How to Create your own Child Policy with this Calculator

POSTED BY ON February 20, 2012 COMMENTS (258)

Everyone is so desperate to buy a child plan (example). The features of so-called children plan are bundled in a way that it looks magical, as if there can’t be any other product like a child plan and hence, we pay much more than the price it really deserves most of the times. So today we will see how we can create your own child policy by combining term plan and other investments like PPF, FD or a Mutual Fund.

When you hear “Child Policy”, It looks extremely attractive. It gives you money on your death, It gives yearly income and it also gives you money on the maturity of the plan (generally when you child is ready for higher education) . So the point is that a child policy is so much in demand and attracts investors because of its features. However there are some issues with child plans in market. They come with high costs, rigid structure and very less control over it. Traditional Children plans (which are endowment or money back type) mainly do not deliver of returns front and ULIP children plans come with high cost .

So what can you do now ? Can we create a child policy on your own by combining Term Plan and Investments in some separate instrument, in a way that the Term Plan will take care in case of your death and investments will take care of higher education cost in case you survive.

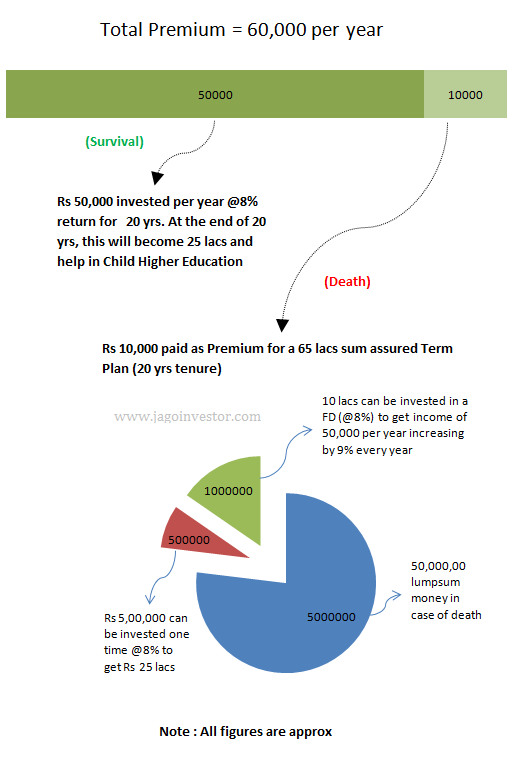

So just like you pay a yearly premium for a Child policy, even in this case you will pay a fixed amount every year. A part of it will go as Term Insurance Premium and rest will go into investments. But in this case the term plan will also open ways for yearly income, as well as future big time expenses for child higher education as well.

When you are not there, the amount received by family from term insurance can be invested in such a manner, that it can provide a yearly income + lumpsum money NOW + Lumpsum money in FUTURE. Lets us take an example and see how it will look like. Suppose you have a 1 yr old daughter for whom you want to create a Child Policy like structure, and you want to achieve these 3 things.

| 1. Lumpsum Money | If you are no more , family gets 50 lacs upfront as lumpsum. |

| 2. Regular Income | After your death, your family should get Rs 50,000 per year separately for your daughter education for next 20 yrs and this Rs 50,000 should increase every year by 9% (so that inflation is taken care of) and assuming this money will grow at 8% return (FD) |

| 3. Money for Higher Education | When your daughter turns 21 yrs old and is ready for her higher eduction, she should get another 25 lacs at that time. |

In order to achieve the 3 things mentioned above , you need to buy a term plan for Rs 65 lacs (Sum assured) and start investing Rs 50,000 per year in something which gives 8% return on annual basis. Apart from this, you will need to clearly define to your family what actions they need to do once you are no more (these are simple tasks like opening a FD or investing money in PPF or balanced funds). The yearly premium for this structure would be around Rs 60,000 (50,000 investment + 10,000 premium for term plan) . Lets us see how this structure will be helpful .

If case of death (Your family gets 65 lacs)

- 50 lacs can be taken out as lumpsum

- 5 lacs can be invested one time to get 25 lacs at the end of 20 yrs

- 10 lacs can be invested one time to get a yearly income of 50,000 increasing by inflation figures!

Incase you survive

- Your investments of 50,000 annually will create a corpus of 25 lacs at the end of 20 yrs anyways

Lets us see this same example through a picture, which will clearly illustrate how this 60,000 premium payment will create a Child policy kind of structure and how it will help you in case of death and survival.

So using this structure you can achieve what a child policy provides. However this whole method has its own pros and cons. There is a lot of flexibility in this structure which a child policy does not have. However this kind of structure would need some level of trust and you will need to instruct your family about it and what they need to do incase you are not around. I think if you are preparing a will, you can clearly mention what needs to be done with the term plan money, so that family members can take those actions.

Download the Calculator and Start Planning your child Policy

Below is a calculator which you can download and punch in your numbers, the calculator will tell you how much term plan you need to take and how much investment has to be done per year. The expected return and inflation is decided by you. So if you want your family to put the money in FD or PPF after you are there around, then put the return expected as 8%, if you want it to be in Balanced Funds put 10-11% and incase of Equity Mutual Funds, put 12-15%. Also note that the premium for term plan will depend on the company you choose for taking a term plan (LIC is coming up with its term plan in few weeks as declared by them recently).

Download Child Policy Calculator Here

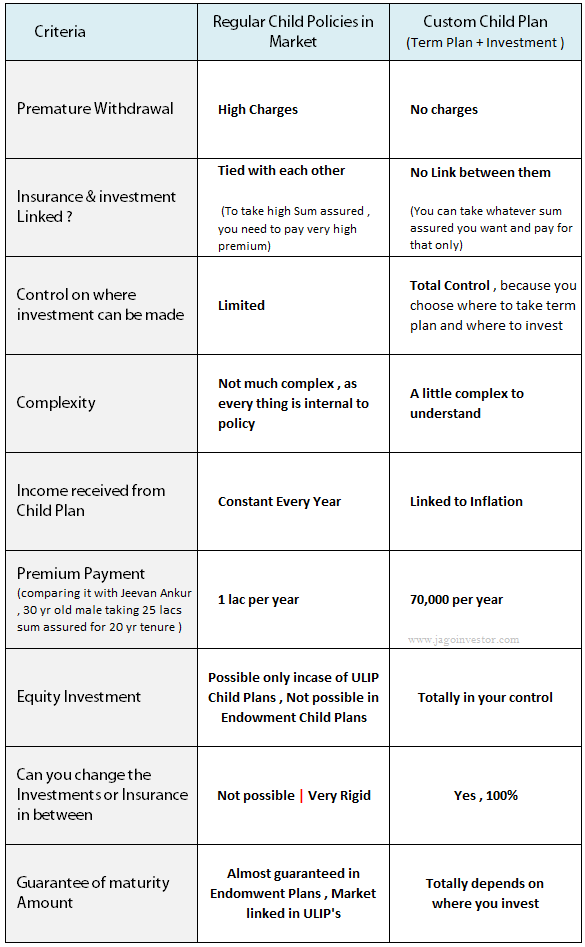

Comparison with Child Plans in Market

It’s important to see what is the difference between the child plans in market and this custom-made child policy by combining term plan and investments

Comparing it with LIC Jeevan Ankur

Lets compare this with LIC Jeevan Ankur Policy. If a 30 yr old male has to take a 25 lacs policy for a tenure of 20 yrs, He will have to pay premium of Rs 1,00,000 per year (approx) . In case of death, his family will get 25 lacs + 2.5 lacs income per year till maturity + 30 lacs of maturity (assuming 20% loyalty addition) , incase the person survives, he will get 30 lacs anyways on maturity.

This same thing can be achieved if a person does a 60,000 per year investment in PPF or FD (assuming 8% yearly return) and taking a term plan for Rs 55-60 lacs for a premium of say Rs 10,000 per year (for most company, the premium is 5,000 but lets assume LIC online term plan is taken which will come in few weeks now). So he has to pay total 60k + 10k = 70k per year to achieve the same results, with a lot of flexibility.

Do you think this whole strategy of creating your own child policy is of any use? Do you think it’s too complex? Share your views.

258 replies on this article “How to Create your own Child Policy with this Calculator”

Comments are closed.

Hi Manish.

Excellent article as always.

I was also approached for some child plan by my financial advisor. But instead of going for it I opted for the combi ation of term plan and mutual fund (HDFC Children’s Gift Fund – Investment.

I hope this decision of mine has put me in the right direction.

Hi Manish

I’m not supposed to go for Mutual funds or SIPs as my religion doesn’t allow it. In order to save for child education, request you to guide me on what are the other options that are available in market. I also have purchased two term plans, 50L and 60L each so term plan option is no longer available. I want to invest some amount per annum to get approx 50 Lac after 10 years. Please guide.

Cant you go with direct stocks also ? Because if thats the case, then the only option for you would be FD ! .. and thats not a good choice for long term investments.

Thanks for a quick reply Manish. Yes direct stocks or any kind of investments in stocks is not allowed in Islam, I was really hoping to know options other FD and PPF.

In that case you can invest in Debt mutual funds, They invest in debt options like corporate and govt securities. Its not Stocks !

In case you are new to this, my team can help you with setting up everything from start to end. Just fill up http://jagoinvestor.dev.diginnovators.site/start-sip

Thanks for reply Manish. However I wanted to know whether I can go for Bajaj Allianz future gain plan that is based on shariah funds. Do you recommend to go with it in terms of good returns.

Cant comment much as I have no idea about it !

Hi,

Nothing better than this, one of the best articles i have read.

Simplified everything.

Thanks for sharing

But with the calculation shown in comparison with LIC Jeevan Ankur policy.

Ankur seems to be a better policy.

Glad to know that ShekharRathore ..

Dear Manish

I am 41 yrls old and I want a child policy for my 7.8 yrs old daughter, i can invest Rs. 2 lac annually…Plz advise which would be the best policy

We dont think children plans are the best thing here. You should build a corpus in mutual funds

Hi Manish. Very good article.

I have 3 LIC policies. Since for 2 of them , I have paid premiums for 13 and 7 years respectively, I think it’s best to continue to pay till its premium term ends.

For the 3rd LIC which is a Child Career Plan, since i have paid 3 premiums and the 4th one is due this month, i am thinking of making it as “Paid Up” and then going for the combination of a term plan and a PPF (or PPF + Mutual Fund).

Let me know if the decision is a good one or not.

Thank you.

Regards,

Manish Wadhane

Yea , keep paying now till the term ends

Hello Manish,

I want to know about full life term plan. You have any term plan for whole life. My D.O.B.02/02/1988

please suggest me.

As far as I know, there is no term plan like that !

The maximum duration is provide by LIC term insurance which is 35 years coverage maximum 75 years of age. Rest ICICI, HDFC etc provides maximum 30 years coverage, but in LIC there is no additional riders.

Manish Bhai Can you elaborate below line by you ? how we will achieve this increasing in income by inflation figures ?

“10 lacs can be invested one time to get a yearly income of 50,000 increasing by inflation figures!”

Dont take it literally . I didnt mean that there exists some product which will do that for you. Its only theoritical !

It really seems good article . i have one question .

In your example how we will achieve “10 lacs can be invested one time to get a yearly income of 50,000 increasing by inflation figures!” ? Does your excel sheet is designed to calculate this inflation part too ?

Yes

Hi Manish,

This is very nice artical..thanks for that.

I have bought ICICI pinnacle super L with highest NAV B in Nov 2011.

its 5 years and each year 50k premium.

i paid 3 premium and not sure if i should continue OR stop paying premium?.

Can you please guide on this?

Is it Highest NAV plan ?

Dear Manish,

i read your valuable article, Im 32 yrs old,I like to invest monthly 3k or annualy 40k over the period of 10 – 15 years for my 2 yr girl baby, my intention is to get monthly benefits after the maturity period and it will help her for education expenses.

Thanks

Good point , then you can invest in PPF ..

Dear Manish,

I was feeling proud that I am also thinking like you.:-). But you have done a great job to create good example. Can you please guide me that from where I should buy the term plan,online/offline, and sum assured amount? My age is 30 years.

Thanks

Manish

You can take a 1 crore term plan from HDFC or Aviva/SBI

buying multiple term plan would be helpful.

I have 50 lakh term plan from SBI and 30 from SBI, 20 from Max life

****50 lakhs term plan of LIC. The trusted insutitution

Hi Manish,

I have taken tata aig maha life gold plan for my kid i have paid 2 year premium now i ‘m thinking of stopping and doing the process as mentioned above.

Kindly suggest should i go ahead and do the same

Yes you can go ahead if you are not satisfied with it .

Dear Manishji,

I had logged in today to search for a child plan for my 5 year old son and going through your article and calculator, I am completely clear on what I will do now. I already have a Term Plan from AVIVA of 1 crore, so now i will go for SIPs (Monthly Rs 5000-7000 for 20 years) to create the corpus. I have 2 questions:

1) Can I take SIPs in my child’s name?

2) Can SIPs be taken for 20 years?

3) Please suggest some good SIPs for long term?

Regards,

Amit Gehani

great !

1. Yes, you can , but why are you doing so ? What is the advantage ?

2. Yes, but whats the use of it, you will not run a SIP for 20 yrs in same fund, it has to change later, so better take it for 2-3 yrs .

3. Quantum long term equity , HDFC equity , HDFC Prudence are good one !

Manish

Hi Manish,

You have mention Term plan of LIC. I checked LIC site but couldnt figure out the exact plan u r talking about. Could you please help me to find out?

Also please provide information on various Term plan which i can look into.

We are talking about AMULYA JEEVAN plan from LIC , its a term plan above 25 lacs sum assured !

Dear manish,

i am planing for my daughter secured future.what about the jivan ankur LIC,i already invested in hdfc young star plus policy (its unit link) 3 years completed but as per market, policy performance not good so i stop my pa premium its 50000,so i planing to invest this 50000 for my daughter secured future, so please guide me how i can invest in different sector for long term with good benefit.

kalpesh

I suggest mutual funds in long run

Hi,

FD is better option for wealth creation but TDS will reduce the benefits.

Is it still better than other tax free child plans?

Can we make single FD for long term in childs name?

I think its better for those people who cant manage policies like ULIP’s .

Dear Manish Sir,

i m become uncle in last month and i want to give a gift as a education plan to my child for his bright future.

Can u suggest me, which one time investment plan(Single premium) i bought for my child. And also suggests its benefits.

Warm thanks

I seriously discourage your from buying regular policies from market . Rather than a policy, better create a FD on the child name .

Hi Manish,

Can you give your views about Edelweiss Tokio Life – Education plan ? It sounds good.

Also, can you shed some lights about the company ?

Regards,

Pradeep.

If its not a term plan, then just avoid it .

Hi Manish,

When we talk of MF over other investments like ULIP or Child Plans, we kind of hide away the facts that-

investment in MF does not enjoy TAX rebate and

the income returns (ranging 7-20%) is Taxable

My query would be-

So when you say 12-15% returns, what will be the actual/average figures after tax deduction?

And an actual/average loss figures for not having put the money in TAX saving tools?

P.S. I am definitely not against ‘Term Insurance + MF’ investment idea.

Thanks

Sanju

Equity mutual funds profits are TAX FREE 🙂 .. Its capital gains and its not taxable after 1 yrs

Thanks for all your Free Gyan Manish!

Hi Manish,

Thanks for detialed explanation.. what is the correct age to take Term Plan? Currently I am 27years old, is this the right time for me to go for Term Policy.

The correct age is when some one is financially dependent on you !

Great manish sir.

Thanks for the reply

can you provide me some examples of mutual funds through SIP route, accordingly i can do additional research and plan

Thanks

Karthik

What do you mean by example here ?

Manish,

I need a favor from you to take and good financial decision…so put your thinking hat and appreciate if you can provide me a good solution…

We would like to invest a lumpsum amount/one time payment with 6 figure amount for little kid of 1 yr old.

looking for safe and riskless and guarantee returns in good trust-able financial institution for kid higher education and marriage.

Looking for ever best answer from you ..do the needful..

Thanks

Karthik

Karthik

You will have to invest in some risky product if you need good returns, with a safe product, you will get only near inflation returns . I would suggest that for these long term goals , invest in mutual funds through SIP route !

Hi this six figure some can be split up into 3 or 4 equal amount and invested in FDs or in Debt funds and systematically transfer the income into equity funds to boost the returns, that way the principal is protected in the bank FD safest so far comparitively(though only upto one lakh only insured), returns would be just matching the inflation but the sips in the equity funds might beat the inflation in long run.

Yea thats one of the option ..

Article is quiet Good, I was alreadythinking in the same lines and was about to invest and then saw you article.

Good to hear that Ankur 🙂

Manish – Noticed that you have responded to others in another blog the max limit for investment is only 1 lac . Thanks for that. In such case what other good assured return product you suggest for a long term investment

1 lac limit is for 80C !

Hi Manish ,

Appreciate your blogs and the information shared .

I have a ppf account and recently started one for my son . Can I invest 1lac in both .

NO , you cant do that, the overall limit is 1 lac if son is minor !

Excellent article Manish!! I always knew that Children plans were just another name for ULIPs but didnt know what can be done as Plan B. Your article has given me exactly that. This will be now my Plan A and not the children’s plan. My query is- if i open a PPF account in my daughter’s name, will i be eligible for deductions under Sec 80 C? and after 15 years, who will operate the account? Can i open a joint account and exit when my daughter turns 18?

Thanks Sankar ! .

Hi Manish,

What happens to term insurance amount if the insurer survives the policy payment term? Will the assured amount be paid at the end of the term?

No , its does not have maturity, thats why the premiums are low, if you want money back , you can go for “return of premium- term plans” , which again are not worth it !

Hi Manish,

Great article.

Would like to know if we can use ICICI Pru Retirement Solution Gaurated Plan for child plan instead. Where we have to Invest 1 lac for 10 yrs you get a choice of lump sum amount at the end of 10 yrs and or get pension every year till death. Additionaly you get Assured amount at the time of death + Pension to the survivor spouse + Money to your child after death of the couple. Please advise.

Thanks

Sanjay

You are focusing on the features ,are you ok with the returns part ? What is the IRR of the policy ?

Hi Manish,

First of all thanks for the good job u r doing. Nice Article. These sort of combos will only work in future as the money-back & endowment plans offer very less returns. During the maturity period the return u get is literally peanut in reference to the inflation. Would appreciate similar way of pension plan from you. These days i m addicted (in positive way 😉 ) to jagoinvestor.

Go through this once – http://jagoinvestor.dev.diginnovators.site/2011/10/pension-plans-drawbacks.html

Hello Manish,

You are doing a great job by enlighting people on personal finance.

God bless you.

Thanks Sirish !

Nice Article Manish…I even liked the lively Comments section and prompt responses from your side..keep up the good work.

Cheers,

Pradeep Nulu

Thanks Pradeep 🙂 . Keep visiting !

Hi Manish,

I am new to your website. I went through this article & your explanation in the video. This looks to be amazing. I should tell tons of thanks to you.

I am now going to use your suggestion to plan the future of my 1 year kid and loving family.

From today, I have become the permanent member of this site. 🙂 cheers.

Regards,

Ravindaran S

Ravindran

Good to hear that . welcome to Jagoinvestor family !

Hi Manish,

I am 36 year old and I have a doughter. I have below in my portfolio. Firstly I want your opinion on my portfolio, whether they are ok or need any changes. Secondly, I need your advice on LIC Amulya Jeevan as I want to exit from this with some other plan. Though I have paid premium for this year.

1) ICICI Prudentila – LifeTime: Premium 20,000/- per annum, 5 lakh sum assured, policy term 20 years, started in 2006

2) LIC Jeevan Anand: Premium 36,000/- per annum, 5 lakh sum assured, policy term 16 years, started in 2007

3) LIC Amulya Jeevan: Premium 14,000/- per annum, 25 lakh sum assured, policy term 35 years, started in 2009

4) PPF: Not a fix amount but keep investing whatever I could. Started in 2006

5) 2 Mutual Funds through SIP, each 1000/-

Thanks in advanve for your help.

Thanks,

Sanjiv Ranjan

You might want to relook at 1,2,3 and increase your investments in 5th !

Great eye opener it is.

A concept of Life Insurance has changed in present day scenario.

This article will get back the original concept of Life insurance and guide the investor to do right thing.

Thanks for your appreciation

Manish, thanks for the article.

Instead of taking the child plan, i have opened the PPF account in the name of my son, where i put Rs. 50000 every year from last 2 years. Also i have opened a savings account in his name and has routed Mutual Fund SIPs Rs. 4000 per month in that account in his name for the tenure of 10 years.

Yea .. its a good way .. did you also cover your self through a term plan or not ?

Yes i have taken a term plan for the life cover of 50L

Dear manish,

Thanks for your advice and would like to request for some more support, thats which mutual funds are good for investing and i dont have a term plan which one should i go for?

thanks and regards

jijo

There is a recent article published just now ,it has names of some good mutual funds .. have a look at them

Hi manish,

Very much impressed with the article, its very informative and i have decided to invest in PPF as its better than any child plan. i would like to get an advice from you regarding LIC Jeevan anand. is it good investing in it, as i need an life cover and will get a return in future. if i survive.

regards

Jijo

Dont invest in any LIC product . Just for for PPF or balanced mutual funds ..

dear

sir i am very happy about your details pl tell me which company policy is good and reliable.

Tomorrow they should not get any problems pl tell me company and policy name also

mr manish pl tell me my child plan and t.p

Komal

Not sure what you are asking , what to you mean by “my child plan” ?

Komal

There is no policy like that .. all the companies have same kind of policies .. if you want guaranteed returns and money back ,then invest in Bank FD or PPF

Hi Manish,

Thanks a lot for this article. Could you please come up with similar kind of custom plan for pension?

Thanks

Viren

Sorry Manish if i wrongly put question. You may take it another way.

I have asked that if i need to secure my child educaiton ( after 18 yrs ) and for that i wana invest maximum in coming 5 yrs, how i can calculate?

I wana invest in 5 yrs and keep it invested for next 15 yrs.

Hope i clear my question this time.

Jig

You can use this calculator for your calculations http://jagoinvestor.dev.diginnovators.site/calculators/html/SIP-Future-Value-Calculator.html

Put 5 in the investment tenure and 15 in total tenure !

Wowwwww Manish, Excellent post..

I read kind of post on BFA site too. ( well not discussing about whose idea)

Everything is fine, But , If i dont want to wait for 20 Yrs , and utilize Initial 5 Yrs for securing the child future by MF, how i can calcuate this. I have small amount in hand ( 1 lac)and wana invest maximum in next 5 yr. to achieve my goal of 45 lac for child higher education after 20 Yrs.

please suggest.

Thanks

JIg

I think 1 lacs is too low to achieve 45 lacs with an acceptable return!

Thanks for the link and yes, whenever I am hitting any bookstore, I am getting your book.

thanks

Shrey

Shrey

Sure .. btw , online has option of Cash on Delivery and it would cost much less !

Hi Manish,

Thanks for the pointers.

As adviced by you, I did some research on Liquid funds (online) and observed the following –

1) It is a low yield investment plan, unless, the STP option is used wisely. Am I correct in stating this?

2) How do you see investing the corpus in Gold? I am thinking of following –

a) FD = 5 Lakh (for 10 years)

b) Liquid fund = 2 Lakhs

c) Gold = 3 Lakhs (say, for 10 years).

Does point 2 makes sense?

Thanks

Shrey

Shrey

Liquid funds are not for investment purpose , Its only for parking your money and nothing else, liquid fund will give you slightly better than saving bank account, thats all

Manish

thanks again.

What about investment in gold for long term?

Yea gold can be done for investments , but make sure you understand that prices of gold are subject to volatlity and can go up and down

Hi Manish,

I finally managed to buy the book and let me share something with you, it made be feel both happy and sad; happy cz it helped me understand the basic on investment, sad cz i am asking myself that why din’t I buy it any soooner.

Anyways, one big change that I see in myself is, I got the understanding of debt vs equity based investment. Have made a commitment to myself to start with MF in next few weeks.

Just wanted to thank you for the amazing book. This is of immense help.

Thanks

Shrey

Great to hear that Shrey ! .. Why dont you pen your review in 2-3 para on flipkart . It will really help the book and jagoinvestor both : http://www.flipkart.com/jago-investor-9380200415/write-review/ITMD68WTDNGHGYQZ?pid=9789380200415

Hi Manish,

It is a wonderful article and I happen to run into it at the right time, i.e. was very close on buying the child plan… so u saved me some bucks and more than that, I feel I more empowered and educated. So many tx.

Have few questions though –

1) Is it possible to have a FD of more than 10 years. I checked online (ICICI, SBI) and don’t see the option for FD of 20 years.

2) Assuming that 20 years FD is possible, will it attract tax(TDS)? Or as it is long term TDS/tax won’t be deducted.

3) Also, whether the lumpsum amount paid by the insurance is taxed or not?

Please advice on the above two points?

Thanks

Shrey

Shrey

1. I am not sure on this, but why do you really want it , do it for 10 yrs and then again do it for next 10 yrs , I think banks will not commit for 20 yrs given that they cant project so much of future. Also your life is not so fixed and predictible either, so better not do it .

2. Nothing like that, tax will be there for sure

3. NO , in general its not . Note that the section which governs that is 10 (10D) . and as per that law , if your premium is less than 20% of Sum assured , then your final maturity value will not be taxed, but now in this budget that number is 10% , so if you are taking a 10 lacs sum assured policy , make sure your premium is less than 1 lac .

Manish

Thanks Manish for the prompt reply.

Well, I think I should have provided more details on what I am looking for but then it would be like I am actually taking an investment advice for free..

But let me put it now –

1) I have surplus cash of 10 Lakhs today, so I thot I would put it in FD now for 18-20 years so that when my kiddo turns 21, the money would be available for higher education.

2) Go for 40 L term insurance, instead of 60 L; so in case something happens to me, the 40 L could be the lumpsum and no need to take out a part for FD.

Considering that FD would attrach TDS, it would be a substantial amount at the maturity, and this is my concern :(. My wife is not working and has no income, may be I could open a Joint FD with her, if it attaracts less interest. Pls. advice.

Thanks

Shrey

Shrey

1. I know you are thinking from Safety point of view and really want your money to be safe . But trust me 20 yrs is a big time to put money in FD , you will not even beat inflation in a big way . You really need to be in Equity . Dont feel that equity will be risky in that time frame , you will surely beat FD returns by a big margin . If you are not that big fan of pure equity , i suggest atleast putting some part in PPF , so that the amount you get at end is tax free (FD is taxble and eventually your final returns would be less than PPF) . And put some part in balanced funds (less volatile than pure equtiyu funds) . So All i would say is dont think much on this, put your 10 lacs in a liquid fund and start a 50k per month STP in some 3-4 good equity funds or balanced funds and let it grow for next 15 yrs + , review it every 2-3 yrs . thats all , you will beat your FD plan by more than 3-5X for sure ! .

2. You will love me , do you know that premium for 60 lacs in term insurance is LESS than premium for 40 lacs . YES . thats how it is , try any online term plan calculator – my next article is no this exact topic , you might want to wait for 2 days for it to come . Take a term plan for 60 lacs (50+ lacs) .

All I would say is have a term plan – do a SIP/STP in balanced funds .this is a good plan for you .

Manish

Thanks again for the prompt reply. This forum is a charm!!

To Point 2: Have to wait for your article, actually based on your crisp reply u hv left me with no other option :). Btw, I am not on Facebook or Twitter so can’t d/l the free pdf that is available on your site. So request you to email it, if possible.

To Point 1: I have seperate fund of 1L/annum for PPF. Not a big fan of Equity, so not very keen. Moreover, I am still a novice when it comes to investment so won’t prefer to start with Equity now, may be, next year. So for this 10 L, I would go with your recommendation on liquid fund and STP. Would appreciate if you could share some link or reference material on on liquid funds and STP. The other thing that I have is, I don’t have any loans so nothing to repay and close with these 10L.

Thanks Again and Waiting,

Shrey

Shrey

1. Mailed you the ebook . Wait for 2 days ,the article will come

2. Saying you are not a equity fan is ok , but then what you are saying is you are ok with near inflation return or very small REAL return , i hope you understand its implications . You should read my book 3rd chapter which is on equity and debt. Anyways .. STP is just a method of transferring from money from one fund to another, nothing else. read this : http://jagoinvestor.dev.diginnovators.site/2010/03/what-is-systematic-transfer-plan-stp.html

Thanks Manish,

Thnaks for posting the wonderful article. I am continuosly reading the JI for past six months. It helped lot to understand investment & insurance

Thanks once again & keep it up the great service.

Good to hear that 🙂 . Keep reading and interacting on comments section !

Hi,

See i am very layman with thes stuff but bein a mothe ri want to invest for my childs future,please help me how i should do this,my husabnd is not supporting me and i am looking for a single payment plan where i can put anything between 2 lacks rupees where after 15 years i can get get a satisfactory amount and the insurance even gets covered,please help

Shilpa

You should take life insurance seperately and do investments in mutual funds over long term .

Hi Manish,

It is indeed a great article.Surely it is NOT a solution but just a guide as you mentioned. I am not sure whether the same excel sheet can be used for 2 kids.

My doubt is whether the sum assured would go up linearly or not at all?

I mean lets say if i have 1 kid and sum assured as in the example is 70L,of which 50L is for family lumpsum, with 2 kids should the sum assured be 1.4Crore?

Basically just need some thought on using the planner with 2kids.

Thanks.

Well i have a daughter 3.5years old and 4 month old son.I have not done any savings for my kids’ education so far.

Dear Sir,

I do agree that it’s good advice but there are certain need base solutions are available if the subject is for child’s basic education,talent development,college education,higher studies,start up in life & marriage expenses….financial security. Being a financial professional am of the view that concept should be such that gives u peace of mind that whether am there or not my kids future remains financially secured beating all market inflation with need base flexiblities.

Regards,

Excellent article. I myself have created exactly this a couple of months ago. Too bad, I did not come out of this article when I was planning. It took me 2 years to design, mostly because of my ignorance, this plan. I have 2 daughters and I have created a plan for both of them using, FD’s and term insurance plan as I am not a big fan of equity linked investments . However, the key difference is that I am treating this as plan- B .

Kunal

Good to know that you are already implimenting this 🙂

THis is really a nice articel, I am having same view and it is difficult to explain to my friends who belive this is all complex, you have given a good written set up for me to share with them. So nice of you thanks.

Harish

Send it to them ! .. they might read it and understand

Very good article Manish. I ws thinking on similar terms for a totally different purpose. I have personal health insurance for 3 lakhs and provided by the company for 3 lakhs. I am presently 32. Was contemplating should i pursue my personal health insurance or create Long term health fund- a combo of ppf and mf. What are your thoughts on that

Very useful article.

Great article. I was looking for such planners for a while. Little more details on the formula would be good for ppl like me who already started his/her own xls planner. Few questions:

1. How is 10L (3rd tranche from “if you die” case) provide 50K annual income after 20 yrs? I am not sure how to calculate such annuity

2. Is it possible to start another thread to help us find out how much to save each month (say at 9% rate) to fulfill future obligations like child education, child marriage, my own pension etc at some point of time in life? We should take into account future value, inflation, compounding – all. I made some start, need little expert help

you can use our calculators to find it out : http://jagoinvestor.dev.diginnovators.site/calculator

Action taken. I’ve taken an term insurance cover of 30L for 20 years just for child education (I already have another cover of 50 L for 35 years for life cover)

One question that I had (though not specifically related to this topic) is that I have a ING policy with cover of only 3 Lacs (endowment). I’ve been having this for more than 5 years and am convinced that I should stop it now.

So my question is:

1) Policy is under grace period. Feb 20 was the date of premium. So will this matter if I want to surrender the policy now? (I will be getting around 25k for surrendering, so don’t want to miss that)

2) What about tax implications? I’ve shown proof of investment under this policy in 80C for this financial year. So, will there be some tax implication? So is it better to pay this month and next month’s premium (around 3,000 total) and then surrender the policy in the next financial year?

Many thanks in advance

Ram

Similarly, I want to surrender an ULIP that has crossed 5 years. What is the tax implication again here?

@Manish,

I would like to share my thoughts on CHILD PLAN, more so because me too have a small kid and i have purchased two CHILD PLANs for her (1st is ICICI PRU SMARTKID for 22 years and 2nd is KOTAK HEADSTART ASSURE for 20 years; both ULIP)..My logics are in FAVOR of child plan..

Single biggest factor would be PREMIUM WAIVER BENEFIT (that is, if something were to happen to me – lets say in 6th year – then ICICI PRU will pay the remaining 16 year premium for the policy and KOTAK will pay premium for next 14 years) ensuring that investment will continue to be carried out for my daughter..Other mode of investments such as PPF and MUTUAL FUND do not carry this huge benefit. If something were to happen to me, PPF and MUTUAL FUND will stop there and then. Whatever fund value will be there will be paid out there and then, and future investments which i intended for my daughter will cease. I think its a BIG plus point in case of CHILD PLAN

Plus, what i have observed in real life is – that if money is handed over to a widow (Lets assume Rs 50 lakh from TERM PLAN), she will not be able to handle it in LOGICAL FINANCIAL PLANNING manner, either for the child or the long-term financial goals of the family. as in FINANCIAL LINES, we have a saying that “CAPITAL is a like an ICE which will melt and sink; and regular investment is like a river, which will continue to flow.” In the CHILD PLAN scenario, at least some investment will continue to be there for my kid and she will get a decent maturity amount after 20 to 22 years..

Another factor is cost. With the new guidelines of IRDA, charges are now minimal in ULIP plans. If you prepare a benefit illustration for 20 years in any ULIP child plan [I am not talking about kotak only here 😉 ], on 10% scenario, IRR would be 8.25 or 8.5% – means a total cost of 1.5% over 20 years. Now compare this with supposedly NO CHARGE product such as mutual funds (Be it large cap, mid cap, or hybrid). They are charging 1.5% to 2% FMC (Fund management charges) on total CORPUS or FUND VALUE which will be HUGE as the term/duration of the investment grows..

PPF now has become a non-guaranteed product, what with government will be deciding the rate of return (this year, its 8.6%)..But going forward, its going to be somewhere between 6% to 7%..So investment of this nature would not be able to help out much..

I dont want to convey at anytime that we should rely ENTIRELY on CHILD PLAN ULIPs or MUTUAL FUNDs only..But a mixture of all this will definitely be a good corpus builder – and CHILD PLAN ULIP are in no way lesser of any of the other investment avaneus.

Yes Dhawal

I can see some substance in your points … how ever this arrangement is totally just a view and how things can be done . Only those who are advanced and are comfortable with it should go forward . Nothing wrong in regular ULIP’s if you feel so . Keep it up

Hi Dhawal,

Isnt the Fund Management Charge of 1 to 1.5% on the CORPUS fund appplicable in Child plan? Well i am sure it IS present in insurance plan as well. Also the other charges like policy maintenance charges are of the tune of Rs400 per MONTH…now thats huge. The Premium ALLOCATION charges of approx 5% on an average on INVESTED amount is also there. All these charges with NO transperancy on how the money is being invested and how the “loyalty additions” are calculated,these insurance plans look to me very risky and opaque. I still liked some of your thoughts so would like to read a well informed reply from you.

Regards,

SAchin

Timely Advice is worth a million. Thank you for sharing the million. I need one suggestion . I am having a LIC Policy

Policy Amount : 3.6 Lakhs

Premium: 24,624 Rs

No of Years : 20 years

Maturity Value :6 Lakhs.

Money Back : 20 % for 5 Years,20 % for 5 Years,20 % for 5 Years,,40% for the rest

Money Paid Back to me : 75,000 Rs.(For first 5 years)

Remaining Years Left :14 Years

Before reading this article i was under an impression that atleast incase of my death, My family will be getting 6 Lakhs. I never thought will this be enough? When i calculated in PPF or even in Fixed Deposit the amount is much much greater than 6 Lakhs. i am kind of convinced to stop this Policy and go for a term insurance. But still need your suggestions: I am still kind of inclined to LIC for the 3 reasons

1. As i already have an Insurance in LIC, So to close the existing one and reopen another one will be better is what i am thinking. or is it good to circulate this money (75,000 Rs) this money with out closing it?

2. Claim Ratio is High. (that is what i think from reading from some articles).

3. A little guilt of closing the existing one.

So kind of around 1 Lakhs 50 thousand i have put (24,624* 6 Years = 1,47,744 Rs) with out taking any interest. i got 75,000 back. Remaining After penalty will i get the amount of 75,000 Rs.

Is it advisable for me to close this account?

Is there any insurance policy that covers the death (in any case like accident, diesase or any other way, without suicide)?

Can you give the names, i can search?

Also in LIC , I saw some term insurance like Jeevan Amol( i think) will it help for me?

Please Advice.

Dear lakshmipathy

i am sorry to say that you are fully covered by myths about LIC. online term plans

are avilable only for past few years. I will answer one by one

1) Already having insurance with a company is no way connected with any other

product you are going to purchase in same company. It is not going to benefit

you in any way.

2)If you are giving correct and accurate details while filling your policy documents

and your nominee is in position to produce proof for any thing about your policy document also well educated then no IRDA approved policy claim will

be rejected. no need to woryy about claim settlement ratio ranking

3) A little guilt can be resolved easily. dont surrender the existing plan.

get back the vested amount at the end of maturity. but stop further payments

and have a mix of online term plan + PPF +Equities as manish pointed out

in his articles.

Also i missed a few in my previous reply. LIC Jeevan amol is one of costliest

term plans in the present market for all age group. All are telling only about

the claim settlement ration but no one is considering the high premium amount

paying for LIC. Then while surrender definitely you may lose good returns but

think that you are quitting early and here after you can make your investments

in better way

Thank you Prasanna for guiding through your answers.

Few things which I could understand from your answers.

There is no point in continuing the way I am doing for the current insurance plan.

1. I have to stop making further payments. Get the maturity amount. And need to talk with LIC person for closing or to leave the current paid amount for Next 14 Years. I am thinking this should be possible.

2. I need to seriously consider various insurance companies for term insurance before zeroing in to something and also things more than the claim settlement ratio, Premium Amount I am yet to read these

http://jagoinvestor.dev.diginnovators.site/2010/09/9-most-asked-questions-about-term-insurance.html#

http://jagoinvestor.dev.diginnovators.site/2010/12/term-insurance-plans-comparisions-india.html#

Can you suggest some links?

3. And also Consider the mix of online term plan + PPF / Fixed Deposits + Equities.

I am also considering fixed deposits than PPF because of the nature of job instability.

Is this a good thing to do?

Please Advice

Thanks Manish and Prasanna.

lakshmipathy

for all line term plans you can read the articles by manish as well

as you can visit policy bazaar and apnainsurance. there you can get

all the premimums of all avilable policies. but some agents may call you

and try to convince you for some policy. dont get convinced . you download

the product brochure fully and read it and take a decision

then i think you have confused ppf with your employer EPF. any individual

can open PPF account with post office or SBI. he can continue investing

one lakh in it per year irrespective of his job. PPF have tax exemption

and comes under EEE(Exempt during investment, growing,closing)

where as bank fixed deposits are taxable while you are closing it

Wonderful.There is a lot of discussion in the forum about this kind of options and well demonstrated that with small wisdom and thinking we can make better money with same investments and of course it need proper planning.As it is rightly mentioned child products are sold in the market with emotional advertisements and they say that your child life is secure.How it can be with 5 to 6 % return and inflation around 8 %.

Nice article and wish to see more this kind of articles so that people will be more financially educated.Thank you.

Sure .. will write more of these kind of article !

hi manish

instead of only sharing ideas we can do more together. is it possible to form a

very good group medical insurance scheme with all of us. I mean jagoinvesters.

manish please try to do that. since you are aware of lot of financial matters if

you try for it all of us followers of jago investers will be benefited by low premium

and good benefits

Prasanna

That kind of group cover can not be made . Most of the group cover needs homogenity across the group , like profession , location or income group or health condition . there is nothing of that sort with the group here ! 🙂

Manish,

One doubt. Where do you go and what do you do to get ideas about the topics for your articles like these.

Nice article buddy. Thanks a lot for spreading the gyan.

Regards,

Arudra.

Arudra

The topics take birth from discussions with readers on comments section , news items which float around in media and personal finance space (like the recent one is that mobile and electricity bills can also effect your CIBIL score now) .. also forum has many things going on and I keep an eye on it . Plus I make a note of topics as they come so that I dont forget , I have 150 plus ariticle titles drafted already ! .

Good article,

Helped me to choose write path…..

Good to know that Nagaraja ! . whats the next action you are taking on this !

Hi Manish,

Nicely summed up. I have been reading your articles for the last few years and has helped me on lot of fronts including child plan.

Keep it up.

Cheers

Atul

Atul

Good to hear that .. keep reading 🙂 ..

Thanks Manish for nice article.

I had take HDFC child plan 4 yrs back and started putting 36k premimum each year into it. For first 3 years they only invested part of my premiums(around 30-70%) in the plan. This has given policy a very bad start. But I am still continuing with this plan and will see after 5 yrs how is it doing and then decide what to do.

But for my second kid(2yrs) I went mutual fund route and started investing using SIP’s. And I agree with you, here I have flexibility of changing funds(balanced, mid-cap, large cap) and how much I want. I had already taken sufficient term insurance plan for myself but not keeping child plan coverage in mind.

So after looking at your article I am realizing that I have to bump up my term plan so that I am covered adequately from child plan perspective. Because original term plan was taken with consideration of only family income, covering loans etc.

Thanks for your articles.

NItin

yes .. better do some maths and figure out the right coverage .. dont just calculate and feel good by thinking .. take action , ultimately thats what matters.

Manish

Hi Manish,

Excellent article. I am a regular follower of JI and it gives good insights on investments.

I am ok with term plan- Can you suggest any best plan available as per the settlements success ratio or els should i wait for LIC term plan. No problem in waiting for abetter plan.

And also for an investment of 50000 every year…. Can you suggest a good break up. It can be staright in to one investment or can be a combo of PPF+FD+MF… please suggest an ideal breakup which accumulates 50k per annum and also gives output of 25lakhs after 20years for my child higher education….

Thanks once again Manish and look forward for your suggestion…

Sanjeev

You can take the term plan from the company you trust .. Kotak , ICICI , Aviva , HDFC are all there .. if you feel LIC is what you want to go with , then better wait for it .

Also the breakup of 50k is something you need to do for yourself .I cant do it for you . You decide on asset allocation first , so if its 60:40 , then 30k goes in MF , Shares , ETF or ULIP and 20k goes in PPF/FD/Debt funds .

Manish

HI Manish,

Sorry to be a nitpicker, but I feel this is an important question and may be a situation anyone can face (though I sincerely hope not).

Suppose I have taken a term insurance of 25 L for specifically this purpose — assume 0 for family because I have another 50 L insurance for that.

Now, if something happens to me after 10 years, then won’t the breakup go for a toss? I mean, the “One time amount for getting a fixed return every year won’t change”, but the “one time amount for getting a fixed return after 20 years now has to change because the target time frame is only 10 years”

Now off course I will be investing monthly some money for the child education which can be clubbed with the “One time amount for getting a return after 20 years”, but still may not add up.

Sorry to point this out, but this is a loophole in the whole plan. If my death happens at the start of the plan (say within 5 years) or at the end (after 15 years) there is no problem, but I think in the middle period — 5 to 15 years this plan will come under some fire

Hope you clarify me and all other readers on how to overcome this problem. Not sure If i’ve explained it fully though

Thanks,

Ram

Ram Mohan,

If you die in the middle period the compounding from the monthly investment done until death should compensate for the amount by which the sum assured falls short. If you are lucky it could actually exceed it.

Yes, that seems about right. I guess this is also something that the spouse/family member should be educated upon while creation of this plan

Ram

Very good question . However you dont need to worry on that point . Let me explain you how this structure will take care of the issue you are talking about .

So take a scenario when one dies after 10 yr.

in this case , when we gets the term plan money and puts 5 lac for FD , the total tenure left is just 10 yr and the total money from that FD will turn out to be around 10 lacs (=500000*1.08^10)

Now this is 15 lacs less than the target . But now see the money which was contributed till now . 50,000 was also invested each year and it would make 7.8 lacs at the end of 10 yrs (when the person dies) . And now this 7.8 lacs can also be put as FD for next 10 yrs and that part will become around 16 lacs . SO the total maturity would be actually 26 lacs + = 10 lacs + 16 lacs

So the amount invested parallely will actually take care of the gap which happens due to reduced tenure . I hope you got this now ?

Manish

Yes sir, thank you very much. As I said before, the spouse should be made aware of this bit also in this plan

Manish, if you could share the unprotected version (over email), I can share some more inputs and collaborte in such planning (without violating copyright).

I have used 6.2L and 8.8L split of 15L remaining (2nd and 3rd tranche from your “if you die” scenario) after taking out the 50L lumpsum. I mapped the output of current accrual (from 50K investment, parallel) and future accrual(from this 6.2L one time investment), and found that the pay out is lesser in the 5-15 yrs. And it’s great to die at the beginning or more so at the end!! I could share the calculations. But anyways, the message is conveyed.

Arindam

May be we can see what changes you want to make . You can get the calculators and work out the number . I doubt if we can share a unprotected version .

Manish

HI Manish,

Sorry to be a nitpicker, but I feel this is an important question and may be a situation anyone can face (though I sincerely hope not).

Suppose I have taken a term insurance of 25 L for specifically this purpose — assume 0 for family because I have another 50 L insurance for that.

Now, if something happens to me after 10 years, then won’t the breakup go for a toss? I mean, the

Great article. One question. It is well known that a person cannot be overinsured. This might lead to problems in (a) getting the second term policy for the necessary sum assured (b) or getting the claim since each insurer will seek details of the other policy during the claim.

If I am to provide for the monthly expenses of my family in addition to what you have mentioned the sum assured needed easily runs into hundreds of lakhs even for middle class existence. I wonder if we will be able to get insured for the whole amount.

Insurers have a way of determining insurance needed (HLV etc.) I wonder of these calculations are sensitive to the kind of needs you have pointed out.

They might project a total insurance need lesser than what we calculate.

LICs online insurance need calculator routinely underestimates insurance needs.

I don’t know about others. I wonder if we can convince the insurer (perhaps the one which gives the second term plan) about these needs.

I was thinking about the same thing…

Pattu

Yes , agree with you , in any case the total insurance you can take is always have a limit . But if you keep the numbers as per your situation and if its linked to your financial situation, then I am sure the term insurance amount would be in limit . You can see that even in the example I have taken , the total term plan cover needed is 65 lacs which is what most of the people will be able to pass as limit .

Nice Article Manish,

My investment portfolio is something like this for my child (for my family as well):

Term Plan – 50L (SBI Life Insurance)

PPF – 1500K/month

MF (via SIP) – 1500K/month

Goldman Sachs ETF – 1 gram every month

Hope it will be helpful some of the guys who are reading this!

Thanks again Manish for your work!!

Sathish

Thanks for sharing it with us

Nice concept…Wonderful article… Easy to use calculator.

As always, it is a very good impressive article and I am going to react on it…

Viswa

Good to hear that . let us know when you take actions !

thanks guru ji for calculator to major child plan calculation

Thanks Rahul

Manish

Hi Manish,

You have laid a complicated financial process in a most simple to understand and execute manner. Unfortunately due to the greed of the agents trying to sell of Child Plans, most of the investors end up taking it and hitting their own future. How difficult is to keep insurance and investments seperate and still making them work for a successful future. But the mere fact of not getting anything in return if a person survives from a Term Insurance is a biggest downplay and it is here where we as advisors need to play a role in Investor education.

Regards

BFA

True .. I echo what you say ! 🙂

Thanks for Giving guideline. I will go through this calculator.

Thanks again

HI Manish,

Very enlightening article, but your calculator seems wrong…the 65 lakhs is something I cannot change and also the money required per year doesn’t seem to add up to the total money required.

I understand the concept and it’s brilliant which I probably will try to follow, but the calculator seems messed up or it’s too complex for me to understand 🙁

Ram

Its because 65 lacs part is OUTPUT , why are you touching the OUTPUT part.. just feed in the INPUTS which are the first 5-6 things in start and it will create the output ..

Manish

Hi Manish,

Ok, I think the part that is misleading is that in the excel sheet, the heading “How 65 lacs from term plan will be utilized ” never changes even if the sum assured changes….

Thanks,

Ram

Yea now i realise what you say .. that heading is constant , seems like I hand edited it .. anyways the graph is coming well ..

Hi Manish,

I think the pie chart is a bit misleading and confusing. The 50,000,00 amount is for the full pie, the graphic above makes it look like you have 50,000,00 left after taking out 10,000,00 and 5,00,000

Thanks,

Ram

Ram

The graph is not for 50 lacs, its for 65 lacs .. its showing how the 65 lacs will be used by FAMILY once the claim is recieved .

Manish

Sorry, my mistake, you’re right

Great article as usual. I follow Term Plan + MF route for the same objective. It is nice to see other ideas of asset location e.g. Gold (silver, platinum whatever), PPF, FD, Debt Funds etc. It will be very nice to see 3 different portfolios based on risk taking capacity (low, medium , high). I chose TP + Equity MF as my risk appetite is high. There is a big pool of believers in ULIP. It will be a good idea to pitch this comparison against leading child insurance policies and not just LIC. I am sure the winner is custom child plan but it will help silent the critics.

Amit

the current structure is comparitive with any kind of child plan not just LIC one .

This is a great article, Manish. Child plans are one of most expensive form of insurance and people due to pressure, emotional attachment to provide “best”for their child, ignorance or any other thing you can name of, buy that crappy stuff and keep paying for life.

Copying the link of article and forwarding it to some new gen parents to ease their concerns and provide entirely different perspective in this context. 🙂

– Jagbir

Thanks Jagbir 🙂

I am bit confused about investing for the child’s higher education.I have followed many online articles and the financial advice coming in various news channels , that a Systematic Investment Purchase (SIP) in a balance Mutual Funds(HDFC Prudence,HDFC balanced) is the best way to create a wealth in a long term for the child’s higher education. My confusion is why most of the advisers suggesting a balanced fund instead of a good muti-cap/ samll-mid cap(HDFC Equity,ICICI Pru Discovery) equity funds as the time horizon of the investment is large(avg 15-20 years). As the time horizon is very long (15 years) the muti-cap / small-mid caps MFs will be a better bet than a balanced fund. Can anyone reply to this.

Thanks

Mano.

Mano

Yes , your concern is right and there is nothing wrong in investing in a mid cap or small cap fund. The final return is not the only thing , Its also the volatility that matters ,you personally seem to be very clear that you will not be feeling bad if your fund makes a huge up and down due to the fact they are mid cap or small cap , but most of the other investor are not like that . they cant take the volatility of these small or mid cap funds and their heart sink when they see such hugh fluctuations in short term despite knowing that long term returns would be good .

So its totally a person choice to choose mid cap , small cap , balanced fund or large cap fund , Most of the times balanced funds are recommended, because there is balance between long term returns and the fluctuations which will come in short term .

I hope it clarifies !

Manish

Thanks a lot Manish for taking my query and clarifying it. Cheers 🙂

Nice article Manish…

My Bank wealth manager had also forced me last year to buy a Child Secure plan.

Instead I opt for a Aviva-iTerm plan of Rs 1Crore in a mere premium of Rs 7861. I have also surrendered my one ULIP after completion of 5 years as it was not performing well & invested that complete amount in HDFC Top 200…. Hugh saving on premiums boss.

Good that you have taken a term plan and investing in MF , however I feel you should get out of that mindset that some one forced you to buy something .. How can that happen ? Ultimately it was your decision at end after you convinced yourself that it was right thing for you , there was no on with a knife forcing you to buy it .

Manish

Think.. If the person left a job to start a business after some years.

In that case, he has to pay higher premium to buy his term insurance…. may be much much higher than what he had saved in happy hours.

Alok

Yes that can happen , but not in all cases .

Dear Alok Agarwal i am not clear with your message. We are submitted our

current income proof during commencement of a term plan. Its ok. But is

the premium changing based on our income change in future. i dont think so

if we are in same policy we have to pay the same premium for the full tenure is not?

Yes prasanna .. once you take a term plan, the premium is constant each year . it will not change for you

Manish

Dear Manish.,

Two weeks before u said Jeevan ankur is the best plan, now you r coming up with new ideas. We knows that inbuilt rider in child plan is very high.. That’s too for a triple benefit plan Jeevan Ankur…and still u suggested that one last week.. Do u think still the above combination is good.. There are few more ideas still competitive than ur MF, FD and Tern Plan with better reduce and nominal charges.

Regards

Subin

I think you have read the article in wrong way ,read the review again it gives a meager 3.5% IRR which can be obtained in savings account

Subin

I dont remember I ever mentioned that Jeevan Ankur Plan is the best plan in market ! .. Its a worst plan . However incase you die in 1-2 yrs of taking the plan , the IRR generated would be very high, however thats not the point on which one can buy it.

Can you point out where did I say that Jeevan Ankur is a great product ?

Manish

How many of you have thought that you already have group insurance given by your company?

Please check if the group insurance policy given by your company is adequate for you. If its adequate you don’t need to buy extra term insurance policy, it’s simply a waste of money if you are already covered under your company’s insurance policy.

Prithivi

Yes .. thats true , Company provided group cover is excellent because there are many advantages a company group cover have like preexisting desease are covered from day 1 without any medical . But I have not seen any company giving a very high cover. 10-20-30-40 , this is the number I see most of the times .

But what about cases when you want to switch a job ? What if new employer does not provide a great cover ? You cant be sure you will be working in your current company for decades ?

Manish

nice article Manish, I’ve already charted a plan for my son along similiar lines. Never bothered 2 look towards Child Plans, coz of the learning from JI articles. Thanks again.

Good to hear that Saurav

So are you using this template and the structure ?

Manish, one doesnt need to look into this particular article to create a child plan, if one has followed JI past articles & comments section for sometime , it becomes quite clear how to workout a Child Plan, right …. U’ve conveyed this n no of times …

I guess all JI followers (who’ve been going thru JI articles since last 1 yr) wud agree …

Yea .. I did that for those who are still not able to create it on their own !

Manish

i totally agree with u,even JI reader can make better investment +insurence.

Hi,

Yeah- you’re upfront right.

Child plans or any insurance plans for that matter sell only coz they result in fiscal discipline.

Filter ur goals- assign the premiums / payments and pay in a disciplined manner- that’s the key ask. I guess if ppf had a feature that could allow monthly deduction (ECS) then it would be amazingly successful just as any ins premium or emi or sip is. Deduct as soon as it hits the salary a/c.

Parry

You can acheive automated payment to PPF online . JUst link your PPF to your bank account and start a standing instruction to that account on monthly basis : http://jagoinvestor.dev.diginnovators.site/2011/12/ppf-account-online-investing-netbanking.html

Manish your talking about PPF can we invest in NPS since we already have NPS account instead of PPF

Rathore

You can invest in NPS , but thats totally a different product . Make sure you understand it well

Hi Manish,

I got this article just on time, when i am thinking to go for a child plan for my 2 months old baby girl. Definitely it has helped me a lot.

I understand your address as in Padmavati. I am also staying the same area. Is it possible to meet you for my financial planning.

Regards,

Chandrakant Patil

Chandrakant

thanks for appreciating it .. Yes I reside in Padmavati .. Our services are totally online : http://jagoinvestor.dev.diginnovators.site/services . We dont not have offline services at all as of now .. Online financial planning is not at all an issue trust me . You can schedule a call with us and talk to us once if you want to get a feel .

Manish

Hi,

What about investing in Gold and Diversified equity Mutual fund?

Rupen

Both are different , you can do that if that looks good to you .

Good article. I was also planing to go for Term Insurance + Mutual Fund investment rather than any child plans.

HDFC Top 200 is on top of the list. Any other suggestions?

Som

there are many funds actually which are good .. HDFC Equity , DSPBR top 100 , ICICI Pru Discovery ..

Manish,

Your calculations are good. But, I dont understand , why you have not shown the figures whith Term+PF+FD+Mutual Funds considering long term to build a handsome corpus for the child.

–Vassudev K.

Dear Vassudev

It means you can take a term insurance and you can invest the rest in your PPF account as well FD mutual fund which ever is maximizing benefit at the point of

time you are investing. you are free to change your investment strategy as per your wish since money is not locked with your endowment policy. i can tell that

it will even compensate the premium you are paying for term insurance if you

invested effectively based on current scenario always

A good article. But, when u consider a duration of 20 – 25, the impact of inflation can’t be ignored. For instance, after 10 years the term cover of 65 Lacs would be inadequate. The plan must be reviewed after every 5 years.

Yes Prashant

the calculations are done considering today in mind .. also 65 lacs will not be enough after few years .. but side by side the investments are also getting accumulated, we have to consider that too ..

Manish

Dear manish i strongly want to oppose your opinion of LIC. All IRDA approved

term plans are equal. It is the myth of older people that only LIC is trusted.

See the claim settlement ration of IRDA. there are many other private insurers

also with good number. If we purchase any online term plan with correct

data no company can reject our nominee’s claim since there is only one general

exclusion of first year suicide of most of the term plans. The claims of some

private companies are not settled to nominees due to poor education of nominee

only

Prasanna

Where did I say that LIC term plan is bad or anything about LIC term plan ?

🙂 you are right Manish..

dear manish i mean why you recommending for lic when all are equal

it is having the highest premium amount among all its peers

Prasanna,

Customers of term plans in 95% cases are not insurance agents or PF pundits. So “education of nominee” will be poor in days to come. With time it was proved that “education of nominee” is not a constraint in claim settlement in case of LIC as opposed to all private companies. No body would have used NOKIA phones if it was mandatory to know Symbian(its OS) coding to make a call from it. It is the scenario in term policy also. Simple and promising settelment system is a must have for a term plan.

Dear Pandey Ji,

Inflation is not ignored this plan is just compared to a child plan available in the market today. These available plans also provide a fixed sum assured.

Not a good proposition at all. For a 20 years tenure purely conservative investment approach with a IRR of 8% only that to pre tax.. Sorry Not agree 🙁

Taking current inflation rate which is more than FD/PPF rates (even PPF rate are not guaranteed).

I am not in favor of any Endowment/ULIP plans, but the investment style given by you even not beating ULIP track records.

Regards

Suresh

Suresh

Its only the comparision between traditional Children plans and your own strucuture and the comparision is not just for returns , there are others aspects like liquidity and simplicity which has to be taken into consideration

Manish

Thank you for the clarification..

Thanks for your comments and ideas. Its an eye opener. I would like to request you to suggest me some good term plan as I am 50+ years old having 2 kids @ 15 & 8 years old. There is no any insurance other than one plan of ING @ sum of 10 lacs. The retrn is only to my family on my death.

i suggest you to compare all the online term plans covered by policybazaar.com

or apnainsurance.com and choose a good term plan that gives maximum sum

assured for lowest premium

Suresan

At your age the term plan will cost a lot ,but better take one if your family is going to be dependent on you for next few years .. you can go with an online option or LIC which you trust fully .

Manish

Hi Manish,

I got the point. But I have already started one traditional policy with ICICI Pru with premium 20360/- PA. Only one Instalment paid.

Please advice me whether to stop that policy and book loss of 20360/-

Or, pay for another 2 instalments and Surrender.

Or, pay for another 2 instalments and Leave it, so that I will get some amount after 23years (Policy Term Period).

Please help me

Thank You

R Siva Prasad

i think you are mentioned a ULIP product. if it is so it will have a lock in period of 5 years being a new one. so i suggest you to pay the premiums till the lock in period and surrender it by the end of fifth year if the date’s NAV is higher than

the principal you invested.good luck

Hi Prasanna,

I mentioned it as traditional policy. It is ICICI Pru smart kid (traditional)

Please advice.

Thank You

dear siva prasad then stop paying further premums. dont surrender also. get back it at the maturity. so that your future investments will give good returns

Hi Prasanna,

Will I get return at the time of Maturity, if I stop now, as I have paid only one Instalment?

Iam unaware of the rules and so requesting your confirmation so that I will happily stop it.

Thank you very much

R Siva Prasad

yes siva prasad. you will get back your actual premium paid and a

neglijable bonus for that. your agent will not recommend this to you

because as much as premium you are paying they will get their commission. any way this year your investment wont perform well

but think that you have saved all your future premium payments for good investments with out locking all in this policy

Dear Prasanna,

thanks for your valuable advice and enlightening me.

Thank You

R Siva Prasad

I second Prasanna’s point. Just stop the sucker. You will never regret it later. Last year I stopped one such SBI policy.

hi dominic

nice to know an aggressive investor i think we can share more about personal finance planning thru jago

Dear Sir,

I strongly feel that it is not appropriate advice,in the case of Traditional plan one need to pay three yrs premiums to acquire a paid up value of policy,there after if u do not want to pay the premium u have to write and inform the insures about your intent of taking the benefit on completion of term of policy.U will not loose the money in fact u would get more than what u paid.

Regards,

This is in continuation to my response to Prasana’s advice at,,comments 25.

In your situation , the best thing would be to discontinue it and take the loss as of now .

Manish

Great article.

Despite being connected with Financial Markets myself, This is the simplest and easiest explanation / break-up of a child plan.

Thanks.

Thanks Atit 🙂 .. good to hear that !

Great article Manish. This strongly reinforces my thought on terminating the LIC policies and other policies that we have bought for our children. Thanks

Aparna

Good to hear that 🙂 .. take the action .. nothing happens by reinforcing the thoughts .. action is everything !

Manish

Manish,thanks for your article and comments it’s valuable.Manish there are better combo concept are also available which has the benefit of total financial security and as a financial professional I do feel that financial security does not come simply buying the insurance or creating the asset in fact as u will agree with me that it should be free from liability,should have eassey liquidity,should have need base flexibilties and withdrawal /maturity benefits should be tax free.So there are v.good child plans are available,with guaranteed returns,payor’s benefit,school fees support,talent support,uiversity boosters,tax free maturity benefits with level death benefit where the mortality charges are low PLUS to accuquire the larger benefit this child plan could be combines with Term plan.These types of concept give u real peace of mind that as a parent whether u r there or not your childs basic education,talent devlopment,college edn,higher studies as well marriage expenses are well secured.Manish with my due respect it would not be out of place to mention that since last 10yrs am working in this area only on need analysis bases and have huge HNI clientel base.Anyway there is no end to learning but yr advice is also a great one.

With kind Regards,

Yes . if a product can give all those benefits which are mentioned , then one can go for it !

Very good and important article which i was eagerly waiting for. Thanks to team “jago Investor” for providing such artcles which is a ready reckoner for those who cannot spend much time on searching here and there and eventually getting trapped to somebody’s advice and unable to achieve the goal when it needs the most. I was also thinking on the same lines as per your earlier artcles and had started investing in PPF already for my 3 year old son. The balance investment now i can easily do with the help of your readymade calculator also.

thanks once again.

arun

Arun

good to hear that it was helpful to you . However wanted to clear that the article is not a suggestion or a ready made solution to you . Its just a support to make sure you think in right direction . from your side you still have to think hard and convince yourself that you want this . Only when you are convinced , then go ahead and take this route. you should be clear about it and accountable to yourself

Manish

Sir;

Everything is well done but we must remember money has no colour meaning whether you buy in child’s name ( emotional selling) or your/spouse name, utilisation would be for the purppse intended ( Here Child Security). YOU FAILED TO MENTION THE RBI RULING WHEREIN ALL MONIES PAYABLE AFTER THE AGE OF 18 YEARS WOULD BE CREDITED TO CHILD’S ACCOUNT. IN CASE OF ULIPs, IT CAN BE A SUBSTANTIAL AMOUNT. CAN THE PEER PRESSURE OR THE COMPANY OF THE CHILD, HIS MENTAL MAKE UP BE IGNORED WITH SUSTANTIAL MONEY WITH THE CHILD. IT MAY LEAVE THE PARENTS IN A SITUATION WHICH COULD BE HEART BREAKING. SECONDLY, CHILD PLANS ARE ALWAYS MORE EXPENSIVE.

Hope readers would appreciate and read in between lines.

Picking up a particular plan like you have done(JEEVAN ANKUR) displays a hidden interest/bias which should be avoided while writing in a column.

Regards.

DK Bhardwaj

I am totally against all types of Child Plans. I prefer to have joint accounts with my kids above 18 years of age, and invest in mutual funds jointly with them. They can independently handle these matters when they are mature enough to do so.

Anil

Thats a good idea ..

DK

Not sure what you are complaining here .. What do you think is the hidden interest here , how am I going to benefit by this article ?

Also , only some of the child plans are bought on CHILD name , most of them are still on parents name , so its same in this structure also . Kindly point out the points where you do not disagree with the article or you feel the conclusions made are wrong ?

I can replace the name of LIC Jeevan Ankur and put some pvt company plan , how does that help ?

Manish

Its correctly pointed. all endowment plans are reducing return. they are just covering the sentiments of parents to sell their policies. But why you are waiting for LIC online term plan. currently there are many IRDA approved online term plans which gives

1 crore sum assured for just 8000 to 9000 per annum premium itself

Prasanna

Yes any term plan can be bought .. LIC is mentioned because most of the people only trust LIC .

Manish

hi manish very good article thanks a lot please let m know where i can get term insurance for one crore i m ready to pay premium of rs.10,000/= i am nri born in 1977 can i get 1 crore rs. insurance for paying premium rs.10,000/= please let me know which company i should contact

your age is 34 and you are NRI , you will face issues with online term plans, you can get offline term plans , but those will not come cheap , minimum 15k will be the premium , check out Kotak preffered plan (offline) .

Manish

Dear Prasanna,

Will you adivse further how come 8000 to 9000 per annum premium assured you sum of 1 crores ?

Lalit

thats the premium for 1 crore term plan these days for most of the people around 30 yrs

A very good article Manish.

You can also do an article (or have already done) on a combination of Regular Investment (PPF etc) + Term + Mutual Fund – which may cover a broader range of requirements than just Education.

Regards,

Ashish

Ashish

Actually this strategy can be used for any goal !