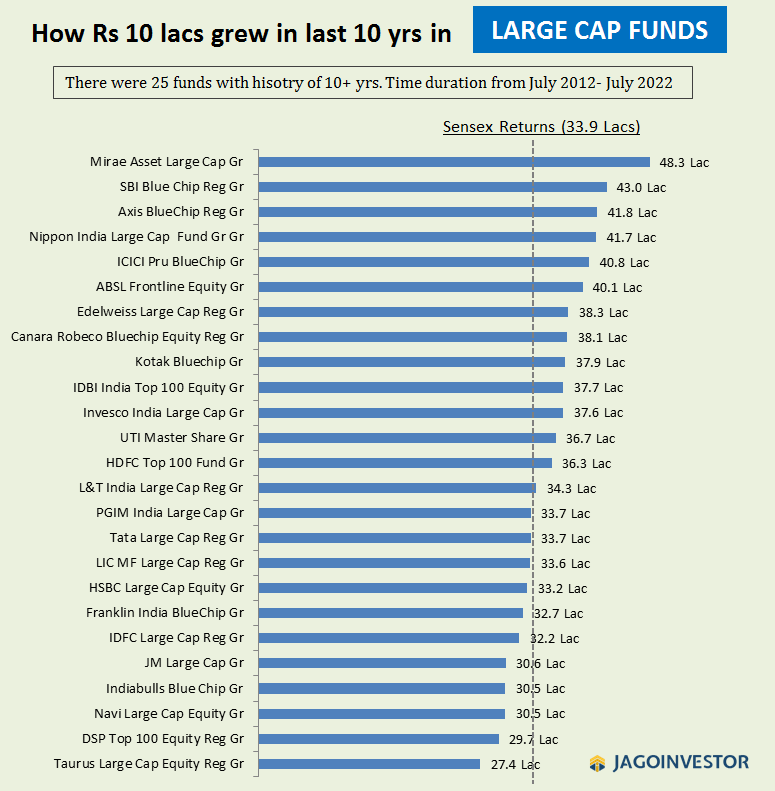

Category #1: Large Cap Funds

There were 25 funds in this category with 10+ yrs of data available. The topmost fund returned 48.3 lacs for the investment of 10 lacs and the worst did return 27.4 lacs. Here is the data in the chart.

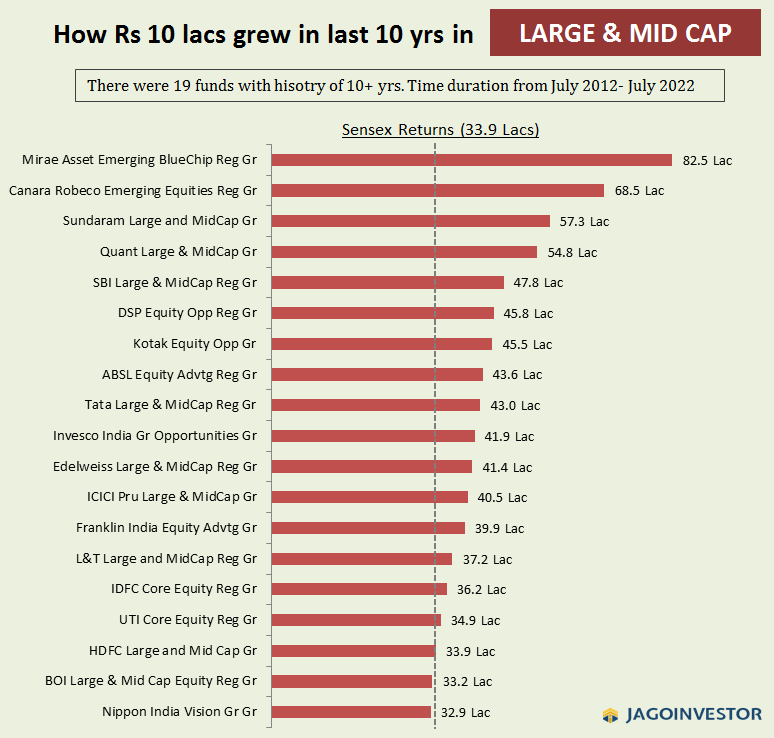

Category #2: Large and Mid Cap Funds

There were 20 funds in this category with 10+ yrs of data available. The topmost fund returned 82.5 lacs for the investment of 10 lacs and the worst did return 32.9 lacs. Here is the data in the chart.

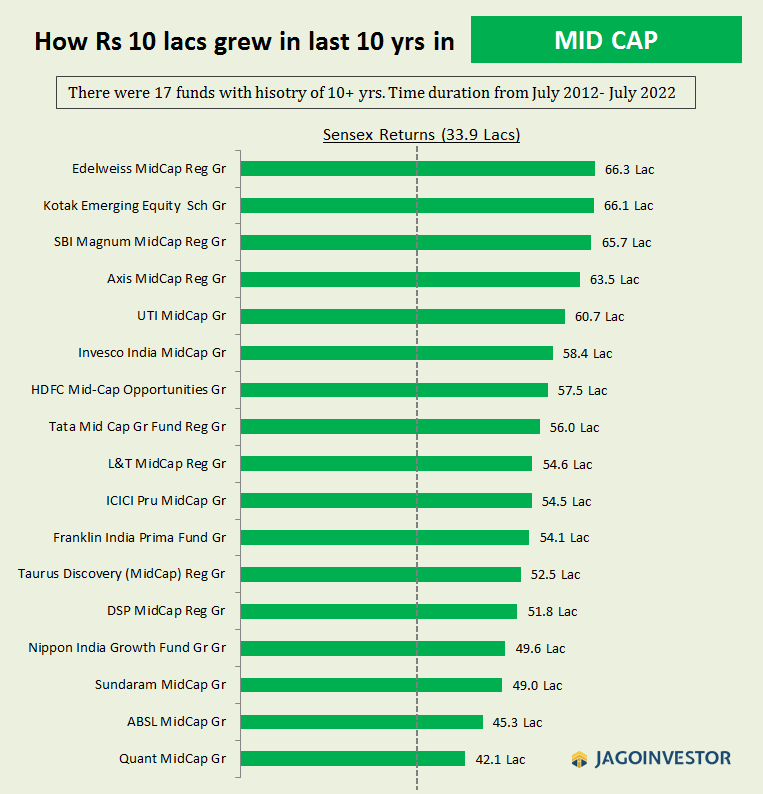

Category #3: Mid Cap Funds

There were 17 funds in this category with 10+ yrs of data available. The topmost fund returned 66.3 lacs for the investment of 10 lacs and the worst did return 42.1 lacs. Here is the data in the chart.

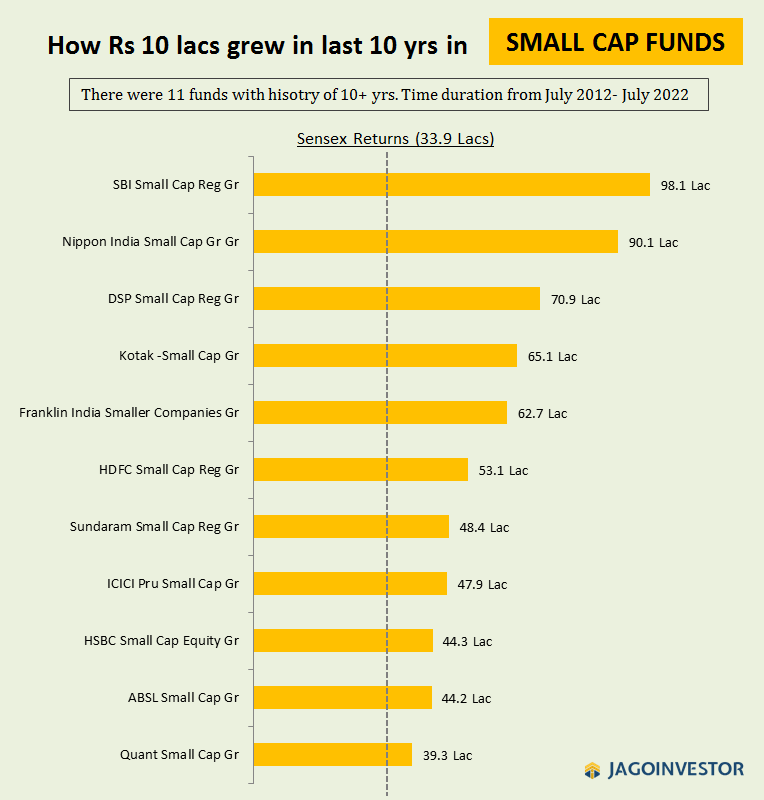

Category #4: Small Cap Funds

There were 11 funds in this category with 10+ yrs of data available. The topmost fund returned 98.1 lacs for the investment of 10 lacs and the worst did return 39.3 lacs. Here is the data in the chart.

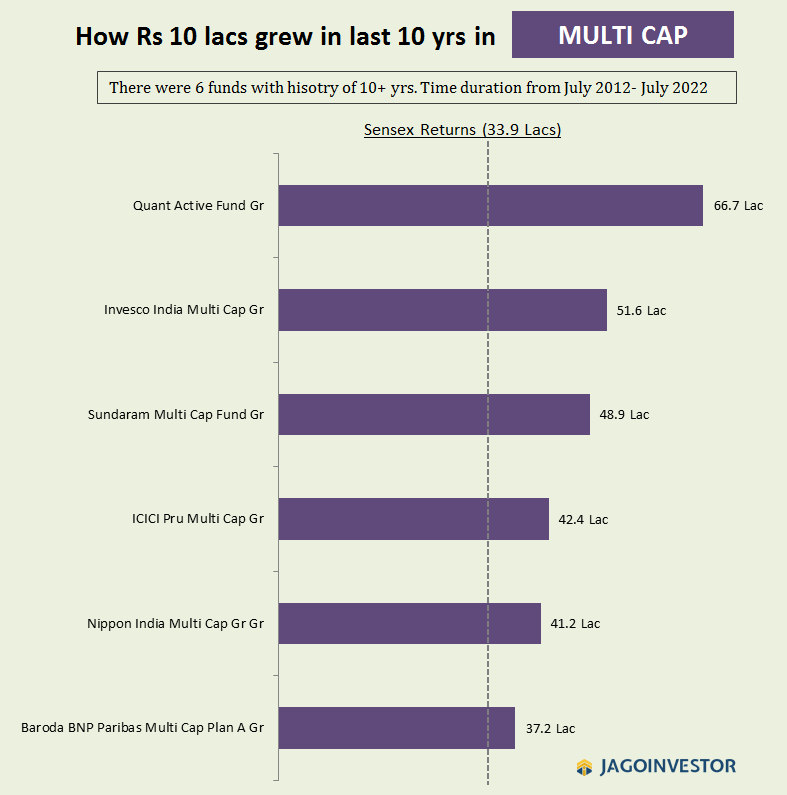

Category #5: Multicap Funds

There were 6 funds in this category with 10+ yrs of data available. The topmost fund returned 66.7 lacs for the investment of 10 lacs and the worst did return 37.2 lacs. Here is the data in the chart.

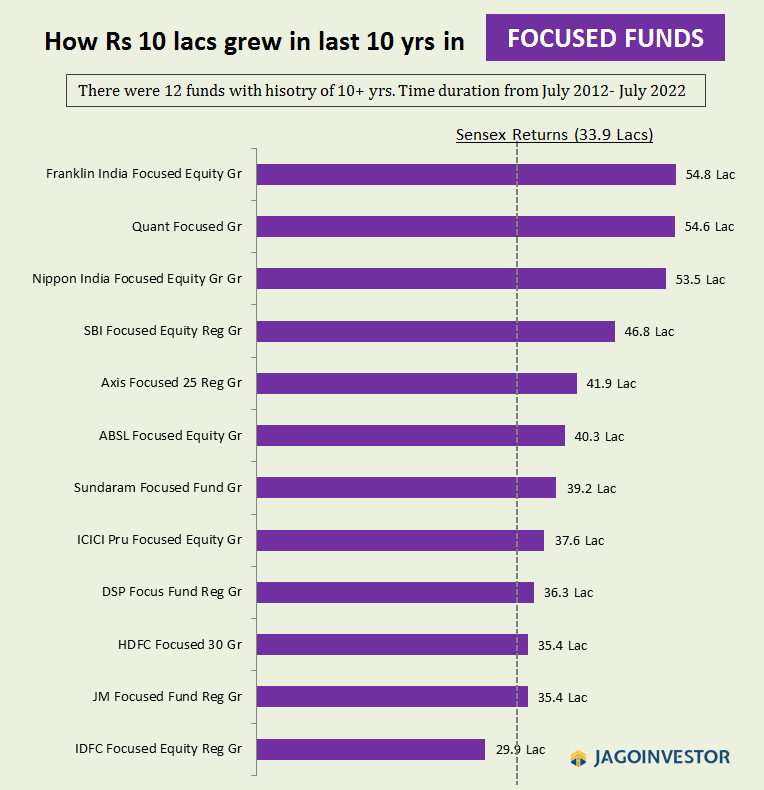

Category #6: Focused Funds

There were 12 funds in this category with 10+ yrs of data available. The topmost fund returned 54.8 lacs for the investment of 10 lacs and the worst did return 29.9 lacs. Here is the data in the chart.

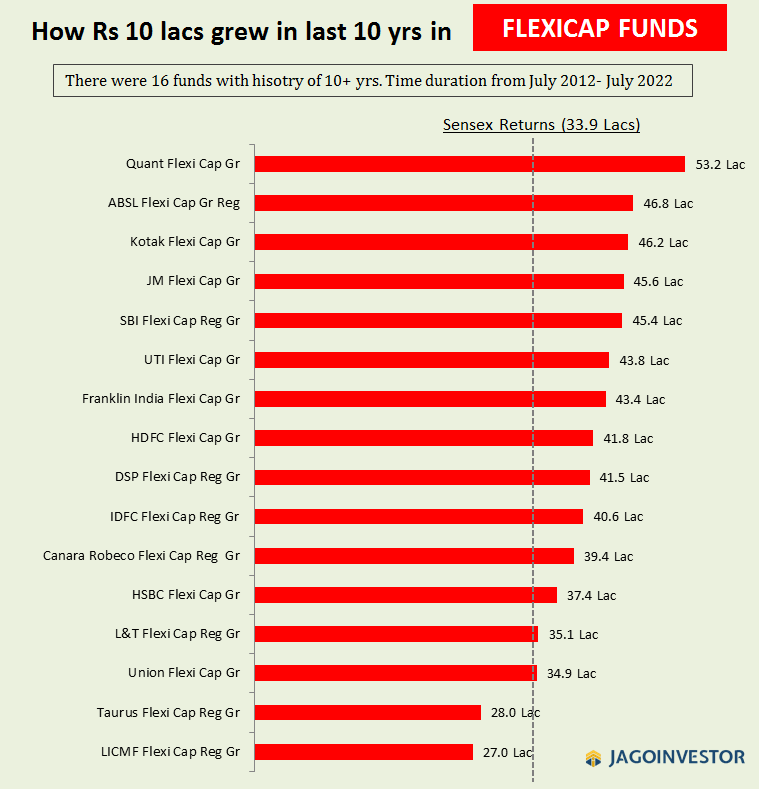

Category #7: Flexicap Funds

There were 16 funds in this category with 10+ yrs of data available. The topmost fund returned 53.2 lacs for the investment of 10 lacs and the worst did return 27 lacs. Here is the data in the chart.

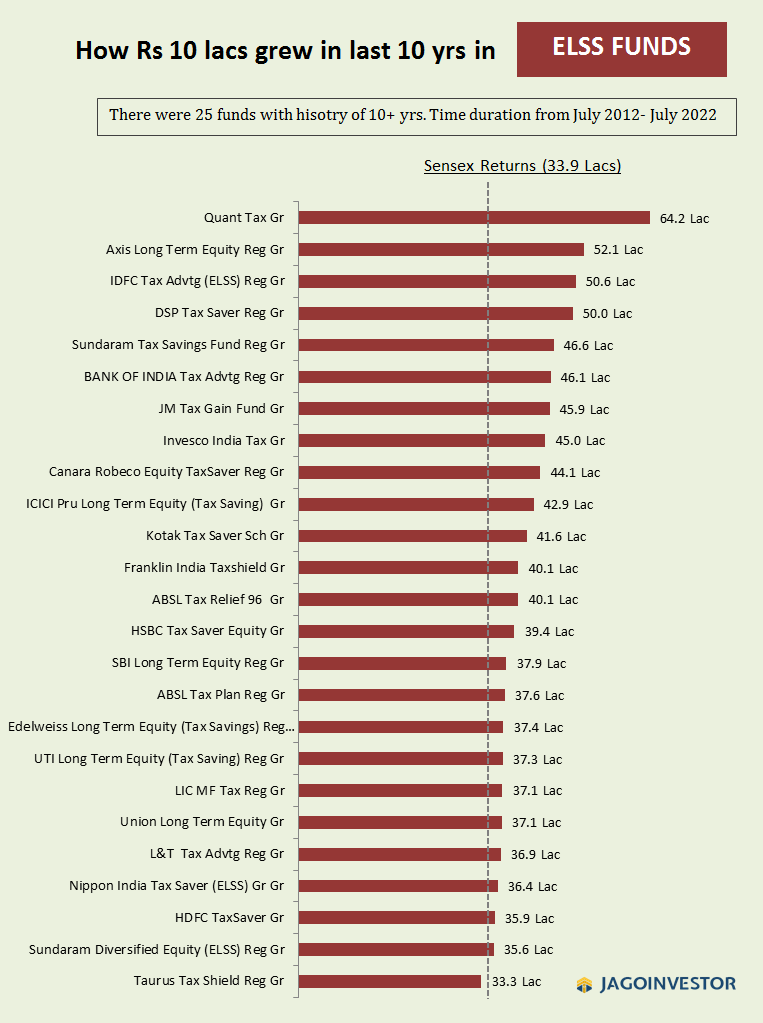

Category #8: ELSS / TaxSaver Funds

There were 25 funds in this category with 10+ yrs of data available. The topmost fund returned 64.2 lacs for the investment of 10 lacs and the worst did return 33.3 lacs. Here is the data in the chart.

Category #9: Index Funds

There were 19 funds in this category with 10+ yrs of data available. The topmost fund returned 41.7 lacs for the investment of 10 lacs and the worst did return 30.6 lacs. Here is the data in the chart.

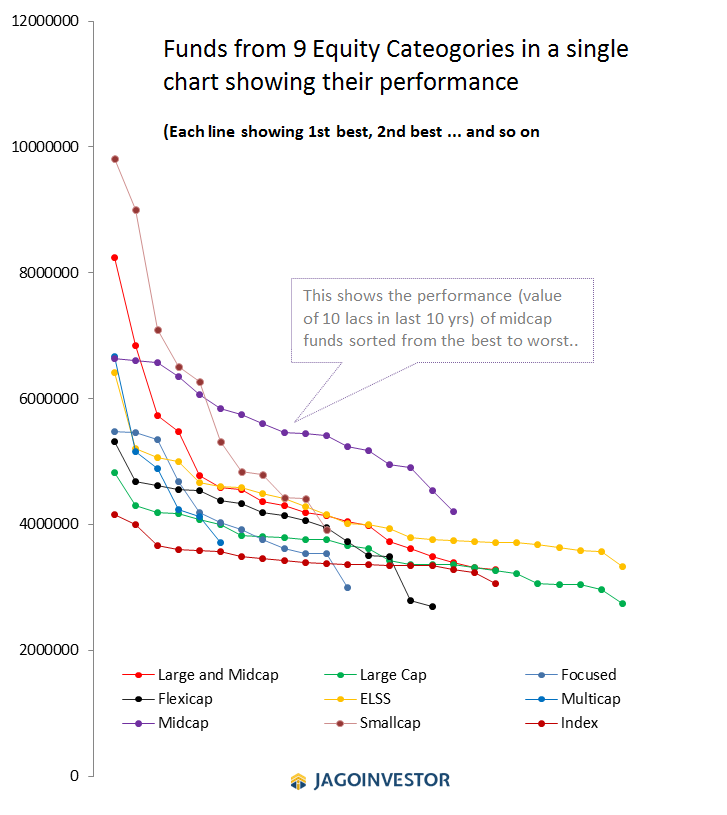

Looking at all the funds in one frame

Let us put all the funds into one single chart to see which category returns have been better than others, worst than others, and their variation within the category.

There is no conclusion I am making from the data and chart in this article, as there are many issues with the fund’s category. You are free to make whatever inference you want to make out of this data.

Do leave a comment below with what has surprised and not surprised you about the data.