7 deadly mistakes every early investor should avoid in life

POSTED BY ON May 4, 2016 COMMENTS (61)

Today I am going to talk about some mistakes which young investors make in their early life. Many experienced investors would be able to relate to it, because often we make these mistakes because there was no one to guide us when we started our journey of wealth creation.

“Young investor” here means any person who has just started their careers. Most of them would be below 30 yrs of age. I will share 7 mistakes in this article. You can consider these 7 points as the words of wisdom from experienced investors.

Mistake #1 – Not Focusing on increasing the income

Nobody became rich by only controlling their expenses!

“Low income” is probably #1 reason, why most of investors are unhappy in their financial lives. Low income means low/no savings, restricted life style and constant worry about future. A small financial mistake can turn very costly if one has small income.

Imagine a guy living in Mumbai & earning just Rs 35,000 a month (or even Rs 80,000 now a days) and have to support a family of 4 people? Can you imagine how “tight” his situation is?

For most of the people, salary increment “happens” naturally and never worked on consciously. Most of the people take whatever comes their way for many years, only to realize that rather they should have come out of their comfort zone and worked “actively” on increasing their income.

They could have relocated to a new place with better opportunities, changes their jobs, asked for a salary raise, or could have worked on an alternative income, but most of the people don’t do that. They just go with the flow thinking – “I will get, what I deserve”

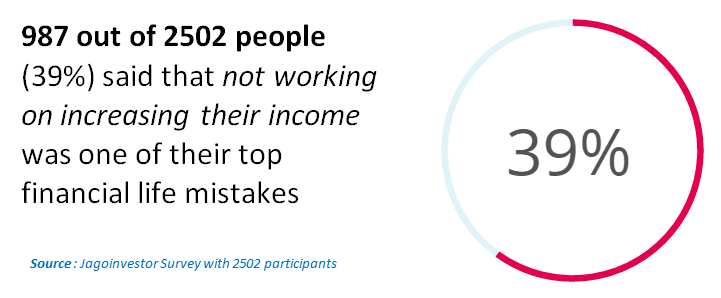

In one of the survey’s I have done recently, I asked participants to choose the top most mistake of their financial life. I gave them 8 different options to choose from and 39% of the people chose – “Never worked on increasing my income seriously”.

As a young investor, the best investment you can make it not some mutual fund, or a policy, but you yourself. Invest in yourself and develop skills which makes you “valuable”. Make yourself so employable that people run after you.

Remember, if you earn a big income, you can still make a lot of mistakes, spend like hell and choose not to control your expenses.

Mistake #2 – Getting into Debt Trap Early in Life

Don’t get me wrong!

I am not against taking debt.

But, a large number of young kids who start their career have bad relationship with money and credit facilities.

They start using credit cards as if it’s a money toy. It all starts with a small outstanding credit card bill, and soon it starts rolling up every month and soon they find themselves paying minimum due amount and finally when things go out of control, they take a personal loan to close off the loan or convert the outstanding amount to EMI’s and starts how their debt trap starts!

Then follows car loan, home loan, another personal loan, another credit card and this way a person gets into deep debt cycle. I am sure if you look back, you will realize that the debt trap started very small.

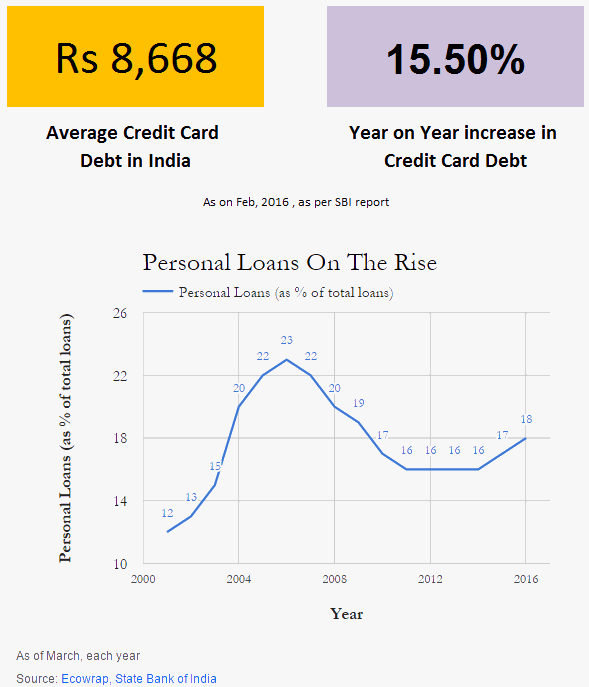

Let me share some data with you on this. As per this report, personal loans as % of loans stands around 18% as in the year 2016 (Out of every 100 loans, 18 are personal loan).

As a young investor, you can still do mindless spending, but that should happen with cash money and not credit. Because getting into debt is easy, but coming out of it is not that simple. So as a young investor try to take debt only if you don’t have any choice. As far as possible, take responsible credit which helps you in life (education loan or home loan).

Mistake #3 – Not taking risks in start of your career

I am not saying that everyone should go and start taking some risk without planning. All I am trying to convey is that its more easy to take risk when you start your career, rather than middle of your career or when you turn 40, because in your early days you have less responsibility and enough time to fix your mistakes if any.

Think of these options below!

- Want to move out of your industry and try something else?

- Want to try a start up?

- Want to try that online business idea?

- Want to change your career path because you don’t feel you belong to current job?

- Want to ask for a salary hike, but too afraid to lose the job

The above 5 things can be tried at any point of career, but practically you have more appetite to try out these things in the start of your life, when you have less responsibilities and enough time in hand to correct the mistake if any.

If you are still confused about this, you should listen to this YouTube video about best practices in Career Risk-Taking. It will help you

Once you have already spent significant number of years in your job, you will get married, have kids, get into the cycle of “life” and it will become very difficult to come out of the comfort zone. I get many mails which starts with “Had I tried it 10 yrs back … ” and I can see how people feel so stuck into their jobs and now they can’t take much risk at this point of life.

Mistake #4 – Buying policies from your relatives/friends

There are millions of investors in India, who have lost a lot of money in bad products which were sold to them by someone close to them. It was often an uncle, aunty, father’s friend, distant relatives or even your siblings at times.

A lot of products are bought in India based on trust and goodwill. Often relatives pressurize you to take a policy.

This is particularly true for Endowments policies, ULIP’s and other insurance products. You will often find someone in your close circle who is an agent and your parents trust them like anything and force you to buy a policy from them.

Years later you realize that you have burnt your fingers and can’t express your dissatisfaction openly. So what is the way out? Either research on things on your own or directly buy form the companies or if you need external help, better hire an advisor or an external agent, but not a relative

Mistake #5 – Investing in a product you don’t understand yourself

On an average, 90% of the investors can’t explain what exactly they have bought. I was once talking to an investor in our workshops (the upcoming one is in Pune on 22nd May, 2016) and the guy said he has few policies. When I asked how many? He had no idea

When I asked what are the names of the policy, he didn’t even know that.

He said that he had bought them few year back for tax saving and does not exactly know what they are !

The problem is that investing in products, which you don’t understand blocks your financial energy. Your money is stuck in a rotten product and takes away a lot of time.

So if you are buying a financial product, please learn how it works and how it’s going to benefit you at the end of the day . Find out everything about return, risk, liquidity and taxation. If possible, better know which financial goal it’s going to fund.

Mistake #6 – Not saving early in life

After spending many years in your job, you will realize as an investor that “I will save when I will have more money” is an illusion.

When you start earning money, your income is less and you are not able to save money at all because you are hardly left with anything at the end of the month.

However note that this is going to be true always. While your income will rise in future, so will your expenses. You will get married, have kids, your lifestyle will improve. You will get a car, buy a house and what not. You will enough feel that you have enough to save.

The graph for expenses is set to rise and this feeling of “I will save in future, when I earn more money” will be intact. This is the reason a lot of investor never save enough money which they deserve.

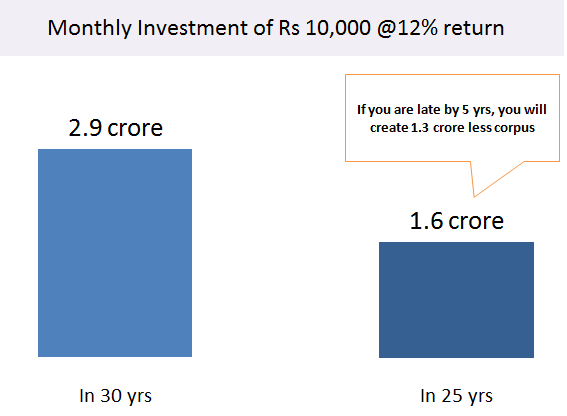

The graph below shows you if a person starts investing Rs 10,000 a month, they can accumulate around 2.9 crores in 30 yrs. However if they delay it for 5 yrs, and then start the same thing. They will accumulate only 1.6 crore by the same time. That’s a big difference because of the delay.

As a young investor, you need to understand that habit of “saving money” is more important than how much do you save. If you can’t save anything, start with Rs 100 per month.

I know it sounds like a joke. But once you do it for 5-6 months, you at east know that you can save Rs 100.

Then upgrade the number!

Upgrade to Rs 500 or Rs 1000 a month. Continue for another 6 month.

Soon, you will realize that you have reached Rs 5,000 or Rs 10,000 because you are just increasing the number, the “habit” was already in background.

Mistake #7 – They neglect their health

If you do not have good health, it will not matter how much money you have earned, because you won’t be able to enjoy that money at all. It does not make sense to lie down on a bed made of gold in your retirement.

While earning money is important and required, make sure you also pay attention to your physical and mental health. These days, the jobs are too demanding and there are many money matters which will take the peace out of your life. You might get lost in the rat race and forget that you have a body to take care for years.

Only years later you will realize that it would have been better to earn a bit less and have a healthy body, rather than having bad health with money.

The quote from Dalai Lama is worth reading

Learn from others mistake

At this point of time, internet is flooded with the mistakes other investors have done. It’s a wise thing to learn from those mistakes and not repeat them.

A good and healthy start of one’s financial life helps a lot and if you are a starter, I strongly suggest you take a note of the points above and implement them.

Please share your views on the points above. Were they helpful to you as a new investor?

Health- The most imp factor. I m 31 years old n have bad health since last 2 years. I neglected my health n as a result i had to leave my job 2 years ago n most of my savings r gone into it.

Thanks for sharing that Amit

Very nice read and very informative

Thanks for your comment Karthik

Hi, this article is so informative and true.. I’ve read many of ur other articles too but I’ve very poor knowledge of investments. Can u pls let me know what investments are to be made early on? What are the options available to invest the 10,000RS for 10 yrs?

We think our pro membership will help you as it fits in your requirement. We have various benefits under it like life insurance, health insurance, mutual funds and your financial analysis too..

Just check out our Pro membership once and schedule a FREE call with us to know more – http://jagoinvestor.dev.diginnovators.site/pro

Nice article. It helped.

Rally great article!

Can you tell me how safe is it to invest in the upcoming peer to peer lending sector?

Its a very new thing .. I am not sure if I can comment on that !

Excellent.

A very very good read indeed.. I am glad that I didn’t do many of these but must say I should work on finding an alternative income source..

Thank you very much!!

Glad to know that Alankar ..

Good

your article is very very educative,very helpful and covers almost all areas.Alas , i had got such advice 35 or 40 years back, now i m 71 years.never the less i appreciate and like it

Thanks for your comment devendra

please advice where to invest (at my 71 yrs age) so that inflation do not eat away my corpus and keep income tax in 10% slab ie lowest.

Equity funds are highly volatile and risky instrument for you, hence its not suggested.

But then on the secure side, debt mutual funds are good alternatives to FD, hence you should look at them

My team can help you to setup the investment if you want

Just fill up – http://www.jagoinvestor.com/solutions/invest-in-mutual-funds

This is really an eye-opening article. The things that we ignore or we are ignorant about, can cause so much financial loss. Not thinking for alternate income, not changing the job a right time, not asking about increment, not knowing much about the financial instrument, etc can cause a hefty loss. The health quotient is also equally important.

You have provided in-depth observation. This is very useful and inspiring article.

Thanks for your comment Viral

Hello Manish,

..forgot to mention,, My age is 30 yrs, single and looking for good investment plans for future..

hello,

I am working in Bangalore in IT company . Can anyone recommend any good financial expert name and contact number in Bangalore?

My salary is very less compared to Bangalore standards hence I want to have opinion of good financial expert.

Sorry , but we dont have any reference.

Incase you are ok with the online advice option, we can help you

http://www.jagoinvestor.com/solutions/financial-planning

Useful advises

Good one Manish ! Keep it going

Thanks for your comment Shreyas

Very Good Article. Thank you Manish

Thanks for your comment SM

Good article Manish. Very apt narratives for the mistakes that most young people make. Adding a few of my own mistakes:

– I was disciplined enough to save each month, but my greed to do something “the do something bias” made me uproot the trees of years of hard work. I took out money before it began to compound and add more wealth. So, it is not only important to start saving early, but save LONG ENOUGH for the power of compounding to kick in is key I think.

– Falling into the “herd mentality” – most young people want to splurge and a saver can be ridiculed upon (which was done to me!) I still remember my friends asking “You are saving up for retirement? Seriously?” and pat followed a good round of laughter. It is extremely hard when the friends around you do not believe in Saving early. So, Daring to follow a path that you internally know is the right thing is also extremely hard. Thank goodness I somehow stuck with it!

– I dared to invest in learning about myself, my faults, my issues with the way I look at life etc, and it was a set of 2 hard years. During that time too, I faced tremendous social pressure as to why am I “wasting” my time in things that most people know anyway!!! But, I believed in the value of Self-education and this has paid me 100s of times over and over. I am glad that I did not put myself through an MBA or an MTech , but chose to invest in learning about my fallacies and my faults.

Thanks for sharing that Venkatesh

If you can go a little bit more deeper into your sharing (I mean a little bit details) then I can add that in the article itself as an example . It would be a great learning for others.

And trust me, you did the right thing. To do something which others ridicule for is not easy job and only few at the end emerge like a winner like you:)

Manish

You have no idea how right you are. Peer pressure is probably the biggest detriment to saving money in modern times. Every few days people expect you to go on parties and splurge money like anything. That’s how the office culture has become and when you refuse to join in, you are branded a miser and laughed at. Most people don’t understand that different people have different priorities in life. Some save up just for parties while some do it for travelling extensively while there are others who just do it for retirement.

great article, few more mistakes would like to add on which i learned from mistakes

1. undisciplined investment

2. Lending money to friends and relatives

3. Not buying medical insurance, life insurance policies at the start of career and then buying them on high cost

4. Not investing money in equity market instead making savings in fixed deposits, post bank recurring deposits, ULIPs and LIC investment come return policies

5. understanding importance of financial experts, not asking for expert opinions for investment and going with the flow

Keep educating us Manish

Thanks for your comment Avinash

Good Article Manish,

Thanks for your comment Raaz

Great article…. Many of us found ourselves at this stage. These are the mistakes one should avoid in his/her early age and good suggesusions to get back on track for 40+.

Thanks for your comment Bharat

I am 40 and looks like he is saying about my life 🙂 but even if i had read this article 20 years back i would still lived like this itself. Its only when you burn your hand or when you see someone you love burn their finger and their sufferings – then your brain awakes.

Over use of credit card, personal loans, gold loans all together put up a whole in my life and when i look back i could have bought my home theatre and all when i had my money rather than purchasing it thru a loan. With salary of Rs. 5000/- in 1997 i jumped to buy a home theatre of Rs. 1lac!! I should have purchased a house with a home loan. Now becos of CIBIL i cant get a home loan and i can never combine my savings to buy a house of my own.

Now i am trying to grab up the loss time and only hope i dont do any mistakes.

Start from nothing stop for nothing

Thanks for sharing that . Glad to know that you can relate to this.

Manish

It is a eye opener !!

Thanks for your comment Tayade

“They could have relocated to a new place with better opportunities, changes their jobs, asked for a salary raise”

This seems to be a popular notion these days. Leave the comfort of home and go to some other state to earn big. But I don’t really subscribe to it. There is a massive advantage to be able to work in your home town. Not only are the savings huge, you get home cooked food & your social life is also better since you know many people in your town which results in greater happiness. Nothing beats the comfort of sleeping in your own home at the end of the day and spending time with family members you love so dearly over the weekend.

When you work away from hometown, you also have to spend all your leaves just to visit your family twice or thrice a year. That also means you don’t get to go on vacations much. As someone who used to work far away from my home state just to earn a little extra, I don’t regret taking a 30% pay cut and returning to my home town. I am happier now, I pay less taxes, I go on vacations twice a year and my savings have quadrupled despite lesser income.

That’s very much true!!!

Very true.. Have seen many such instances. Leaving your home for 30% pay rise doesn’t make sense. However if your hometown has limited career options which impacts your growth in the long term then it’s a different thing.

Well growth too is a relative term when you put various other factors into perspective. I know my salary will probably never get as high as 30 LPA even if I work for 30 years in my hometown as growth prospects are very slow here but cost of living is also significantly less here than places like Bangalore & Mumbai. I can enjoy the same luxuries for a lot less. So it doesn’t really matter at the end of the day.

Hi Anjan

Glad to know that you are clear about it. I was mainly talking about people who are already relocated and working away from their homes. You have mainly taken a concious decision of not moving any other place because you have your priorities right, however there are many people who do it not because they have thought like you, but mainly because they are too lazy to do that. They want to earn more deep down, but not ready to take required action.

I agree with you that one has to also look at various elements you talked about, It does not make sure to just relocate to some place only because you are getting 10-20% increment. One has to look at the final profit (in terms or money and personal life like you mentioned).

Manish

excellent article

Thanks for your comment SivaKumarDattu

no mention

Great knowledge’s getting from it

Thanks for your comment abhijeet

Great Article Manish, keep it up~!

Thanks Manish, rightly said.

point to correct low income factor should be pursued very carefully

In today world with immense competition be careful not to loose what you already have in your hand for search of some un realisable dream

Risk reward ratio is part of every decision in life not only for financial matters.

Thanks for your comment

Thanks a lot, Manish!

Those points were spot on.

It’s worth coming back to this post and recalibrating all the financial decisions one has to make in future.

Thanks for your comment Rahul

The most important point is just the Last point .

Thanks for your comment PALVINDER

Thanks. Good One Manish!

With your help at least i am not making 6 of the mistakes!

Glad to know that JP ..