The Biggest reason Why you will not be able to save enough for your retirement ?

2014 has started, and I wish you all a Happy New Year!. We are into the 4th week of our Investors Bootcamp and I recently brought up a very important point there, which was, “What is the that one thing which stops you from saving for retirement?”. When I dove into this topic and heard […]

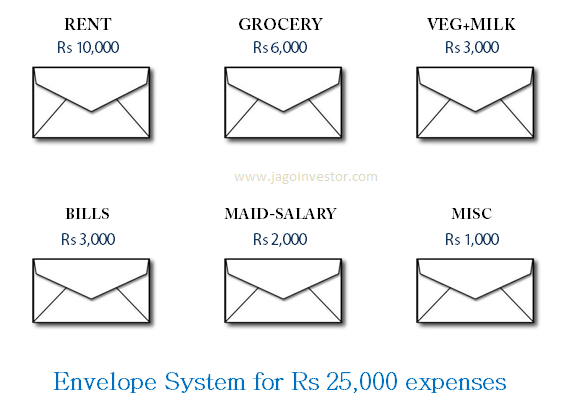

Envelope budgeting system – A simple way to control your expenses

Some months back, when we were working with a Mumbai based client of ours, we noticed that one of his expenses of “Eating Out” was extremely huge. Their explanation was they were never able to control the number of times they went out. So we thought how about limiting the amount spent somehow ? Envelope […]

How a newcomer should start his financial life – 4 steps

Today we will talk about how a newcomer or a fresh investor start his investment journey. We will see 4 steps which a newcomer can follow to start his invstments. I see a lot of new people on the blog asking things like Hey Manish I am totally new to this world of investing, I […]