Getting Claim from Multiple health insurance policies – Rules and Process Explained !

POSTED BY ON April 8, 2013 COMMENTS (86)

One of our readers Yogesh asked on our Jagoinvestor forum, about the claim process in case of multiple health insurance policies. I then realized that this is one the biggest doubt in the mind of investors and it needs to be cleared. Another doubt which is there in many minds is what is the claim process and the documents required if one wants to claim from multiple health insurance companies.

In this article, I will explain you the rules regarding heath insurance claims from multiple companies and some important points, along with the claim procedure too!. Recently IRDA came up with IRDA (Health Insurance) Regulations 2013 and overall it has made the claim process more easy and customer friendly, which we will see in some time.

A lot of people can end up with multiple health insurance policies with them. It may happen that they have a health cover from employer, and side by side they have taken a separate health insurance plan (which is a good thing) . Also there might be a case that a person had a old health insurance plan taken years back and now he has taken extra cover through a different plan . Another case can be when a person has taken more than two health insurance plan so that parents are also covered and immediate family like spouse and kids are in another policy. So these are few reasons why a person can hold multiple health insurance plans.

Declaring your existing Health Insurance while buying a New Policy

Before we move forward, its extremely important to understand that when you take a new health insurance policy, you always have to declare your old health insurance policies which are currently in force. This would include all those policies for which you are paying the premiums yourself from your pocket. If you are not paying the premium from your pocket and if your employer is paying it, then you don’t need to declare it in the new policy. Note, there are certain Insurance Companies which do not demand such information. In such cases, you are not required to inform about this.

This is extremely important because if you do not disclose this fact, you are violating the terms and conditions of the health insurance contract and in case of investigation this could be termed as mis-representation. Now we will discuss the rules regarding claiming from multiple health insurance policies .

Claiming from multiple health insurance policies

A lot of things have changed few months back. So we will discuss both “before” and “after” rules, so that there is no confusion left.

Before the Regulations (Previous Rules)

Before the regulations came into effect , there was something called as “Contribution Clause”, which said that a customer has to inform all the health insurance companies he is insured with and all the insurance companies will contribute the cover amount in the ratio of their sum assured (read how much health insurance is good enough). Obviously the assumption here is that the insurance companies are aware that you also have a cover with someone else , which you must have declared with them at the time of taking the policy .

For example , if earlier you had two health insurance plans with 3 lacs sum assured from company A and 1 lacs sum assured from Company B , and if you had a claim of Rs 2 lacs. Then you had to ideally inform both the insurance companies about the claim and they will settle your claims in the same ratio of the sum assured. So 1.5 lacs (75%) was to be paid by company A and 50,000 (25%) had to be paid by company B because of the “Contribution Clause” . Its a different matter than customer never told one insurance company about the cover with another companies and the company which got the claim request happily settled the full amount, even if it was not supposed to . This kind of rules earlier made sure that it was not in customer interest and lot of hassles was there if he had more than two policies. But after the regulations it has changed !

After the Regulations (Current Rules)

Now after the regulations are into effect, the claim rules are very easy . Now the contribution clause will not be applicable if your claim amount is less than the sum assured of the insurer where you are claiming. However , if your claim amount is above the sum assured of the policy, then the insurance company will impose the contribution clause. You are free to choose which insurer to catch for your claim. So let us revisit the same example we took some time back.

- 3 lacs sum assured by company A

- 1 lacs sum assured by company B

- Claim amount = Rs 2 lacs

Now with the new regulations , you are free to catch company A or company B to settle your claim, but now

If you go to Company A for settlement – Then your claim amount (2 lacs) is less than the sum insured (3 lacs) , so company A has to fully settle the full claim of 2 lacs and they cant tell you that the contribution clause will apply.

If you go to Company B for settlement – But, if you choose to go to company B for settlement , then your claim amount (2 lacs) is more than the sum insured with them (1 lacs) , so company B , has the right to apply the contribution clause and then they will only pay 50,000 to you (25% of their share , remember they have only 1 lacs sum assured out of your total 4 lacs) and will ask you to claim the rest from company A .

Now imagine the different scenario where your claim amount is 4 lacs

In-case here in this same example, if your claim amount is 4 lacs, then your the contribution clause will apply because your claim amount is more than the sum insured of 3 lacs and 1 lacs both, so it does not matter which company you approach first, the contribution clause will come into effect .

Better to have a Large cover with single insurer

Which now explains why its advantageous to have a big enough cover from a single insurance company (like say 10 lacs sum assured from one company) , rather than having small covers from multiple insurance companies like (4 lacs , 4 lacs and 2 lacs from 3 companies) . You will face a lot of documentation issues if your claim amount is large because then the contribution clause will apply. ( Read 17 Most asked questions in Health Insurance)

I hope these examples has made it clear to you about the the rules for multiple health insurance policies claims . In-case you have more than 2 policies , still the same rules will apply.

What is the Claim Process in case of multiple health insurance policies?

Here there can be two cases – Reimbursement Claim or Cashless Claims , but for this article, we are looking at reimbursement claims procedure. Even in case of cashless claims , if its from more than one insurer, reimbursement is involved anyways, because – The final approval for any Cashless claim comes at the time of discharge. Hence, only one claim can be made through cashless. All the other would have to be made through the reimbursement mode. Now lets see what is the procedure involved in claim process.

In case of single claim

- Intimate the health insurance company at the time of hospitalization

- At the time of actual reimbursement, fill up the claim form

- Attach all the bills, receipts, discharge documents, prescriptions, diagnostic tests, including films required by them in ORIGINAL

- Keep tab on the claim status. The TPA or Insurance Co. could ask for additional documents for settlement of the claim. You need to provide such documents.

- You will get the claim in around 30-40 days depending on Insurance Co. to Insurance Co.

Incase of multiple claims

- Intimate all the health insurance company at the time of hospitalization

- Now you first have to choose the company from which you will claim first.

- Fill up the claim form

- Attach all the bills and documents required by them in ORIGINAL

- Take additional attested copies from Hospital for the no. of insurance companies you are likely to claim from.

- Insurance company will issue you a statement saying that they have all the original proofs and documents and they have settled the claims

- once the claim is settled by first company then you move to the next company, you need to get a claim settlement summary (which mentions about the claim made, deductions made, and claims settled etc.) then you move to the next company

- Fill up their claim form

- Attach the claim settlement summary

- Attach Attested copies.

- Create a covering letter explaining that you have earlier claimed from Company X, and the details of documents enclosed.

- If you still want to claim it from more companies , take the claim settlement document from 2nd company also.

- Repeat the process with all companies from which you want to get the claim. You will get the claim in some days or weeks

How will the claim be paid

- The first Insurance Company will apply deductions and limits as per the terms and conditions of the policy against the claim made and make the payment.

- The second Insurance Company will also apply deductions and limits as per the terms and conditions of the policy against the claim made as if the claim is originally made to this Insurance Company, and arrive at the payable claim amount. Once this amount is arrived, it will deduct the amount already received from first insurance company.

Does Sequence of Claim matter in-case of multiple companies ?

My friend told me that the amount of claim you get back at times can be different depending on the sequence of claim. Mean if you settle your claim from company A first and then Company B , it might happen that you may get less money back compared to when you first approach company B and then company A .

But there is a catch here, this situation assumes that the insurance company does not apply the contribution clause, which actually happens in reality. Mahavir Chopra shares with me that in real life , the claim cases they handle, they have observed that companies do not bother to apply contribution clause even if it applies. So the companies in real life in maximum cases, the health insurance companies settle the claim or reject it as per the situation and condition.

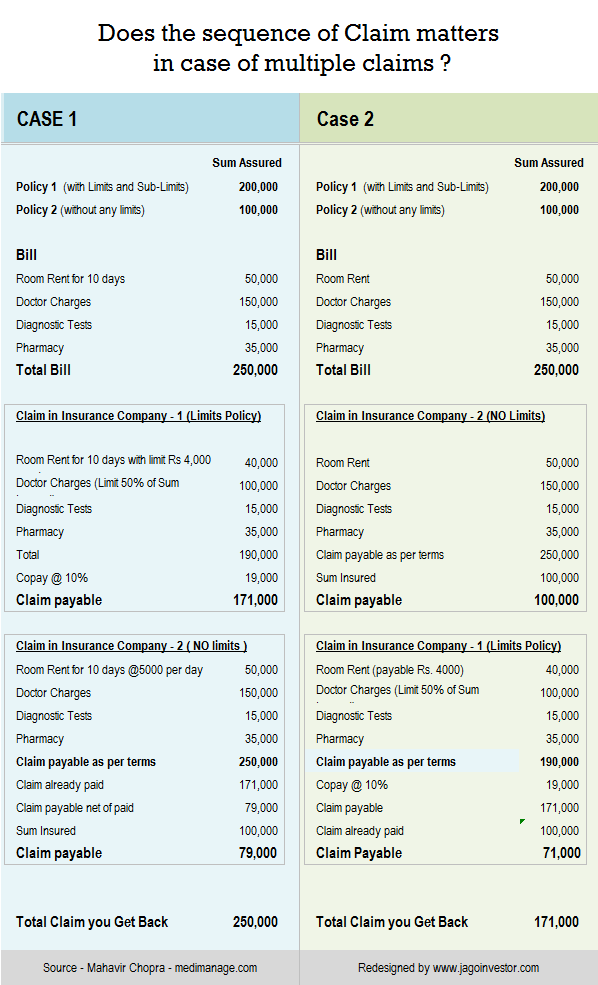

Now coming to the main point which I wanted to tell you. Lets say that someone has two health insurance policies with him.

Policy 1 – 2 lacs sum assured (but with some limits and sub limits applied)

Policy 2 – 1 lacs sum assured with NO LIMITS or restrictions

And lets say that his hospital bill was 2,50,000 in total as explain in the chart below. So now he has two choices , Either claim from Policy 1 and then Policy 2 , or reverse that order and first claim from Policy 2 and then Policy 1 . In both the cases he will get back different amount. Lets see those.

Learning – In case you have 2 policies , and there was a case where you have to claim from both of them, always claim first from the company which has LIMITS and restrictions, and later from the company which does not impose any limits, this will maximize your claim amount in total.

Important Note – In case where contribution clause is applied, even in that case the conclusion remains the same, the case 2 claim amount in that case is 1,14,000 (unlike 1,71,000 without contribution clause) . You can check out the workings yourself.

Some Good practices and points to remember

- If you have a group cover from your employer, it would be a good idea to apply for the claim from them first, because the claim process is faster with group cover , the preexisting illnesses are also covered there in initial years and lastly, the number claims there is not going to impact your premiums .

- Its always a good idea to have a single company cover of a higher amount, rather than having small covers from many policies, If you have small covers from different companies, it would be a good idea to consolidate your cover in a single policy or maximum 2 policies, not more

- The same thing claim rules will apply in-case of Top up and Super Top up health insurance policies, because there you claim from more than 2 health insurance companies.

Conclusion

At the end, I would say that its always good to have a big enough cover for yourself so that you don’t have to deal with multiple health insurance companies. You can have the separate cover along with your employer cover if you want. So, How many health policies do you have currently ? I hope you are now clear about the claim procedure from multiples health insurance policies ?

86 replies on this article “Getting Claim from Multiple health insurance policies – Rules and Process Explained !”

Comments are closed.

sir, My father is 63 years old. My Mother is turning 60Years this December and going to retire (Gov. teacher).

My father (and Mother) has 4 Lakhs Insurance coverage as he retired as a bank manager. Last year he underwent surgery for stroke and he recovered.

Now I am planning to take 10 Lakhs Senior citizen health insurance from star health. It is saying that 30% co payment, and also In star health insurance it is showing limits for specific disease and surgery. For example for 10 lakhs SI it is showing 350000 only. If the claim amount is beyond 3.5 lakhs can I claim in 4 lakhs insurance coverage which is provided by my fathers bank.

Kindly give your valuable suggestions sir…

It has standard rules like eveyr other company for senior citizen . go ahead . At least you are getting it .

MY team can help you find the better alternatives, but we will have to talk on that

We think our pro membership will help you as it fits in your requirement. We have various benefits under it like life insurance, health insurance, mutual funds and your financial analysis too..

Just check out our Pro membership once and schedule a FREE call with us to know more – http://jagoinvestor.dev.diginnovators.site/pro

Thank you Manish, you doing a great service. My hospital In Mysore is refusing to give me an attested copy of the the bills. They are saying that I cannot claim from two insurance companies. Total claim is 3lakhs, first insurer is paying 1 and second has agreed to pay 1.5. But the hospital is saying it’s illegal. How can I convince them?

Its not illegal. They just dont know the law. I am not sure what can be done in this case !

Hi Manish ,

I am 59 . I have reliance health-wise from past 7 years for a 3Lakh cover . I might have to undergo a knee surgery in the next two years. I would like to have a 10 L coverage . What is my best option. I am considering not to disclose my knee problem as I will have a waiting period of 4 years in most insurance policies.

Sorry , the insurance policy is only for things which are not planned and comes as a surprise. No company will give you the policy which pays for that

Hi Manish,

Your article is great help for people like us.

Both me and my wife are covered by our respective employers. Both of these policies seem to have sub limit on Maternity claims. The hospital expenses we incurred exceeds the sub limits of both these policies.

So after reading you article what I understand is, I can claim from both these policies one after the other and get back my full amount spent.

Am I right?

Thanks

Joji Abraham

Yes, but the total amount you claim should not be more than the total spent !

Hello Mr. Manish,

Thanks for all your answers and clear our queries.I need a help on the following matter.

My wife is having a Policy for last 4 years from Maxbupa and on 16th June it will be her 5th renual.Last week she had to be hospitalized following a breathing trouble and she was diagnosed with ILD. This is a pulmonary disease.

She had HDFC ERGO policy and cashless claim has been settled.Now she has Maxbupa Policy and I wanted to increase sum insured by putting some more Money. As a protocol I have disclosed her disease to the Max bupa Doctor who called me for medical queries. Now I have got a letter from Maxbupa which I am not able to understand the clause.My question is Can she still continue with the existing Policy without having to increase SUM insured and this disease will be covered henceforth?For this Can company ask for more premium amount?

Regards,

Sanjoy.

You can continue the same policy and the same illness will still be covered.

Regarding increase of premium, that will happen , but not due to your claim , but because of age increase, which is a standard thing in all policies!

Hi Manish, please help me on below query.

I have a group policy from my employer ( sum assured 3 Lakh). Recently my father went through surgery and hospitalization expense came around 1.3 Lakh. Since there was a co-pay of 20% hence i had to pay 26000 from my pocket. I also paid pre-hospital expense ( test reports) for around 25000. My father also has a individual health insurance policy (sum assured 2 Lakh) but that has a limit up-to 45000 for this surgery. Can i claim 51000 ( 26000+25000) against this individual policy?

Thanks,

Pankaj

No , these amounts are to be paid by you only irrespective of the type of policy !

Hi Manish,

Excellent and very helpful article. I am trying to claim from multiple insurance companies.

Following is break up of the hospitalization cost for my Mom’s knee replacement.

1) Hospital 2.5L 2) Implant 1.3L 3) Pharmacy + Tests 30K 4) Physiotherapy 15K

Total Cost: Appx 4.2L

I have two policies : 1) From a private player SA 3L + 60K Cumulative bonus

2) Employer cover of 1L

My Calculation is that private player will have a share of 78%(3.6/4.6) and Employer cover will take 22% share(1/4.6).

Sequence of claim will be 1) Private player 2) Followed by claim with employer policy.

My Questions

1) Is my calculation correct. Will cumulative bonus be considered during the calculations?

2) Do I need to submit all the original documents to private insurance company.

e.g Hosp cost + implant cost is 3.8L which is more than private player’s share of 3.3L. Should I submit photo copies of Pharmacy and Physiotherapy to private player and keep the originals for Employers policy? Or do I need to submit all original bills worth 4.2L with 1st claim.

3) Is physiotherapy covered in most of the policies? I went through policy wordings , didnt find any specific clause for the same. What all documents will I need to claim cost of physiotherapy.

Just for Info:

Both policies are more than 3 years old and cover knee replacement cost.

Room rent is taken care of and is within policy limits

Thanks in advance,

Dev

There is no % ratio .. you need to first claim from one company and then rest amount to be claimed by another as simple as that.

You will have to submit the originals to first and that company will give declaration that the originals are with them, based on that the 2nd company will honour the claim

Regarding physiotherapy is covered or not, if the policy says its not covered, then its not covered, else it is !

Thanks manish

Hi Manish,

Thanks for wonderful article

I have a group cover from my employer under which my father is also covered (sum ass. 2.5 L). He also has his own personal policy with a different insurer (sum ass. 2L). My father has been undergoing bypass surgery. that will total expenses of 3.9L. In this case to whom should i contact first for maximum expenses cover?

First contact the group cover !

Hi Manish,

Excellent article as all have said. Good work here buddy.

Please suggest some options for Family Floater Policy which have maximum coverage and benifits

Hi Merwyn

Thanks for sharing your health insurance requirement. I think the best think you can do is leave your details at https://www.coverfox.com/jagoinvestor . And you will get a expert assistance on selecting and buying the right policy for you.

You can then take the decision.

Manish

Nice article Manish………very informative and helpful!

I am seeking your advice on one issue. I have health cover of Rs.4L from employer. But there is clause of 20% co-pay for parents. I also have personal family floater health cover of Rs.1L. Both insurance policies are from ORIENTAL but with different TPA.

Recently, my mother underwent ear surgery which costed us around 2L. Employer insurance covered 1.6L(20% co-pay). So I registered claim with my personal health policy for remaining 40K. But they rejected my claim saying contribution clause is not applicable in this case.

I have been through IRDA guidelines, but i didn’t find any such specific clause. So I need your advise on this item.

Company is correct there. The copay part can not be claimed. COPAY is what the customer pays from their pocket !

Manish,

Very good article. As per you illustration with Case 1 with limits and Sublimits and then claiming through Claim 2 , its giving back the policy holder full amount of Rs 2,50,000 right which includes the copay right?

Please ask open ended questions, i will have to read the whole article to understand which part you are refering to ?

Hi Manish, I have life insurece policy with Helth riders sum assured 3L in reliance company and helth insurance policy with star health insurence company sum assured 3 L . Then recently I undergone kidny transplantation surgery. Total cost: 4.78 L. First I claim with reliance company. I submitted all original bills . They settled the claim amount is 3 L. Remaining amount 1.78 L was claim in star Helth insurance company.. But they asking me original bills. I explained them and submitted them claim settlement letter which is settled by reliance company. But they asking me still original bills and herrased me. Then I filled case in consumer court. They still argue about original bills in front of judge. I explained same procedure which is explained by you in front of judge.. But judge told to me submit any proof of this rule by authorised organization. On before 28/12/2015. Can you help me regarding this..?

As per industry standard , you need to take a declaration from the old company (Reliance) that they have the original bills and the other insurer should settle the claim based on the xerox or the declaration

Manish

Hi Manish – Thank you for this wonderful article.

Please see if you can help me with this query.

I have a group cover from my employer under which my father is also covered. He also has his own personal policy with a different insurer. My father has undergone a cataract surgery. I have heard that the entire cost of the cataract surgery may not be reimbursed. In this case can I go to the 2nd insurer and ask them to reimburse the remaining amount.

e.g. Group cover is for 5L and individual cover is for 2L. If the cost of surgery is 80K, and if the group cover company reimburses only 40K, then can I go to the 2nd insurer to claim the remaining expense?

No it wont happen this way . There is a reason why the first company is not reimbursing the full amount. THey might not be covering few things and most probably even the first insurer might not cover them .

I have exactly similar case like Brijesh. I applied from my company for cashless and was allowed 85% of the cost, rest I paid from my pocket. My younger brother has a medical insurance policy for my father and his company covers full cost. Now can he submit the rest of bills and get claim for that.

Yes, he can do that

Hi Manish,

First of thanks for very informative website. I must confess i have read most of your article great work !!. I need some advice on below doubt

say for ex:

Your article mostly deals about either two personal health insurance provider or one personal insurance provider and one group insurances provider. My question is for couple who are working and have respective group insurance from their respective employer

Both Husband and Wife are working and have group medical insurance provided through their employer. Now incase of hospitalization can both of them apply to their respective insurance firm for the medical expense.

Yes, they can .. Ideally first one should try with their spouse health insurance .. and then their own .. and if it needs to be shared, they can do it for both , if sum assured is less than what is needed !

Hi ,

I’ve been reading your blog since long and must say that it has educated me a lot in terms of finance.

Thanks. In line with the above querry, wanted to understand what does it mean by ‘if it needs to be shared, they can do it for both , if sum assured is less than what is needed ‘

For eg. if my employer has cover of 5L and husband’s emplyer has 3L, then if needed I can claim max. upto 8 L ? or max. upto higher or two i.e. 5L ??

What is the reason for claiming from spouce’s insurance first and then form my own?

It would be max 8 lacs. The reason why you should apply from husband employer first because it will be treated as others claim and not yours

Thanks Manish for Reply.

As you siad “he reason why you should apply from husband employer first because it will be treated as others claim and not yours”…How does that matter?

Employer insurance is kind of temporary , which you have for few years and then you will have another if you change the job, so its better to do any claim if the policy which is from employer so that your main policy is untouched.

OK…Thanks 🙂

Thanks for the article. Quick question on the same line, If it in case of Maternity costing 1lac, can we claim from both Husband and Wife Employer Insurance from company. Please advice.

Hi Vigneshwari

Not for the same expenses, but partially you can do that. But the documents sharing will be an issue

Manish

Could you detail about Royal Sundaram or other insurance better to go with. I need to go have health insurance immediately

Are you ok with their features !

I myself had this doubt about multiple health covers, and must say you explained it in the simplest of ways, had researched a lot on this and found a lot of data on it but not many were as simple as this one. I guess its always simple and easier to manage one policy over multiple ones.

Thanks for appreciation Aniket . Yes, one policy is always the best !

Hi Manish,

Thanks for the detailed information. As always an excellent article. It helped me a lot to claim reimbursement.

Regards,

Sukanth

Great !

I think that w/contribution

Case 2: Policy 1 will pay 83000

Policy 2 should pay 2/3*1.71 = 114000

so total shd be 197000… am i missing something?

Check the image

Hello Manish,

Thanks for this detailed information.

I have a query related to multiple policies:

My mother was hospitalised recently. Initially I used the health policy from my employer. The amount of 2 lacs got exhausted and I had to pay additional bill of 1 lac (Total bill was 3.20 lacs).

My father also has a health (1 lac) policy from his employer.

Now we want to go for re-imbersement from using his policy.

My question is: my mother was hospitalized last month. at that time my father was on duty. But 15 days later he got retired. When we got discharge from hospital my father was retired.

Now will we get re-imbersement from the second insurance company? will we get re-imbersement for only the amount of days for which he was on duty or will we get for whole hospital stay?

Please provide your inputs on this.

Regards,

Sachin

Only if the policy says so in the brochure ? You need to check the policy document on the rules.

Hello Manish,

I see one disadvatage in going with Single Policy. As many companies will provide benefits if there is no claim.

Say for example:

I have Apollo Munich and Max Bupa policies for 5 lacs each.

If my claim is less than 5 lacs in a claim year and I claim in Apollo ; MAx Bupa would give me the no claim benefits (and Vice versa). But the above no claim benefits would not be applied, if I would have had single 10 lacs coverage from Apollo (or Max Bupa) Only.

Please advice.

Thanks,

Neelesh

Yes. thats a good point ..

Hi Manish

I am going to buy the Max Bupa Family First Policy very soon (within a day or 2). I have a query regarding the above product:

1) The tele-sales guy said that since the policy covers both myself and my parents; I can claim 80D benefits for both. For instance my premium turns out to be 25000 p.a. for me, my mother and my father; and in that I can exempt whole amount (15000 for self and 15000 for parents). I am not sure whether this is true? Is it possible to claim tax benefits for my parents (15k) and myself(15k) from a single policy ?

2) Secondly, due to a recent Angioplasty; my mother is not covered till Nov 2013. So shall I go now with my father and myself now and include my mother next year? OR should I wait till November and then take the policy ?

3) Lastly, how is that product: Max Bupa Family First ? And is it true that if sometime in future if any one from my family is diagnosed with a major ailment (say kidney failure); then in succeeding years the insurer will not increase the SA further ?

—

Nikhil

Already replied on email

1. Yes, what matters is that you are paying parents premium , does not matter if its seperate or same policy . You should be able to claim 15k , and if your parents are above 60 , then you should be able to claim 20k for them and 15k for them , totalling 35k.

2. Ok , you mean that they will not allow your mother any policy till Nov 2013 . in that case better you take your and father policy and then take seperately for mother later, if you wait for later, it might happen that your father also does not get it . There is a plan from star health just few days back which covers cardiac patients only, even if some one has gone through angioplasty , still it covers them and covers them in just 90 days .. but the premiums are VERY VERY HIGH , for obvious reasons 🙂

3. Obiovusly , If you have a major attack and then ask insurer to increase cover, why will he do that , when he knows the inherent risk now , look at it from business point of view. Insurance is all about covering the UNSEEN , when its already SEEN or mostly SEEN , then it has to be HANDLED and not INSURED 🙂 . I hope you got my point .

Hi,

In claim process you have mentioned that ‘after’ one company settles the claim, ‘then’ file claim with another company with the letter from the first company. I do not think this is feasible as by the time the first company settles the claim, time limit to file the claim with second company will run out. Now a days they have a time limit to file a claim. In which case your scenario may not work effectively.

Please comment.

Thanks

Hmm, nice query.

Manish, any comment on this?

Hello Mr. Choksi,

Time limit is not applied in such cases, as there is a genuine reason for delay in submission. When you provide the claim settlement summary, there should be no query or issues on delay in submission.

thanks buddy, this is really a knowledgeable article

Thanks

Hi Manish,

A great article again from you. Thanks for sharing such valuable and useful information.

Thanks,

Puneet

Thanks

Eyeopener.

But having multiple life insurance policies should not cause any problem right

No , it will not

No

What I think the meaning of contribution is:

Say 2 policies with SA 1 Lac and 2 Lacs (so contri ratio is 1:2).

Claim Amount: 2.5 Lacs

Now,

Poilicy 1’s payable claim is 1 Lac (considering it being the only policy)

Poilicy 2’s payable claim is 1.71 Lacs (considering it being the only policy)

Now, bringing the contribution into picture within the context of actual claim of 2.5 Lacs.

Policy 1’s proportionate claim: (1/3)*2.5 = 0.83 Lacs

Policy 1’s proportionate claim: (2/3)*2.5 = 1.67 Lacs

Since the above are below their respective payable claims i.e. 1 Lac and 1.71 lacs.

I think in end the customer will get 0.83 Lacs from Policy 1 and 1.67 lacs from Policy 2 = 2.5 lacs in total.

—

Nikhil

What doubt you have in the chart above ?

The chart above is w/o contribution. Suppose the contribution is there then having the above 2 policies (with contribution clause); the customer will get full claim ? Am I correct ?

Hi Manish

I have a doubt. In your article above you mentioned:

Important Note – In case where contribution clause is applied, even in that case the conclusion remains the same, the case 2 claim amount in that case is 1,14,000 (unlike 1,71,000 without contribution clause) . You can check out the workings yourself.

I am assuming that with contribution clause the total amount claimable is 1,14,000. Now, consider that the policy 1 (of 1 Lac) was not there i.e, he only had one policy worth 2 lacs. In this case he could claim 1,71,000.

So, by having a separate policy of 1 Lac (so contribution coming into picture); the guy ultimately got lesser money? Having a second policy is causing overall losses?

—

Nikhil

Its mainly the desicion of going with the first one (policy with 1 lac) . A lot of people might think that they shoudl just randomly do that , and then then mess up

manish,

thanks for the article.

the link pointing to “top-up-super-top-up-health-insurance-how-they-work.html” is incorrect. “http://jagoinvestor.dev.diginnovators.site/www.jagoinvestor.com/2016/01/top-up-super-top-up-health-insurance-how-they-work.html”

Fixed 🙂 . thanks for pointing it out

Hi Manish,

I must compliment you on writing such a detailed, succinct and well researched article!

Can I just say that most of the point are on the spot and very helpful. But I think the idea that one should claim from a “restrictive” policy first isn’t true all the time. In this example it does make sense but that’s because the data is slanted accordingly.

In my case my ICICI (no limits) is 4lacs and New India (restricted) is 2lacs. Its my opinion that in case of 2 policies its better to claim from the policy with higher SI. Even in the above example if you change the SI to make a no-restriction policy have higher SI than the result would be different and opposite!

What’s your take?

Amar

In most of hte cases it will work , but first the restrictive amount is paid , then the next company does not have any restriction and can pay the max amount . I think in majority of cases , it should work

Just to clarify , you should not go with restrictive policy if your claim is possible with just one company , In the example in article , we had to go with multiple companies because the total claim of 2.5 lacs was more than the sum assured of 2 and 1 lac.

Well done Manish. Very detailed article. It will give a lot of clarity to several people who have more than 1 health insurance policy

Thanks Steven

Glad you could get invaluable learnings out of my writing !

Thanks for this detailed write-up Manish, now that I have to apply for a claim, will try to incorporate some of the advice and then share with you me real-life experience in dealing with my health insurance company …

that would be a great thing 🙂 . Please share your experience for benefit of others

great .. please do 🙂

Small mistake here:

“Now the contribution clause will not be applicable if your claim amount is less than the sum assured of the insurer where you are claiming. However , if your claim amount is below the sum assured of the policy, then the insurance company will impose the contribution clause.”

Hi Pankaj

I corrected it, thanks for pointing it out 🙂

Fixed Pankaj 🙂

Best of the best article ….

Thanks Sanyam !

Quite and extensive article Manish. Very impressive.

And i totally agree with your advise on “having a big sum assurance and that too from a single insurer”. In fact this is very much easy these days due to the portability benefit and many private players coming up with huge sum assured option. Unlike earlier when the maximum sum assured used to be avaialble was on Rs 5 lakh.

True Manikaran 🙂 .. thanks for your views on this article .

Nice Article Manish.. very informative and helpful..

I have employee cover and a personal family floater of 10L(With 2 year NCB it will reach 20L) from Apollo Munich and I hope it will suffice when employee cover is no more….

Although i have read many places on Top Up cover but havent seen many products in the market.

I will write very soon on the top up covers .