How this Lady paid Rs 25,000 in pay-order charges for claiming her PPF maturity amount

POSTED BY ON August 6, 2014 COMMENTS (37)

Is your PPF account going to mature very soon ? You are excited to finally redeem your years of saved money in PPF account.

But do you know that some banks are playing with some investors ignorance and charging them hefty amount in the name of DD charges or Pay-order charges to give bank the Public Provident Fund account matured amount.

Let me unearth this no so known or talked about thing today.

Read this incident below to understand what I am talking about

My neighbor (a very old working woman) had a PPF A/c in SBI, on 31st of March 2010 it completed its 15 year term and hence the same was eligible for withdrawl, she duly filled up the redemption form and asked the bank to redeem the amount.

On 14th of April 2010, the bank issued a pay order but deducted bank charges (as the savings account is with another bank), SBI has nearly deducted bank charges of about 25000/- from her.

My neighbor didnt have a bank account in SBI, her account is in IDBI and SBI has deducted the charges for preparing a pay order. Here no service is being rendered but rather its bank obligation to make the payment.

Please help. It would be good if we can help her.

Some Banks not allowing PPF Maturity Redemption directly to saving bank account

When your PPF account matures, and you want to redeem the money, there are several options you can get the money. You can either take it directly in your saving bank account, or get a DD created or a pay-order.

However a lot of banks fool customers and never share with them that the money can be directly credited to the saving bank account and force them to make the Demand Draft or Payorder, because that involves charges and it adds to the bank revenues.

And most of the times, the helpless customers fall for it because the charges at times are in range of few hundred and they do not want to pursue the matter and complicate it.

In the example above, you can clearly see that the person was forced to get the money through pay-order and such a heavy charges for that was applied.

This whole mis-guiding worsens, when the person does not have the saving bank account in the same bank, the officials in-charge tell that its mandatory to have a saving bank account in the bank if you want to get the redemption amount in your saving bank account, else you will have to get it through DD or payorder, which is completely wrong.

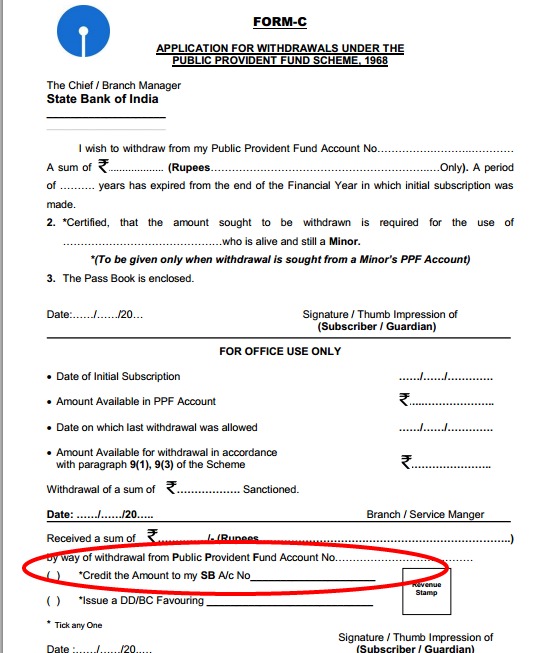

There is no rule like that. One should be able to get the money through NEFT or RTGS or direct bank transfer if they wish to and the PPF redemption form gives that option clearly. Have a look

You can clearly see that there is an option of crediting your PPF maturity amount to any saving bank account.

Some real life Incidents of Banks Asking for heavy charges at the time of PPF maturity payment

Mr. Naresh was asked by Bank of Maharashtra for DD Charges for PPF maturity Payments

Bank of Maharashtra charged me DD charges of Rs 5050/ while making maturity payment of my Public Provident Fund account money. I had asked them to transfer money by cheque or NEFT, but they refused and issued me DD. Is there anything I can do?

Mr. Premji was charged payorder charges of Rs 900 by State bank of Hydrabad

State bank of Hyderabad recovered about Rs.900/- for issuing their banker’s cheque (pay order) for PPF part withdrawal. I am told that as per the PPF rules, the bank cannot recover any charges for issue of Banker’s cheque or pay order for PPF withdrawals. However I am unable to find out such rule in print.

What is the correct status regarding the above issue? Which authority will give a authenticated clarification?

Where to complain for these kind of issues?

A lot of people are not even aware that banks are taking them for granted and trying to levy charges which are unethical. Customers do not resist at times, because they dont want to get into the mess and waste their time for small charges (like Rs 500-Rs 1000).

At times they are excited to receive the big amount from their Public Provident Fund account and cant wait for it. At times there are emergency situations which dont allow them to fight back. But incase you want to fight back. Make sure you follow these following steps

- Make sure you meet the Bank Manager and tell him clearly that you know the rules and there is no such rule that you have to pay DD or Payorder charges to get back your own money

- Ask them in writing for charges and also insist that they show you the rule book.

- If nothing works, file an RTI to RBI asking about the bank action and if there is any such rule. You can also file a RTI to Post Office (which handles PPF finally) about this rule.

Have you ever come across this situation in life ? If not , great ! .. you are now informed what to do when you face this situation

I did a partial withdrawal of my PPF, the bank gave a banker’s cheque. Now due to change in circumstances, i do not need the money, can i simply cancel the banker’s cheque? What could my options be? the cheque is still with me.

Better check with bank on this

Hi Manish,

This is indeed a very useful information, which you have just shared I have two more queries in addition to the above discussion.

1) I have my PPF account in IDBI. And IDBI has just started the online transactions for PPF accounts. I asked them the formalities that I need to do to get the Online access to my PPF account. They said only customers having IDBI savings account can have online PPF account access. And I don’t have any other account with IDBI. so is this correct that we need to have a savings account with the bank in which we have our PPF account to get the online access to our PPF account.

2) To get rid of the above issue I was thinking to transfer my account to the bank in which I have my salary account. So do I need to pay any charges for this transfer and is it possible to transfer our PPF account from one bank to other.

1. Yes, its a bank policy . So they can have that restriction

2. You can do that, but I think its much easier to open a IDBI account 🙂

Hi Manish/ Nandish,

are the comments blocked out. I am unable to find comments for any of the article.

You can see the comments now 🙂

I recently went to SBI to close my old FDs. Officer was polite but gave only 2 options: (i) transfer to SBI SB ac (ii) bankers cheque (pay order) if no SBI ac. Since I didn’t have SBI SB, I had to take bankers cheque, but with only nominal charges (I think they prepared 4 cheques worth total 2 lakhs), with around 500 bucks.

Reason for SB: it is easier for regulators to track SB for money laundering, so every bank (public/private) is insisting on SB. As of now, insisting on SB is legal!

But what is confusing is why they cannot transfer thru NEFT to another bank SB ac, as it is easy and swift.

I enquired about PPF pay orders and mentioned this case. They said it cannot be 25k for any amount of PPF money, and grievance redressal should’ve addressed it.

Not sure what happened to that case though!

They can easily do NEFT , but they never gave you that option .

Manish

Could you pls post an article on the Country Club like marketting scams ?

http://placetaken.blogspot.com/2014/08/the-country-club-total-mall-scam.html

Dear Sir,

Thanks for this informative article. Having retired recently, I was just mulling to open a PPF account online with any good bank like ICICI or HDFC. Now I will be careful.

I concur. The floating links on the left makes this site unreadable on tablets and smartphones. Please remove them or make them static. Its not an issue on my laptop but I suspect people using 4:3 screens in their offices will also face the same issue of text being blocked by those links.

Sir,

This is a real issue. Please try accessing this website on a tab . Its really irritating. Lets see whether u take an action on this Complaint/request. Or u too willbe like others giving a dead ear 🙂

But its not an issue with ICICI or HDFC

Hi Manish,

Thanks for such an informative article. I have a question here.

Has anyone faced complains against Post office too? I have my PPF in post office

Not yet !

I wish to share my experience. For issuing pay order for partial withdrawal SBI charged commission. For closure of the account and issuing pay order no commission was charged. In this instance, the person should take up the issue with Banking Ombudsman, after taking up the issue with the bank concerned first.

Thanks for sharing that Elaya

Really good one Manish. So it is better to have one no frills account with the bank where you are having PPF. It solves the first necessity of problem. then you can transfer by NEFT, IMPS…etc.

Really i am very sad last two days for being an right person. i am fighting with Sun direct DTH for their poor quality service and negligence in replying to customer which is causing mental agony.

Also. i debated with SBI for claiming my money which was wrongly deducted. claimed via banking Ombudsman.

Also, i can go on for many instances….i am really feeling bad for being straight arrow.

Yea .. its better to have a no frills account

This is my recent experience. My son is an NRI, the PPF account has completed 15 years and I was asking for withdrawal on maturity. My son was a minor when the account was opened and the original signature was my wife’s. SBI insists that they will deposit the amount only to accounts in their branches else they will give pay orders/drafts. We had an account which went void as people are rarely rooted to one single city for 15 years! Thank you very much for warning me in advance and this is how I got the funds:

(1) I sent the withdrawal form to my son, got 3 signatures by courier on that form. Along with that I sent the KYC form and identity proof for signature, which were returned to me.

(2) I sent a draft letter to my son (given below) for his signature, requesting withdrawal.

(3) He had to send a signed copy, scanned and sent directly to the branch PPF office. (They will give you this detail when you ask for it).

(4) I submitted the form from #1.

(5) I clearly mentioned my preference to get a cheque with 3 to 4 options.

SBI cleared the cheque in one day after they had all details. Ther were no deductions and the cheque was local.

October 16, 2014

The Branch Manager

State bank of India (0XXXX)

YYYY Road,

Pune 411 0ZZ

Sub: Withdrawal of PPF on completion of 15years from my PPF account No:

Dear Sir/Madam:

My account has completed 15 years and I do not wish to renew it, as I am stationed out of India. I have spoken with your officers Mr. XXXXX and Mr. YYYY and I am submitting the following documents by hand:

(1) Duly signed Form – C.

(2) Photocopy of my valid Indian Passport having my signature.

(3) A cancelled cheque (with my name) of my SB A/c with ABCD Co-op. Bank at Deccan Gymkhana, Pune-411 004.

(4) Details of my bank account for direct funds transfer are:

RTGS/NEFT/IFS Code – ABC———————

S.B. A/C No. _______________________ (15 digit account number)

I have also emailed a copy of this letter to your email id sbi.9061@sbi.co.in

:

I do not wish to receive payment by bank draft. I would prefer any of these options:

(a) Direct transfer to my bank account.

(b) A cheque be sent to my permanent address as given in my PPF account/Passport.

(c) A cheque be handed over to my father: ABCD EFGH IJKLMN at your branch after due photo-identification.

Thanking you,

S/d by Account Holder

Thanks for sharing that with all of us !

There is indeed utter lack of clarity around PPF even with national banks like SBI. I has a similar overcharging incident, but not at the time of maturity. I had opened my PPF account in 2006, made an initial deposit and then made no contributions until 2014. When I wanted to get it reactivated, I was asked to pay a penalty and the arrears for all the years the account was dormant. Since I had done my research, I was aware that the penalty is Rs 50 for each year. In my case it should be Rs50 * 8 years = Rs 400 penalty. However, I was surprised when I was asked to pay a penalty of Rs 1800. According to their weird interpretation, they calculated the penalty cumulatively as if it were some sort of interest. So, Rs 400 (Rs 50*8) for Yr 1, Rs 350 (50*7) for Yr 2 and so on until Rs 50 for Yr 8, and totalled it to Rs 1800 (Rs 400+350+300+250+200+150+100+50 = Rs 1800).

I argued with them, spoke to the Branch manager but they simply said ‘It doesn’t go to us. It goes to the govt’. I said I understand that but check the calculations. They obviously didnot bother despite showing them printout with example calculations from Financial forum. They replied ‘ Sir, logo ko pata nahi hota aur woh websites pe kuch bhi likh dete hain’. So ultimately, I made the payment of Rs 1800, to get my account active again. Upon returning home I filed a complaint with SBI on-line complaint system. I started getting calls from Branch asking what is the issue, that’s is how it is done etc. They were genuinely convinced that their interpretation is right, and also read me this paragraph from the SBI PPF rule book “A subscriber who fails to subscribe in any year according to the limits specified may approach the accounts officer for condonation of the default on payment for each year of default, a fee of Rs 50/- along with arrears subscription of Rs 500/- for each year”. I said exactly, where does it say cumulative. And if you interpret the charge of Rs 50 to be cumulative, why haven’t you done so with Rs. 500 arrears. To this they responded, “Sir, we are not able to convince you. You go to some other branch and check with them”. I went to another Branch and got it clarified. The Branch Manager also called up my PPF account home branch and clarified them that customer is correct. But look at their stubbornness, they didn’t refund my money. In response to my SBI complaint, they sent me the same line from SBI PPF rulebook. And that’s it. Now it is up to me to further escalate the complaint. I really don’t want this botheration for Rs 1400, but its about Logic. And therefore, now I am planning to escalate it. Pssst!

A really good initiative that u escalated the complaint

Thanks for sharing your views on this

Great info Manish.. You always come up with striking issues.. Keep it up.. Keep enlightening

Thanks

very informative indeed. thank you.

Thanks for Sharing it across.

Manish,

This is very informative article. I will try to spread this info as much as possible.

Thanks for Sharing it!

Very useful information, Thanks Manish!!

dear sir file complian in banking ombudsman. if your problem does not solve you can file complian in consumer forum.

Yes, in that case go to consumer court

here two links to file complaint against bank

https://secweb.rbi.org.in/BO/precompltindex.htm

http://www.sbi.co.in/webfiles/uploads/files/1348749777896_GRIEVANCE_REDRESSAL_STEP_BY_STEP_NEW.pdf

how about going to bank ombudsman and also consumer forum since they are cheating the customer by not giving option in form and its service fault from bank’s end.

I am totally against this view. As a Banker of an Nationalized Bank I would like to inform you that Suppose if you have a PPF account in SBI branch CP, DELHI and you want to withdraw after maturity but you don’t have any account in SBI at anywhere and you want money as a DD or Payorder…. then customer have to pay commission for this.

Agar aap ka account us bank me hai to aap ko kuch pay nahi karna padega.

NEFT or RTGS hum log nahi kar sakte kyuki PPF se direct NEFT or RTGS ki subhidha nahi hoti….aapko amount withdraw kar ke kisi Individual ke account me hi credit hone baad hi NEFT/RTGS ho sakta hai.

Charges se bachna hai to aap us bank me apna saving account khulwa lo..

AFTER CBS ab to aapko without saving account koi dusra account open bhi nahi hoga…

Thanks for sharing that Archana

Please see my response dated today. SBI can issue a local cheque and they provided you ask them in writing beforehand. I got it in fifteen minutes,. But this would not have so, had I not reaqd all this useful information on the blog. Thanks again!