Have you linked your Aadhaar with PAN? If not PAN may be blocked soon…

POSTED BY ON May 9, 2017 COMMENTS (85)

Government has decided to make it compulsory for every individual to link their Aadhaar Card with PAN card by 31st July, 2017. This is part of the digital India campaign and an attempt to digitalize everything.

Why it is mandatory to link Aadhaar with PAN?

There is a great chance that there are a lot of fake PAN cards in India, because it can be easily applied online with fake identities and anyone with a little luck can get a duplicate PAN card. Hence in order to identify those fake PAN cards, govt wants to link Aadhaar card with PAN.

Because each person will have only one Aadhaar card, they will only be able to link it with a single PAN. Rest other PAN cards will be of no use after this process. This is an important move and is necessary for an orderly society and also to keep pace with the technology.

Importance of linking Aadhaar with PAN

PAN card and aadhaar card are the unique identification cards which can be used for verifying a person’s income and address respectively. Let’s have a quick view why this linking is important.

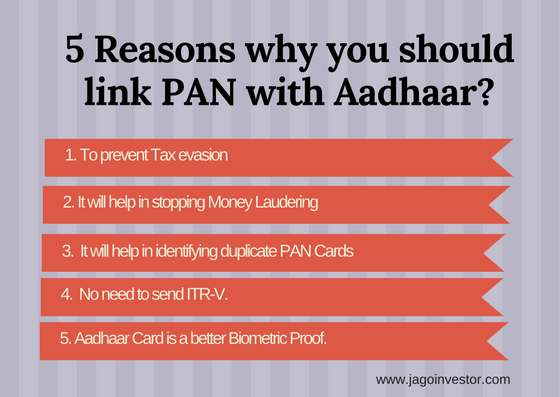

Some reasons behind linking aadhaar with PAN in details are as below:

- Fraud PAN cards– Because of this linking a person can use only one PAN card wherever it is necessary which is linked with his aadhaar card. Though he has any fraud/duplicate PAN card, it will be of no use.

- Tax Evasion – with the help of this, government will be able to track on the taxable transactions of an individual or an entity.

- Tracing money launders- Aadhaar card is a full-proof identification of an individual and it cannot be duplicated easily so that linking of aadhaar with PAN can also be useful for tracing money launders.

- There are fewer chances to have a duplicate aadhaar card as it is a more secured source of identification. Because Aadhaar card is the only identity proof which has all the possible information including Bio-metric. So it is little bit difficult to have a fake aadhaar card as compared to PAN Card and voter ID.

- Curb corruption: This is also useful to curb corruption to a significant level as the record of each transaction will be verified by the government.

- ITR-V: While paying tax, now you don’t need to send your ITR-V acknowledgement if your Aadhaar card is linked with your PAN Card.

Also, the government wants to get every individual identified by their Name, Address and also their income. A lot of PAN cards were very old, and many people have changed their address, contact details etc which were given to govt at the time of applying for the PAN card decades earlier. With this linking, all the data will also get updated.

What is the process to link aadhaar card with PAN?

If you are unable to link your aadhaar card with PAN, no need to worry. Here are the steps to link your aadhaar card with PAN.

- Visit the page of Income tax e-filling portal & register if you are not registered with it. If you have your registration already then just login.

- Login with the details i.e. registration ID, Password or date of birth.

- Your PAN no. will be your registration ID

- once you login you will immediately get a pop-up to link your aadhaar with PAN

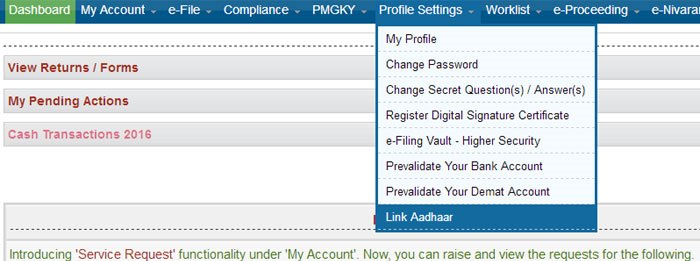

- If you don’t get a pop message then check the blue bar above and click on “Profile setting” and then on “Link aadhaar” in the list.

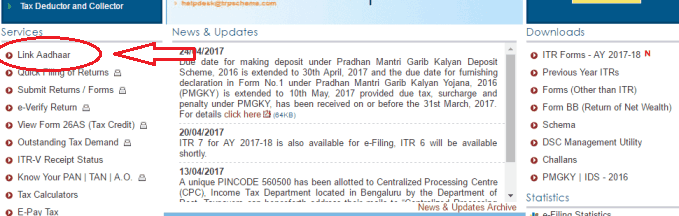

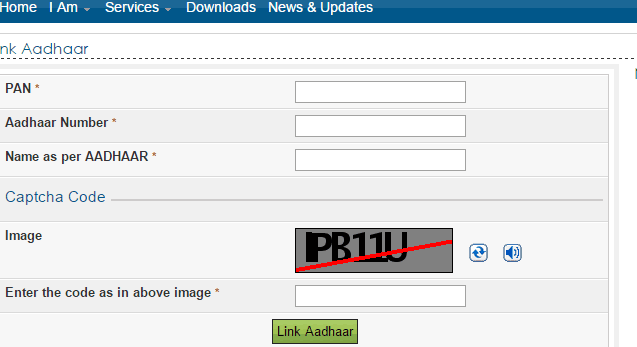

- Or you can also see the option “Link Aadhaar” on the left side of the site when you open it without logging in. Simply click on it.

- The details like your name, gender and date of birth will be given there already as per the registration. Just check that the details available there are same as on your aadhaar Card.

- If the details match with aadhaar card then fill your aadhaar card number and captcha code and click on “Link Aadhaar”.

- Once you submit you will get a pop-up that your aadhaar has been linked with your PAN successfully.

What happens in case of name mismatch between Aadhaar and PAN?

UPDATE: Now you can link your aadhaar card with PAN without changing your name as the option “Name on Aadhaar” has given there.

Now it’s suggested that you first decide what is the exact name you want to keep for future, in case you have different names on various documents.

If your aadhaar card has the name which you want to keep, then you should change your name in PAN. However if your PAN has the desired name, then change it in Aadhaar card.

Now, for those who want to change their name in aadhaar card, they can follow this process or watch the video below.

And if you want to change your name in PAN, follow this link

We really feel that one should have the proper name in Aadhaar card, because it’s going to be the universal documents in future.

UPDATE: New Feature by IT department

Besides this, there is also a new option on the e-filling site from where you can link you Aadhaar card with you PAN card without changing your name.

Only date of birth, Name and Gender on both the documents should match, however we feel that as a long term solutions it’s a good idea to have the same name on both the documents.

What to do if I don’t have one of the documents (Either PAN or Aadhaar)

Now a days, almost all the people at least in urban areas have both aadhaar and PAN, very rarely it happens that someone does not have both the documents. However incase one of the documents is missing, here is what you should do ..

For those who do not have PAN

If you don’t have PAN card, then this rule is not applicable to you right now. You don’t need to take any action at the moment.

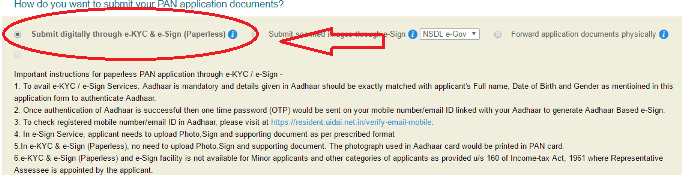

When you apply for PAN in future, at that time you can give your Aadhaar details as the address proof while applying for PAN offline or you can choose an option called digital e-kyc and e-sign, where you will be asked for aadhaar number and it will be automatically linked to your PAN. Below is a snapshot of the e-KYC looks like.

What do you if you don’t have Aadhaar?

If you don’t have Aadhaar card then you should apply for it soon, because anyways it’s going to be the universal mandatory documents very soon and every PAN has to be anyways linked with aadhaar. You can apply for aadhaar card by online or by visiting its office and providing you essential documents.

How to Check whether your PAN card is linked with Aadhaar card or not?

For some people their PAN might be already linked with Aadhaar card. To check this you just have to visit the official page of e-filling and click on the login button on the right corner of the site. Fill your PAN number and captcha code and click on OK.

If your card is already linked then it will show “Your Aadhaar is already linked with PAN” and if your card is not linked then it will show “User ID does not exist”.

Below is the demo of this process

Is it safe to link your PAN details with Aadhaar?

Recently there was a news that M. S. Dhoni’s Aadhaar details were leaked somehow, which shows that aadhaar details are not 100% secured. If this can happen to a big celebrity, this can happen to anyone.

Many people are wondering if it’s safe to link their Aadhaar with their PAN?

- Will their bank details be exposed ?

- Will there be any fraud involved?

- Will others get access to their income tax data ?

- Will others get access to my personal data like Mobile number, Email and Bio-metric details?

But, you don’t need to worry!

The solution to problem is here. There is no need to worry about the security of your PAN after linking with Aadhaar. UIDAI has introduced safety features of aadhaar Card.

Now there is a facility of “Lock” and “Unlock” of aadhaar details.

If you “Lock” your aadhaar details, all your data will be freezed and the access to any third party will be blocked. All you will need to do is, verify the OTP which is sent to you when you apply for this “Lock” feature online. If you want to get details about all the safety features, you can download this PDF.

What will happen if your Aadhaar card is not linked with PAN card?

- As per this amendment if a person do not link his aadhaar with PAN card then there is possibility that he could lose his access to the PAN card after December 31,2017 as per Hindustan Times.

- You will be unable to file IT returns and pay the dues or claim the IT returns.

- It’s been also said that the use of PAN cards may stop in upcoming days as Aadhaar card will be the unique Identity proof. So if you don’t link it now you have to link it with your PAN in future in any ways.

- Because your PAN card will be blocked, and for higher value transactions PAN is mandatory, you will not be able to do many high value transactions online as the bank will keep asking for PAN

UPDATE: What if I have both the documents but don’t have any Income Tax Returns?

If you don’t file any Income Tax Return then this rule is not for you. It will not affect either you link your Aadhaar card with PAN or not.

But if you have both the documents, we suggest to link the documents.

UPDATE: What if I’m an NRI and have only PAN card?

NRI’s can also apply for the Aadhaar card. The procedure and documents required for NRI and Foreigners are same as Indian residential’s. Only thing is they have to be physically present at any of the Aadhaar card center in India.

But it is not mandatory for NRI’s till date because as per Indian Government Aadhaar is an unique identity for the person who is living on Indian soil. Read this PDF by UIDAI.

How can I apply for Aadhaar if I’m out of India?

If you are not in India currently and wanted to apply for Aadhar crad then the procedure is almost same. But you should have an introducer who can introduce you by providing his/her own Aadhaar card.

The verification of your identity will then become the responsibility of the introducer.

So, what are you waiting for ?

You should quickly complete this whole process as it’s just a 5-10 min work. Not completing this can impact you in negative way, so do not wait for the last minute.

Also you should spread this news among your friends and help others to complete this important step in their financial life.

In case you have any questions, I will be happy to answer them in comments section

85 replies on this article “Have you linked your Aadhaar with PAN? If not PAN may be blocked soon…”

Comments are closed.

I have been filling my return through adhaar card and getting OTP on my registered phone which is linked to adhaar card since the last three years. But this year I have been unsuccessful because I’m not getting the OTP on my registered phone. I’ve been trying to get everification for the last two days through adhaar card but no success. Please help.

Hi Maxwell Baptist

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

My mother is unable to link the pan card to aadhar inspite of correcting name mismatch. It has been more than 2 months since the name mismatch has been corrected. What to do in this case? Please advice.

Hi Kripa Mohan

What error is it showing?

I think you should check for other information also like DOB and all. There might be some mismatch because of which it is not linking. Otherwise contact to Aadhaar customer care center.

How can I link my Aadhaar card to my PAN card, if my PAN card has my old surname, and my Aadhaar card has my new surname?

Hi orowealth

You have to update the name that you want to continue with on your Aadhaar or PAN card and then link it.

I have a mismatch in Date of birth .

how to proceed.

Hi Arti Pathak

Login to your Aadhaar or PAN where you have wrong DOB from their official websites and update it. The detail instructions are given in article.

If i update my name in pan do i need to resubmit KYC?

Yes

In case of HUF’s PAN, do we have to link Karta’s Aadhaar (which may be already linked with his individual PAN) ?

And also in case of Partnership company whose Aadhaar should be linked ?

And also for Minor having PAN

Hi Manish,

I’m currently in US (SF) and I don’t have Aadhaar card; and not planning to come to India at least for next few months (potentially next year).

Any solution? Any way that, I can get Aadhaar card?

Seems, not possible based on above updates from you. Any other workaround possible?

My situation shouldn’t be unique; and there should be many like me 🙂 … so thought of checking one more time.

Thanks in advance for your help!

I am not aware of any way how you can get it

Manish

Very informative.Thanks for Sharing Article.Thanks a lot.

Glad to know that prosper ..

Very informative article thanks a lot.

Due date is 30th June 2017 and not 31st July 2017.

thanks amita

I tried to link Aadhar with PAN but after clicking on submit, it is showing the message as “Your PAN is deactivated. Kindly contact your assessing officer.” Please help!

try again after some time, you know how these systems work

Hello Sir,

I was searching for useful articles related to income tax filing services in India and come across your various income tax articles which is quite informational and based on your detailed analysis.

The content of your articles seems very comprehensive and interesting to read.

I would like to draw your attention towards the Delhi-based online income tax filing services website.Kindly check out the link http://www.trutax.in/ .

It is a portal where the taxpayer can upload their form-16 with required documents and file their income tax returns with ease.It is a platform to give the latest updates of taxation and manage client’s taxes as well as their income tax returns.

This Might be a worth mention on your page.

Either way, keep up the awesome work.

Also, I was hoping you would consider us in contributing articles about topics related to taxes, taxing systems in India, etc. so that we can tap into the audience you have.

Is this something you would be interested in?

Let me know what you think.

Regards

Harsh(TruTax)

Thanks for sharing about your organization. After proper verification and background check of any organization or person we allow them to write articles on our blog. If there is any requirement of such articles we will get in touch with you

Thank you for the informative and timely article. But Aadhaar-PAN linkage might not be only for those who file income tax. Nowadays, PAN seems mandatory to open even bank accounts.

Yes, may be .. PAN is surely required if you want to open a bank account as there might be income tax liability for you !

Hello Manish,

Thanks a lot for all the information.

I am an NRI and I don’t have any income from India to declare for tax return.

I have PAN and Aadhar card and i invest in NPS/MF and Shares.

My Question is,if I don’t link my PAN with Aadhar,will my NPS or Investments in MF/Share will get affected?.

Thanks a million.

No , with linking there will not be any impact

My mother (age : 72 years) has been bed ridden since 6 Jun 2004 on account of fall resulting in breaking of ferum of left foot. Since then sha has not been able to walk at all and hence totaly bed ridden. My query is hoe to obtain her AAdhar(UID) card being unable ro visit AAdhar enrolement centre. My father had twice email;ed this query to AAdhar Authorities but no reply so far despite reminder. In the circumstances what remewdy is there if her PAN is blokeds? Pl. advise

Hi Durgesh Suhas Kothari

You can introduce your mother with your ID as an itroducer. Plz read updates. It happens in case a person is out of India. You can visit Aadhaar center for help. Besides if your mother don’t file any IT returns then it will not affect if you link her documents or not.

I am getting information mismatch error how to resolve it?

Hi Sumit

You can Login to your Aadhaar or PAN and update your information.

Hello Manish,

Very easy and Informative!!

Thanks for sharing these important updates with step by step procedure.

Anyways, I’m going to subscribe your newsletter to get updates in my inbox:)

Great content:)

Glad to know that Rajan Chauhan ..

What to do for the PAN allotted to an HUF (Hindu Undivided Family)?

In such case you will have to attach your Adhar card with your HUF account

sir,

I forgot password when I registered in e-filing i don’t receive any activation link what to do.

You must have got some login details in your email or you can click on forgot password and generate a new password for yourself. If there is any customer care details write to them or try to call them

As Aadhar being mandatory is being questioned in SC, until its decided don’t link it

Approach a lawyer he will ask for al the required documents. Basically they check the title of the property and the land is free from any kind of litigation

i have recently changed my name (expanded my initial) in my PAN card.

So i have to change my name now in Aadhar as well. But i had a different mobile number while registering for aadhar, so i am unable to update namechange online. Where do i do this aadhar name and mobile number change?

I was not knowing about the time limit !!

In that case you will have to go to Aadhaar center offline in your city and given documents etc for making the changes

If the new mobile number is updated on Income Tax website then just link Aadhar with the PAN card using the same website. This also changes the mobile number linked to Aadhar .

Very easy and Informative!! Thanks Manish for sharing these important updates with step by step procedure.

Thanks

Sumit Kulkarni

Glad to know that Sumit ..

Hi Manish! Thanks for your response. I want to talk to you regarding my personal and family’s future securities, owing to the fact that I have a medical condition. Awaiting your response.

Thanks

Sumit

You can get in touch with my team on support@jagoinvestor.com

I think supreme Court stopped it.

I think they have questioned about making aadhaar mandatory, but not stopped linking. Have you read that somewhere? Can you share the link?

Thank you Manish for this information. I was not aware about this fact that there is a deadline also. But I think this is really a good step to make things more simpler.

Thanks for your comment Santanu

What happens to NRIs and their PAN or Tax returns? I am an NRI For 7+ years and only visit India every 1-2 years. But I do file tax returns each year for the income earned in India. what happens to my PAN?

I think the govt has given the deadline till Dec this year. You can do the linking till then. If you have both the documents, then whole process is online and it just takes few minutes !

Thanks Manish. Am just worried if I can’t get the Aadhar by then. I can apply for the Aadhar when I visit India later this year. Hope I get my andhra by then 🙂

Are you sure that NRIs need Aadhaar? Aadhaar is for residents not to be meant for citizens. If an Indian national is an NRI, I think he doesn’t need Aadhaar as he is a resident of another country. So, they should be able to still file the returns.

NRI does not require adhar card

as per UUID and Income tax, there is no need to link PAN and addhaar for NRIs as adhaar is nkt appicable.. infact getting adhaar for NRI is crime .. any idea is there is an option to change the status to NRI in income tax site ?

VERY NICE ARTICLE. what in case of HUF account. i have already huf pan card. there is no provision of adhar card

Thanks for the reply but still I have following queries. Please answer.

1.My mothers name,date of birth(only year of birth is mensioned) are incorrect.Also mobile no was changed long back. Hence I cannot get OTP. Then what to do?

2. My son has PAN .He cannot visit India for along time to come! Then how to get Adhar and link it in time?

1. I think you need to change many things in aadhaar now. If the phone is not updated, you need to visit the offline center and make all changes

2. He can get the aadhaar only when he visits India. there is no other way of getting the document. Govt has not issued any information for NRI’s regarding this.

Link individual adhar card with HUF account

Thank u for valuable info

I have a HUF I.T. File. I have PAN also and every year I have been filing returns for my HUF File. But as it is not an individuals file, no Adhar Card can be issued .In this case what will be the procedure of connecting PAN and AADHAR .

There is no clarity in this regard on net. I think you should check this with IT department directly !

Dear sir, regards. I am regular reader of jagoinvestor article. I am having one question . My wife name before marriage was deepali. On her educational documents, driving license. After marriage I have written that deepali spelling as dipali. In pan account, bank account, Lic account, mutual fund folio. Only on aadhar her name was written as deepali. So please guide me which name should I continue. If for change of name in bank, mutual fund please tell me procedure

Thanks in advance for suggestions

Ideally you should use the same name in all documents. I think the name which you really want to use should be on Aadhaar Card.

So whatever name you really want to use everywhere put it on Aadhaar card. If you want to use Dipali , then change it in Aadhaar card.

Manish

Fine

Thanks for your comment yakub ali

1.there is no date of birth on AC.Then?

2.For NRIs no AC.Then how to link with PAN?

Hi Gopal reddy N

1. You can update your details like date of birth, education and other in Aadhaar card.

2. NRI’s can get Aadhaar card.

Thanks for such elaborated information.. However once central government emphasized to make this mandatory.. Supreme Court had reprimanded for justifying the reason then government had appointed a lawyer.. After what was final conclusion.. That I don’t know but aa SC had an objection I was relaxed for taking any prompt action for this linking activity..

Any idea what happened then?

We are not clear on that. I think there is no final news on this . SO we should actually complete this anyways .

Hi Manish, Nice information as usual…

I am currently out of Country and I am not sure when I will back to India….Is there a way I can get the Aadhar card….?

Hi Harsha

You can apply for the Aadhaar card but for that you should have an introducer in India. This information is updated in the article, you can read it.

@Priyanka Jadhao

Parents of 70+ age having PAN card and Adhaar Card.

But if they are not having any income & don’t submit IT returns. What will happen to their PAN card? Do they need to link Adhaar to PAN?

Hi Manjunatha

If your parents don’t file any IT returns then it’s OK if they don’t link the documents. But as they have both Aadhaar and PAN we suggest to link. Any ways it takes 5 minutes only.

What about NRIs who do not have Aadhar Card?

Hi Kalyani Chakraborty

NRI’s can also get the Aadhaar card. This information is updated in the article, you can read it.

Incorrect data .. It’s crime to get adhaar card info you are an NRI

Good article. I thought it is beneficial to share this experience. Few days ago I tried to link PAN and Aadhar, but not able to do it due to name mismatch. Today I tried it again, and what I found is there is a new provision to enter name in Aadhar. I entered my name in aadhar and it accepted it. So, no need to change names.

Hi Kishore

Thanks for comment.

Sir

I have applied for Change in Name on PAN Card because the information provided in this article was already known to me.

I applied for Change in Name on PAN Card on 06 April but till date nothing happened. When i check the status of my application on NSDL site, it says Your application for ‘New PAN Card or/and Changes or Correction in PAN Data’ is under process at NSDL

So what should i do as the same message is being shown since April 10th

Hi Sushil

Ideally it takes 20 days to get a new PAN but it’s a government agency. Sometimes it takes more time. So just wait for some time or you can contact with their customer support.

Priyanka

Customer support number is always always always busy

Yes, it can be tough to deal with govt bodies !

Finally i was able to Link Aadhar with PAN using new link in efiling Websites….It uses OTP in case of minor mismatch in Name on PAN and Aadhar. So for now onwards…Minor Mismatch is no issue