Days Past Due (DPD) section – What is the meaning in CIBIL Report ?

POSTED BY ON January 25, 2013 COMMENTS (143)

You might have seen a section in your Cibil Report which says DPD (Days Past Due). While Loan Status and Credit Score matter a lot when it comes to getting a loan approved or rejected, a big myth among people is that a clear report (without SETTLED or WRITTEN OFF status) and a credit score above 750/800 are the only two things that they need to get a loan.

at

That’s not true. While a clean report and a good score are definitely primary level requirements for getting a loan approved, there are finer details which a bank looks at, before deciding if they want to give you a loan or not; and Days Past Due or DPD is one of those important metrics. Lets understand this then …

What is Days Past Due (DPD) on a CIBIL report ?

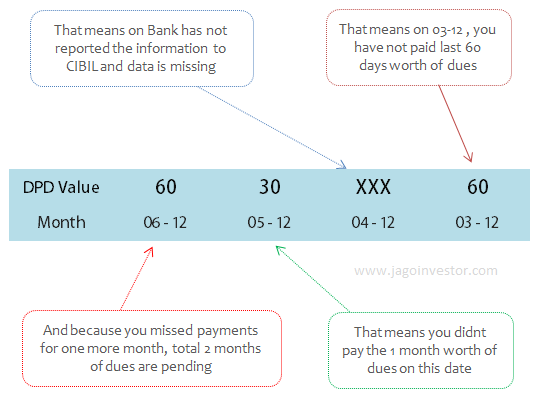

Days Past due or DPD means, that for any given month, how many months worth of payment is unpaid. And this information is for each account . Which means that if you have 3 different loans going on, then you will have DPD information for each of those accounts. For each account you can see Days past due information for each month for the last 3 years , i.e., 36 months.

You might already be aware that your cibil report contains the past 36 months of your credit information. Each and every month, your lender who is a member of CIBIL, will update the CIBIL with the latest information like Did you pay on time or not? How much outstanding loan do you have at that moment? How many months worth of loan is remaining and other micro details are shared on monthly basis by banks and lender to CIBIL. So each month, a new month’s data is added and the oldest month (36th month) is removed from the cibil report and this way a sliding window of 36 months data is available on your cibil report at any given point of time.

Example – Date 06-12 and DPD value is 90

If DPD value is 90 for a date say 06-12, it means in June 2012, the payment is due for last 90 days, which means 3 months dues! So you can now understand the the DPD in the last month (May 2012) would be 60 and for Apr 2012 would be 30.

When you default on any payment or do not make the full payment, this DPD value will start getting a number and it will be a negative thing. So if there is a cheque bounced from your side and the loan not paid on time, you can expect one entry of DPD for the latest month with value 30 – which says one month of dues are not paid. If you clear it on time before the next cycle comes, it will help you to improve your bad credit score and the DPD value for next month again will be normal, but if you do not make the payment and keep those dues , then the DPD value for the next month will increase to 60, which implies that from 2 months you have not paid the dues. See the graphic below to understand more examples of DPD

What does XXX means as DPD Value ?

There are certain values which can appear in DPD section and each of them has some meaning, however the safest values are 000 and XXX . If you have the value as 000, it means the dues are totally clear on that date and nothing is outstanding. And if the DPD value is XXX, then it simply means that bank has failed to report the data for that month to bank, and it does not impact you at all . At times instead of 000, the value can be STD which means that the dues are for less than 90 days . While any other number other than 000 is a negative thing, but make sure it does not go above 90 days , because then its super negative.

At times, some lenders also report DPD values in a different way, as per asset classification norms set by RBI. In that case, the values which appear under Days Past Due section are STD , SUB , DBT or LSS which denotes good to bad , where STD is good and LSS is the worst one. Here is what each of them denotes

| STD (Standard) | Payments are being made within 90 days. Note that any delay of more than 90 days is seen as Non Performing Assets (NPA) by banks |

| SUB (Sub – Standard) | An Account which has remained NPA for upto 12 months |

| DBT (Doubt ful) | The Account which has remained Sub Standard Account for a period of 12 months |

| LSS (Loss) | An account where loss has been identified and remains uncollectible |

Can DPD values be changed ?

There have been cases that lenders have rejected loan applications based on DPD information even though the credit report was clean and the score was quite good. And the common worry at the time is “Can’t I change my DPD information somehow?” and the answer is NO . You can’t change DPD information like you can change SETTLED or WRITTEN OFF status by taking some action. All you need to do is wait for some time and as time passes, new month information will get added to your report and old data will keep getting phased out. So if you have some bad DPD data before 12 months, then it will go out in next 24 months, and if you have some DPD data 2.5 years old, it will go out in 6 months period.

For those who like to learn through video’s, we have a 40 min course on Credit Report and Scores in detail on our Jagoinvestor Wealth Club, which will explain all the aspects of the subject in a clear manner and great detail

Did you understand the meaning of Days past due or DPD which appears in CIR (Cibil Report) ?

Hello sir in cibil report 2007 settlement (written off acoount) loan account is with Citi Corp finance..pl advice how to remove it in the cibil pl

Can you share more info please

I had running car loan from sbi bank and my ecs debited from PNB bank but on june 2015 PNB bank show unsufficient balance on my account but there is not any unsufficient bank on that month this leads a one month overdue running from june 2015 onwards on april 2016 month i personally visit PNB bank and asked on month june 2015 my account balanced is sufficient why are you show unsufficient.Then PBN bank say due to wrongly entered data interchange account this will happen .PNB bank gives june 2015 penalty amount t to account on april 2016.But this leds my cibil score drop down to 605 so how can i improve my score and days past due from june 2015 to march 2016.kindly suggest me how can days past due change to zero from june 2015 to march 2016

It will not change to ZERO unless its really ZERO !

what can i do further..

Sadly you cant change it . Let 3 yrs pass and that entry will go away !

Hi, Manish,

ICICI BANK CREDIT CARD INDIVIDUAL

(MEMBER NAME) (ACCOUNT TYPE) (ACCOUNT NUMBER) (OWNERSHIP)

ACCOUNT DETAILS

CREDIT LIMIT – RATE OF INTEREST –

HIGH CREDIT 50,921 REPAYMENT TENURE –

CURRENT BALANCE 0 EMI AMOUNT –

CASH LIMIT – PAYMENT FREQUENCY –

AMOUNT OVERDUE – ACTUAL PAYMENT AMOUNT –

DATES

DATE OPENED/DISBURSED 08-09-2005 DATE OF LAST PAYMENT –

DATE CLOSED 22-04-2009 DATE REPORTED AND CERTIFIED 31-01-2011

PAYMENT HISTORY (UP TO 36 MONTHS)

PAYMENT START DATE 01-12-2006 PAYMENT END DATE 01-04-2009

DD-MM-YYYY DD-MM-YYYY

DAYS PAST DUE (No.of Days) or ASSET CLASSIFICATION (STD, SMA, SUB, DBT, LSS)

YEAR MONTH DEC NOV OCT SEP AUG JUL JUN MAY APR MAR FEB JAN

2009 281 250 222 008

2008 007 007 007 XXX 006 008 006 000 000 000 000 029

2007 000 XXX 000 000 000 000 000 000 000 000 000 000

2006 000

COLLATERAL DEFAULT STATUS

VALUE OF COLLATERAL – SUIT FILED/WILFUL DEFAULT –

TYPE OF COLLATERAL – WRITTEN-OFF STATUS –

WRITTEN-OFF AMOUNT(TOTAL) –

WRITTEN-OFF AMOUNT(PRINCIPAL) –

SETTLEMENT AMOUNT –

If CIBIL Score shows payment history of last 36 months then why is this account showing on my CIBIL report?

All accounts are showing in CIBIL by default !

What actions should I take to increase the CIBIL score and to remove the already closed accounts?

The standard things one has to do is

– First close all the outstanding loans/settled loans by contacting the old companies with whom there is dispute

– Stop taking any loans for time being and start paying their current EMI’s on time

– wait for few months and that should help the CIBIL score/report to get better

Regarding the old credit card dues, should I go for settlements or pay in full or foreclosure.

Pay in Full .

If you pay partially pay it, then your name will be under defaulter section in CIBIL

a loan account was originated on1st may 2010, last paymnt was on 1st august 2011 , the due date felt on 15th sept2011, when will an account get onto 60 DPD bucket ?

Hi Harleen

I am not clear on what is your question. Please repeat it with more clarity

Manish

Hie Manish,,

I really need help for understanding this CIBIL. till now I am having 1 consumer loan with AEON finance and 1 PL with Bajaj Finserv and 1 Consumer loan with bajaj finserve.

1.Consumer loan with bajaj finserve is got cleared without check bounce,

Personal Loan with Bajaj Finserv is going on in which 24 EMI is paid and 3 check got bounce and last check bounce on 07March2015. and now I am paying without fail.

Settled the AEON consumer Loan in march 2016 and total check bounce is 12 and as per statement last bounce check showing on date 09 sept 2014. I paid full amount and got confirmation from AEON that cibil update from there side.

Now i am checking my cibil its showing score of 767 and DPD.

I need help to clear this mess and create healthy CIBIL Score …Please suggest…

The main reason I can see is that you are using too much of credit in your life. Better avoid taking all these small loans and rather save first and buy using cash. Slowly your CIBIL score will get better !

Hi Manish,

I had a education loan in 2010 as per bank I dont need to pay any charges in between till I get a job and later I found they charged me with interest charges every quarter and I was not aware of same when I came to know about this my father closed the acc by paying all amt including int and principal in year 2013 june. Last week I applied for a personal Loan my loan was rejected because of High DPD. please sugest what can be done

So for the time you didnt pay it, you were marked as defaulter . Incase you were not communicated on that, then its a bank mistake and you should take up this matter with them

Hi Manish,

i have been a good follower of this site and you people are doing a fantastic job by educating people like us which is really helping us a lot to understand these complex things. By the way i had a conversation with you long back regarding one of my standard chartered credit card dispute and finally i had to make settlement by paying some amount in Last Nov’2015 and the third party(Shaha Finlease) said they will clear my bad CIBIL.

Now on my CIBIL report,

# Status shows nothing/blank where as earlier it was WRITTEN OFF in my 2013 cibil report

# Current Balance is 0(zero)

# Date of last payment is 19-12-2008

# Date Closed is blank/nothing

# Date Reported & Certified shows as 27-10-2015

# DPD(Days Past Due) shows

Oct’15 as 000

Nov’15, Dec’15 as blank

and no more cell shows where as this is a recent March’16 report.

My queries are:

1) As per the status i mentioned, does it mean that that dispute is clear in my CIBIL and i am good ? or does it have any other side effects?

2) i received their offer on 16 Nov 2015 and prior to that i never say i will make the payment and finally made the payment on 18 Nov 2015. Then they said it will take 30 to 45 days to update in CIBIL. But here the report shows the last report date was 27-10-2015. So how can it be possible for them to clear my CIBIL before i made any settlement ?

3) i fetched the CIBIL report on 21st Mar 2016 and i was expecting the DPD values should be showing till Feb 2016 but the cell itself shows till Dec 2015 and in that Oct15 is 000 which means “paid on time” i believe but my question is how is it possible as i made the payment on 18 Nov 2015 ?

4) DPD values for Nov’15 and Dec’15 shows blank, what does it mean? where as i know XXX means not reported by bank.

Thanks

Deepak

Hi Manish, I have a score of 782 as of 10/16/2015 and HDFC credit card is where i messed it up. but later i am paying all my well. Can you please let me know if i can apply for a car loan now looking at the data below on my report.

HDFC BANK CREDIT CARD

(MEMBER NAME) (ACCOUNT TYPE) (ACCOUNT NUMBER) (OWNERSHIP)

ACCOUNT DETAILS

CREDIT LIMIT – RATE OF INTEREST –

HIGH CREDIT 51,576 REPAYMENT TENURE –

CURRENT BALANCE 12 EMI AMOUNT –

CASH LIMIT – PAYMENT FREQUENCY –

AMOUNT OVERDUE – ACTUAL PAYMENT AMOUNT –

DATES

DATE CLOSED

DATE OPENED/DISBURSED DATE OF LAST PAYMENT

DATE REPORTED AND CERTIFIED 30-09-2015

PAYMENT START DATE 01-10-2012 PAYMENT END DATE 01-09-2015

PAYMENT HISTORY (UP TO 36 MONTHS)

DD-MM-YYYY DD-MM-YYYY

DAYS PAST DUE (No.of Days) or ASSET CLASSIFICATION (STD, SMA, SUB, DBT, LSS)

YEAR

MONTH DEC NOV OCT SEP AUG JUL JUN MAY APR MAR FEB JAN

2015 000 000 000 000 000 000 000 000 000

2014 000 055 026 025 026 026 025 026 000 026 023 000

2013 000 025 000 000 000 000 000 000 000 000 000 000

2012 000 000 000

COLLATERAL DEFAULT STATUS

VALUE OF COLLATERAL – SUIT FILED/WILFUL DEFAULT –

TYPE OF COLLATERAL – WRITTEN-OFF STATUS –

WRITTEN-OFF AMOUNT(TOTAL) –

WRITTEN-OFF AMOUNT(PRINCIPAL) –

SETTLEMENT AMOUNT –

Hi Karan

One cant comment like that. It all depends on the bank how they look at the report.

Hi Manish,

I have a personnel loan in ge country wide 2005, which was not paid. Now that is showing in my cibil as follows

Opened 19_8_2005

Closed. 07_08_2007

Reported 31_12_2012

Status blank

DPD. 600, 500 etc. From 2005 to 2007 (36 months).

Kindly let me know how to remove these dpd & why reporting in 2012 & dpd shows 2005-2007

Kindly suggest

You cant remove DPD

I am a regular reader of your blog and try to follow all the wonderful tips.

I have recently viewed my CIBIL SCORE and found out this.

I had taken a consumer loan on 31-7-2-13 . I also got a card from Bajaj Finance Ltd for this loan saying it can be used in future for rest of my needs.

The loan was paid in regular instalments and paid in full till 5-4-2014.

On my cibil report the status is account balance : 0 open: no . last payment date 5-4-2014. all entries are 000.

But the Acoount status is : current account .

There are no other adverse remarks in the statement.

Can you help me understand wheather my loan is closed or still considered as open.

I was under the impression that once I have paid all due instalments the loan will close automatically .

Please help me understand the problem as in future I am planning to get a housing loan.

Thanks

If its not mentioned as “CLOSED” then its not closed in CIBIL . Please ask your bank to update it

Hello,

I had closed SBI Credit card on 29-07-2014, but DPD ( DAYS PAST DUE) shows 000 till Dec 2015. Can someone let me know, what going wrong here. Please be not that, it was clean exit , I have NOC from SBI Cards.

cibil report as below –

DATES

DATE OPENED/DISBURSED 25-02-2012 DATE OF LAST PAYMENT 19-07-2014

DATE CLOSED 29-07-2014 DATE REPORTED AND CERTIFIED 25-12-2015

PAYMENT HISTORY (UP TO 36 MONTHS)

PAYMENT START DATE 01-01-2014 PAYMENT END DATE 01-12-2015

DAYS PAST DUE (No.of Days) or ASSET CLASSIFICATION (STD, SMA, SUB, DBT, LSS)

YEAR

MONTH DEC NOV OCT SEP AUG JUL JUN MAY APR MAR FEB JAN

2015 000 000 000 000 000 000 XXX XXX XXX XXX XXX XXX

2014 XXX XXX XXX XXX XXX 000 000 000 000 000 000 000

Dont worry .. 000 means good . You are clear !

Dear Manish,

There is account which was written off in 2012. The DPD code used after that was XXX and suddenly last year september they changed the code to 900. Due to this my CIBIL score has dropped by 80 points. Can you advise if financial institutes can use 900 after the account is closed as written off.

I have the Same Question…Manish Please Reply on the above query

I am not aware on this .

Written off means your loan is not closed though your dpd stands for XXX.

Hi Manish,

I have a defunct HDFC salary account, which i completely forgot. But the banker has levied a penalty for non-maintenance. When i checked the message to my old mobile number, i was shocked to see that it is -4500. What do i do now? Will it impact my cibil score

It will not impact the CIBIL score. HOwever if you have any work in future with HDFC, then you might first have to pay the balance and then only you can get your work done. I suggest pay it off and close the chapter

Hi Manish,

I recently closed my car loan which had a tenure of 4 years. I have always made the payment on time through ECS and never missed a payment. In spite of this for all the four years my CIBIL report shows a DPD of STD and xxx, for all the months, none of the month shows 000. How is this going to affect my credit rating and if I get this corrected will it improve my scores. My personal loan applications are getting declined due to a low score of 630.

Thanks,

STD or XXX is not worrysome . You need to increase your score now .

i have cibil score is 747……but my previous auto loan was payed delay paymets….dpd is there above 90……then…how to get loan…how many monts i have to wait

Better clear your DPD asap

Recently I applied for Personal Loan which was declined citing reason my 4 months old Auto( Car Loan) record is not good. Surprised by this I purchased Cibil report as on 31.07.2015 and found that lender of Auto loan has reported DPD for 6/2015 as 051 days and 07/2015 as 27 days which are wrong figures.

Because EMI due date for 6/2015 is 30.06.2015 and EMI paid on 04.07.2015.

EMI due date for 07/2015 is 31.07.2015 and EMI paid on 04.08.2015.

That is actual DPD is 04 and 03 days. Is 04 and 03 days are bad?

(However this is also fault of branch as branch has obtained SI and in spite of sufficient balances available in SB on due dates transferred EMI with delay)

After discussing with Manager pending correction of CIBIL report he has issued me a letter certifying actual No of DPD for 6/2015 and 07/2015 as 04 and 03 days.

Will CIBIL show correct DPD for these months if branch informs CIBIL?

Talk to lender first, they need to update the correct numbers to the CIBIL

Hi Manish

Recently i got my CIBIL report from one of the free website. In that report it has mentioned like “DBT” . I took a education loan from Indian bank and i closed that with one time settlement on September 2014. Still am getting rejection of my Personal loan and Credit card application. Please assist me what will be the solution for this?

You mean you didnt pay the full amount and paid less ,right ? In that case, you will not get further loans as you are marked as defaulters

My cir report showing std so cn igt credit card frm banks

MOstly yes , if your report is clean and does not have bad remarks !

Hi Manish, as per ur responses high number of DPD or written off or settled tag on civil report goes in some time but I have a loan which is for the year 2006 ‘settled’ due to which my current score is is 576. I could manage to get one loan on a LED TV to improve score which is being paid o time with STD from last 7 months. How much should I wait to take another updated report with should have improved numbers as I am paying on time?

I think you should wait for atleast 6 months

Recently i get my cir report

My que is in my report dpd is indicate 000 for 4mnth

Aftr tht its shows STD so having std in cir report is good or bad i am confused totally pkz help me in diz

Its totally safe .. no worries !

Thnk u so mch

In diz base of cir report cn iget credit card frm banks

Not clear of your question

Valuable information. Thanks Manish. My CIBIL trans union score is 825. I took auto loan from Union Bank and all EMIs are paid in time , Loan account is closed and no out-standing. But last 36 months DPS shows ‘STD’. It is learnt that any value other than ‘000’ in DPD implies negetive. I raised dispute . I got a mail from CIBIL , says that

…”We would like to inform you that UNION BANK XXXX0433 DPD STD indicates if DPDs is 0- 90 days (There is no system validation for the account to be reported as STD or DPD. Submission of STD/ DPD varies from bank to bank)”.

If DPD values varies from Bank to Bank, How score is evaluated?. In my case Can I take ‘STD’ seriously.

As per cibil “. Anything but “000” or “STD” is considered negative by the lender. ”

So nothing to worry !

Dear sir, may I have a setteled personal loan in 2014 april but DPD is very high & today I want housing loan but bank was reject my file sugest me how to left Dpd in my cibil reports

Its not an easy task to improve your CIBIL score now at short term notice. If you have not repaid things on time, its going to be messed up for some years

Wonderful Article. Want to keep myself updated for more. Please subscribe me for your periodical Newsletters

You can do it yourself by putting your name and email on right top of the blog

i took two wheeler loan in 2013 and from that onwards emi are being paid on EMI dates but in DPD is showing everymonth as 030, I don’t what to do. why it happens. plese tell me.

Looks like some month dues are pending . Check with bank on this

Great Article. I have CIBIL Score 811. Can I get PL?

Its not the Score, but the report remarks which matters more !

I got my home loan in 2014 from Govt. Bank & it was also approved by DHFL but i go with Govt. Bank.I had more than 7 Credit card & 3 PL in 2005-2008 but due to some personal problem a was not able to pay my dues on time.I had done settlement of all my credit cards & PL in 2011-2012.My CIBIL Score was 512 in 2011 & all CC & PL were showing written off status.

In my CIBIL report DPD 900 days or more but i got my home loan easily in 2014 after rebuilding my CIBIL report.After settlement I took Credit Card against Fixed deposit & started pay all dues on time. My score was 767 in 2013 & all CC or PL status POST (WO) SETTLED.so there were no impact of DPD or Settled status to get a Loan.

So whats your question ?

Hi,

very ibformative article. I had applied for a credit card abd it got rejected. I think it will only be because of my outstanding balance in my credit card. I have 70% of my limit outstanding and that has been for the past 6 months. I am payin only my minimum amt payable to the bank. How will this affect my score? Will it be considered as default? Is it enough if i clear my outstanding for my credit score to improve? Please help. TIA

Then you are seen as defaulter by credit card. Your DPD must be messed up . Kindly pay the dues in full soon !

Dear Sir,

My current score is 784 and nothing any due to existing loan but some my DPD issue can i rectify for the DPD and get the personal loan…..

dhaval shah

No you cant correct DPD

No , you cant fix the DPD whenever you want

“Std” means payments were made in 90 days right? That means there is a delay im payment right. Then why is “std”not viewed negatively by the bankers . While if a number like 30 or 60 which is less than 90 is reported is dpd then it is seen negatively?

Hi ankit s

Its a good question. I am not clear on this at the moment. Will try to find out and get back

Manish

Yes u can rectify

Dear Manish

In my CIBIL report, I have lots of XXX. what is mean of xxx

You are safe in that case . XXX means unreported !

Dear Manish

In my CIBIL report personal loan score is 765 and cibil trans union score is 710 this is good score or bad i know. and what is the difference in cibil personal loan score and cibil trans union score. please explain.

Saleem Ahmed

CIBIL personal loan score, is mainly for only personal loan.

What matters is your report remarks and then comes the score !

my cibil score appears CIBILTUSCR 000-1 and the loan was rejected .

Would u tell me why is it so

I think you dont have any loans in past also right ?

yes i dint have any loans , but all the applications are rejecting ,Not sure why .

Hi, I have checked my Cibil report. In that it still shows DPD for 2004 &2003 whereas it should not be showed beyond 36 Months. Why it is showing

It will not show beyond 36 months if the account is active, not for inactive one;s !

I have DPDs before 2009 not after 2009. I have repayed the banks my debs. At present have an bajaj finance consumer loan is running with regular EMIs which my CIBIL score is 821. Now If i apply for any credit card or personal loan, will my application will get approved

Hi arun kumar

There are good chances that you will get the loan, but its final decision only from bank . We cant comment on that !

My cibil score is 001. Whats mean

Thats ok . It does not mean anything bad

I took my PL in the year 2009 and Tenure was 36 months. I made my payment for one year without any delay. Due to my personal issue I didn’t make my payment for 2 years and later I called up customer cared and made my payment before my tenure gets over (not a settlement) and I have got the Zero balance report & NOC as well. Later some days I applied for a Credit card and it was got rejected in the year 2011, only then I got to know about CIBIL till then I was not aware of what it is. I pulled up my cibil report and found DPD as 698. Due to that am not getting any secured loans. Please suggest how can I remove DPD. PS is closed at November 2012.

Hi Manish

My CIBIL score is 769. I have SBI Card and I have paid all he outstanding amount and blocked my card instead cancelling it after 3 months I got a statement to pay 80 Rs. as charges I did not pay that for 3 to 4 months and it is reflecting in my CBIL report as in 2013 year Feb 001, Mar 030, Apr 060, May 000. How ever I have paid the amount with penalty and other charges. I have a personal loan in HDFC Bank and I have 2 Check Bounces I have cleared EMI amount later but they did not inform me about the Check Bounce Charges and it is reflecting on my CBIL Report as 024 for Staring Month. How can I clears this DPD on my CBIL Report.

You cant clear DPD for a closed loan , as far as I know .

nice to here this, i get confusion when calculating DPD, in my client when I am working with renewal of our client in our office, but though your article i learn how to use those DPD in my report

Welcome

HI Manish,

I checked with CIBIL reg DPDs issue. Please find below comments from CIBIL.

The Credit Information Companies (Regulation) Act, 2005 mandates all credit information to be reported in your report for a minimum period of 7 years from the date it was reported by your Credit Institution. CIBIL cannot modify any information in the database without confirmation from the relevant Credit Institution.

Thanks

Reddy

Yes, thats correct

Hi Manish,

I am having CIBIL Score 820 and all persoal loans closed. But there are lot of DPDs. In CIBIL Report still shoiwng 2007 DPDs also. As you mentioned in CIBIL it will show only last 36 months data. I applied for PL & Home Loan. Both are rejected. Because of DPDs. Please suggest.

Thanks

Reddy

What exactly is the issue. please share in detail

I have taken personal loan fron hsbc and credit card from abn amro. I started paying regularly. I have been transfered from Mumbai to chennai. I stopped using the abm amro card. Since the personal loan is debited through ecs, I am repaying the loan on monthly basis. Without my knowledge, there is some amount not paid in the credit card and some emi was not paid. These loan and credit was took on 2008. Recently I took the cibil report which shows 10000 and 8000 as written off respectively..then I have contacted the bank and paid the amount shown in cibil. Is that mean i have paid less amount or full amount. Bank also given noc full amount has been paid and no oustanding and account closed.whether the bank will remove the word written off or they will post as post written off setteled.i need a blank status.pls guide

Dear Manish.

I have a DPD in my CIBIL Report of 2008-2009. As per your information the DPD is removed as and when time passes but it is still showing in my report. Please suggest me any way to resolve it because I am facing too many problems in getting a loan.

I have Cibil score of 821 with couple of CC’s and PL’s showing DPD’s in 2008-09 and 10. I am applying for the loan but they are getting rejected with DPD reason. Now all of these CC’s and PL’s I closed with their full payments and penalties. Let me know how will I get rid of these DPD’s now. Can anyone help to make them 000

You cant change the DPD of closed loans ! . Not sure how you can do it !

Hi Manish,

My cibil score is 816. But in DPD section of two accounts there are nos. 180-600 for 2010-11. These accounts are cleared now and other four accounts in CIR are clean. I want apply for Home loan. Will there be any issue?

While its a minor issue, not a big issue, but finally it depends on bank how they want to interpret it.

I have never made late payments or defaulted.

Great !

Hi Manish

My CIBIL score is 836 not 900. Never ever in my financial history I either delayed the payment or denied it or any other insincerity in paying the dues. however

Under SBI Auto loan(PERSONAL) : MONTHLY EMI which gets paid through ECS mode every month since it started in Dec12, its Showing STD under DPD against various monthly entries whereas I have never defaulted in SBI’s payments and it should show as “000” This is really a worrisome fact I have come to know.

I would like to ask is this some thing to worry? Is it affecting negatively to my score? Should I raise a dispute to get it corrected. for your information ;This payment is always made (has always been made) on the due date via ECS mode; is this something I should ignore or raise the dispute?

000 does not mean much . Its a neutral thing , not to worry !

Hi Manish

I meant does “STD” as entry over there means negative.

NO

STD and OOO are both neutral !

Hi Manish,

Thanks for your explanation regarding DPD’s ,

For my Case I was a defaulter in capital first and Full tron India. Last year June I’ve cleared the both the loans by paying the whole amount including interst &principal and penalty charges.

Now My account status in cibil is blank but my DPD’s are not up to date, last DPD was updated on june 2013 when my account was closed. as per your explanation Cibil should update my latest DPD as xxxx as my account is closed.

Can you please let me know will the cibil update the DPD’s for closed accounts?

if they will not update for the closed accounts DPD will remain same?

Ratnakar

As far as I know, For closed account, DPD’s cant be changed !

Hi,

No remarks in the report ….. only my loan info & dpd. In DPD it shows “STD, 000 & XXX” only. Is there any other remarks in the report other than DPD ?

Regards,

Senthil

Then it will take some time for your score to get better

Hi Manish,

thanks for very good explanation. Myself having CIBIL score as 670 & all my DPD’s are “000” & “XXX”. I settled my CC payment….. but its shows this value only in DPD’s. its good to apply loan ?

regards,

Senthil

Yes, you can apply for loan, but 670 can be much better. Are there any other remarks on your report ?

If I pay minimum amount due in credit card. Is it also calculated as negative.

Obiovusly . Read this – http://jagoinvestor.dev.diginnovators.site/2012/05/myth-of-minimum-balance-in-credit-cards.html

Have read this… I know but I was put in myself into such condition that was not able to come out… But now I am free from that ( from last 2 months)

Hi,

I had credit card and enterd a settlement in 2010.now i am going for Nil outstanding.after doing so what sort of entry would be there for DPDs,will it have last entries as 000.Also

of account is closed,then it seems DPDs cannot be modified.Does this also effect future loan process.

DPD cant be modified like that, it will only change with passing time .

What if the Loan Account is already closed………The DPD’s will stick there for decades.

I have seen various CIR, the loans closed prior to 2006 still reflects as on date, though the DPD string is for past 36 months from date of closing.

Moreover, its a myth that after 7 years, the Loans a/c details will be taken off the CIR. It does not happen in India unlike other developed countries.

Its not necessary that a defaulter will always be a defaulter. I would expect the CIBIL to remove the closed loan a/c details after completion of 7 years. Its a good timeframe (like a punishment which should not exceed more than 7 years) for the loan applicant to re-apply for credit facilities, which will be decided based on merits/profile.

Furthermore, I guess CIBIL is doing more damage than good.

Customers with good credit score are getting multiple lines of credit without any documentation (based on existing relationship with the a/c holder). These set of customers are turning bad after mishandling credit.

Moreover, the BANKS ARE NOT GOING INTO THE MERITS OF THE PROFILE. Most of them have lost knowledge, that by just looking at the Credit Score, they decide the fate of the Loan i.e., Approve or Reject.

There was a time when banks used to critically appraise the Loan Application and Customer profile. Now, they are using, system-generated number to decide loan. If it continues, then we don’t need more employment in Banks esp. Credit Department.

DPD should get shifted each month . If its not happening you should complain to CIBIL . also its always a Credit beureu decision on how long they want to keep the records.

If you are not satisfied with something on CIBIL, i suggest complaining to consumer forum

DPD will get shifted each month only if the loan account is active. Even if the lender has not updated the CIBIL report for any particular month, the DPD string will get shifted with remark XXX which indicates data for the month not provided.

However, if the Loan a/c is closed or written off, the DPD string stays constant and will not shift at all. My father is a Banker and I have seen tons of CIBIL reports…..I am 100% sure about this.

Had CIBIL come under RTI Act, I would have surely escalated the matter. But, as its a Private company, I can’t do much.

then its a news and knowledge on this . I didnt knew that it does not shift if its inactive loan ! . Thanks for educating me !

Hi,

My DPD shows “SUB” as follows.

PAYMENT HISTORY (UP TO 36 MONTHS; LEFT TO RIGHT BEGINNING WITH THE MOST RECENT PAYMENT)

PAYMENT END DATE 01-04-2006

PAYMENT START DATE 01-08-2006

DPD:DAYS PAST DUE AC:ASSET CLASSIFICATION

DPD/AC SUB SUB STD STD STD

MONTH-YEAR 08-06 07-06 06-06 05-06 04-06

Few questions on the above DPD. Why it it showing past 7 years data under 36 months history?

I paid all the amount in the year 2006 itself, but it is showing still in 2013.

How can I rectify this?

Should I contact the Bank or CIBIL?

Please help.

Thanks and Regards,

Saravanan.D

Only CIBIL will be able to explain that .

My loan applications are getting rejected due to the DPDs with one of my personal loans and credit card though my score is 812. There were 30, 60, and 90 written over there in my cibil report. Can I remove them by paying any penalty or fine? or What steps need to be taken from my end to correct this?

At the end of the day, I want to make myself a “loan worthy individual”. I tried talking to banks but of no use. Can I do anything with Cibil?

Regards,

Krkn.

No you cant do anything . They will go as per time

Hi Manish,

Thanks a lot, It does remain the same from June 2010. The DPD still remains on the date June 2010 for credit card.

As well as the same for personal loan. How long should I wait for these Banks to consider my loan application?

It should ideally shift each month by 1 entry … If its not having , ask the bank for explaination why it happens .

Manish,

I tried asking Banks, They have come with a reply “that the card account is closed”. Now, Can I ask the bank or Cibil association to do the follow up to shift each month?

Hello Manish,

Thanks for all your efforts for educating us on CIBIL DTDs.

Here’s my case. Hope you help me.

I had a personal loan which was due for 30 days in 2009 So the recent most DTD at that time was shown as 02-09. (Feb 2009) and then I closed the personal loan by paying off the outstanding amount (not settled) in March 2009. So technically my personal loan is closed. But still till date i have 02-09 as the recent most DTD followed by 35 months.

Though its been 4 years (48 months), i still have the recent most DTD as 02-09. Since its been 48 months and i also since i closed the loan, i expected all the 36 DTDs to be removed. But i still have them

Any pointers?

Thanks

SubbaRao

Actually I am not aware about this . As far as I understand , it should be the recent 36 months data there. Did you check with CIBIL customer care on this ?

Im not sure whether im correct. But i think this data will be pumped out only when the loan is active and again you start making the payment regulary for that particular loan.

Once you start making the payment the new data/transaction details will come on top and the old will be automatically moved out of database. Because in my CIBIL report i still the data of 2006-2008 for a loan which was closed in the year 2008, as there were no further transaction on that particluar account.

Very informative article Manish!!.

Thanks Chetan

Hi Manish

In my CIBIL Report I got 011 instead of XXX or 000, what does it mean?

That means that on that given date you were having pending dues of 11 days.. Did you default on any payment ?

Thanks Sekhar

Hi Manish,

I have recently applied for CIBIL score and it is very poor, just 592. I got DPD on few credit cards and they are from old cycles (02-09,03-09,05-09 etc). I could see for 1 card, PAYMENT START DATE is 01-06-2009 and PAYMENT END DATE is 01-05-2008. So, I believe the DPD information is reported between these 2 dates. My Question is while reporting last 36 months credit history why CIBIL displayed details prior to that time period. Is there any way i could avoid these old DPD details in future reports. Please advice. Thanks.

You will have last 36 months of DPD data . if its before that , better talk to CIBIL about it . It should not happen !

Dear Manish,

Nice article, just want to ask from where to get CIBIL report.

Ashok,

Please check this link: http://jagoinvestor.dev.diginnovators.site/2011/12/get-cibil-score-online.html

from CIBIL – http://jagoinvestor.dev.diginnovators.site/2011/12/get-cibil-score-online.html

its very simple to get the CIBIL report. just go to http://www.cibil.com, then click on the cibil report order now, fill some details of yours like name, date of birth, address, email id, some matching exercise like your previous or current loans, their amount and date of dispersal and pay an amount of 470/- by your credit card/debit card/net banking and you will get the CIBIL report in your email instantaneously.

nice, added to my knowledge

Good to hear that !

Dear Manish,

Thanks for wonderful article. One question:

“If you have the value as 000, it means the dues are totally clear on that date and nothing is outstanding. And if the DPD value is XXX, then it simply means that bank has failed to report the data for that month to bank, and it does impact you at all .”

In my CIBIL report, I have lots of XXX on one of my loan. As per your above statement, it shall impact me at all. Can you please clarify? Did you mean to say will NOT impact at all? Is there any way to get rid of these XXX in case of correct/timely payment history? Response appreciated.

Ahh I meant , DOES NOT impact you at all !