Penalty Charges on failed transactions due to insufficient balance at other banks ATM

POSTED BY ON January 30, 2014 COMMENTS (108)

Imagine this situation. You are in urgent need of cash and looking around for your bank ATM, but you are not able to locate one, but you can see other banks ATM and then finally you give up and want to withdraw the cash from other banks ATM knowing that its FREE to withdraw the money from other banks ATM (at least 3 times a month)

Then, You go to other bank ATM and withdraw Rs 5,000, but you see the message on screen “Insufficient Balance, transaction Failed” only to realize that in a hurry, you have punched in an extra ZERO and have tried to withdraw Rs 50,000. You then ignore this minor mistake thinking that it means nothing and then finally you withdraw Rs 5,000 and leave the ATM happily!.

However, By the end of the month – when you are looking at your bank statement, you are in horror to see that there is some Rs 28 debited from your account as ATM decline charges and you are like – “What the hell is that”? You talk to customer care and come to know that there are some “ATM decline Charges due to insufficient balance”, you are not happy as you were not aware of it and customer care just has one answer – “It’s as per RBI guidelines”!

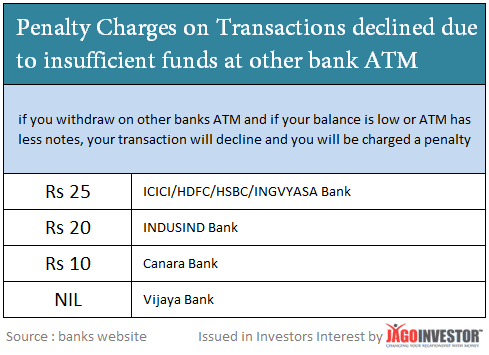

Penalty charges due to Insufficient Funds

Almost all the banks charge you a penalty charge if your transaction at other banks ATM is declined due to insufficient fund. So if you have an ICICI bank account and you are withdrawing money from HDFC or SBI ATM and if the transaction fails due to insufficient balance or fewer banknotes inside the ATM, the transaction will fail and you will be charged!

Here is a real life incident which happened with my Father, when back home, he tried to take out some money from SBI bank ATM (the account is with ICICI bank) and he was not that sure of the exact balance and he tried to take out the money 3 times in a row. We only realized about this charge when I was looking at the bank statement at the end of the month.

| 2 | 07/02/2011 | ATM DECLINE CHG/08-JAN-11/2713 | DR | INR 28.00 |

| 3 | 07/02/2011 | ATM DECLINE CHG/08-JAN-11/2713 | DR | INR 28.00 |

| 4 | 07/02/2011 | ATM DECLINE CHG/08-JAN-11/2713 | DR | INR 28.00 |

How ATM decline charges are calculated?

Decline charges are the base charges + service tax! Each bank is free to define the penalty charge. So in the case of ICICI Bank (and other several banks), the penalty charges are Rs 25 per failed transaction. So when you add service tax, the final figure is Rs 28 (approx). Here are some of the bank penalty charges I found out on their websites.

Is it for real that people pay penalty when there is insufficient cash in the ATM?

If it’s customer mistake, one can still understand the penalty charges, but what do you say about charges, when your transaction is declined because of the bank mistake ! , like if notes in the ATM are not sufficient? What if you are trying to withdraw Rs 5,000 but there are just Rs 100 notes in the ATM (Rs 500 are over) and the transaction failed (maximum 40 notes at a time is allowed) and you are charged for the failed transaction in other bank ATM ?

Here is one incident !

Dear Sir, I the undersigned wish to inform you that i am having saving account no. ******84712 with State Bank of India, Vadgaon Branch, Pune. When I was having balance of Rs.5106.19 (9th January 2014) in my account I went to SBI ATM at laxmi road, Pune but due to technical reason it was not in working position. So I went to opposite Bank of India, Laxmi Road ATM. When I tried to withdraw Rs.3300/- from that ATM it declined saying insufficient balance when I checked with security guard there he informed me that there are only 500 rs. notes available so you withdraw in multiples of 500 only.

So I withdrew Rs.3500/- (ATM 40091 BOI LAXMI ROAD II PUNE MHIN). When i checked today my account it is showing TO TRANSFER INSUF BAL ATM DECLINE CHARGE – ****** Transfer to ******14906 Rs.17/-. Will you please explain me the reason behind this charges.

Here is one more experience you should read where the bank had charged a customer for no mistake!

My friend once had a bad experience with SBI credit card. During some emergency, using his SBI Credit card he wanted to withdraw Rs.10000 from an SBI ATM. He entered Rs.10000 but the ATM refused to dispense that amount and gave a message that it could dispense only 40 notes at a time. Unfortunately only Rs.100 were present in the ATM (This point was not mentioned any where). So, he had to use his card thrice to get the required amount (Rs. 4000 X 2 times and Rs.2000 X 1). After he got his credit card statement, we were surprised to see that he was charged, cash withdrawal charges – 3 times (Rs.250 X 3 = Rs.750). Had the ATM been filled with Rs.1000 notes, the transaction would have been only one and my friend could have saved Rs.500. Is this ethical to charge the customers for such things? (Source)

Have you been charged for Failed ATM transaction due to insufficient balance at some other bank ATM ? Do you feel its justified?

SI fail due to insufficient balance..I am holding salary account in hdfc bank and i was charged 230 INR for insufficient balance.Is that salary account requires any minimum balance?

No , salary account does not need any MB .. check with bank on this

I was charged for the same, by using an SBI debit card at the SBI ATM Machine, But they still charged Rs. 23 as ATM decline Charge. This is ridiculous. what loss do they incur to initiate such ridiculous charges?

Can U please explain for these Losses as mention below.

08-Nov-2016 (08-Nov-2016) TO TRANSFER

INSUF BAL ATM DECLINE CHARGE-111016 23.00

08-Nov-2016 (08-Nov-2016) TO TRANSFER

INSUF BAL ATM DECLINE CHARGE-111016 23.00

08-Nov-2016 (08-Nov-2016) TO TRANSFER

INSUF BAL ATM DECLINE CHARGE-071116 23.00

07-Nov-2016 (07-Nov-2016) TO TRANSFER

INSUF BAL ATM DECLINE CHARGE-071116 23.00

07-Nov-2016 (07-Nov-2016) TO TRANSFER

INSUF BAL ATM DECLINE CHARGE-071116 23.00

07-Nov-2016 (07-Nov-2016) TO TRANSFER

INSUF BAL ATM DECLINE CHARGE-071116 23.00

Hi Mohammed Altaf khan

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

I hold a SB account with SBI, . I had availed a consumer loan with bajaj finser and the EMI was going through ECS. This month I have received a message from the bajaj finserv that ‘ a ECS/cheque bounce charge may be debited by your banker for cheque return. Please ensure sufficient balance next time” . I immediately checked my balance and found that I had sufficient balance. Still I dont understand what type of ECS/Cheque bounce charges have been levied for ECS and that too no fault of mine.

Hi N.Rajendran

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

SI fail due to insufficient balance..I am holding salary account in hdfc bank and i was charged 230 INR for insufficient balance.Is that salary account requires any minimum balance?

No , salary accounts are 0 balance accounts

I was charged for the same, by using an SBI debit card at the SBI ATM Machine, While I entered wrong amount, I wasn’t worried as it wasn’t another bank ATM. But they still charged Rs. 23 as ATM decline Charge. This is ridiculous. what loss do they incur to initiate such ridiculous charges?

You should check this with SBI then !

TO TRANSFER-INSUF BALATM DECLINE CHARGE-290516-TRANSFER TO

98353090018 ,this was the remarks and notes mentioned in my account statement SBI ACCOUNT the ATM is left with only 500 notes i have punched 100’s instead i was charged with 17 rupees .. 🙁

Hi SRIKANTH

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Same thing happend with me, the last 0+11 digit number was different though!

NICE WORK MAN IT WAS INDEED OF GREAT HELP

Thanks for your comment OMKAR

This did happen to me as well. Wrote back to HDFC asking when the communication was sent out informing me of this change.

They didnt reply but reversed the 28 Rs debit mentioning “long standing customer”.

So when did this rule get introduced? Shouldn’t bank send a communication informing of the same?

Bank must have send some communication to you on this

I have received this message on my statement but I didn’t even go to an ATM to receive this message. What does this mean? Was someone trying to take out money from my account from an ATM? HELP

It might happen . You should check with the bank on the time when the ATM was used and then investigate further !

i have for got to provide you RBI rules

https://rbi.org.in/scripts/BS_ViewMasCirculardetails.aspx?id=9008

you can have everything here about the rules you can search more on internet

thank you

Hello Guys,

I have faced same problem Many Many times

but iam gald to say that i got refund of the all the amount which i have been debited from my account

I have an account with ICICI bank ..

mostly i wont check my balance with the ATM ..i use Online Banking so there is not much Occasions

where i used to go bank and when i have to Go i wash out all the money with in 3 transactions..

Let me tell you one of my experience

I have used my card in a Dmart Hyderabad ..After i completed my shopping

i have giving my debit card for payment at the bill counter ..shocking it says declined.i asked him to swipe it again as i was sure about the balance which i have checked online a hour i move to shopping as i was sure i was asking him to swipe it again and again but no use

as i went to near ATM and check the balance there was some amount debited to the RD which has to be debited a 3 days before ..i unknowingly asked the person to swipe it for 5 times

after a month ..i have seen my account is debited with 28 rupees for 5 times

i was shocked to see the transaction.

Guys frankly saying i hate to call the customer service and holding for minutes together to get the Representative to the line and we need to waste the balance in the mobile ..for that ..

That why i use customer care email id which is more responsible and accountable to the customer and

i request you all use email than a call .. as there will be a proof of conversation which you having with the representative ..that will be the good record if we move to the consumer court ..

You wont be having any proof or record of the conversation if you talk to them on phone .

and they will never provide you the conversation audio if you ask.. i hope you guys got the tricks the bank play

Let come to my experience i have placed

email regarding my declined charges ..they have reversed the amount to my account

not only this declined charges ..a month back i have been debited with a Dcard yearly charges ..of 168 ruppes

where i have place a email .and i got it reversed by couple of email

I don’t understand why should we pay D card charges every year when we are already payed for the card first time of rupees 250 for the card ..

This is the Email

” Dear MR. Prasad,

We understand your concern.

we inform that Debit CARD FEE 4546 APR 15-MAR 16 Rs 168.54 has been reversed on June 12,2015.and point of sale decline charges Rs.28.50 has been reversed on June 23,2015.

We thank you for giving us an opportunity to be of service to you.

Sincerely,

Rupa,

Customer Service Officer

ICICI Bank Limited

NEVER SHARE your Card number, CVV, PIN, OTP, Internet Banking User ID, Password or URN with anyone, even if the caller claims to be a bank employee. Sharing these details can lead to unauthorised access to your account.

On 6/24/2015 5:48:33 PM ”

I got only one transaction reversed

and i placed a email for the other 4 transaction to be reversed ..

AND GUYS THERE IS NOT RBI RULE TILL NOW SAYING TO THE BANKS TO TAKE AWAY THE CUSTOMERS MONEY IN WHAT EVERY THE POSSIBLE WAYS

BANKS HAVE ESTABLISHED FOR THERE BUSINESS NO FOR THE CUSTOMERS

WE THE CUSTOMERS MAINTAINING THE BALANCE MAKING BANK PEOPLE LIVE A LUXURIES LIFE

GO GUYS MAIL TO YOUR BANKS AND GET YOUR HARD EARN MONEY BACK TO YOUR ACCOUNT AND ENJOY YOUR EVERY EARNED PENNY ..

Bank are getting billions of rupees profit apart from there maintenance of the staff , banks space rents and ATM machines,

SO RAISE YOU VOICE OR EMAIL OR WHAT ELSE TO WANT TO RAISE BUT FINALLY GET YOUR MONEY BACK

PLEASE USE EMAIL FOR FREE OF COST AND FOR PROOF ..

I am sure i will get my other 4 transactions back ..if not also i am not worried i will appeal to the consumer court and will place a PIL to make it transparent to these kind of issues..

you can find your respective customer care email addresses in internet or on your introduction pack

ALL the best ..Guys

Hey Laxmiprasad

Thanks for sharing your experience with all of us. It was a great learning.

Manish

I was also not aware but the same happened with me last week. I am a SBI customer and withdrew fro Bank of maharashtra ATM. Bank charged ₹ 17 per declined transaction for insufficient funds.

Thanks for your comment Man

You deserve the thanx manish. I wish I w’d have read your post earlier..

Welcome !

Too bad.. din’t saw it earlier, I lost ~120 for four decilned transactions,

don’t feel it is justified at all. They should atleast send one sms stating the same.

Hi rajiv

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Many many thanks…really helped and explained in clear cut way…

Thanks for your comment Harishanker

Its really bad the way this ATM thing works. I have about rs 8000/- and since there is a bandh in my city tomorrow, i went to take out just rs 2000/- with my SBI ATM card. First it was declined saying there is insufficient fund. so i checked my balance and found that i still have around 8000/- balance!. So i went to another SBI ATM booth and there the same thing is repeated. This time i took out a mini statement of my transaction and to my surprise, i found that for each attempt i had been charged Rs 17. I found that they had deducted 17×3=51 rupees!. This is not ethical and the bank should rectify this kind of problem which is not the fault of the customer at all!.

Hi T. newmei

Thanks for sharing that. I know its a issue. I suggest you raise this with the bank grievance cell also

Thanks man, nice & clear article .

Welcome !

i have experienced same incident many times.. i dont know what is the problem…can anybody reply me.. when i checked my account statement it was written like this…

09-aug-2014 To transfer insuf bal pos decline charge-080814

Transfer to 98353029214 Rs.17…

whose account number is this ? Please tell me…Bro

YESTERDAY I HAPPENED TO ME . I WAS USING AXIS BANK ATM TO WITHDRAW MONEY FROM ALLAHABAD BANK ACCOUNT BUT MISTAKENLY USED SBI CARD WHERE FUND WAS INSUFFICIENT , AND SERVICE DECLINED . AGAIN I TRIED AND GOT BOUNCE . THEN I GOT THAT POINT . BUT I THOUGHT THAT THIS IS THE LAST OF MONTH AND I HAVE SOME FREE USAGE AT OTHERS ATM . BUT WHEN I CHECKED STATEMENT OF MY SBI ACCOUNT TODAY 17+17 HAD BEEN CHARGED. VERY BAD EXPERIENCE .

Thanks for sharing that !

Hi Manish,

Are such “Insufficient Funds” charges also applicable for online transactions ?

Like, for example, few days ago, I tried to create an FD in ICICI Bank, using other Bank debit card option, but selected ICICI Bank as the Funds source by mistake, because of which I got the message “Insufficient Funds in the account”. I thereby promptly corrected the option to “Other Bank Debit Card” and created the FD. However, now I can see a debit transaction of Rs. 39 /- in my ICICI account, which, after enquiring from Customer Care , I got to know, is for insufficient funds.

Is it correct for the bank to deduct such charges ? It makes no sense to me, as the transaction wasn’t even completed in the first place. Isn’t the insufficient funds parameter just supposed to be a check rather than a mechanism to collect unwarranted charges from the customers ?

Ravindra

Not for online transactions I guess. . but not sure !

Hi Manish,

I came across the situation with SBI ATM (with SBI card). They are collecting 17 rs for declined transaction. I think its unfair coz they are declining the transaction and charging as if they have given money for the credit though the account is out of funds.

@other readers I could see the term Service by Govt Banks. But in my opinion they are not providing any service as they are charging like anything from common people and feeding tycoons (like Malya). Really shame that the Govts are always in the service of Richies and not at all bothered about the common man interests.

Vijay

Thanks for sharing that Vijay ! ..

In the second scenario, where the ATM doesn’t have sufficient notes and u still end up paying the penalty, Isn’t this a clear cut case of illegal gains/service deficiency. Why not question them in Consumer forums and also complaint to the RBI(Though the channel is to be followed).

Yes, one should do that !

I have been using my debit card from past 5 years with out worrying much about the penality charges. Thansks a lot for sharing the information.

Welcome !

I have charged Rs.17/- for Insufficient balance in State Bank of Hyderabad branch, even I am a customer of SBI. How could they charged to the customer when he is using their own Group Bank’s ATM. I did’nt understand this.

Its group bank , not the same bank !

You can use STATE BANK ATM card in any of the STATE BANK ATM. I confirmed this by calling customer care long time back when the rule of 5 times a month usage came into existence. Since then I am using too and never had a trouble.

But I did have a trouble similar to the topic, where they charged me Rs 17/- as ATM declination charge. My account was having only Rs 300/- balance, and I wanted to take Rs 200/- from State Bank ATM. But when I keyed for Rs 200/-, a message said that the currency denomination not available. Then I tried Rs 500/- ( I didn’t know that time the correct balance of my account), but a message and slip came saying insufficient balance. So I went to another SB ATM where they Rs 100/- notes and took Rs 200/- and from there I learned I had only Rs 300/- balance.

But after few days when I checked online statement, I saw the ATM declination fees. I immediately called the customer care and registered a complaint. There was no reply for almost 2 weeks. Then I send a mail to grievance readdressall in Mumbai office. I got the amount Rs 17/- credited back to my account the next day.

Thanks for sharing that !

As I didnt maintain my minimum balance in Axis Bank they charged penality but along with that they charged an additional 100 bucks as Service Charge on the penality of Rs. 750. Is that correct cause there is no service delivered so how can they charge service charge ?

Hi Prasad

I really have no idea on this . Service charges seems unjustified to me , but once ask them where is it mentioned ?

Is this applicable within bank too? As in if SBI ATM declines transaction due to insufficient funds to an SBI ATM?

No charges in same bank ATM , the article is only talking about other bank ATMs

This is really a good information you have given. I also was shocked when I saw 19 rupess deducted in my SBI account. What should be the solution for this

You cant do much if its valid (bank has mentioned that in their website)

For the credit card transaction, the fee is different from debit cards. Each transaction is chargeable. I don’t see anything wrong here. For the bank, you did a valid transaction and for that, they charged you. The customer is aware that, his requested denomination is not available and he made 3 valid transaction on other bank ATM.

I wish the customer should be aware of the bank charges for any kind of transaction. Thus, easily avoid the transaction charges and not to blame the banks.

And, thank you Manish, for creating such awareness to public .

Thanks 🙂

For using other bank’s ATM, NSF (non sufficient fund) transaction is chargeable. And, it’s logical. You are using your bank, other bank and switching company resources. its a common practice all over the world. I am working in one of switching company in middle east.

But, charging for ATM’s insufficient fund is not correct. Technically, the transaction is declined and that should not be charged. A customer can raise this issue to his bank.

True , its not right to charge customer for insufficient funds !

This is also true for Debit card transactions that are declined due to in-sufficient balance. It happened in my case. But, I was lucky as I requested ICICI bank to refund it for one time as I was not aware of it and they responded positively.

Cheers

Ohh I didnt knew that 🙂 . thanks for sharing !

Thanks a lot for this wonderful post and making us aware of such kind of things.

Cheers!!!

Welcome

Never do the ‘balance check’ at other bank’s ATM.

Always do only ‘withdrawal’ at other bank’s ATM.

Because balance check is also a transaction. I was charged extra 2 months back because of this.

For getting balance of ICICI bank account, give a missed call to 02230256767 from your regd mobile number.

you will get sms within 1 minute, mentioning your balance.

Thats Great ! .. thanks for sharing that !

Hi Manish,

Sorry to post an out of context comment here. There is too much confusion in internet regarding PPF accounts in the name of parent and minor both. It is clear that tax benefit obtained is limited to one lakh. But is it also true that if I put x rupees in my PPF, I can only put 1Lac – x Rupees in my child’s account? If I put more, I wont get any interest and at maturity it will be returned?

I also heard that rule was like that earlier, but now it has changed. Can you please clarify?

Regards

Aparna

Aparna

You should put this query on http://www.jagoinvestor.com/forum/ and for sure you will get 100% clarity on this issue !

Manish

Hi All..It happened with me too…I have one suggestion..Now all bank publised toll free number to get balanced immediatly by just give miss cal from reg. mobile number.So when ever you try to withdrawn money from other ATM..n not sure how much balance in your account.Then before using ATM give a miss call on your bank toll free number to get instant current balance in your account. For HDFC i know 18002703333..i will update all banks number very soon over here. Thanks N happy banking.

Thanks for sharing that Nitesh !

nice article manish , but how to know that which atm will charge decline crgs

Its not which ATM , but the bank ATM, every bank charges some penalty amount, you should get exact number on their website !

Penalty charges on Declined ATM transactions is an unfair rule specially for cases when it is due to ATM machine dispensing issues or connectivity issues.

thanks for sharing your views on this topic .

But isn’t it wrong on part of banks to charge the customer for ATM not have sufficient cash or high denomination notes. I think RBI has to rethink on this. Also if a banks ATM is not working (as I have seen with few banks many a times they are out of service or no cash) and due to this if we withdraw from another bank ATM then if charge is debited then the bank which had its ATM not working should bear the cost.

Yes , Even I think that bank can not charge for the mistake of bank (less notes) , one has to follow up on this with bank

Hi,

Adding my personal experience here.

With ICICI, I was having RD account wherein ECS was going on particular day of month. Once I tried withdrawing some money out of ICICI savings account through HDFC ATM, I got message of ‘Insufficient balance’. Till I insert card to ATM machine, I was sure about balance. My account was also charged with ‘ATM transaction denial charges’ when I checked balance through my mobile banking and saw balance is actually insufficient and less than money I was trying to withdraw.

Then I saw debit transaction of XX amount towards my RD account. Day on which this was debited was not ECS date for RD. Because of bank’s mistake some funds were moved to RD as installment for month on odd day, my balance was low and hence denial fees was levied.

I called call center and registered complaint and got refund of this charge.

You are requested to be very careful about bank charges and thus keep yourselves updated with ‘Schedule of Charges’ updated by your bank time to time. You will get PDFs at bank portals which you should have in your records updated.

Thanks for sharing your experience and what all you did . Lots of things to learn for all investors.

Seems customers should minimize their ATM transactions within a month. A new RBI rule is that withdrawing more than 5 times from home bank ATM i.e from the ATM’s of the banks which we have account also will be chargeable. This is a new feature coming up to cover the burden of maintaining security guards in all ATM centers which is about 40 crores/annum.

Yes, I think you are right . One should withdraw more amount in on go and use it on monthly basis , rather than taking out 1k-2k each week !

Hi Manish,

Thank you for bringing such a nice point to everyone notice.

I think wih a little caution we can easily avoid these kind of charges. Most of the people have multiple bank accounts, keep only some fixed amount in the account for which one always carry a debit/ATM card; and the remaining or extra money in some other account which you do not need to operate frequently. Saves you from fraud as well as we are always aware of our spend limits and know how much amount is remaining. Its easy and not dificullt to remember the amount in your account in this way, one can check his or her sms any time to refresh their memory. In case one is still not know the balance use your smartphone to check it or drop an sms to check the available balance.

Now coming to the second point where the fault is from Bank/system side; make a habit to keep the ATM slip with you till you find everything ok with your account ( I am doing it from last 10 years, even when I was in my 1st year of graduation I had the habit of keeping the records and tallying it every month or quarter and its there till date)

Dont be lazy and ready to fight with the system, you can bring the change. of course it will not be easy but now a days we just need to keep dropping e-mails for that.

In case the ATM is not able to give a printed slip insist the gaurd to give you in writing by signing over it and stamp it if possible. (Axis bank ATM cheque collection always insist to get the stamped counterfoil from the gaurd and with ATM stamp)

Thanks,

Swetank

Quite inspired by your sharing Swetank ! .. Great to hear your consistency of maintaining the docs .. lots of things to learn from your financial life !

Hi,

Thanks for the article!

According to you, what do you think we should do when such things happen to us? Do you know of any incident where the banks have refunded these charges due to technical failures? Just curious to know.

Rameez

If its customer mistake, then its as per terms and conditions, but if its not because of customer mistake, then you need to talk to bank on this first and then take it forward.

Thanks for the information.

Thanks for always getting us Hidden charges by cunning financial institutions. our mistakes cost mony. banks are very innovative on charging. good one.

Welcome !

Hi manish,

Really shocked by seeing these kinda rules. Few days back i was trying to take money from Indian Bank itself (Account holding bank), it showed ur transaction declined. later i took from icici, but just now i checked my account, surprised to see Rs20 has been debited from my account. Customer care people explaining that i might have taken from other bank ATM. Anyway hereafter atleast we should make record of ATM visits!

Thanks for sharing that !

Nice information… But surprised that even the issues with ATM are also charged for the customers…

They are, but the question is if they should ? I think the systems of companies are not equipped to find out who was at fault and they just charge based on the failure , so I think that should be stopped and compaint should be made with RBI on this !

Hi Manish,

I was also in surprise and horror, when I few days back checked my ICICI Bank account statement. There was a debit of Rs. 28.09. It was towards a declined transaction at an other-bank ATM done in the month of Dec’2013.

I guess I had been aware of balance in my bank account before initiating the transaction to be declined, and had not entered any larger amount. But as I did not have a habit of recording my visits to ATMs, I cannot say for sure which of my transactions was declined and why. From this incident, I have learned to keep a record of these details about my every visit to any ATM henceforth: Bank of ATM, my bank name and account balance in the beginning, address of ATM, time of transaction, response shown on ATM screen, and most importantly preserving every printed transaction slip for future reference.

It really feels very bad if we are charged as well as declined withdrawal for some technical problem with the ATM. It must be curbed.

Hi Rishi

True , that should not happen . I think you should follow up with bank on this and take their explanation on why you were charged for the system failure ?

Its not due to some technical reason.

They have this mentioned in ICICI website.(Not sure about other banks)

I came to know that after sending an email to ICICI customer care.

25 Rupees + Service charge i believe.

Yes, but its when you make the mistake of taking out more than what you have in the account, incase of system failure or some technical failure, they should not cut the charge, but they still do !

manish

I cannot go to bank and ask them confidently because I do not remember which transaction I had been charged for, nor do I have such an ATM receipt. I am feeling so bad about this. This is the lesson I have learned from this experience – to preserve the date/time/ATM bank name and address and ATM receipt for later reference.

I think let it go this time and be careful from next time

Hi, Even i faced this problem when i tried with ICICI Bank Debit card in Non ICICI Bank ATM. Without knowing the actual balance i tried 4 times thinking it was some ATM error and lost 112 rupees (28 * 4) 🙁 🙁

Yea, then you would be paying those charges. you should know about it now !

This is my personal opinion and I am entitled to one :

Here is what i think . Such nonsense charges should be done away with because all these systems are automated and based on IT and software . If you are not charging for every positive atm transaction then whey charge for a negative one . Basically its all ways of looting . Earlier banks used to sends sms for free now they charge for it , charges for extra cheque book , charges for bank statement , etc .. Many of them are justified since it involves Manpower but for automated systems this is not acceptable , where there is absolutely no extra cost involved.

Hi Joel

Yes, I agree with you.. But I am not sure if they can really abolish those charges. When you get in contract with any company, you do only when you are ok with their terms and conditions and these are all part of terms and conditions, you don’t ask them to change them . So if bank is doing anything other than what is mentioned in their terms and conditions, then its a wrong thing, else I find it ok .

Manish

Hi,

I disagree to an extent. When it’s a matter of service to public then public interest has to be first. Charging for SMS is ridiculous and do we expect common man who lives on daily wage to pay for it? The same is with charging for declines transactions and for the debit cards (why Credit cards are given for free?). Bank account is required due to LPG and Aadhaar transactions and that makes everybody susceptible to such leakages of hard earned money. Bank’s are supposed to be responsible towards customers. The IT and Computerization of ATM is made to make life easy, but I see with all these policies we will go back to old days.

I have lived in Europe for couple of years where banks are open of 4 hrs day, but ATM’s and all automated stuff works 24×7. Big idea is reduce the amount of people coming to bank, this reducing the manpower, saving the revenue for the bank, and bank focus on utilizing that revenue for providing better services/needs (24×7), which will swell the customer base.

Problem with Indian market is that everybody wants to make money even banks who are supposed to provide public service (including SBI) and these are cheap tricks to just do that.

About getting in contract with a company, being consumer we have to be cautious. Some of the basics I following are:

a) Have a salary account – prefer ICICI

b) Have an account in Gov. bank – such as SBI (sort of dormant account with no card. Transactions are by cheque or online, but just for tough times)

c) Have an account in Kotak, Yes or similar where you get 6-7% returns. (again no cards and Transactions are by cheque or online).

That works at this moment. Need to change strategy when such charges are levid on online transactions also :(.

Hi Bhaskar

Thanks for sharing your views on this topic . Nothing wrong in having a different opinion, in this case what do you suggest banks should do ? I think RBI has clearly agreed on this with banks that they can put their charges for these things . Now are you saying that regulator is at fault on this ?

Thanks for spreading awareness about this. I don’t understand the logic behind these charges. Maybe if there are repeated attempts to withdraw despite low balance, the bank can levy some charges. But a genuine mistake of entering an extra zero or if that ATM is out of cash – why should we bear charges for things like that?

This statement about “Its as per RBI guidelines” is all good when its in favor of the bank 🙂

Yes, I think there is some gap between what really should be charged and what they charge for. If there is any change from what is mentioned in terms and conditions , then better follow up with bank and take further action on that !

Actually, I am not aware of this penalty charge. Today I learned from your article. Thanks for this article at right time. Because after implementation of some charges even if we withdraw the money from the same bank ATM, this case will occur frequently.

Great to know that. One has to be aware about all the charges !

Didn’t even know something like this happens. Thanks for bringing it to our notice.

Welcome !