Gratuity Calculator

Do your Financial Health Checkup in 5 min, Take this 25 questions test

What is Gratuity?

Gratuity is a lump sum amount paid to employees at time of retirement or resignation. It is covered under Gratuity Act, 1972.

Gratuity is the reward given in the form of money by an employer to his employee for being loyal to the company and completing 5 or more than 5 years of service in the same company.Various countries have different gratuity limit. In India, this limit is Rs.20 lac.

At what time gratuity is given?

Gratuity is a kind of superannuation. When a person completes 5 or more years of his service in the same company then he is eligible to get gratuity.

The criteria for gratuity payment is given below.

- Retirement of employee

- When an employee resigns the job after completing 5 years.

- In case of death or permanent disability because of an accident.

The criteria of completing 5 years of employment will be relaxed in case of death or permanent disability caused due to an accident. In this case, the employer will pay gratuity for 15/26 days of every completed year of service.

Is gratuity amount taxable?

In the current situation all the government employee has a tax benefit on their gratuity. There will be no tax on the amount received as gratuity for government employees for state government, central government or a local authority.For non-government i.e. private sector or public sector employee’s tax exemption is depending upon either the employer i.e. company is covered under gratuity act or not.

1. Employer covered under payment of gratuity act:

When a person is working in a private sector and his employer company is covered under gratuity act then he can get tax exemption on his half months salary i.e 15 days salary of every year of his employment.

2. Employer not covered under the payment of gratuity act:

When your employer company is not covered under the gratuity act then you can get tax exemption on any one of the three options given below. Whichever is less will be considered for exemption –

- Rs.20,00,000

- Actual gratuity received by an employee.

- 15 days salary of every year of employment.

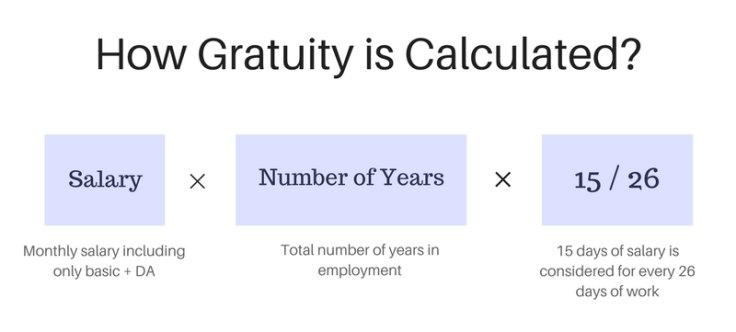

Gratuity Calculation

Is nomination facility available in gratuity?

Is it necesarry to complete 5 yrs service to get gratuity?

Yes, it is mandatory for an individual to complete 5 yrs of service to get gratuity. However, This rule is not applied in case the employee is disabled or dies during his/her service tenure with the company. In this situation, the nominee of the employee gets the gratuity amount as calculated by the gratuity calculator.

Can an organization refuse to pay the gratuity amount, if it is not stable financially?

What so ever may be the financial condition of the company but under no circumstances an organization can deny an employee from paying gratuity. The company is bound to pay the gratuity amount irrespective of its financial condition. Any kind of financial loss cannot be a reason to refuse the gratuity payment.

If a person has resigned from his/her job after servicing the company for 4.5 years, will he/she be able to get the gratuity?

If a person has completed 4.5 yrs in his/her job then he/she cannot get gratuity because he/she has to complete 5yrs to get gratuity. However, if the employee dies during the tenure, then his/her legal nominee will be eligible to get the gratuity amount, even if he/she has not completed five years of service. In another case, as per the Madras High Court rule, if an employee has served 240 days in the fifth year of the service with the company, then he/she is eligible to get the gratuity benefits.