The Biggest and Most Detailed Guide on – Income Tax Return Filing FAQ’s (ITR)

POSTED BY ON May 30, 2013 COMMENTS (498)

Do you have some doubt on Income Tax Return Filing Process or some question whose answer you are not getting anywhere? This post might be the end of your struggle.

Few weeks back, we ran a survey and asked investors to send us their queries and doubts on Income Tax Return Filing, whatever it may be. We then picked up some of the most asked and common doubts which investors face and thought of creating this comprehensive guide which will act like the bible to your ITR related queries.

Nobody in this world likes the annual exercise of filing Income Tax Return. Yet due to legal responsibility, everybody has to file his Income Tax Return. Now before understanding the Income Tax Return filing, let’s understand few common things first, which will help you to resolve your queries on ITR.

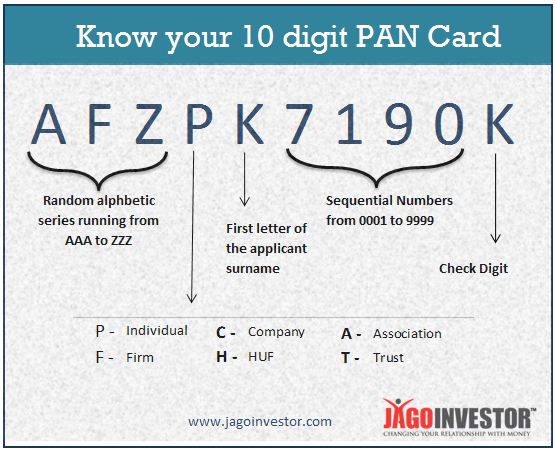

1. Permanent Account Number (PAN)

Permanent Account Number (PAN) is a ten-digit alphanumeric number, issued in the form of a laminated card, by the Income Tax Department, to any “person” who applies for it or to whom the department allots the number without an application. PAN enables the department to link all transactions of the “person” with the department.

These transactions include tax payments, TDS/TCS credits, returns of Income/wealth/gift/FBT, specified transactions, correspondence, and so on. PAN, thus, acts as an identifier for the “person” with the tax department.

A typical PAN is AFZPK7190K

First three characters i.e. “AFZ” in the above PAN are alphabetic series running from AAA to ZZZ

Fourth character of PAN i.e. “P” in the above PAN represents the status of the PAN holder.

- “P” stands for Individual,

- “F” stands for Firm,

- “C” stands for Company,

- “H” stands for HUF,

- “A” stands for AOP, “T” stands for TRUST etc.

Fifth character i.e. “K” in the above PAN represents first character of the PAN holder’s last name/surname.

Next four characters i.e. “7190” in the above PAN are sequential number running from 0001 to 9999.

Last character i.e. “K” in the above PAN is an alphabetic check digit. (More Details on PAN)

2. Tax Deduction Account Number (TAN)

TAN or Tax Deduction and Collection Account Number is a 10 digit alpha numeric number required to be obtained by all persons who are responsible for deducting or collecting tax. It is compulsory to quote TAN in TDS/TCS return (including any e-TDS/TCS return), any TDS/TCS payment challan and TDS/TCS certificates. (More Details on TAN)

3. Financial Year

In India, the Financial Year is defined as a period starting from 1st April of a Calendar Year & ending on 31st March of the next immediate Calendar year. All the income earned by a tax assessee has to be accounted for segregation on the basis of dates in different Financial Years.

4. Assessment Year

The applicable Assessment Year for a given Financial Year is the next +1 year. For example, if a FY is 2012-2013, the relevant AY ‘ll be 2013-2014. All the income earned by you in a FY and taxes paid by you in that FY ‘ll be assessed only in the relevant AY.

5. Form-16

It’s the statement of your yearly income provided by your employer to you after the end of FY. This includes your gross income, deductions claimed by you, net income, tax liability there on, Tax deducted by your employer, any tax liability or refund.

The most important thing to be remember in form 16 is the TAN of your employer should be written clearly & so do your own PAN.

6. Form-16A

Form 16 is issued by the Tax deducting authority where the TDS is applied on your investments (say FD in banks) or non salary cases. Say TDS applied by tenant against rent paid to landlord. Here again TAN & PAN quotation is must.

7. Types of Income

As per Income Tax Act 1961, the income can be classified only under the following heads.

1. Income From Salary or Pension

2. Income from House Property – Rental Income

3. Income from Business or Profession – Say Income to a Doctor or an Agent or Advocate or a Shopkeeper

4. Income from Capital Gains – Income arising out of sell of capital assets like Property, Gold, Art, Coins, Mutual Fund Units, Equity, Precious stones

5. Income from other sources – Any income which can not be classified in the previous 4 categories, comes under this head. Interest income, winning amount in Lottery or Quiz show (example KBC), Horse racing winning, Amount received as Gift from non relatives are some examples.

Now from the above list you can identify that you are having at least 2-3 income sources. Income Tax Deptt. has created different types of Income Tax Return Forms for the combination of different income sources.

Before Discussing Income Tax Return Forms, let’s discuss Income Tax Return itself.

8. What is the importance of Income Tax Return

If your income exceeds the zero tax limits, it’s mandatory for you to file an Income Tax return. During your income earning in the whole FY, there may be a situation that the tax deducted from you is more than the actual liability or there are some losses or deductions which you could not claim during the income earning phase or you paid less tax than the actual liability.

In all such case, you can only save yourself by filing an Income Tax Return. Actually your Income Tax Return form is the account statement of your income, tax liability there on & the tax paid by you. If there is excess tax payment, you ‘ll get refund. If the paid tax is less than your tax liability you w’d have to pay the difference amount.

Below is the official version for Income Tax Return filing essentially.

“The filing of income tax/wealth-tax return is a legal obligation of every person whose total income and wealth tax during the previous year exceeds the maximum amount which is not chargeable to income tax or wealth tax under the provisions of I.T.

Act, 1961 or Wealth Tax Act 1957, as the case may be. The return should be furnished in the prescribed form on or before the due date(s). Penalty of Rs. 5000 is imposable for non-filing of return within the assessment year.

Interest is also chargeable for non-filing or late filing.”

Watch this video to know why you should file income tax return:

9. Types of Income Tax Assessees

As there are multiple source & types of Income, so are types of Income Tax Assessees. Here are few examples –

- Individual

- Hindu Undivided Family

- Firm

- Limited Liability Partnership

- Association of Persons

- Company

- Trust

- Body of Individuals

- Artificial Judicial Person

- Local Authority

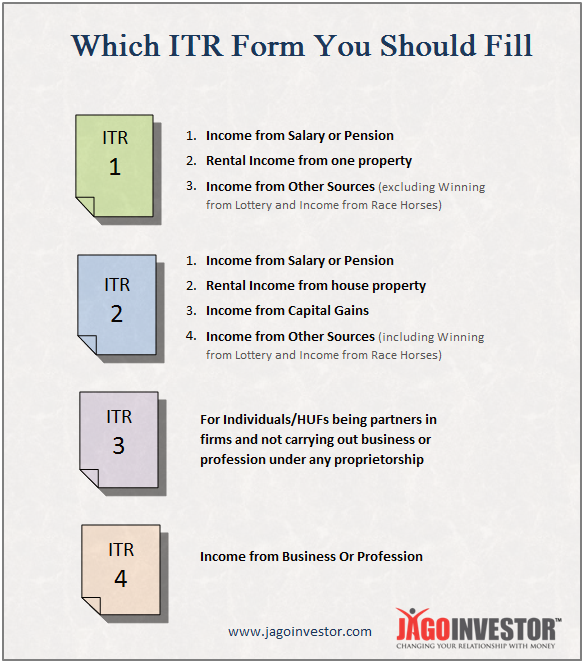

10. Types of Income Tax Return Forms

On the basis of the income combinations as well as Assessee types as discussed above, the Income Tax Deptt. has issued multiple Income Tax Return forms. these are numbered as ITR-1, ITR-2 ……. ITR-7.

Here is a table to understand the combinations of types Incomes for Individual Assesses & the applicable ITR form. Please do note, ITR-5, ITR-6 & ITR-7 are used by assesses other than Individuals & HUFs, hence not discussed here to keep this matter relevant for general public & common Individual assessee.

Majority of common individual tax payers fall in ITR-1 & ITR-2 category.

11. Online & Offline filing of Income Tax Return

The Income Tax Department is slowly transforming itself. Earlier all the returns were only offline mode. First non Individual & non HUF ITRs were made online filing compulsory. After that for Individuals & HUFs having income more than 10L Rs. were made online filing compulsory.

Now From AY 2013-2014, the income limit has been reduced to 5L Rs. for online filing. So we can safely assume that from next AY i.e. 2014-2015, the online return filing ‘ll be compulsory for each & every tax payer.

12. How to file online ITR

It’s quite easy. Now a days, a person can e-file either self by logging into the official site of e-filing. Apart from this, there are many other private online portals who are helping you to e-file your ITR. (Taxsmile, Taxspanner, Taxyogi, Cleartax are few examples)

Frequency asked doubts on Income Tax Return Filing

We hope that you are very clear about the basic information which every tax payer should be aware about. Now lets see some of the most commonly asked questions on Tax Filing. We collected these questions from one of our surveys and just categorized them into 13 questions. Here are they –

1. I forget (or could not produce in time) to claim HRA/Savings/Home Loan/LTC/Medical Bills etc from my employer. What to do?

Please relax. For all such cases, where either you could not claim on time or forget all together, your return filing is the time to tell the Income Tax department about the same & now you can claim the refund for the excess tax deducted from you. Note that the declaration given to employer is just to make sure that your TDS cut by employer is inline with your plans in a financial year. Incase something does not match, It can be finally done at the time of tax returns filing.

2. Where should I produce Bills/papers/receipts of the things related to Q. 1 above

Please do note that current ITR forms are ‘annexure less’ forms. Which means, that you need not produce any support documents to the Income Tax Department at the time of filing. Just keep the documents safely with you, so that you can produce the same if Income Tax people demand it from you in future. Documentation should be surely done by you, because incase there is a scrutiny case in future, you should have to documentary evidence.

3. I could not file my previous years income tax return on time or forget it .

It happens ! . There are penalty provisions if you do not file your due Income Tax Return on time. To correct the mistake, please file a delayed return now if you have not filed the previous years return. For ITRs related to previous years, please take help of a Tax professional to do the same. Filing late is better than not filing at all. Just contact a CA or tax filing portals, and they will be able to help you. Read this article on Late Tax Filing for clarity

4. I did not get the refund order/cheque . What to do ?

First check your refund status here. In case your refund status is available as cheque issued & the same is not received by you. Please contact at the E-mail or Phone nos. in the shared link. Also you read this article on how to Check your Income tax refund status online & Learn how to use RTI

5. I received the Refund cheque but I misplaced it/delivered at wrong address/wrong bank account number.

A lot of these issues happens because the address you provided at the time of filing returns years back is not the same where you are residing now, and the cheque goes back. For all such cases, you should contact your Jurisdictional Assessing Officer for offline filed ITR or CPC Bangalore for online filed ITRs. For online filed ITR, there is a link within your login window for Refund Reissue Request, use this for refund reissue.

6. How can I calculate my tax liability arising out of capital gains

Relax. You just need to punch in the required data in the excel sheet for ITR e-filing available at the e-filing portal. The sheet ‘ll calculate your tax liability on it’s own. Or you can refer to this article which will guide you on how to calculate capital gains.

7. How can I pay my due taxes as per calculation done by me or ITR excel sheet

Paying your due taxes is very easy. There are 2 ways to it. a) Use your net-banking account . b) Use the Official Portal . Please do note for self payment of Income tax, the applicable challan number is 280.

8. I fall in 20-30% tax slab. Bank deducted TDS @ 10%. Should I pay more Tax

The answer is yes. Bank has merely done it’s legal responsibility. Your Tax liability is more than the work done by bank. So please calculate your actual tax liability by adding the interest income into your gross income & pay your due taxes. Here is a full article on TDS related issues.

9. I forget to put in some data or wrong data was put in during my original return filing. How to rectify it ?

No problem, you can file a revised return to rectify these mistakes. The revised return can be filed before the assessment year is over for your original filed return. Here one important point is that the original return must be filed within due date. Just note this point, that if you have filed your returns and if there are any issues or errors, you can always file a revised return later.

10. I own a house in the same city & reside in a rented accommodation. Can I claim HRA & Home loan benefit simultaneously ?

The answer is YES. If you are actually residing on rent due to your Job or any other issues & the home loan house is also in the same city, you can claim both HRA as well as Home Loan benefits. Read this article for more on this

11. I was earning salary earlier. But now there is no income due to break or because I have become NRI with no Indian Income. Should I still file my ITR for zero income ?

The answer is no. if you do not have income or income is within the zero tax slab, you need not file your ITR. Yes in case, some TDS was there, you w’d have to file your ITR to claim the refund of this TDS amount..

12. My wife is a home maker & investing small money into direct Equity & earning some income. Which ITR should she use ?

First of all make sure her income is under zero tax slab or more than it. In case she is earning more than zero tax slab, she should file her ITR. Now the quantity of trades done by her to earn that income ‘ll decide the applicability of ITR. In normal situations, such earning ‘ll be Capital gains (Here it’s assume that gains are short term in nature due to holding less than 1Y) & she should use ITR-2.

For a very high quantity of trading activities, the applicable form ‘ll be ITR-3.

13. I worked with 2 employers in a FY. How to handle & file my ITR ?

First of all please collect form 16 from both of your employers. Now consolidate the income from both employers & check for an pending tax to be paid. Pay it now. Once all this is over, please file your ITR.

We hope all your queries about income tax return filing is solved in this article. If not, please post your doubts over comment section.

This article is contributed by Ashal Jauhari . A key member of Jagoinvestor community and a Tax expert . He writes on his blog here

Hello Team

My father gets pension(army pension) from bank,and has not filed any income tax return yet,Where do we get form 16 at financial year end in order to file IT returns next year

Hi mitz

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/pro

Manish

i have filed ITR 6 on 30.9.2016 and realised to enter proposed dividend

can i file revised ITR 6 ?

is there any problem we will face in future?

Hi phelegreen

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/pro

Manish

i had sold my property for Rs.62 lacs and have used this 62 lacs to purchas a property worth of Rs.75 lacs with loan from LIC for 13 lacs during AY 15-16. Now income tax department sent a notice to me to pay tax for the above said sold property . How to reply to them. I have already filed my income tax return for said period. Kindly help me to reply to them

Hi solomon

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

I’m a homemaker & my husband purchased a house in my name & subsequently sold it in Jan 2016 attracting short term capital gains of about Rs 53000. There was a tax deduction of Rs 1.1 lacs on this transaction. My husband has taxable income but I do not. Should I file a return for claiming tax refund or should my husband include this in his return?

I think you are talking about the TDS here and not tax deduction

Manish

Yes, should I file return to claim refund or should my husband claim it

You will have to claim it

IF HUSBAND AND WIFE BOTH SALARIED AND HAVING FORM 16, INCOME TAX RETURN FILING IS MUST FOR BOTH? OR ANY ONE IS ENOUGH”

For both

I have a doubt regarding trust. How to present my computation and Form 10B in case my application is more than the sum received ???

Hi Shaily

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/solutions/ca-services

Manish

Hi Manish, In section 80 TTA, I have entered Rs.823 [Interest from my Savings account] but it is not getting deducted under Chapter VI A Gross amount. I dont why it is not getting deducted?

[My Declaration – 80C Rs.150000, 80D Rs.5000 [Preventive Health Checkup], 80G Rs.1000 [Donation], 80TTA Rs.823 – Total: 156823, but It shows only 156000]

Please advise.

Hi Chandru

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/solutions/ca-services

Manish

Thanks Manish 🙂

Dear Sir,

Today I was looking for information to decide the ITR form to file.

My income is only from interest on deposits & bonds. I was under impression that I must file

ITR 1. But on Internet I found that ITR-1 can not be filed if exempt income is more than Rs. 5000/- & ITR-2A

can be filed only if I have Salary Income. So, I am confused which form to file?

I started filling Form ITR-2A. But it seems filling details in Schedule OS 1d are mandatory even if income from

the heads is 0. In fact none of the heads in 1d (5BB,115A(i,ii etc) are applicable to me but Calculate Tax does

not allow to leave 1d(1,2,3,4,5) empty & I have to select heads forcibly & randomly with Income 0. This does not

look proper to me. Kindly suggest ASAP.

Can you send me a link which provides detailed information about filling or leaving different Schedules & their

sub sections.

Kindly reply ASAP.

Thanking you. Best regards, RAKESH

Hi rakesh

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/solutions/ca-services

Manish

I did job earlier and enjoy tax benifit under sec 80c paid against PF and others.

Now, i resigned my job and claimed PF. My PF was settled with 10% deduction

Can i claim the refund of this 10% .

Accumulated PF is for 2 years, Amount is more than 50,000

Submitted Pan copy and 15G ( mentioned income above 3 lacks)

YOu can do that only if you are eligible for tax refund !

I opened a bank account when i started college. It has many many transaction of my expenses, college fees, allowances etc. Now i started my job and will be filling for taxes. Do i need to mention those things too. Someone told me that to start with taxes i must open a new bank account from now.

There is no reason to open a new account. You need to mention your bank account anyways, because if there are any transactions, you need to count that !

My brother’s pan card was made after april 2016, can he file income tax return for financial year 2015-16 or say assessment year 2016-17. And if he can file income tax returns for previous financial years also.

I am not sure on this. Check with a CA on this

Form 16 issued by my employer includes the salary of month of March, 2016. But, the payment of march, 2016 was made in April 2016 i.e. FY 2016-17. Can i claim a lower amount as my salary income while filing IT returns for FY 15-16 , than what is reflected on the Form 16 ?

Hi Neha

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

under section 89 it is taxable in financial year march 2016

Section 15(a) of the Income-tax Act, 1961 says, regarding income chargeable under salaries as: “any salary due from an employer or a former employer to an assessee in the previous year, whether paid or not”

This indicates that you have to show the salary for the month of March, 2016, as the income for the FY 2015-16 (AY 2016-17), whether received or not.

Thanks for your comment Wam

my friend is running a man power recruitment and supply agency.The pan card is in his name only.While registering his to obtain EPFO code number after verifying at the official website of IT department he given his name as RAJENDRAN JOE JULIAS and it was accepted.The problem is when he tried upload his pan card it was displayed at EPFO web site something is wrong with the pan card where his name appears as R JOE JULIUS RAJENDRAN.My question is how to rectify? and upload the pan card

Change the name in PAN itself .

I am salaried person with regular TDS done and for the last 8 years I have been filling ITR-1. From this year onwards I have also started trading on stocks. At the end of FY March-2016 I made a very minimal short term capital gain of Rs 300. I have not even transferred this gain to my bank account. Do I need to show this in ITR? If yes which ITR form I need to use?

Hi Anand

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

Same case with me and I have researched a lot, I have small gain of Rs 825 You have to fill ITR-2

I am a home maker for 8 years. I worked in IT industry for 12 years and have a home of my own where my parents reside. I don’t collect any rent from them and neither want to. I have not filed any income tax all these 8 years. I want to invest in a single premium Annuity plan. My husband is currently working and putting the Annuity plan under his name means paying 30% of monthly annuity to Income Tax Dept. So, I want to put it in my name, I can submit PF, Gratuity, Last Salary, Super Annuation as source. We want to invest 15 lakhs (9K monthly annuity for self & spouse for life) and I need to show source additionally for 5 lakhs. Which of the following ones will be more valid and what are the supporting documents that we need? (1) Giving all Gold to my husband and getting money transferred from him (2) My husband paying rental arrears for the last few years to me on behalf of my parents?! Considering my husband’s job security factor and the fact that we have to financially support both side extended families, planning for 30% Tax for this bare minimum 9000/- monthly Annuity would be bad. Please guide us on how to take the insurance in my name with self source to avoid tax.

Truely speaking your query is too complicated for me to understand exactly what you want. Please share your query in short and be crisp please

I’m a student… I deposited my mom’s saving of Rs.5lak in FD and getting an interest of 8.5%… As I’m unemployed do I have to file income tax returns…

It does not matter if you are unemployed or employed, what matters is what income got generated by you in a year. For 5 lacs, the interest is hardly 45k or 40k in a year, so its below the taxable limit and hence no tax.

I want to claim LTA while filling tax. I am still using my maiden name in all the documents and official papers. However while booking the ticket the travel Agent used my married surname instead of my maiden name. Will it be a problem if i submit this ticket details while claiming for LTA?? Providing my marriage certificate along with the tickets, will solve the problem??

Sir, I am house wife. I own bank deposits jointly with my husband. Can I take only 50% of the interest earned on those bank deposits for computing my Income for the purpose of Tax assessment since the remaining 50% of interest goes to my husband. Please clarify me in this aspect.

No , the FD interest will be for the person who is primary holder !

Is it possible to show form 10(I) under 80DDB at time of ITR filing. right now im running out of time to produce it before my organisation for tax declaration.

Which product are you talking about ?

Sir i have created my pan card i am a student while creating i have ticked income from other sources so is there necessary to file income tax returns

NO , you need to file returns only when your income is above the limits

I PAID ADAVANCE TAX RS 50,000/- 2015-16 AS PER MY AUDITOR STATEMENT . BUT MY AUDITOR NOT FILED IT FOR ME . FOR 2015-16 WHICH DATE OF TRANSCATION SHOULD CONSIDER . ALSO CONVEY LAST DATRE FOR FILING RETURN WITHOUT PENALTY

Hi SRINIVAS

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

In last financial year I have received my last 3 yrs ariers. I end up paying 2.8 lakhs as total tax.

1. Will i get something back?

2. If yes , it comes under in which section while filling the itr form ?

Thanks

Hi Saksham

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

Hi

I filed a NIL ITR 1 for AY 2014-15 (FY 2013-14) i.e belated return and received the acknowledgment for the same but i did not mention the section under which i was filing the return in the return filing status column. So i want to know if i should revise the same or should not bother if that does not pose any issues?

Hi Nidhi

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

Hi Manish,

Very innovative site you have created. 🙂

Need your help.

My Scenario :

I work in a company. They provide me Form 16.

I am a freelancer too.

I got a contract. Contractor paid me 50k Deducting 5,5k as a TDS@10%. And gave me Form 16A.

I paid 40k to people who helped me.

Now at the end of the year, I have carried out 10 such contracts worth 5 Lacs. But after keeping my commission, I am only left with 1Lac as the net income and paid 4 Lacs to people who helped me.

So please let me know how should I show to the Income Tax Dept that I only earned 1 Lac as commission and paid 4Lacs to people who were working for me.

I don’t have any company. I do some stuff as a freelancer along with working in an Information Technology firm.

If at the end of the year I have to pay tax on 5L then I will be left with nothing.

Please help.

Thanks,

Rizwan

You have to pay tax only on 1 lacs and not 5 lacs, and mostly you have paid TDS also . I suggest contact a CA on this

Hi Manish,

I am need to file my mother’s income tax return, but someone else seems to have already registered her PAN details to an unknown mail ID.

I’ve tried resetting but get stuck at the secret question/answer bit (no way of telling what has been set for that)

Is there a workaround to all this?

Thanks and Regards,

Wriju

Not sure . Please email their customer care with this issue

Hello,

yet my employer has not provided me form no. 16. and the last date was 7 th sept, 2015

can i fill the it return after this date? will they charge me any fine ?

please guide me.

Thank you

Hi Deepali

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

Hi,

ihave wrongly put my gross total income,and now instead of payable tax, refund is generated,also i have recieved refund amount check

pls advice what to do.

Hi ,

I purchased a under construction flat in Feb 2013 and took a homeloan of 35 lakhs. As per builder , the tentative date for offer of possession is Dec 2015 ( although registration of property is not allowed from authority at present for that area). My question is

-> Am i eligible for interest on home loan rebate under sec 24 for this year (1 april 2015 – 31 March 2016) assuming the possession is in Dec 2015 and registration of property will be after April 2016.

-> How will the interest already paid ( from March 2013 to March 2015) be adjusted in income tax

No you are not. As registration has not happened, techncally you dont own the house as of now . So why will you be allowed the tax benefits ?

I filed ITR for AY 2014-15 (FY 2013-14) & same got process too without any problem, but now I am aware, I forgot to claim home loan interest. Can I revise the same now?

Yes, you can revise the returns

My question(s) please:

If I have purchased (a) Axis Treasury Advantage (bv) Axis Liquid Fund (c) Sundaram Gilt and (d) Sundaram Debt STO on 27/29th March 2015.

What is tax payable on WITHDRAWAL on (a) 10th April 2016, (b) 27/29 March 2017 and (c) 03rd April 2017 ?

Please enlighten.

Debt funds before 3 yrs have a normal taxation like FD, its added to your income and taxed at your slab rates

I have filed online ITR1 but we have not received any feedback from Tax Department about of acknowledgement number or TRP number,what is possibility

If you have paid by netbanking, you will see the reciept there !

My wife is a homemaker with no income of her own. I am a salaried income tax payer and file income tax returns every year. In 2013 we got possession of a flat which was purchased through my savings and PPF withdrawal trough installments spread over 5 years. My wife’s name is a co-owner in this property.

She has recently received a communication from Income Tax Department about explaining non- compliance of not filing her returns of 2012-13 and that they have received information through AIR w.r.t the immovable property transaction in 2012-13.

How best does she explain in the e-filing portal that since she does not have a positive income it is not mandatory for her file income tax return.

Thats what she should tell them . That she does not have any income, thats why she has not filed any return . If she has got any money in her account, then she should explain from where it has come and should have valid justification !

Hi,

I have withdrawal my EPF fund of my last company before 5 years in last year Aug 2014, the amount I have received in two installments i.e. 35000 and 13000. So I just want to know how much tax I have to pay in my ITR FY2015-16.

Because I don’t know the tax for the same is already deducted or not and I have checked in EPF account , no details of previous company account is showing there.

So please tell me how much amount I have to pay as a tax in other source of income.

Thanks in advance.

Akhil

The TDS is not deducted on EPF . So you need to pay tax on that. Add it in your income and pay tax. check your 26AS form to see if TDS is deducted or not?

Hi,

I have two source of income, one is from a company working as full time employee and another one is freelance income as I am working for a US client through online. So, my earnings will be around Rs. 45000 per month.

So I am not sure filing tax as I am having two source of income.

Please help me in filing tax.

Importantly, I need to get tax exception by doing some tax plannings through deductions. So please help me.

Hi ChowdaReddy

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

Hi Manish,

I have already filed ITR for assessment year 2015-16 but forgot to mention the income from FD.

Now I am planning to file ITR again and (as per new calculation need to 1500 extra tax.)

What is the procedure to pay the tax and then file new returns.

Thanks.

Hi Deepak

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

My original return was not filed in time but some rectification in original return iam filed revised return.what is the problem.

Hi Mahender

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

During the period 1st April to 15th September2014, I have short-term capital gains of Rs. 30000/- from sale of equity shares and during the period 15th March to 31st March 2015, I have short-term capital loss of Rs. 10000/- so that the net short term capital gain is only Rs.20000/-. How to show this in Table-F of Schedule-CG of ITR-2, since the table does not accept negative values.

Hi Sinha

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

I had thought that since you are providing guidance on Income Tax Filing, you will be able to help out. Thanks anyway for your response. I do not think that a CA would be able to help, since this is a defect in ITR-2 and can only be corrected by CBDT. The only option for me appears to be that I show a gain of Rs. 20,000/- in the first column of Table-F in Schedule-CG for the period April 1 – Sept 15, although actual gain during this period is 30,000/- and loss during March 15-31 is 10,000/-. This means that I shall be giving correct information about the total gain over the year but the distribution of the gains over the four quarters will be incorrect.

Hi Sinha

I am not well versed with that area. I suggest that you catch a professional in that area , or use RTI !

Hello,

I have taken a break from job after 10 yrs and left my job 1.5 yrs back and there was no income from salary in FY2014-15. I had “no income from other sources” as well in FY2014-15. I am continuing repaying home loan EMI (Sec 12B) and also have LICs (Sec 80C). Which ITR form should I fill this time. Whether it is required this time for my case. If yes, whether I should mention the loan interest under sec12 & investments under 80C. Waiting for your response. I have filed ITR for the last 11 yrs.

Thanks & Regards

Vikram

Hi Vikram

Actually you dont need to file return, but its suggested that you do it, because you are doing it from many years and expected to do it in future also, so better not have a gap !

Hi,

In ITR-1 form do we need to fill present address or permanent address in the address column ?

Permanent

i am having income from other person under Longterm Gains as investment on shares please help me where to enter how to the details in the itr 2 -> other income ->income from other sources ->inconme from other persons

Yes, it has to be income from other sources

Hi Manish,

I Left job on dec 2014, I have below doubt related to mutual funds deduction in e-returns?

I quit my job last year for my further studies. previously i used to provide investment (mutual funds) proof to my employer.

Last month my previous employer has provided me a copy of form 16 (current year) which does not contains any Mutual funds deductions.

please let me know how and where should i submit investment (mutual funds) proofs for availing Tax Deduction?

You should better talk to a CA on this , because he will compute your tax liability and then apply for tax refund !

In financial year 2013-2014 I have my first home loan and paid interest on that but I have neitherapplied the rebate while filling return nor shown to employer (so not shown in form 16 for that year. I had filed It return for fin year 2013 2014without it. In financial year 2014 15 I have shown it to employer and got it under 24 us section . now can I file the IR for both the year in the 2015 under 24 us for this year and section 80EE for last year home loan interest 2014.

Hi Rajoria

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Hi sir,

I have left my organization last year in august.currently i am unemployed.i was filling my itr-1 form but i don’t know what to write in income details??

Hi Kanu

A CA is more qualified to answer you query, hence I suggest better get in touch one. We are not right people to talk on this

Manish

Sir

I have received arrears in salary from 2006 in FY 2014-15.With the arrears my salary goes to 20% tax range and without arrears it is in 10% tax range. For arrears received for back years I am claiming tax relief under section 89.I have earned interest for fixed deposit in the FY 2014-15.If I combine the interest on FD and my salary for FY 2014-15 without arrears ,it comes under 10% tax range but my income tax portal says I will have to pay 20% tax on FD.Is there any act I can claim relief to go to 10% tax range for FD?

Hi Pradeep

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

Hello Manish,

I had filled the ITR for AY 2014-15 through ITR-1 form on 30th July 2014. I left my job on 30th Sept 2014 and became an unemployed person with zero income. However, the Income Tax Department is contacting me to rectify the defects in the return I had filled i.e. Error Code – 38 (Tax determined as Payable in the return filled by you has not been paid).

Please advice me what I am suppose to do now being an unemployed individual.

Hi Gojendra

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

I missed filing my IT return for FY 2013-14 (AY 2014-15) as I worked in two different organisations. Now when I try to file my IT return using different portals (myITreturn.com, clearTax.com, incometaxindiaefiling.gov.in), the “Tax to be paid” differs from site to site.

I’m confused where to file my returns. Kindly help me out.

GTI: 425155

Total Deductions: 44851 (80C- 20851 , 80GG- 24000)

Total Taxable Income: 380304

Tax paid – 15530

Balance Tax Payable:

1090 (myITreturn)

1080 (clearTax)

3000 (incometaxindia)

Also I have filed IT return for AY 2015-16 (FY 2014-15) for which I haven’t submitted the House rental agreement yet. When and where should I produce the proofs, as I have already submitted e-filing?

Hi Prakash

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

Hi,

My office records have my maiden name (as a result my returns were filed in that name) and my PAN card has my married name (recently changed). As a result, a refund that I was expecting for AY 14-15 has got cancelled. What should I do? I don’t want to change my name in the office records and I was told by my office HR dept that it shouldn’t be a problem because the tax is filed based on the PAN number and not name. I was told by the IT help desk that I need to file revised returns. Can I do it in my married name, without changing the office records?

Hi

I have joined new company from march15 , So i have two form16(From Old Company and New Company ) , can u please guide me which form need to consider while filling ITR?

You need to consider both of them , because that divides your income in the year !

I have an unusual question.I submitted For.ITR 1 Sahaj for A.Y.2013-2014.But I should not have used this form because I had interest income of more than Rs.5000 form Bank savings Acct,.

So I started completing For,ITR 2.But for various reasons i could not tender this form until 22/05/2015.

The dead line was over.

Next I decided to file “Belated” form

But on trying to complete I come up with a problem.(1) I have to state that this is “Revised” form under 139(5) But i should also state that this “After Due Date under 139(4). How can I do this both? I am trying to e-file my return

Hi Rasiklal

Your cases is a bit complex and I think we are not the right people to comment on it.

My suggestion would be hire someone who is professional in this area and consult them

Manish

Hello,

Do we need to file ITR if the salary goes under 4.5 Lakhs? Or is it mandatory to file ?

Hi,

I am paying my sister’s tuition fee as my father is farmer. Can I claim tax deduction as she is dependent on me? How to show the dependency of her?

No you cant .

Intimation us 143(1) showing different amount under income from other sources in both column but no demand is raised from IT dept and I am satisfied from it. Now what i have to do next …is rectification return should be filed or I have to do no nothing

I think you dont need to file a revised return , if you have not for any notification

I am retired but not senior citizen and have not yet started claiming pension. I am not sure whether my income this year will cross minimum taxable limit. So I have few questions

(1) What avenues of tax exemption are available to me? What is the max income from FDs I can have, taking exemptions into account, to stay below taxable limit?

(2) Should I submit Form 15G or wait till I know my taxability status before doing so? If I submit Form 15G now and later find I fall in taxable bracket, can I pay tax on the FD interests without penalty?

Hi Rao

I think if you are investing 1.5 lacs in 80C , then you can get upto 4 lacs of income , so that after deducting 1.5 lacs, your taxable income is only 2.5 lacs and no tax for you. So you can make upto 50 lacs of FD !

You can also give form 15 G/H

Manish

Thank you.

Hi

I am taking a salary from my wife’s proprietorship business as I manage day to day activities and there is no other income for me apart from this (No TAN is there and no deduction has been made while paying the salary). Now let me know which ITR form I need to use.

Thanks

Raghavendra Bhat

Hi Raghavendra bhat

I think a CA would be a better person to comment on this

Dear Sir,

I have a shop which gives around 2 lakh of income

and i also did trading (delivery+intraday) with turn over of around 35lakh (huge amount is because of intraday trading) but the profit made is only 40000.

my queries:

1. Do i need to fill ITR2 or ITR4?

2. Do i show the trading as my business or as other income?

3. in calculation of capital gain in ITR,

Will i have to show the complete turn over amount or i can show only the base amount which i invested and the final amount which i got in end year.

Hi Gaurav

Your cases is a bit complex and I think we are not the right people to comment on it.

My suggestion would be hire someone who is professional in this area and consult them

Manish

Hi

I am Non-Resident Indian, Sold my Flat in 2013 and as per IT regulations buyer paid 1% TDS to the Tax department & I paid the same to the buyer. Subsequently in 2014 I filed ITR to claim the TDS. To my surprise IT department has not refunded the amount, because there is payment of advance tax under my PAN number.

I have never paid advance tax as there is no Income in India. Is it possible that somebody can wrongly make payment into my account? I can understand one payment can be made by mistake but here there are 5 payments by unknown payer.

How this can be handled / solved?

Yes, its possible that some goof up happened . I suggest filing RTI and taking help of that

Hi,

I have a query, my mother is a pensioner. What documents are required to be present while filling ITR? Also which form i need to fill – ITR 2C?

Nothing to be given at the time of filing .

If I fill itr 4s can I claim benifit under section 80 u as I am 100% blind

Hi Zohar

Just wanted to understand , if you are 100% blind, how did you comment on the website, if you cant see ?

Hello Manish this is not the platform to discus this issue if you want to know how do I run computers pls mail on zosk79@gmail.com

PLS ADVISE i DO NOT HAVE FORM 16 – MY EMPLOYER DID NOT GIVE TO ME

SO CAN I FILE MY RETURN AFTER FEW DAYS //WILL THERE BE TAX LIABILITY .I AM SALARIED EMPLOYEE AND WHEN COMPANY FILED RETUENS FOR ALL OTHERS I WAS ON LEAVE /// HOW MUCH WILL BE TAX LIABILITY ,MY SALARY IS 190000/- LAST YEAR PLUS MEDICLAIM 6000/- PLUS INTEREST ON EDUCATIONAL LOAN 32000/- PLUS HRA 180000/- PA

PLUS LIC 30000/-

The filing of return happens anyways till July 31st !

01. what is the max limit of LTA, can we utilize the same every year/alternate year.

02. how does a pvt ltd co., makes works contract Service Tax payment when it is

main building construction to a firm contractor.

Hi p r chary

1. There is no limit as such, your company provides that to you

2. Not our domain, so we cant commnt

Hi,

We have spent almost 1.6 lacs for IVF which was not reimbursed by my employer and we are not having any medical/health insurance policies also.

My taxable income is 10.5 lacs n tax was deducted on 30% slab. My question is, can I get IVF expenses in tax ememption. If yes, how much and what is the limit.

2nd question is, I’m paying LIC premiums for my mom and dad from 2009. Can these premiums be claimed under tax exemption in any section or way. In my previous company, they accepted these premiums for tax exemptions as I’m the only one paying the premiums. My present company is denying for doing so now.

Please clarify my above doubts.

I am not sure what is the IVF expenses ?

Please note that life insurance premium paid by you for your parents (father / mother / both) or your in-laws is not eligible for deduction under section 80C. Your first company was doing it WRONG . The present company is following rules !

Manish

Thank u Mr.Manish. IVF is In Vitro Fertilization. A medical procedure for couples who are facing becoming parents naturally. Do these IVF expenses eligible for tax exemption ?

I really have no idea on that

Hello,

My wife is a doctor( free lance consultant). which ITR for should she fill? Is it ITR4 ?

thanks for your response in advance.

regards,

Manoj

Yes

Hi… Tax got deducted for 2012-2013 FY. So I received Form 16 Part A and Part B.

For 2013-2014 FY, No tax deductions as I showed HRA,LIC. So I got Form 16 Par B only and not Part A.

HR department informed that there would be NO Part A issued if NO deductions. Is this true? I need Form 16 Part A and Part B for applying loan. What can I do now?

Please guide me.

Hi Surendra

Your case is very specific, what is Case A and CAse B ?

pl help me in my issue.I am DDO.in FY 2011–12 i deducted TDS on thid party bill @ 2 % under 194c. Later i came to know it is to be under 194J @ 10%. in year 2013 i recovred difference amount of TDS @ 8 %. but IT dept chargd intrest of 25 month.The amount involved are huge. also the amount of 2011 cannt be carry forward to next year or cannt be adjusted now i.e. in year 2014-15.

my query is 1. am I responsible for payinf intrest for whole 25 month or upto the date when the party have filled its return in very next year in july.(which is approx 10 months).

2. if only upto date of party filed the return,then pl tell hoe to file or act to do so..

3.some of these party are trust and exempted..but first they have to pay tax and then take claim..so in such case also am i responsible to pay intrest.

4.when we go to IT dept office,they avoid any cooperation and verbally tell,no no ou have to pay this..but never drop intrst.also TRACES also donot drop charges and keep creating pressure..

pl reply to my email urgently . Your guidance willl be a great help to me.

Hi TARA CHAND SHARMA

The question asked by you is beyond our scope. Its suggested that you hire an expert on the issue and pay them for the advice.

Manish

What Business Code should be opted in the Column no. 2 of NATURE OF BUSINESS sheet in case of PRIVATE TUTOR & YOGA TRAINER respectively.

Best regards,

Hi A. BASAK

The question asked by you is beyond our scope. Its suggested that you hire an expert on the issue and pay them for the advice.

Manish

HI, i have filed last 2 year ITR but have not filed 2012-13 ITR. i have form 16 fot the same year. What are the declaration do i need to give for applying foreign VISA.

Thanks

Hi NIlabh

You should take help of RTI now in this case ! .

Manish

Sir,

in it return of a person we can claim loss if we are not maintained books of accounts

Hi a nagesh

If its not on books, how will you prove it !

Hi

I changed my organisation in mid of Aug ’14 and now pleasue suggest do I need to consider full amount received from my previous organisation i.e. LEAVE Enchasement, Bonus, etc.??? If yes, in which category in ITR or I just have to consider salary received???

Please revert!

Hi Sumit

The question asked by you is beyond our scope. Its suggested that you hire an expert on the issue and pay them for the advice.

Manish

Hi I am new to ITR filling,

I want to know on 80 G deduction.

The cash limit is 10000 . Is it cumulative cash for one financial year or is it capped for one time. If I have pai d more than 10000 in cash but not a single installment is more than 10000 , all are in 5-6K range. So is it fine or not ?

Also at the time of claiming do I need to submit any thing or just have to mention the donation.

Plrase help

Thanx !

Hi Rohit

Its the total in a year, so even 5k+5k is fine. You need to keep the document with you to show later if required

Manish

This is one of the most insightful and useful blogs that I have read recently. Hats off to you. I got a home loan. the loan amount was disbursed in two instalments in two consecutive financial years. I am aware that as per section 24 (b) i can claim IT deduction if the acquisition is completed within three years from the end of the financial year in which the capital was borrowed.Three year period is to be calculated from the disbursal of second (and final ) instalment or the first instalment? is it the date of sanction of loan or the actual disbursement? the month of the disbursement of first instalment was Jan 2011; second was May 2012. got possession in july 2014. if we reckon from the first instalment then it is more than three years. if second them it is within 3 years. would appreciate your opinion

Hi DEBASIS

Its the date of registration I guess

Hi,

I have invested 8 Lakhs in Bank FD in my spouse name during FY 2014-15. She is house wife and having a separate PAN number and her PAN number is printed on FD receipt. She has submitted for 15G and tax is not deducted by bank. The interest earned from these FDs is around Rs. 50,000 this year. She do not have any other income.

Do I need to show this income in my tax return?

Regards,

KS

Yes, you need to

can i post a request letter to A.O. for refund re-issue in case of Offline Return?

Yes

i forgot to put 80 c deductions like ppf while e file tax? what to do in that case how to rectify it? Please help and my gross income (Rs 187760 from salary- form 16) is less than taxable income.

Hi qutub

You need to mention it in your yearly return in that case !

Hi Manish,

I have been reading that a tax audit can be initiated on an individual by the IT department for update 6-8 years back. So its necessary to maintain tax proof documents for upto 6-8 years.

Now my question is, who is liable to maintain the proof documents? Does the employer has to maintain the documents because they are the ones who deduct on our behalf?

My employer is not returning back my original proof documents and are saying that they have to maintain the proof records as there might me an audit for the company. Is it true that the company/employer is liable in record keeping of employee’s proof documents?

Hi kp

I think they are not liable for the scrutiny part, but only for their own audit , I mean they have to keep the records for all the benefits they have provided you, You should atleast have some kind of proof , like xerox of documents or even a bank entry (like premium payment or investment done through cheque) which you can show up in future if required.

I think you should not loose sleep over it, while its an important issue- dont be too frightened for it !

Sir,

I am employee of Maharashtra government. I stay in a rented house which is located in Nagpur. But my office is located in Amravati. These are separate districts / towns. I commute every two days between Nagpur & Amravati.

When I tried to claim HRA exemption in my income tax by furnishing the rent slips belonging to my rented house in Nagpur, my office objected to this and told me I cannot claim HRA exemption for rent I am paying at Nagpur.

I was told that as my headquarter is Amaravati I can claim HRA exemption only if the rented house is in the town / city of my office.

Plz let me know, Is there a such a restriction in claiming HRA exemption? Or I can claim HRA exemption irrespective of location of my rented house.

Hi Vyasang

I am not 100% sure on that. Please open a thread on our forum so that someone who knows the answer can reply you on that.

Manish

how to fill tax chalan return fill

Hi Rajat

For that , I suggest look at youtube for some videos .

Hi, I have few queries.

I am a salaried empployee

1) Can we claim the tax benefit on the telephone bills while filing IT returns? If so what is the limit and under which section?

2) I do pay rent (staying in rented house) and also have house loan on my name (parents are staying). So, my company has given exemption only for house loan and made HRA as taxable. can I claim HRA while filing IT-return?

3) Need to know where we can get information about different categories we claim for exemption (like I head for telephone bills, are there any others?)

4) IT return department ask only for ITR form but they don’t ask for the proofs for which we are claiming return if we submit any. why? how will they know about it?

1. No you cant . If your employer is reimbursing the expenses for that, then anyways you dont have to worry for it

2. You should be able to claim the HRA as you are living in rented house. Talk to company

3. Some companies give exemption on internet bills .

4. Because its too much of work for them to collect all proofs . They are needed if you are asking for scrutiny . Hence its suggested you keep a good record keeping for 6-7 yrs

Manish

Thanks Manish 🙂

Dear Sir,

Regarding LTA,

If employee is eligible for say LTA of x = 12,000 Rs/year ( say FY 2014-2015 ) in Employer A, and in April 2014 he enjoys LTA with 3+ days leaves in Employer A with LTA cost y = 18,000 Rs; and leave the Employer A in Sept 2014 as Last month.

( LTA_A_Employer = 6000 Rs of 6 months )

Now same Employee is unemployed for Oct 2014.

(LTA_O_NoEmplyer = 0 of 1 month).

In Next Employer B, he is eligible for 24000 Rs/Year ( say FY 2014-2015), he is g not going to enjoy any LTA till FY (Dec 2014-March 2015 ) End.

(LTA_B_Employer = 10000 Rs of 5 month )

So Total LTA = LTA_A + LTA_O + LTA_B = 16000 Rs

Actual LTA cost incurred = 18000 Rs ( 2000 Rs Loss )

So my Queries are

1. At he FY end, while filling ITR, what he should do to avail complete LTA ?

2. Where should he claim LTA ?

(A) or (B) or Both place (A and B) or something else ?

3. Should he claim (-2000 Rs = 18000 – 16000) as Loss ?

4. Suppose if he switched job on Jun2014, without Gap, will his additional LTA income will be Taxable ?

In this case Total LTA = LTA_A_3000 Rs (April -June 2014 ) + LTA_B_18000 ( July2014-March2015) = 21000.

Actual LTA on April 2014 = 18000 during Employer A tenure.

So

4a. Can he claim LTA_B_18000 ?

4b. Will his additional 3000 taxable as per his slot ?

Please give clarity ?

Ultimately in your 16A form , you will get all information . When you request form 16A from first employer see how much LTA is recorded there.

Dear Sir,

I switched my job in Sep-2014 without any consideration of Tax work.

1. I opted for ‘Extra MediClaim Topup’ in April2014, How can I show it in ITR ?

as I invested Base (Free from Company)+Extra ( For parents ), but invalidated after resignation.

2. I had taken 5 days Leave & enjoyed LTA, but forgot to claim LTA to previous employer. I received Full & Final, but not Form 16.

I have to submit 12B with raw understanding wiht F&F attached, to current Employer in Jan2015.

Previous Employer said – I could claim LTA to current employer as Block (2014-2017).

Current Employer said – As I taken Leave in previous Tenure, I should have claimed there, now I should claim ‘unclaimed LTA’ under ‘Loss’.

3. Can I claim ‘Notice Pay Amount’ paid to previous employer under ‘Loss’ (as negative income)?

Please suggest & guide.

Hi Kuntal

I think you should take it forward with a good CA . Its a bit more complicated . Do you want me to connect you to a right CA ?

i have agricultural income from farms where should i show it in itr and in which itr .i also have have in come from busineess. please tell me

Agricultural income is exempt from income tax. You just need to file your income tax return for the business income !

hlo sir

I have filed refund reissue request because my bank account no. was wrong earlier. my refund was 11900 rs and when i filed refund reissue i have received only 7300 rs. what is the problem. plz clear it and how can i get my remaining money???

Hi,

I have small question. I have changed companies in same fiscal year. I have already delclared my investment under 80C to my previous employer hopefully it will get reflected in the Form16.

My question is do I need show same investment to my current employer? If yes will it be a problem of double counting that I will have 2 form 16s showing my investments under 80C. Please help

In this case, what you should do is

– Specify the same investment proof like you did for previous employer

– Also mention the income received from old employer , so that he can adjust that and then cut the TDS !

my income is arised from post office agent that is only income source of me then which ITR form i can use?

It matters on the income amount . Is it above 2.5 lacs ?

Hi Sir,

Thanks a Lot for the illuminating article. The Language is quite simple to understand. My query pertains to home loans and deductions regarding interest on them.

Whether it is required that owner of the building should be owner of the plot also ?

If plot is in the name of wife who don’t have a source of income (as normally is) and expenses for building are made by Husband out of his income, then what would be the proof of ownership for Husband in case he applies for a Loan ?

Whether she needs to be a co-applicant in such a case ?

In case of Joint owners whether the %age of Ownership in Plot itself is sufficient to claim Interest benefit on home loan ?

In case of co-applicants whether any %age of share is required to be mentioned ?

If not then in which %age the co-applicants will be able to claim the Interest Loss ?

Regards

Kanwal

The house must be registerd in the name of the person who is applying for the loan , thats the prerequisite . On whose name did you register the house which was built ?

Hi sir,

My income from salary was taxable in the past and last 2 yrs I have no income except bank FDs and some lil equity, together not in any tax slab. Earlier I was filing ITR and paying hi taxes and have no dues to ITDept. Recently, Bank deducted TDS out of some confusion and this year I would file ITR1.

I have doubt on my equity – I hold some of bluechips for last 10yrs, some of them got bonus, splits etc But I never gained (in cash) except notional profit.

Pls adivse if I still need to show them as part of ITR1 now ? if So, which section ?

No , they dont need to be shown in the ITR !

Dears,

I have been trading in fno and equity last one year having taken a pan, but have no income for the year till now, but a loss of around rs. 2L in the interim due to some wrong trading reasons. Do i need to file tax returns and can i claim to offset these losses in the comming year ? I do not have any income of my own but trading using my husband given funds.

Prabha

YEs, I think you can offset these later by showing them as business loss !

Hi,

I have a full-time job and draw a salary of Rs. 11 lacs p.a. In addition, I conduct private tuitions and get Rs. 4.32 lacs p.a. How am I supposed to account for the tuition income?

My company provides Form 16. Should I submit ITR-2 or ITR-4 and under which head will the tuition income appear?

Tutions will come under Business Income ..

Thank you so much Manish.

So I should file ITR-4 even though my primary source of income is from Salary?

Yes

Hi

I’ve submitted my e-returns for ay 2013-14 on time and got refund also. But later i found that i missed to declare income from other sources and TDS. I’ve paid an excess tax of around 25k. Some people commented that revised return can be filed before the end of one year of assessment year or assessment by CPC whichever is earlier. But i revised my ITR electronically this November and sent ITR-V to CPC and got an acknowledgment for receipt. The current status of ITR is under processing. Pls let me know if i’ll get refund or it ‘ll be rejected.

You should ideally get the refund

Thanks for your reply. What is the difference between revised and return and rectification?

They are same ..

For AY 11-12, I filed the online return which was transferred to AO in income tax office by the CPC. According to the details which I furnished, there was no income tax was due on the return. I am seeing a demand raised in the income tax efiling raised for that year dated 7/11/12 but I didn’t receive any demand notice for the same from IT department with details on why the demand is being raised. What should I do? Should I write to AO to send the demand notice giving the details on why this income tax is charged? Also can I ask for correction in demand in case of any incorrect details now that around 2 years have passed since the demand date?

I think you should better file a RTI and ask it .. that would be better

Thanks for publishing this wonderful FAQ’s answers for ITR. It’s really helpful for beginners.

Thanks Bhavesh

Sir, where to fill the Gift received from father in ITR-4.

I think you need to take help of CA on this .

I have filled ITR 1 for Y14-15, i had worked with two companies in this year and filled the data. I got an email from income tax where some tax is still payable. Sections 234B and 234C have differences in amount. How do i fill rest of the amount. Do i have to make chalan no from bank ?.

Could you email me the steps as i am new to this.

This will be great help

Waiting for reply,

Thanks

You can just pay the tax online using challan 280 .. Just look at it on internet .. its easy

Hello sir,

I had received demand notice under sect.143 (1) as TDS on other than salary was not credited in 26as statement. I perused with the bank and later on 26as statement was updated by the bank and matched with details of my return. Thereafter, I filed the rectification under “tax credit mis-mtach” by uploading all the details of my TDS on salary and other than salary. But now I have received rectification order under sect.154. Kindly guide me under which head now I may file the rectification.

Hi Rajeev

Its very much not into our knowledge scope . I suggest you better hire some CA locally or if you want we have tie up with a CA firm who can help you on this – http://www.jagoinvestor.com/services/ca-and-income-tax

Hi,

I have paid the insurance premium for current year and the next year (in advance). My question is can I claim tax benefit in the next year?

Thanks

Manoj

Dear Manoj, for next year’s Prem. paid in current year, the benefit can not be claimed in next year.

Thanks

Ashal

I dont think so ! .. it should be paid in the year of claim only !

Hello Sir,

I want to know some clarifications on these points

1. My father was having in SBI Insurance policy (70,000/-) after his death (10/01/2010), my mother received 87,500/- so is this amount taxable?

2. My mother received following IDA Arrears of my dad’s after his death.

IDA Arrears Period – 01-01-2007 to 31-01-2008 – 62,926/-

IDA Arrears Period – 31-01-2008 to 10-01-2010 – 1,07,828/-

IDA Arrears Period – 01-02-2008 to 30-09-2011 – 1,75,152/-

3. 46,913/- as Difference Leave Encashment payment

(I heard that Leave Encashment on Retirement is exempted )

Please let me know

thank you

regards,

Narayan

Karnataka

1. no , its not taxable

2. No tax

sir, my mom is running a boutique ,how to file an ITR for her

Just like any other business person does. Meet a CA and he will help you on this .

Manish

dear manish ji,

I want to ask that

my employer gave me form 16 showing tds deducted 25000 for f.y. 2013-14,

but form 26as for f.y.2013-14 show tds 21000

I contacted my employer ,he said by mistake he deposited 4000 of tds to IT dept for another employees salary,

I filed return according to form 16 given to me showing 25000 but till now my employer did not rectified that mistake,

More ever ,the form 26AS for f.y.2014-15 show regular tds entries with no mistake .

now

I want to ask you that will the entries in form 26as for f.y. 2013-14 be rectified if my employer deposit my 3000 to IT dept for year 2013-14??

I dont think the past year entries will be rectified like this !

sir,i claimed some amount refund from IT dept according to my form 16 as given by my employer.

acc to form 16

amt tds=2870

receipt number of form 24g =5057653

DDO sequence no in the book adjustment mini statement=00266

date on which tax deposited=31/03/2014

will I get that refund as entries in form 16 doesn’t match with 26AS?

Hi Kewal

This is a bit technical for me to answer . Better meet a CA on this .

Manish

Dear Kewal, you mean to say, in your form 16, there are entries of tax payment which are not there in your form 26AS? In case of mismatch, no refund ‘ll be there for such situation.

Thanks

Ashal

I am tyring to file ITR for assement year 2011-2012, my TDS by employer was all correct and I have paid what I was supposed to, but while filing this ITR I am facing problem as I don’t know what to select under “Return filed under section” field.

Also It will be helpful if you can please, where to mention unclaimed HRA in ITR, can we mention in 80GG(I get HRA from employer)? what is the section where it should go?

Please clear my doubts, thanks for your help in Advance.

http://jagoinvestor.dev.diginnovators.site/forum is the right place to ask that

I have a question.

I revised my IT declaration to 1.5 lacs instead of the usual 1 lac.

Should my tax liability (and therefore deduction at source) reduce?

Not sure why you did that. This new limit is applicable from the next year filing

I have one more query. my employer (govt department) has deducted Rs. 15180/- as TDS and form 16 also shows the same but when i viewed my form 26as it shows that only Rs. 10036/- has been deposited to govt account i.e Rs. 5144/- less deposited. I wrote the the concerned authority in my department but they are reluctant and not rectified the mistake so far. What may be the consequences of this and what is the solution?

Regards..

Kittu.

File the RTI

I am a salarized govt employee. I received gift of Rs. 18.5 lacs from my father in law . Do i need to show this amount in my income tax return (as this amount is not taxable under IT Act)? if yes, under which head? I presume that i have to use ITR-1 for filing my return.

Regards.

Kittu

No.. Gift revived from a relative is not taxable.

56(2)(vii): Gifts received by Individual

Better check this with a CA

Hi Sir,

For the fiscal year 2011-2012, there was a deduction of TDS which I forgot to claim, because due to some reason 26AS was not available with me. The tax was deducted by the bank for an FD. Since I was out of India during the fiscal year (and paying taxes outside), my Indian income was not taxable. I had already filed the tax and it got approved. Now my question is can I ask for a rectification?

Regards,

Amit

Yes, you can now file the taxes and ask for refund !

Hi Sir,

I am a government employee (Indian Army). First I want to know which ITR form should I file. Secondly, I have query regarding exemptions, my annual salary is Rs. 3,57,000 (shown under hear salary in form 16) and my transport allowance is Rs 1600/- per month. My salary include transport allowance ( not exempted in form 16). And I want to claim this. Where should I mention this in ITR and how should I calculate my salary income.

Thanks,

Ashutosh

Do you get the transport allowance in your salary or not ?

Hi,

I filled my ITR which was showing a tax liability of Rs. 4000 at me (I chose the option Quick eFile ITR->Personal Information Tab-> Filing Status-> Tax status -> Tax Payable, as I had to pay extra tax). Then I sent the same ITR form to income tax department. Later on, I paid the remaining tax using chalan 280 online. And I checked that it is being reflected in my form 26AS under part C.

Now my doubt is that do I need to file revised return and send the new ITR form to income tax dept or should I wait for an acknowledgement of my previously sent ITR form? Please suggest.

Thanks,

Purish

Dear Purish, please file a revised ITR now and send the ITR-V of the same to CPC Bangalore.

Thanks

Ashal

Please consider consultation with a CA on this .

Manish

Hi

I have filled my itr1 on last year(2013-2014) through online , but i missed to post the itr1 to Income-tax dept . can i refill the itr1 for last year and send it it now?

Dear Mohan, please post your ITR-V now.

Thanks

Ashal

Yes, you can do that !

Hello I have income from tuition & cloth stitching work. my total personal income 2 lac.I would like to know that which ITR form should be filed. and my husband having a agriculture & professional income so for him which ITR form should be filed. kindly reply me . thanking you

Dear Ravina, as your total income is in zero tax slab, you need not to file Income Tax Return. Your husband can use either ITR-4 or ITR-4S.

Thanks

Ashal

You do not cross the first slab of 2.5 lacs, so its fine if you do not file the returns

Hi,

I have deposited 4L Rs. in my wife’s SB A/c. during FY2013-2014.

AY2014-2015

She invested some in FD & earned some interest out of it.

Also the bank has done TDS for Rs. 97 for her.

937.00 was the total amount paid thru FD, as interest.

Now she got a email from IT dept, with subject:

“Compliance – Income Tax Return for Assessment Year 2013-14 – PAN: XYZ”

Please advice how to proceed.

Hi Prasad

You better get in touch with a CA on this .

Manish

Hi

In this financial year my income tax was not deducted as i have submitted all investment proof do I still need to file form 16. And my employer has not given me the hard copy of form 16 as i have no income tax deducted.

I would be greatful to you if you reply to my query and mail me to my email .

Regards

Meena

Dear Meena, it seems your total income is less than 5L Rs. and due to your declared tax saving, the tax amount is zero, you need not to file your ITR but you should have hard or soft copy of Form 16 for your future reference.

Thanks

Ashal

You still need to file the Returns

Excellent article.

Thanks

Hello,

I have filled 100000 rs. under section 80C while filing my income tax return. The actual amount which was mentioned in my form 16 was 123000.

Do I need to rectify the above said amount.

A quick response will be highly appreciated.

Regards

Vikas

Dear Vikas, the effective amount is 1L Rs. only, no matter you invest 1.23L or 2.5L or 5L Rs. in 80C instruments.

Thanks

Ashal

Thank you so much Ashal.

I dont think so .. because anyways the max taken would be 1 lac only !

I am just wondering that what is the best time to invest in PPF account. So I can show it in income tax filing FY 2013-2014.

Should I invest amt in PPF before 31-03-2014 or 1st Jan 2013 to 31 Dec 2013?

Please clarify

Thanks

Narayan

Dear Narayan, at the start of FY e.g. 1st April of that FY is the best time to earn full year’s interest as well as tax benefit.

Thanks

Ashal

Before 31/03/2014 will be considered for 2013-2014 year !

Hello,

I have made an FD for a period of 6 years (starting in may 2013) in United Bank. For the Assesment year 2014-2015, the yearly interest earned was Rs 39310 for which the TDS of amount Rs 3931 was deducted.

However the entire interest earned will only be credited to me after the completion of six years(i.e- May 2019).

I file my ITR for the salary which I get. In Form 26AS the amount of Rs 3931 is also displayed. Do I need to file ITR for this amount also along with my regular ITR.

Dear Ashish, yes you should report the accrued interest and TDS thereon. Even if you opt not to declare, IT people ‘ll seek clarification from you due to TDS entry in your form 26AS.

Thanks

Ashal

Tax on FD is payable on accrued income and not the income you get in hand !

Hello sir,

It is nice to go through the site, which has given clarification to many doubts on IT matters to its viewers. I am posting a querry which require your attention and reply.

I engage persons for training on medical transcription and also has started a sole proprietorship concern wherein jobs were taken on contract and executed with the help of my trained staff and freshers. For this, my income is from two sources 1. The trainee fee that I am collecting from trainees. 2. The contracted payment being received from my clients. These clients deduct 1% tds from the total monthly bills being paid to me. I distribute the salary for those staff who are engaged in doing my work for my clients. Also I incur expenses towards electricity, Internet, salary for other teaching staff for conducting english classes for the training. The payment is being received into my current account. Please let me know my tax liability in such a situation. Also, which form i should use for filing my return. The business is started during this financial year and as such when should I comply with the tax requirement. What are the deduction that I can claim for running my business? Can i efile my return? Do I have to deduct income tax from my staff from their salary and if so, where I have to deposit the deducted amount. Would like your expert advice.

Dear Vineeth, how about hiring a CA for doing all this petty work (Income Tax) so that you can concentrate more on your serious job?

Thanks

Ashal

I think its better you consult a CA On this . It would be a complex thing to find out what is your income tax .

I am a medical transcriptionist doing my work at home on the basis work given by my client. I have two client for my work and one client has deducted 10% TDS and issued me form 16A and other client has deducted 1% TDS and has not given any form 16A. Now I would like to know on which IT form I should file my it return for the AY 2014-15, as I am confused on the form to be used for filing. Would like to know from experts. Also, whether can i e-file my return with the available information. Pl guide.

Dear Santosh, please use ITR-4S.

Thanks

Ashal

Hello Sir,

I have some doubts in income filing (FY 2013-2014 | AY 2014-2015)

My mother is pensioner and getting approx. 3,00,000/- annual pension.

And investing 100,000/- every year in PPF account. (PPF funded in 12-04-2014)

She has 3 fixed deposits in 2 different banks.

4,91,108/-

3,31,354/-

2,00,000/-

All FD’s are deposited in March 2014 and their interests will be received next year.

And as per bank’s request, she has submitted Form15G on April 2014.

Now she is confused whether to show next year’s interest in this FY 2013-2014 income tax filing or in the next years filing. Can you please clarify?

Another query; Last year she had received approx. 1,00,603/- FD interest (Sept 2013 – 28,728/- & March 2014 – 71,875/- ) but not submitted any Form15G nor Bank deducted any TDS.

So should this be added in this FY 2013-2014 income tax filing?

Thank you