EPF withdrawal made super easy – No Employer signature needed

POSTED BY ON December 9, 2015 COMMENTS (1,307)

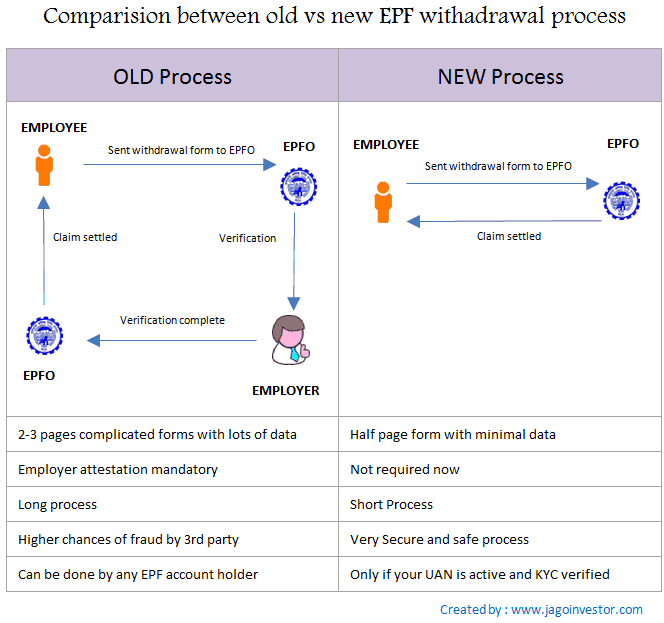

Here is a great news for all EPF account holders. EPFO has come up with new and revised forms using which EPF withdrawal process is now super easy and can happen without employer signature or any involvement. Now you can directly submit the EPF withdrawal forms and the settlement will happen directly into your bank account.

Earlier, the EPF forms were first sent to employer for their verification and signatures, which used to take a lot of time and many a times employers used to harass employees because they had the power to block the EPF withdrawal. However with these new changes, withdrawing from your EPF account is going to be very easy and fast and now it makes a lot sense, because EPF should not be linked to employer anyways. Few months back, with the concept of UAN, the EPFO had anyways delinked the EPFO from the employer to some extent, and this move looks like an extension to that.

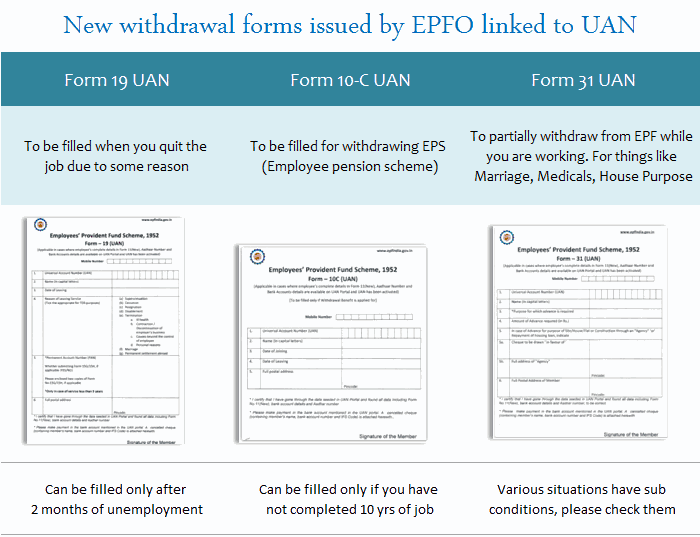

New Forms – 19 UAN, l0-C UAN and 31 UAN

EPFO has issued 3 new forms which will be used for as follows

- Form 19 UAN – You can fill this form to withdraw from your EPF at the time of retirement or leaving the job. Taking our money from the EPF is allowed only if you are unemployed for 2 months. So in case you just change a job and join a new company within 60 days, you can not offically withdraw from EPF, You need to apply for EPF transfer in that case

- Form 10-C UAN – You can fill up this form in order to withdraw from your EPS amount. EPS account is a seperate account linked to your EPF which is for the purpose of pension. Note that one is allowed to withdraw from EPS only if your EPF is not more than 10 yrs old.Check more details on this here.

- Form 31 – UAN – This form can be submitted if you want to partially withdraw from Employee providend fund (EPF) account for the purpose like marriage, house buying or medical emergency. There are different rules for different situations. You can check more details on this in this article

Note that there exist forms 19, 10C and 31 already (without the word UAN), but now the new forms end with the word “UAN” to differentiate between old and new forms.

Who can fill up & use these new EPF forms?

Here is the catch!. The new EPF forms can be used by only those employees who fulfil following two conditions

- UAN must be active and should be linked with aadhaar number

- Your KYC details (especially bank account number) must be verified by employer using digital signature

If the above two points are true for you, only then you can use these new EPF withdrawal forms

Step by Step process of withdrawing money from EPF account

Let me help you with the steps of EPF withdrawal now. For the sake of explanation, we will consider the case of Form 19 UAN, which is used to withdraw the EPF money once you leave the job or are retired. The same process is used for the other forms as well.

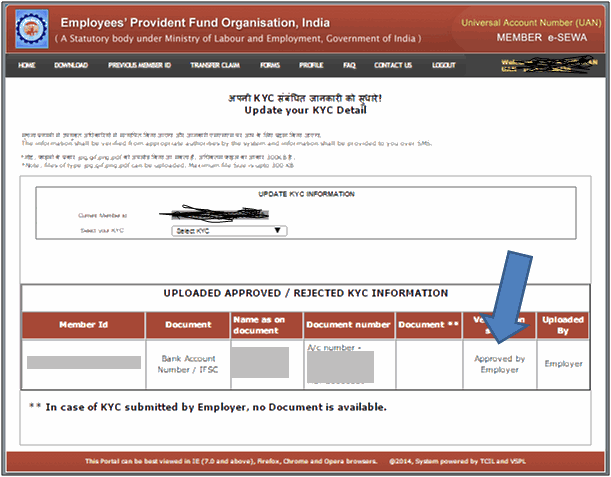

Step 1 – Make sure your UAN is active and KYC details are verified

These new forms can be used only by those whose UAN is active and all the KYC details are verified by employee as explained above.

Hence, the first step is to verify your eligibility. For that, you can go to http://uanmembers.epfoservices.in/ and login with your login and password and then go to Profile->Update KYC Information, where you can either update the details or check them. It looks something like the below example (thanks to my close friend who has passed his details to me for creating this snapshot)

In case, you have more than two UAN allotted to you, then you should discard one of them and should be using the latest one provided to you by the current employer.

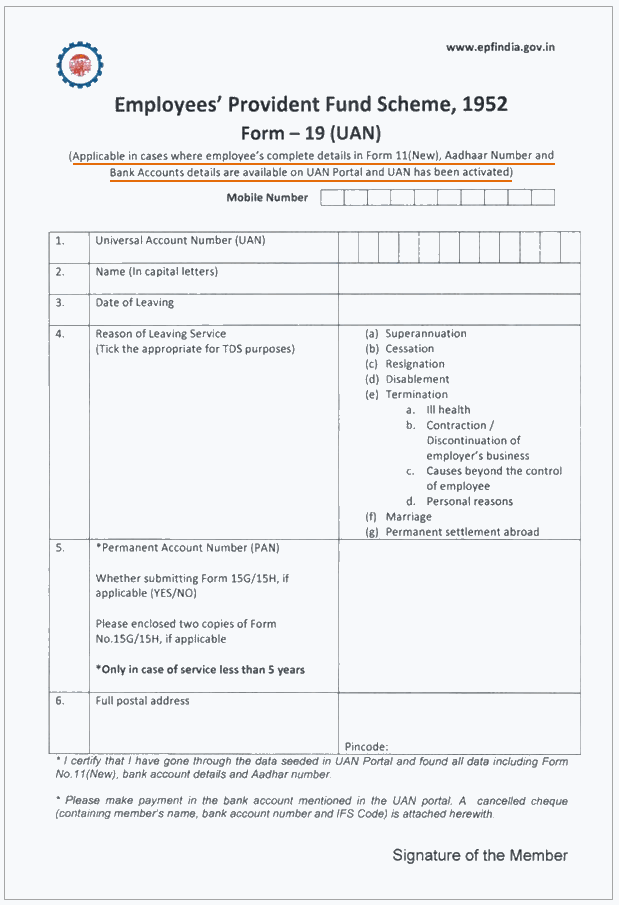

Step 2 – Fill up the EPF Withdrawal form and send along with cancelled cheque

Once you have verified that all the details are fine. You can then fill up the form. Below you can see form 19 UAN as an example. One has to provide the Mobile number, UAN number, date of leaving, the reason for leaving the service (make sure you choose it properly, because TDS will be applied depending on that reason),PAN & full postal address.

Note that apart from this form, you also have to attach the cancelled cheque of the bank account which is mentioned in the UAN KYC details.

Step 3 – Send the form to the EPF jurisdiction office

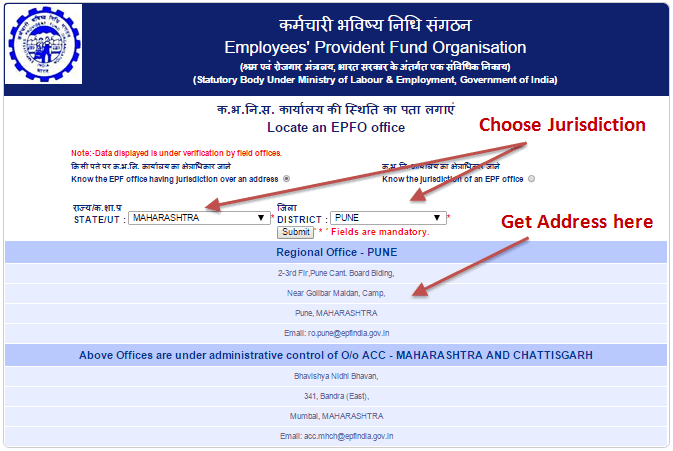

Finally, the last step is to submit this form, along with the cancelled cheque to the EPF office which comes under your jurisdiction. The simple way to find the exact address of the regional EPF Office is to go to http://search.epfoservices.org:81/locate_office/office_location.php and enter your state and district of the office where you work/worked. You will get the full address. You can then courier the documents to that address.

The above 3 steps will help you to withdraw from EPF money easily. If you want to withdraw your complete EPF amount, then you need to fill up form 19 UAN and form 10-C and send both of them.

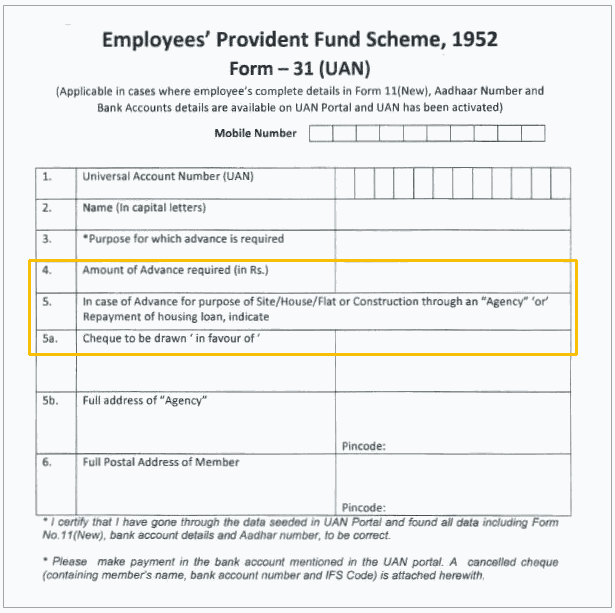

BONUS – Fill up form 31 UAN to withdraw from EPF for purpose of buying house

Let me also share one very important thing related to buying house or repayment of house loan through EPF amount. Form 31 UAN can be filled for partial withdrawal for the purpose like buying house, repaying home loan or things like medical emergency or marriage at home. For more on this, please look at this article.

You can see the snapshot of form 31 UAN below. If you look at 4th and 5th point, you can clearly see that you can take the money directly in the name of the “agency”, which can be the builder or the company which is helping in construction of house. The cheque can be taken for that.

EPF Withdrawal process to be online very soon

I hope you are now clear about these EPF withdrawal forms and how to fill them up. Note that very soon these facilities will become online, it’s just a matter of time. Once that happens, the process will be much smoother and fast, because things will become online.

Let me know if you have any doubts or any questions on this topic. Do you think these forms will help in EPF withdrawal a bit faster?

hi… I have to submit pf form in pf head office does it compulsory that I have to go to office or my husband can submit. because my due date is near I can’t travel so far…

I am not very sure of this.

how to fill up my epf details ?

Where?

Hi Manish

I have completed 9 years and 11 months in previous organization. Can I withdraw my pension funds. As per our Trust 9.11 years will be considered as 10 years and I can’t withdraw the same. Please suggest.

It might be the case, as you dont qualify as per rules !

I left the company in 2014 and submitted the PF withdrawal form in 2016 and waited for almost a year nothing happened so went to my company and they said its with third party management and now they are asking me to submit form 15.I don’t have a UAN number.what to do now. Confirm me how to get UAN Number.

Here is the answer – http://jagoinvestor.dev.diginnovators.site/2015/02/uan-epf-guide.html

Hi Manish I was working for a company for 4.5 years than I had to leave and join another company I did that without serving my notice period

And I tried linking both my epf acc with my uan acc however I m not sure weather this happened actually

Coz both my companies have a different dob of mine

Can I withdraw my epf from the previous company

I think this will have your answer – http://jagoinvestor.dev.diginnovators.site/2016/11/duplicate-uan-problem.html

Hi Manish Please help me

Mera PF withdrawal nahi ho raha maine company june 16 main chod di thi aur company mera form PF office nahi bhej rahi hai aur Maine direct PF office bhi form bheja tha UAN wala form wo return agaya reson ki apka UAN activate nahi hai magar mera UAN activate hai aub main UAN cheque karne kai liye side par ja raha hu to open nahi ho rahi hai please help me.

Hi Sovit Gupta

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

hi I am Karthik,

I worked in HCL for nine months after that i moved to new job in 2011. for the nine month pf deductions has been carried out by the HCL . Actually i dont know the PF account no. how would i get the pf account no of the past employer.

It should be there in your salary slip, Ask them for the PF number

Where can I get these forms?

From EPF website

Hi Manish, I need few details regarding my online pf withdraw. I have two pf account numbers( One to bangalore & second to Chennai) linked to my UAN.

Also there are employee pension scheme deduction added to my second employer. My KYC has been verified and approved by both the employers.

I understand for pf withdraw I need submit form 19 and 10C is required for pension withdrawl.

To submit my above mentioned forms for pf withdrawl,I need to submit by forms to both the offices( Bangalore & Chennai)?

Please let me know me know your inputs.

Hi Raj

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

The article is very informative and helpful

Thanks for your comment Datta

This is great!!could u pls tell me how much it will take to get the amount. I mean approximate time once we submit it in the pf office..

The timeline from PF office is 3-4 months !

Hi,

I Want to Know my Pf transfer claim status I have submitted the form 13 I did get any reply or no response plz help me…

Hi KOMATHI

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Hi

Plz tell me which form I should submit to withdraw PF…

Hi KOMATHI

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi

I have left my previous organization in Feb 2016 but relieving date was 2-Mar-2016, later joined new organization where in joining date is 3-Mar-2016 so will i be able to withdraw PF Amount?

If not how can i transfer it to my current organization?

Thanks In Advance 🙂

Regards

Sandhya

You need to fill up the transfer EPF form for that.

Hi! Manish,

Please help me

1) I left my job on 31/08/16 two months passed my employer is not paying my settlement and conveying if f&f is not clear they cannot process my pf. Is wat they are saying is correct?

2) may I apply myself for my own pf, then what is the process

EPFO processed the EPFO money, not your employer. To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Hi, i worked in an office for 1yr nw i need to withdraw my pf. Wt are the forms to be filled. Im unemployed for more tgan two months.

Hi Kumarr

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi Manish,

I am Pooja from kolkata. Your article was very helpful. I resigned from an organization on 3rd Nov 2016 and wish to withdraw money upto Rs.50000 due to marriage and i have active UAN but Aadhar is not linked to it. Can you please help me on this, how to link aadhar card to UAN and where do i have to submit Form 11 and form 31.

Thanks,

Pooja

Hi Pooja Joshi

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Hi Manish

I left the my pervious employer 1 year back & I didn’t with draw my 7months PF till know, Can I will with draw my balance know with out help of my pervious employer ?…..I have my PF number with me.

Hi Kalesha

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi Manish, First i would like to say my sincere thanks for this information. I need some more information. 2 months back I left a job and immediately joined a new one. But I do not want to transfer the amount. I would like to withdraw the amount from the previous PF. Is it possible? I have a UAN number and the same bank account now & Phone Number.

Is it possible to withdraw without any issues?? and please help me out with complete procedure…

Hi Mahesh

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Sir, I have Aadhar card problem… My name & details are completely wrong on the card due to negligence of the adhaar card agent in 2010. Is it necessary to link with my eyes portal….

Yes it is

I am worked in private ltd for 11 years.now I am claim EPF but pension scheme not interested. So i need to full amount claim get or not pls reply

Hi kalidoss

I am not clear on what is your question. Please repeat it with more clarity

Manish

Is there a simple way to transfer PF from old employers to new employer?

No , there is no simple way 🙂

You need to fill the transfer form and do it traditional way only

When I withdraw entire amount from epf, does it eligible for any TDS? Do I have to take any special care to avoid TDS? My service tenure was 5 years.

If its above 5 yrs, then there is no TDS involve !

And what happens when its below 5 years?

TDS and Tax will be there if its below 5 yrs, No TDS or Tax after 5 yrs

Hi Manish,

This article was very helpful. I need some more information. I left a job and immediately joined a new one. But I do not want to transfer the amount. I would like to withdraw the amount from the previous PF. Is it possible? I have a UAN number but I dont know which phone number was updated (maybe the same number). I have the same bank account now.

Is it possible to withdraw without any issues??

As per law, withdrawal is possible only if you are unemployed. However its your choice if you still want to apply for withdrawl. You need to fill the offline form for this.

what is an offline form?

Hi Lav

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi Manish,

I left my previous org 2 years back and joined new company. is it possible to transfer/withdraw my previous EPF money to new EPF account online without any paper work ? Coz I believe in save paper and save environment ?

Thanks in anticipation.

You will have to do paperwork. There is no escape

Hi.

I leave a company and joined in new company. Now i have sent the EPF claim filed form to HR for claim . HR told me , There is name mismatch with PAN vs Bank Account (Eg : Bank A/c Name : Gopinath.K : But PAN name Gopinath only) There is initial missing at PAN. So ,the HR people said to correct the PAN name as GOPINATH.K, otherwise they said, not able to process my claim. Kindly clarify.

Thats true, you have to first make sure the name mismatch is not there!

Hi Manish,

So if I am employed and am from Maharashtra, am i not eligible to withdraw my EPF? I read online that I need to be unemployed for Atleast 2 months and only then I would be eligible to withdraw.

Could you please advise me on this?

Thanks

Joel

Yes ,thats true .. you can only withdraw it after 2 months of unemployment !

Where is Form 10-C UAN

read http://jagoinvestor.dev.diginnovators.site/2015/12/epf-withdrawal-process-forms.html

Hi Manish

I worked for4 years in a company where i had to leave due various reason and i havent withdrawn my pf from that company and its been more than 7 years now .

1 ,will this be active

2. Do i need to get back to my prev employer

can you please suggest me what to do.

Mera nam rashidul hai aur mei 9 mahina se company sor diya hu mera uan no v hai ,mujhe avi epf balance withdraw karne k liye kya kya karna hoga ? Kon kon form fill up karna parega aur kaha vejhna hai kindly mujhe help kijiye !

Hi Rashidul hoque saikia

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

I am from Karnatka and my PF account is in delhi

Then where should I send the withdraw forms for claiming

Should be to bangalore office or to delhi office

It should be Delhi in that case

Hi, currently I can not able to generate my UAN due to bod mismatch so what can I do for update the same and any other way to generate UAN number???

Talk to your employer for that ..

I have updated my KYC details and it is verified by the employer too.. But still it showing pending status it’s been more than a month. What can I do further??

Hi Janu

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Hi,

I had a EPF ac in my previous company. I left the company 2 years back. As company was shut down. They transfered all money my account.

Now i’ve joined new company and opened a new EPF account.

Company has just provide me PF account no. I generated UAN from net. Checked the balance also.

Question is

1, is it possible that my earlier PF account is still active. If yes then how should I close it?

2, how to operate this new account

Thanks

All EPF are always active. You can take your money out of it if you want.

Which form I can use for transfer of EPF to new EPF account?

Thank you in advance.

Form 13

If am not having pf fatality in my office… Can I apply from pf?

No you cant

Hi manish, I have initiated PF transfer request from old company to New company, my new company approve it.

Approval pending from my old company from last one year.

I have send email and called to HR, After that also not getting proper response.

what I need to do for my PF transfer.

Follow the process mentioned in this article

Dear sir ,iam left job 9 aug 2016 kya m pf l liye apply kr sakta hu pls suggest me apply prosses

Yes, but only after 2 months

Hi i have PF lying in two companies which i left in 2006 and 2008 how can i withdraw them now.

Hi Rajeev Bhardwaj

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi, My Name is Mahesh, i have worked with some company from 2009 to 2012 and resigned to join higher studies. I have linked my UAN and this EPF account. In 2015 i have joined another company and got new EPF number and i have filled the form to add my new EPF number to UAN. But they didn’t do the same. Now i have resigned there and currently not working. Now i have applied for withdraw of 2nd EPF , but EPF withdraw team is asking UAN number linked to 2nd EPF a/c. can u pls suggest how i can link my 2nd EPF to UAN as currently relieved from the company? Thank you .

Ask them if you cant withdraw the EPF without UAN ? It can be done offline

Hi sir

Last 18 months back I left my job. Still company was not paid my PF amount to PF office. Pls advice how can I get my PF amount ASAP.

Hi Devaraj

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

My date of birth is 24.1.1988 and dob updated in UAN portal is 4.1.1988. I have given the request to change it, but it is not yet submitted by my previous employer. I want to withdraw my PF fully. What should I do to withdraw my PF Amount?

Hi Sandeep

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

I worked for 7 years and now i want to withdraw the EPF money with this i can get the EPS amount as well or i need to separate applied for that?

When you fill up the form to withdraw the EPF, there is one more form you need to fill for EPS withdrawal too

I know I’m applying now but it’s cams bahubali 3 opening day

?

Hi sir, i leave jab in 2013, applied for withdrawal bt hr department told me that,their is variation in the joining date , and refused withdrawal , naw what to do Sir, plz help me

Hi Ashish gawai , paratwada Amravati , mh .

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

I resigned March 2016 but not applied for pf till now and I activated my UAN no so should I send pf form to office and later on submit to pf office?Please answer

Hi,

I don’t have any UAN. I had left the company 6 yrs back and the the account is no more active. That company has also been closed. How can i withdraw my PF amount.

Thanks,

Bhakta

You can still contact the EPFO and withdraw the EPF !

I have resigned from my previous job of FCI in 2011 (almost 5 years of service) where EPF account was maintained and joined Central Excise & Customs (Central Govt.) Can I get back my dues now if i apply for it and if yes shall I apply with Form 19? Kindly guide me…

Hi ASHOK RAM

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi sir,

I am worked in Bangalore in a star hotel 22/08/14 to 24/04/16 after leaving the job i applied my EPF on July/2016 to my employer. still now 4 month left on processing i am not getting my EPF.

can you give me a solution for this.

If i apply in your process, how to get the BANGALORE EPF office address ?

You can get it from internet

I left my job in 2014 hoe the clear my pf account plz inform me…

Hi Hitesh ahjoliya

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hello Sir

I want to known that i have working at JSPL Barbil from Oct-2007 which is comes under Keonjhar EPFO office and then our company change IT sector to JISL is Based on Gurgaon form Nov-2011.All my EPFO amount transfer from keonjhar to gurgaon EPFO office but rest Rs.25000 is on Keonjhar EPFO office.

My UAN no is activated and i watch regularly online.

My question is how i get the Rs 25000 money or transfer to gurgaon EPFO office.

Please clarify the same or any query please contact my no : 7894404406

Hi Biswabhusan Chakra

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Hi sir ,

This is varun. I have worked in TCS and I resigned 6 months back .After 1.5 months from resign I joined Syndicate bank .Tcs follows EPF system and syndicate Bank follows NPS system .So I wouldnt be able to transfer my PF Amount.So only option in front of me is withdraw the PF Amount.But my unemployment periode is only 1.5 months .Can I withdraw the amount since it was specified in the article that minimum 2 months of unemployment is necessary to withdraw the amount. What should I do.Could you please guide me on this.

I have active uan number and my bank account and pan number is verified by the employer.

If it didnt cross the already set agreement timeline, then you can do anything !

Hi,i need to transfer my old company pf to new company.pls tell me how to get it.I left my previous company 2 years back and that account is not having uan.current company is having uan.

Hi Purushotham

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Dear Sir, as i have worked in an organization for one year that was 3 yrs back and i have the salary slip but i dont know UAE no so is it possible to apply my pf and if not then how i can know my UAE No???

Hi kapil sharma

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

sir i work one private before 3 years back.now i claim the epf amount

Hi S.PRABHAKARAN

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

how to fill up online epf form

Check google

I work for Curent comapny from 2014 and my last day will be in Dec-2016..but i will join new job in Jan-2017.. I have UAN no .

Can i withdraw money from EPF or that is not allowed.

Also How pension is given to Employee..

Hi siddharth

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hello, I wanted to confirm that this new procedure is applicable from which date?

Its already applicable

Hi sir

I was working with a coffee company. Company close the outlet and i didn’t resign. Now it’s four year back i jusy saw few of comment and ur reply, So can i apply for my pf.

Please help or suggest me a path.

Sandy

Hi Sandeep

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

My KYC IS pending from past 3 years how to get it verified

Hi harsha

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

hi sir i am working 2007 to till now, but i want to withdraw my epf amount fully. is it possible? how? plz explain me.

Hi rahman

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi sir i left the job in 2015 how i can take my epf

Hi Ravi Gupta

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

I left job in 2011 till now I am not withdrawn PF, is it possible to withdraw now without approval from Employer?

Yes, but you need to follow the process mentioned in the article

How to withdraw PF amount without UAN number . Can any one suggest

Hi hemant

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

I worked though a contractor n stopped working since April 2014 my contractor not singing on my PF withdrawal form i m in Hyderabad n my contractor in Visakhapatnam

Pl give some advice in this regard April 2014 on words I m not working anywhere now I m studding

Follow what is written in the article

Sir I resigned from my last company on 2September 2016….I have collected PF form and filled it …now iam confused should I need to submit PF form to my previous company and then need to submit form to PF office……i heard about new PF withdrawal form …. So sir suggest me now iam confused about PF form… should I submit my form to PF office after signing from my previous company.

Hi Saju.K.Chacko

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

I resigned frm my old company on nov_2012 after working 2 yrsand joined in another on next week.i am having uan for old company but my new firm is having nps.please confirm whether i can withdraw my epf fully now.whether if i withdraw now it will atract any income tax?.

Hi Anji

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

I have an active UAN account and all my KYC details are updated and verified by previous employer.

I want to withdraw my full PF amount. Can you please suggest something

Hi Aamer

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Sir i my working for an Mumbai based company. Last 3yr back i rejoined the company .in my new pf no i tried check thru my uan no it is showing sign in login error. Invalid credentials.

Pls hepl me to know epf balance

Hi S.unesha

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Can you please update how to link Aadhar with UAN…?

Talk to your employer on this . He will assist

Hi ,

Actually my DOB in EPFO is wrong.a joint declaration was already made by me and my employer 8 months ago,bu still no correction has been done.What is the solution for this?

Hi Rituparna

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

How can i withdraw my epf where as my office is in bangale and i am in orissa

Hi hrudananda das

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Dear sir, I have been having issues for my pf withdrawal as my previous hospital are creating a lot of drama.. So if I do directly apply in the pf head office will there be any problem. Please do let me know.. I left the hospital since last year December 2015

You can apply for withdrawal directly . Just follow the article

Hi,

This is Chintamani swain from odisha. I joined in ssa, bhadrak on date 10.03.2014 then my EPF Account start and my UAN also activate. After one year my transfer have done from ssa, bhadrak to ssa, Jajpur on date 24.07.2015 then my EPF account become dormat. No money deposit in this EPF account till date. After one year I leave this job and joined in a new place and merge my ssa, bhadrak EPF account with recent EPF account,

My question is, any problem arises in future for the ssa Jajpur account.?

2. I want to Withdraw ssa Jajpur EPF money, is it possible?

Please answer

Hi Chintamani swain

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Dear Sir, I left the job in 2005, applied for transfer when joined new company, with drawn of in 2010, but old amount not got transfered, I have acknowledgement from pf office when applied for transfer, now suggest me how to proceed, regards, sekar

Hi s.sekar

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

HI SIR IF WE WORK FOR 4 MONTHS IS THIS ELIGIBLE FOR CLAIM

From what I know, its minimum 6 months !

It may helpfull for fast settlement off employee

I have worked in a company for 2 years ( 2004 to 2006) & then joined another company where I got UAN number also. But I never transferred previous company PF to the new one. I have this company also& now without any work for last 6 months.

In the old company, UAN was not available & I also do not know my PF account number.

How to proceed in this case ?

Hi Narender

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi,

I worked in my previous company upto Nov 2014 , And I joined new company on February 2015. I have not withdrawn my EPF till date. Now I want to withdraw it. What is the process? Kindly suggest.

Hi rakesh Kumar

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi sir,

I resigned from my job 6 months ago. Can i withdraw my pf as i haven’t joined any organisation yet. As you mentioned Form 10-c and Form 19,Where should i submit them? Should i sent them where my pf account is held (i.e.. maharashtra) ? or Where my previous work place is held(Andhra Pradesh)? Please help. While googling i found that i should submit forms at regional office. What should that mean i don’t understand. I filled up both forms and even i took sign from my previous employer but i dont know where to submit them. Please help me sir.

Thanking you

Hi Anil Raju

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

I have worked for IBM for 4.5 years and left IBM and joined a different company and worked for the new company for 4 years. I have transferred PF account held at IBM to the second employer. Even though my total number of experience is 8.5 years, the current PF account reflects only 4 years. When I withdraw, will there be TDS since the current employer held PF account will show only 4 years?

Thanks for your help

I think YES. If its showing 4 yrs , then TDS will be applicable and finally the tax when you withdraw it

But the total number of years of service is 8+ years. Is not the total years of contribution to EPF considered? Should one must have 5 years in same organization? Does not make sense!

No , it should be a EPF account with more than 5 yrs of ACTIVE contribution. If you changed company, you must have transferred it

Thank you. Yes. I have transferred PF from IBM to the new company. I have one PF Account with all the money. Do you still think TDS is applicable? I have total of 8 years and 10 months of active service with 4.5 years in each companies.

Thank you

In that case its not taxable . The total number of years for which EPF was active has to be more than 5 yrs.

Manish,

Thank you a lot for valuable information provided. It is not just the information you have provided for my question, but your answers to all other questions are also useful for most.

Greatly appreciate your help

Thanks

Rajan

Glad to know that Rajan ..

HI Manish,

The information you gave is really useful but I have few doubts,

1) will after submitting the EPFO form any follow up is also required or will it be a smooth process.

2) EPF jurisdiction office address would be the one where I worked before right? because now m in Pune I was in Bangalore before.

I suggest that once you submit the forms, do one follow up in next 4-6 months . THE JURISDICTION WILL BE the old address from where you left the job

Sir, I have Lest My Company as on the date of 10-09-2016 and i want to withdrawal my PF at on online process so please give me some instruction that’s Process.

Hi Hitesh Makwana

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Thank you sir,

I have lest job as last 2 month but i want to PF Withdrawal as online so please give some suggestion for that process.

Hi Hitesh Makwana

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

I left my job on 2013 at that time UAN number was not allotted. Now how do i get my withdrawal.

Hi Arul D’souza

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi Manish,.

I am working with concentric with last 6.5 years.

Due to some financial issue I want to withdraw my deposit amount which is possible.

Hi koushik saha

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Dear sir

i left my job 6 month back.

i have uan No. How can i withdraw my amount ?

please help me

Hi Dipti Ranjan

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi,

I have uploaded all necessary documents to epf website,it is approved also but KYC in UAN card is still appearing NO;can you please help me to make to correct .

Hi Hemanth Mysuru

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Thanks for the info

Hi,

I left my job 3 years back only. At that time UAN number is not allotted. Now how can I withdraw my EPF amount? What is the procedure for that now?

Hi Shiva Kumar N

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Dear sir

WHICH FORM I WANT TO GIVE FOR WITHDRAWN MY EPF MONEY THRU

OUGH UAN BASE…I AM WORKING 1YEAR 11 MONTHS…

i left the job onm 31 ,8, 2016. i am working in HGS BUT MY PREVIOUS COM

ANY HEAD OFFICE IS IN MUMBAI …WHERE SHOULD I SEND MY EPF FORM…PLS SUGGEST…..because i am staying bangalore ..our previous company head office in bombay…Pf number also mentioned as bombay regional office…how can i send my epf form and to whom…pls suggest….

NAYAZ

ICICI….

Hi Nayaz

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

I want to with driw my of but previously I work for two companies where I work for 10 month’s only and my previous company cleared my all of pr ammount what I will have to do for withdrawn my ammount also they don’t made me the New uan no kindly suggest me for the same

Hi vivek rai

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi,

I worked in my previous company upto Nov 2014 , And I joined new company on December 2014. I have not withdrawn my EPF till date. Now I want to withdraw it. What is the process? Kindly suggest.

Hi P MAKESH

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

hello

how we know the status of fund transfer once we sent the documents to pf office..bcz nobdy in pf office receive the calls ..

thnx regards,

Hemant

Hi hemant

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Hi,

I want to know if i just want to withdraw my pf. In that case also i have to fill and submit form 31, along with form 10C and 19.

Hi Rohit soun

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

HI, I wan to withdraw my PF but my cheque book dont have my name on it . So in this case can i attach my bank statement of last 6 months?

Yes, it should be good enough . Also sign the cancelled cheque

Hiii…

How many dayz will it take to get the amount in my bank account after i sent all the documents to epf office by post.

One more question is that how can i transfer my previous company epf money to the new one epf account bcz i tried it by UAN portal twice but got rejected by my previous company. Plz help me regarding this issue…

Thanx n Regards

Hemant

It takes anywhere from 4-6 months . You can transfer the EPF online . Search for that

sir i repet

mai apni company me last july 2016 tak kam kia nd then i resign her post ok nd now aftr 3 month withdraw my pf in pf office bt he says mera pf only October 2015 tak ka hai ,my 8 month pf kaha gya,plss help mai kya kru company ko kahu ya pf office

May be the company has not deposited it !

Hi,

I resigned from my previous employment in March 2015 where i worked for 6 years. In my existing company, there is no PF. I am worried if my PF account will become dormant as there has been no contribution for 18 months.

Can i completely withdraw the PF and close the account? Please also advise on the form applicable.

Thank you.

Yes it will become dormant after 3 yrs of inactivity

Hi,

I have tried lot of time to link/upload my PAN with my UAN but every time was saying no document uploaded i mean it getting fail. So how can i link/upload my PAN in my UAN account KYC .

can u please help me in this.

Thanks

Check the size of the doc that you uploaded. It should not be more than 300KB

Hi Sir,

I have UAN number also I uploaded KYC documents month back but it’s showing approval pending ….but my question is who will approve my uploaded KYC documents…. pls help me on this

Hi NisargaRaj

I have limited understanding of UAN hence I dont have 100% sure answer regarding your query . It would be good if can connect with your employer on this issue or use RTI for finding answer to your query.

Manish

NisargaRaj,

Your current employer can approve the KYC, Just submit them the hard copies of your documents and they will do this.

Hi, Thanks for sharing this information. I have the following query, would really appreciate your response in this matter.

I have an accumulated PF balance of INR 2,00,000 in my EPF account. I have a plan to change my job in next 1month. I’ve been watching this EPF rules update space but somehow I could not understand the jist whether If I apply for withdrawal

1. Will the entire accumulated amount would be paid to me or just the contribution I made

2. What if the purpose of the withdrawal is for purchasing a property (for own living), will EPFO allows to withdraw the entire accumulated amount? Will there be any TDS applied on this withdrawal?

Thanks for your response.

Hi SK

Thanks for your query .

You can read http://jagoinvestor.dev.diginnovators.site/2014/02/withdraw-from-epf-account-for-buying-house-marriage-education-and-medical-treatment.html

This article will answer your above queries on EPF.

my New pf From Has not deducted

Hi sandesh

I am not clear on what is your question. Please repeat it with more clarity

Manish

can you pl. say about pf withdrawal rules, is employer contribution withdrawal restricted till certain age even after leaving the organisation

Sir I applied for pf amt last 2 mnths back

Nd I called one person to know my status

She replied your application was rejected

Because there is no name on your cancelled check nd once you send all documents correctly .but my uan I uploade all the documents like aadhar ,pan,account details

In that a/c details I upload my cancelled check

Nd approved by employer is there necessary in cancelled check upon name of member

Pls suggest me sir

Hi Srinivas

Yes , its necessary that your name & account no. are there on cancelled cheque .As cancelled cheque is required to validate your account details.

Hi, Thanks for sharing this information. I have the following query, would really appreciate your response in this matter.

I have an accumulated PF balance of INR 2,00,000 in my EPF account. I have a plan to change my job in next 1month. I’ve been watching this EPF rules update space but somehow I could not understand the jist whether If I apply for withdrawal

1. Will the entire accumulated amount would be paid to me or just the contribution I made

2. What if the purpose of the withdrawal is for purchasing a property (for own living), will EPFO allows to withdraw the entire accumulated amount? Will there be any TDS applied on this withdrawal?

Thanks for your response.

Hi, i need to withdraw my pf amount. The IFSC code mentioned in the uanmembers.epfoservices.in is wrong. How can i change that? Which scanned document i need to upload in order to edit that field?

Verification status is showing as approved by employer.

Hi Shaik

Thanks for asking your question. However, I dont think I am eligible to answer your query as its either out of scope of my knowledge or its not related to money matter directly

Manish

sir i worked my company till june 2016 because that closedher site nd now am withdrawal her money , but my company pay only oct 2015 so plss help me for copny against step

Hi ashok kumar

I am not clear on what is your question. Please repeat it with more clarity

Manish

My employer approved the KYC details but it’s still in pending status. May I know within how many days it will change to approved status

Hi Janu

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Thanks. I heard that the person should wait until the PF office members approving the KYC in UAN portal.

How many days does it take to credit the epf amount once filed Online….???

Generally it takes anywhere from 60 days to 120 days , but being a govt entity its not very defined thing. I suggest that incase you dont get the money in next 4-6 months, in that case file an RTI and ask them about it, This will speedup the process.

Manish

i forgot my password, can u help me how get password

Hi dennis

I am not clear on what is your question. Please repeat it with more clarity

Manish

Dear sir ,

Already i am having UAN , also i left my job i wanted to withdraw my money .. could you please assist me how to get my money.

Just have a look at this article – http://jagoinvestor.dev.diginnovators.site/2015/02/uan-epf-guide.html

Whats meant by regional office. Is it the PF office near my worked office (I worked at Bangalore office) or the account maintained office( My account is maintained in Bandra office Maharashtra). Please let me know ASAP.

Thanks!

In that case it will be Maharastra. Because all the calculation and the department is there . IN your case, only your office location is Bangalore. So it would be Maharastra for you

Sir,

I am willing to withdraw EPF amount now.

Shall I follow the steps as per your above information without any second thought.

Plz reply

Yes, please do that if you are not getting your employer support !

Thanks for your reply Sir !!

good

sir,

my i joined my 1st company in Jun2007 till August 2011.( PF transferred to 2nd company)

joined 2nd company august 2011 till Jun2013( this company went in loss and had not paid us in last 10 months of year 2013 ) we were not got paid any thing and company had not submitted its PF amount from their side also. means we were not employed for those 10 months as we were not having any transaction from company to our bank account.

after that i joined 3rd company and never trasferred 2nd company pf to 3rd.

now whether it is possible to me to withdraw that pf amount?

Yes, you can withdraw it whenever you want

Manish

Forms should be made online

Thanks for your comment Vivek

Thanks for your comment Vivek

Hi..!

How to UAN no activation.

Hi januprasad

I am not clear on what is your question. Please repeat it with more clarity

Manish

Hi januprasad

To activate UAN no. visit – http://uanmembers.epfoservices.in/uan_reg_form.php

Hi,

I was working in Delhi now 2 yes back I left the job now I m sifted in lknw.Thing is that my previous no which was linked with UAN that is closed now I am using another no so here is much difficulty to get of money.please advise me eat should I do now

I think you mean its INACTIVE ! ..

Either you can work on linking the old EPF with the current UAN you are using. We will come up with an article on that!

Manish

My date of birth is wrong in EPF details how can I change plz suggest me something

You need to write a letter to EPFO for this mentioning your correct date of birth along with the DOB proof.

Sir please let me know which pf office address required to send the form to claim for jurisdiction either our state where I have worked or employer mentioned epfo address in our pay slip.

Please tell me.

It would be the employer mentioned one , however we suggest you confirm it once with your HR departmnent

Hi,

Currently working with Delhi based firm in Delhi. Want to withdraw EPF accumulated while working with Chandigarh based employer earlier.

But the New Forms – 19 UAN does not have any reference about the EPF number issued in Chandigarh. Then how EPFO will come to know about the amount to be withdrawn.

I do not want to withdraw the PF from current establishment.

-Sunil

Why dont you use the old EPF number while withdrawing ?

The form has only the UAN column. And writing that may authorize the EPFO to withdraw the Amount from both the Previous and Current EPF accounts.

Is there any way to withdraw PF from previous EF account using Forms – 19 UAN?

hello sir I worked in old company for 9.6 years I left job in Feb 2016 till now I did not get a new job can I withdraw my PF amount throw online EPF or not I am having UAN number plz tell me .

Yes u can. approach the pf office where the deduction is happened. if new UAN is not generated and u are not working any where then it will be very easy.

You can check your UAN number online using your EPF number online. Then you can explore how you can withdraw it online – Read this – http://jagoinvestor.dev.diginnovators.site/2015/02/uan-epf-guide.html

Hi,

I don’t have UAN Number. I left my last job in 2012, there was no concept of UAN that time. How can I generate this number. I don’t want to see my employer again. Is there alternative method?

Just go here http://uanmembers.epfoservices.in/check_uan_status.php

And you can find your UAN using your EPF number if generated!

My company some employs not receive UAN code what can we do…plz

Hi mallikarjuna

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Instead of Cheque can we proceed with Bank Passbook or Bank Statement which contain all the information like Name Account number IFSC code?

No , i think cheque is required

Thanks for the article and update..:) Also Please create an article for Online Transfer with all the details.. Would help a lot of people.. there are lot of loop holes in EPF website.. Each time when I request for a Online transfer it says, This request is already exits and tells me to check in “View status”, But when I check, It says No Requests Found..

Yes, we will create that article very soon .

sir, i have resigned my job perminently. ihave uan id & i fill kyc details also & employer was updated my kyc details.what is the next step to with draw my total pf amount within 10 days.please send me information sir…..

Check with EPFO office on this

Hi nagendra

Being an government entity it would take time .Generally it takes 60-90 days.

I think it is not working out if the EPF account owned by company Trust, for example HCL

Sir actually without resign I left my job and I joined another company after that I have applied my PF online transfer but my previous employer rejected my PF two times I don’t have UAN number for previous employment How can I transfer or withdraw my PF pls suggest me sir frm 4 years onward my PF was blocked due to this condition pls help me sir

Hi Balaji

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

I am not able to get my UAN Number ..how to get the my UAN number plz mention the process’s how do I get my number sir ..This system is very good

it is much helpful to all

Thank you…

Hi SudhakarRao

Thanks for sharing your request . We would surely write an article on the process to get UAN no. in the near future for you.

Thanks

Hi SudhakarRao

I have limited understanding of UAN hence I dont have 100% sure answer regarding your query . It would be good if can connect with your employer on this issue or use RTI for finding answer to your query.

Manish

Hello,

I have problem in my name which is submitted to office i.e my surname is Yamali but they enterd like yamili and they submitted to epfo office now I want money for marriage how to withdraw the money?

What is minimum period to eligible withdraw the money.

Hi yamali

You need to contact EPFO office for that.

Hi yamali

You need to first follow this process for change of name. Once done with that then only you will be able to withdraw .

Hello Sir,

on oct 31st i have been absconded due to emergency.. i worked Xyz company for 6 months..

can i withdraw PF Amount & close the PF a/c??.

if then please let me know the procedure to withdraw & close the PF a/c

Thank you

Hi Abc

The company has no right to block EPF payment . You can ask them to sign on your EPF form. If still the issue is not resolved you may contact EPFO and file a complaint with them regarding the situation.

Hello Sir,

I am working outside India from last 4 years and doesn’t hold the UAN number. Please advise how can I withdraw my EPF amount.

Hi Mayank

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi,

I left my last company as they had to shut down the project. Company kept me on bench for almost 2 months, mean while they were trying to accommodate me in another project… I tried in another company I got selected.. Now for 40days I was dual employed…later I resigned from old company and joined new one… I have not withdrawn my pf from old company… It’s about 35-40 thousand…it’s been 5years now in the new company… What should I do to withdraw my pf? …. Will I have any issues in withdrawing my pf

Lot of issues

Hi Arfat

In case you have left your previous company on amicable terms. I don’t see a point in them creating any issue . Still you may contact your previous company HR and confirm the details.

How to transfer the pension amount from old PF account to new PF account??

Please help

Hi Yash,

Your pension amount gets transferred along with your PF contribution. There is no separate process for pension amount transfer.

Hi YashPhutane

Nowadays we have UAN No. for an EPF a/c . In which all your EPF a/c can be clubbed . I suggest you link your old epf a/c no. by visiting http://members.epfoservices.in . with your UAN No.

Our company not deduct ppf. How to start.

Hi anil

Your company may not have that facility as generally a company with moderate no. of employees or minimum 10-20 employees have this facility.

My old account no uan give epf how to get please help me

Hi siva

You can get your UAN no. online by inputting your EPF No.

My UAn is not active ,I left job in 2006 , how to activate and withdraw PF amount , plz guide me,or I hv to consult my old employer or any other online way if any suggest me

Hi Sntripathi

I would suggest you check – http://members.epfoservices.in .It may be of help. You can check this site with your EPF A/C no. or contact your old employer.

Although ,as your case is bit complex one I doubt about an online solution though . Therefore , i would suggest you file an RTI regarding your situation.

For Info regarding how to file RTI check – http://jagoinvestor.dev.diginnovators.site/2012/12/rti-application-for-psu-banks.html

I cant collect my money ,they are rejecting my request ,how can I contact them, now I am in outside of India

Hi linta

You can contact EPFO office and inform them about your situation. Also inform them that you are outside India.

I HAVE LIFT MY JOB AT TRANSPORT CORP OF INDIA LTD 6 YEARS BACK .HOW TO WITHDRAW THE MONEY.

I, Mr. Shiva P. Rathod, worked with Maitiri Electric house, Surat from Date:1.4.2013 to 30.10.2014.

During this period, my PF deposited in my PF A/C No: SRSR—————-. For this PF withdrawal, i had submitted PF withdrawal application form.As per SMS recieved on Dt.:12.10.2015 from PF Dept.,

PF was transferred by NEFT transaction in my Axis Bank A/C: ————-. But i have found my axis bank a/c FREEZED from axis bank dept. due to some technical reasons.

As per Axis bank rules when A/C got Freezed, there was no transaction facility and as per their record no transaction made on this period.Some necessary details, i have mention below and scan copy of Bank Statement and PF statement attached.From PF Dept., On Dt.: 12.10.2015 PF transferred sms received details: PF claim ID: SRT———(Rs.—–) and Pension WB claim ID: SRT———- (Rs. —-).So Please do the needful.And Please guide me what to do now for My PF withdrawal.

Hi sivabhairathod

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Hi…sir I have some prbalm I am not leave d work bt urgently I get pf amount how to withdraw plz tell me sir…..

Hi manukumar

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

how to link with my UNA number

Hi Sakthi

I am not clear on what is your question. Please repeat it with more clarity

Manish

Hi ,

I am Anshuman .

Please help me in suggesting how can i transfer my EPS amount ,as on applying for its withdrawal my Form no 10 was rejected on the grounds of not completion of NCP days.However, i worked with Protocol Solution Ltd from 02-March-2015 to 07-Sept-2015 so according to that my 6 months with the company was completed.

So now would i be eligible to transfer the amount lying with EPS account to my new PF account. I would like to apprise the fact that this employer had fed wrong DOB and Father’s name and for the same i have submitted the Declaration form duly certified by the respective employer to PF office along with the requisite docs .But PF office had not rectified the same details on their EPFO PORTAL.

So please suggest what could be the course of action from my side.

Hi

I have 2 different UAN no I want to withdraw the old one which has a good huge amount . Will I be able to withdraw it . Please help.

Hi Lakshmi

I have limited understanding of UAN hence I dont have 100% sure answer regarding your query . It would be good if can connect with your employer on this issue or use RTI for finding answer to your query.

Manish

Hi

Due to some personal reason i left my job 2 years back and didn’t withdraw my EPF. Is it still possible to withdraw. If yes then what is a process??

Yes you will have a Epf A/c no link it with UAN no then epf settlement is easy. Might be you already had UAN no, go to Employers office ask them first what is your Epf they sent or not or is it declined due to any mistake. If any mistake occurred then resolved the mistake for any assistance , you may contact to HR department of the company.

Hi Vidhula

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

My total serviservice expexperience is 5 years in same company i want to withdraw my epf for marriage is it possible. Please reply.

Hi vijay

Yes , you can withdraw . For more info on this -http://jagoinvestor.dev.diginnovators.site/2014/02/withdraw-from-epf-account-for-buying-house-marriage-education-and-medical-treatment.html

Very good intimation to all EPF subscribers.

Thanks for your comment VENKATESWARLU

Really very helpful ..

thanks

Thanks for your comment Ankur

The article is quite helpful and precise except that there should have been made available links to download the withdrawal forms mentioned in the article because the forms available on http://www.epfindia.com/site_en/WhichClaimForm.php are not updated ones. Please make available these forms in your article. Thanks

Hi Shubhangi

Sure , We will try to do that for you in some time.

I called to my company’s HR dept and they told that there is new rules from 1st July 2016 that PF amount only can withdraw at the age of 60 years.

Pls let me clear with new updates.

Hi Ronak

This rule has been already withdrawn. So currently , there is no such rule . It was proposed but was cancelled.

Hi im malhothra i previously worked 1year in crpf central govt .but i discontinue that job but in epfo i have 25000 amount how could i got that amount plz help me

Thank u great news

Thanks for your comment Saravana

I am regoining the security duty from sukhee securiy service from bombay.

I do work inthis security one and half year.

Isend the epf forms for company with my

Signin. I am from mangàlore.I am do duty

in icicibank

Hi BsyogappaYogappa

I am not clear on what is your question. Please repeat it with more clarity

Manish

i had left an organization in 2014 feb without the manager’s concent so am i eligible to get the epf can you guide me in detail??

Hi Anuj

Yes , the EPF deducted from our salary is deposited by the company with the EPFO in our EPF A/c. In case your company has followed the procedure . Sure you are eligible.Else you need to file an RTI regarding this.

I want change my phone number. Who can i change tha number. Becouse l lost my old phone number. I register my new number

Hi Mallesh

Thanks for asking your question. However, I dont think I am eligible to answer your query as its either out of scope of my knowledge or its not related to money matter directly

Manish

good process

Thanks for your comment gangieswareddyg

Hi

I have UAN number also I uploaded KYC documents but it’s showing approval pending ….but my question is who will approve my uploaded KYC documents…. pls help me on this

Urban co op employee .u an no collect ed.7 years complete .my house is constructed. Withdraw the money .how much money close ?

Hi Shwetha

I am not clear on what is your question. Please repeat it with more clarity

Manish

Great News…Thanks a lot:)

Thanks for your comment SathishKumar

Good and valid information for many people including myself.

Thanks for your comment Sathish

Good article.

Thanks for your comment SurinderKaul

Hi

My earlier one company deducted EPF from my salary regularly and no details was provided e. g. Salary certificate or p.f. Account no. Total amount in efp

No response received till date. …written to PF comissioner Delhi as HO of this in Delhi

What to do to avail this amount of pf

Kindly guide me

My email prabhakar.shanbhag2010@gmail.Com

Will be very grateful if you provide me details of this

Thanks for the excellent information!

When we say soon it will become online, does it means then we don’t even have to courier the documents?

Best Regards,

Riwaz

Hi Riwaz

May be or may be not . As scanning can be an option added or they may still ask you to courier the documents. Not very sure about this.

Hi,

Is worked for ‘xyz’ company for 15months due to some personal reason I left the company.I have my UAN number also it is linked with my aadhar number. Now my question is how can I get my EPF amount and how to attach the form 15G , where I will get that form.

Please do the needful.

Thanks,

Priya

Sir

I left long back my job.i don’t have Uan .now doing my own business. How to open UAN now.is it possible now

Hi Muraleedharan

I have limited understanding of UAN hence I dont have 100% sure answer regarding your query . It would be good if can connect with your employer on this issue or use RTI for finding answer to your query.

Manish

How can is generate my UAN nuber please help me

Hi Yogesh

I have limited understanding of UAN hence I dont have 100% sure answer regarding your query . It would be good if can connect with your employer on this issue or use RTI for finding answer to your query.

Manish

What if , the employer has not deposited the epf funds for 8 months. After leaving the job. It was said that the epf will be deposited and you can then withdraw the money. Now the company is declared bankrupt. They haven’t deposited the 8months fund though deducted from salaries . Now How can I get back my money.

Hi APDhurandhar

Thanks for asking your question. However, I dont think I am eligible to answer your query as its either out of scope of my knowledge or its not related to money matter directly

Manish

Hey hi

I want to withdraw pf from my previous organisation which is 10 years back and that time we didn’t had the uan concept. I have applied several times but then the organisation has not received the form

Kindly advise

Hi Manish,

I have a bought an apartment, Now planning to withdraw pf for registering the house.

I have 3 questions.

1. Can i withdraw before registering on my name. (I have sale deed now)

2. Can I get the money to my linked account and not to agency ?

3. Is the Declaration form needed along with Form 31 ?

Appreciate your support

Sir I am resigned one company after six years. I withdraw epfo from there but I cannot got pension scheme money how to getting that plz inform me

Thank you so much Manish.

I have one quistion Will we get

pension amunt as well with the PF amount.

How I can withdraw all EPF money one time.

Please suggest.

Hi Manish

My Father has passed away in 2006 and the company he was working is no more functioning. I am able to get hold of the employer. Would the above forms help me withdraw the money from his EPF account.

Thanks

Nice Manish. Thank you .. its useful great…

Sir,

I resigned my job in 2008. Present I’m working in new job. I have not received EPF amount can I avail EPF amount through UAN format No. 19.

Dear Sir,

I resigned my job in 2014. Presently I’m working in new job. I have not received EPF amount can I avail EPF amount through UAN format No. 19

ng & setelment amount. Can I avail EPF amount without UAN & also how to get my settlement.

Thanks

Avinash

Hi Avinash

I have limited understanding of UAN hence I dont have 100% sure answer regarding your query . It would be good if can connect with your employer on this issue or use RTI for finding answer to your query.

Manish

Hello Manish,

I have left my job in feb 2016 and started my own company. I have been working for 8 yrs before starting my own and I have UAN number for EPF; BANK A/C details and PAN are verified by Ex-Employer as KYC documents. I didn’t had AADAHAR card till feb 2016, now i have that too.

Can i apply for EPF withdrawal with new form 19 – without employer signature. If no, if i upload AADAHAR card, how it can be approved ?

What is form 15G/H for??

One has to fill form 15G also, if his service is less than 5 years.

Thanks a lot Manish, Well I have few days before got money and it took hardly 20-25 days as per new rule

Regards,

Anand

Hi, i left the company 7 yeara back and my pf money is not withdrawn or transferred Now how can i withdraw that money??

Hi Eagappan

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi i have upload my aadhar card for kyc but after 3 months its showing pending or not approved by employer plz suggest me what i do

Hi saurabhattar

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

i want to know that how much amount we can withdraw? I think as per new process we are able to withdraw pension amount only not the employee and employer share. Am i right about it or not . And one more thing i have worked for 4 month with my previous employer and they did not do any full and final of my account , so is it possible for me to withdraw my pf from there . Please write me on malka.rani9889@gmail.com

You can withdraw the full amount !

For the last 5 months I claimed for my epf settlement , but neither have I drown cash nor conformed, if my Withdrawal Claim Form is correct,through mobile message or by mail. I need your help in this regard as to how I ensure myself about whether my WF is received by the Concerned Office. I have got my UAN no.

Hi Bishnu

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Hello Sir,

I dont have old company PF number and that company also closed now.

Now what steps should I follow to get the amount.

Please help.

YOu can still withdraw it. Fill up the form with EPFO

Which form sir ?

Is it possible online or i have to visit pf office.

my previous company’s PF not received sir, i don’t hsve any UAN / UID number. How to withdrew my previous company’s PF amount kindly help me sir.

Hi Vivek

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi Manish,

I left my last company in Jan,2011. But PF amount is still lying as it is. I have the PF no. How can I withdraw it. I don’t have UAN/UID no. Pls share ur mob. no. so that i can call.

Ajay

Hi Ajay

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Is the similar new form available to transfer the PF amount from previous employer EPF account to the new (present) employer?

No , we are not aware of that

How to update my new mobile no in EPF

I think you are looking for mobile chance in UAN , find it here https://www.quora.com/How-would-we-update-our-phone-number-in-the-UAN-Universal-Account-Number-portal-to-login-to-the-UAN-portal-and-manage-an-EPFO-account-if-we-dont-have-our-registered-mobile-with-us-or-our-service-is-disconnected

I have the same issue which is given above, can you please help me out, I talk to my employer even they can do anything, can some one help me out, my mobile number,+919108609108,

Email syednadim72262 @gmail.com.

Hi nadeem

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

You ll just download a aap from googgle play store name EPF

only bank details are updated in UAN portal.But now Iam not using that account.

Iam trying to upadte my adhar details.But its not updated.What I have to do now?

Please suggest me

How are you updating them ? What process are you following ?

Dear sir,

My name is Mohammed.Khaleel Basha my previous company’s PF not received sir, i don’t hsve any UAN / UID number. How to withdrew my previous company’s PF amount kindly help me sir.

Hi Mohammedkhaleelbasha

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

I dont have cheque book of mentioned bank ac on UAN portal.

any other option available ?

Why dont you apply for it ?

I have filled login page and entered UAN number,mobile number.

Then it will ask Log in ID and Password..which log in id they will ASK I DONT Know pls help me

U will get username & password to your mobile number

YOu will have to create one yourself to access your information !

Hi Team,

I have finished first i unable to do from second step , i should Download the form or else should get the form from EPF officeCan Anyone Help me Please???

You can get it online at EPF website

I have linked Bank Account & PAN number in KYC & it has approved. i haven’t uploaded aadhar. but i left that job now can i upload the aadhar??

is it compulsory to upload aadhar?

if i uploaded means employer should be approve that???

If you dont upload adhaar, you will not be able to withdraw online. Thts all . You will still be able to do things offline

For same case mine got approved by employer. Try it.

Sir if I want to withdraw my previous company PF then the digital signature will be given by previous company or by present company??? If they don’t give the signature then what should I do???

It will be done by your company

How I add my new mobile number with UAN Number, because My old mobile service is stopped.

You will have to fill a offline form for that, search on net

How to check in my p f amount …..any salution …

Hi mahesh

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Hello I am not know my UID No. How can I withdrawal my p.f settlement, please send me details

Hi Ramesharikala

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

what is univarsal account number

I think you mean UAN

Read this – http://jagoinvestor.dev.diginnovators.site/2015/02/uan-epf-guide.html

My Adhar card and Bank Accounts are linked with UAN and also approved by employer.

I have submitted form 19 UAN and 10C-UAN directly to EPF regional office. It will take maximum how long to get the money?

And is there any way to check my status?

Generally it takes 2-3 months max.

Dear Manish,

I am a retired person at the time of my retirement my employer has handed over the cheques pertaining to my PF account,but to the best of my knowledge it should have been more than what I have received,when I have enquired about the same I didn’t get any responses from my ex employer,I was asked to commute1/3rd of the pension amount and the balance will fetch certain amount every month as a pension,but it’s only few hundreds am getting,instead of that can I withdraw the entire pension portion and close the account,please guide me the way forward.Also let me know whether I can proceed legally having not cleared my doubts and having not answered my clarification about my PF by my ex employer.

Thats not possible

Once you have more than 10 yrs of service. The pension is compulsory !

Hi… If all criteria are satisfied… Can me and my wife as two different employees withdraw our respective PFs against a common property which was bought earlier this year in my name (Jan 16)? And, how much time does it take usually? It was purchased by taking a personal loan from a family member,and we would like to pay off the loan by withrawing from our PFs.

I cant comment on the time taken because thats not fixed !

I have leave the plant and after that plant is stopped no more running now, so can i withdrawal my epf money without employer signature plz tell me what is the prosidure for withdrowal money.

I think thats what we discussed in the article

Thanks for new withdrawal epf system.

I am having a PF with previous company(Which is closed now). PF account is not linked with UAN. I am trying to transfer it to my present account but it’s not possible online as previous employer don’t have digital signature.

I want to withdraw previous PF what should I do as getting sign of previous employer is not possible.

Yes, it cant be done online

May I withdraw my epf balance with existing employee of a company. What is the process.

Hi Prasant Kumar Swain

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi I already withdrew money as house loan can I know whether there will be any verifications regarding site registalration

NO

Hi

I have not linked my aadhar to UAN because i did not have aadhar at that time. Now i left my job 6 months ago. Do i need employer approval for linking aadhar?

Can i withdraw my pf without employer signature?

Yes, you need employer approval

thanks for your reply. please let me know the procedure to withdraw my EPF money without employer signature

Thats exactly what we have discussed in the article

I’m currently unemployed and would like to withdraw my EPF (Oct-2005 to Mar 2008) for my service with HDFC Bank Ltd (Trust),There was no URN at that period,how can I withdraw my EPF ? Someone told me since its a trust you will not be able to withdraw unless bank signs the form,Is this true?

I am not sure of the TRUST EPF. You might want to use RTI here to find out the process

Thanks Manish

Pls anyone help me reg filling a column in form 19 (UAN). Whether 15g is needed to enclose if service is less than 5 yrs.

Hi Ramyaa

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

How to linked aadhar number in pre activated UAN ? Kindly provided the process.

Hi Falgun