Should Income Tax limit be raised to 5 lacs ?

POSTED BY ON May 28, 2012 COMMENTS (71)

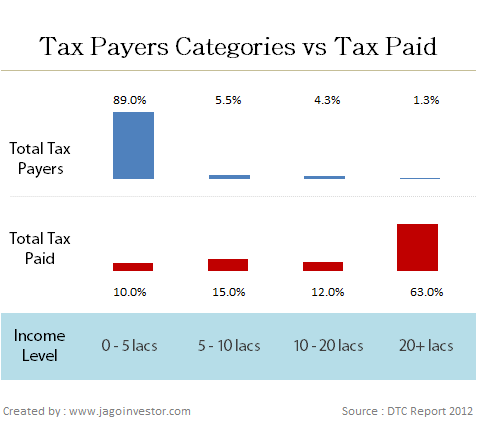

Do you know that 89% of tax payers in India have income of less than 5 lacs per year? Yes that’s true! Such is the case of most of the low earning people form the tax-paying population. However can you guess what is their share in total tax paid? It’s just 10%.

why doesn’t govt make income tax limit as 5 lacs ?

Yes, 10% of total income tax comes from 89% of taxpaying population. Now that brought a very interesting question in my mind, that why doesn’t govt make 5 lacs income as Tax free? Only those who have more than 5 lacs income will be paying tax. Imagine what will be the situation!!

In one shot, 89% of the tax-payers will be free from the headache of paying tax each year and the govt will still get 90% of the taxes. What they can do is increase the taxation rate a little bit, so that they still get 100% of the taxation recovered from the rest 11% tax payers (having income of more than 5 lacs). If you look at deep down into the statistics, do you know that 1% of tax payers earn more than 20 lacs income and they account of 63% of tax payment. Imagine this – 63% tax coming from just 1% tax payers.

But it will not happen

Let’s come back to reality now. It was great to imagine that govt should raise the income tax limit to 5 lacs. But do you know that collecting tax from this segment is the easiest. Because these 89% tax payers are mostly salaried employees and the overall tax collected comes in the form of TDS. Companies hiring them have the responsibility of cutting the tax each month and paying it to govt. Hence Govt has almost no work to do to collect the tax from this section of 89%.

This brings us to a very important conclusion now, How should govt restructure the taxation rates and limits such that they increase their tax collection, but it impacts a small percentage of population? What about doubling the taxation rates for those having income of more than 20 lacs? What about making a marginal increase in taxation rates for those having income of more than 10 lacs?

I know I might be overlooking some important points here, but what do you think about it ? Dont you think govt should raise the income tax limit to 5 lacs or something like that ?

True. I believe that Individual Tax , Property Tax should be removed. We can not pay for living. Its more than a looting where we try to find to tax everything.

I disagree about implementing any tax on agriculture , water, electritycity etc.

Tax should have a genuine side.

Big companies use natural resources of country on which every country has a right. They make money and big profit and god know about all manupulation they do.

Govt should constantly make money out of those natural resources and tax these companies very high. They dont have right to have all the money.

Let me explain:

Many Telcom companies have grown beyound imagination and accumulated wealth. This wealth is of public. But govt sold it at very low premium. Such natural resources should not be paid to any company but they govt should have a bigger share on behalf of public.

Same is applicable to all natural resources.

I hope you get it.

Thanks for sharing your view on this topic

Income tax is by itself an absurd concept and should be done away with. Several reasons for this.

1) I pay service tax when I avail any service. I pay sales tax, VAT etc when I actually avail some thing. Here I work to earn income meaning I spend efforts and govt. decides to take away some part of it.

2) It is presumed that tax collected is meant for govt. to give back to society in the form of various facilities & services. Does a person earning more get more facilities? Definitely NO. So does govt. thinks itself to be Robin Hood who steels from rich and gives it to poor?

3)Taking from rich and giving to poor is short sited thinking that it will bridge gap between rich and poor. In fact it would take much long term thinking and actions to improve living conditions of poor.

4) Even if I agree to taking from rich and giving to poor, govt. is one of the most inefficient mechanism to achieve it. Very large portion of collected money gets misused and not all real rich get caught in tax net.

5) But all of us spend from our earning irrespective of the fact if any tax is paid on that income. So taxes based on spending make sense.

I agree to some points of you.. not sure about other

if the tax is less why people will try to avoiding taxes instead pay the tax.

10-20-30% tax sounds some thing BIG……., previously govt. had limited options to generate revenue but now there are many options like service tax(which is one of the biggest tax collection source),tds(lot of amount still unclaimed) & so on……

So Deepak , what exactly is your point ? What is your conclusion ?

now best way is lower the taxes (like IT,VAT,CST,EXCISE etc……) then collection will improve

yes

Govt. should charge less tax for more earning.It should be less for High income group say 10%,for middle class it should be around 20% and for lower class it should be around 25%.So people will certainly try to earn more and declare more income to become eligible for less tax rate.Here those who earns more pay more tax.So there is no incentive for creating more wealth.Thats why people wants to declare their earning very less or hide their earning .There is urgently need to encourage wealth creation but 30% rate is a big factor for them.

Thats a wierd thought , but many would agree with this !

A very interesting article,and i am surprised to know about the said facts.In my opinion if we earn a good salary then it’s our duty to pay for the country.But what about business,politician ,they always manupulated their income and not paying correct amount of tax.But they are people who are availing the most from our hard earn money. So policy maker should come with some other solution.These people should be penalised and thats come as a detterent for others.

Gajendra

Thanks for your views on this topic

Sorry, i dont understand the problem statement here in this article. Looks like we have two or three answers(even new answers are debated) on how/who to tax and we are finding the best answer out of it. But what is the problem statement? Why are we finding best answer for how/who to tax?

This is not a problem solving article , its just a view and discussion article

Countries like Australia do have a system based on number of people in family and marital status.

There are a lot of people who do not pay tax and have tendency to ‘hide’ the income. This probably is a leftover practice of the ‘Raj’ days when the taxes were exorbitant. Other than campaigning that taxes should be lower we should also be encouraging practices for increased ethical behavior from citizens.

To cite an example – (other than oneself not paying tax which is obvious) how many take printed reciepts from the local kirana store while purchasing products hence encouraging the trader to hide his income.

Its a cycle – people who have to pay tax (cause its tough for them to hide) pay higher because usual tendency of public is not to pay tax.

(How else you explain the ‘selling line’ – buy this policy of 1 Lakhs to save tax of 30K. People still go for it.)

Hmm .. can you explain more about taxation in Australia ?

There is a significant workload & associated cost overheads (labor, infrastructure, running costs, IT etc.,) caused due to collection of taxes from 89% of population.

If it can be avoided, there should be a decent surplus left 🙂 !

Not sure on that .. i have data on how much man power they spend on tax collection

Agree. Taxation should be equitable. In my opinion, only salary earners are the faithful payers of taxes. Business community create so many loop holes they get away with rightful payment of taxes.

Agree with that

Hi Manish,

Good debate…but I opine that current tax slabs are fairly good. B’coz every individual feels the responsiblity of public property or something held for public interest as that is developed from his tax payment.And also Laws should be mended in a way such that there should be no possible way to hold the money(black).

thats ideally one should be thinking !

Sorry to say Manish but very uncharacteristic article for this website.What you may not have considered is the fact that the average effective tax rate for the 89% people may be less than 5% which means they are paying less that 5% of total income as tax which does not hurt at all. & yes High tax for High income earning people was always there in early days of India are you aware that rich were taxed @ 97% of income at one point of time in India, which is what created the Black money monster in India,

Not sure why we cant debate on this topic ? Why do you feel like so ? Its a concept and we all can put our views on this topic , thats all .. the article is for that, not to put my thoughts on what govt should do .

In my limited knowledge, I am of the opinion that above a minimum wage, everyone should be liable to pay income taxes, however nominal the income tax amount is. The reason is because people who don’t pay taxes at all because they earn below the lowest tax slab should be considered as “lower” salaried class.

Not only that I am also of the opinion that income tax should be per household and not per person e.g if husband and wife both draw a clubbed income of Rs 10 lakhs (hypothesis of 5 lakhs each) then the income tax should be on one income of 10 lakhs.This way “lower” salaried class would make absolute sense because the faily income is below the lowest tax slab.

Going forward, this “lower” salaried class should be provided some social benefits like cheaper healthcare (with the same quality standards as any higher income personnel), kids welfare fund (to pay for kids education) etc.

Based on my opinion as explained above, I don’t think removing all taxes upto 5 lakhs is a good idea, because I reckon a person(read family) earning 4.9 lakhs (taxable income) is not drawing a “lower” salary.

The equation can get very complex if we distinguish metro cities from other cities, but that is not the debate here, isn’t it?

All in all, let more people pay income tax, as a higher percent of people paying taxes implies a more prosperous economy.

thanks for your views .. dont you see lot of issues in implementing this ? How does one make sure they calculate the “family income” correctly ?

Manish

I would categorize any income tax payee into one of the following category:

i) Single

ii) Married and both the spouses draw salary

iii) Married and only one draw salary

iv) Single parent

v) Senior citizen

In our income tax slabs, there is also discrimination between man and woman, this should be removed. I agree that a senior citizen deserves more money in his/her hands, but don’t understand why a woman deserves more when her man is also earning well? Instead a single parent should deserve more income in his/her hands.

I reckon every kid (up to maximum 2 kids per family) should get a nominal amount from government and every citizen (whether tax payee or not) should get basic healthcare facility at nominal cost (the rich can upgrade this to a five-star red-carpet type of facility by paying the extra sum).

This is my vision, coming to the practical aspect of it probably this is not very easy to implement because of the huge population base and the complications for tax computations.

Of course, it will be possible to exploit the system as no system can be full-proof, but if income tax evaders are prosecuted with harsh penalties then it would discourage people from cheating the system. I reckon it should be a social responsibility to file your income tax returns with utmost honesty.

Being an optimistic person as I am, I believe that this vision can be realised.

I am sure a lot of simplification will happen in DTC 🙂 . what you suggested can happen years later , but its really desired !

Many Thanks Manish! Iam reading your website for 3 years now and you have really learnt me a lot.

Thanks for appreciation

Interesting facts , 89% tax payer resulting only 10% of total tax. Looking at this figure first things that comes to my mind is why so much headache and govt can increase the tax bracket to 5 lac. But in one way we are contributing to our country by paying tax and we should. Indirectly this tax amount is coming back to us in various forms of development (although corruption is there.. ignore it for the time being) .

Yea .. thats also a fair thing .

Manish

The best way is to let Govt. itself decide or rather find out what is your true income based on your expenditure. The more the expenditure the more the income and tax!

There have been few experiments on Income Tax based not on your declared income but on your expenditure which also may be declared but more that declaration, it would be seen and hence little scope for hiding it. But then how to assess expenditure in relation to income. Well, there also so many suggestions and models have been developed. Yet, the complex issue of Taxation has remained an issue of debating. I feel that New model of DTC may be welcomed as a step towards reforms and rationalization.

I think that govt should also allow some of the deductible expenses like rent, minimum costs for grocery and children education from the income and then tax people , what do you think about this ?

I am afraid you have not got my point of view. I am talking about deduction but basis for assessment being income for Income Tax! You see, computing and then hiding income has become routine part of business for non salary earners! So, claiming deduction is important for those who do file returns honestly. But what about who sit upon mega corruption- black money? Of course, Govt is rightly trying to learn about expenditure through credit card, PAN, capital market investment, real estate, TDS, certain bank transactions, etc. But we need radical rethinking so that black money can be regulated(!?) instead of regulating honest income. Therefore, below 5 lac, no I Tax fine. But what about dent in Govt treasury and tremendous fiscal deficit?

Yes thats a serious topic and a different topic. In this article we didnt target that point, but good that those point are coming and we are discussing it !

Hi Manish.. There is one common myth around spread by the govt that only few people pay taxes. In actualy Every one pay tax in India ..be it in the form of IT, Service Tax..Tax on Petrol+Diesel etc. There are 64 types of Taxes in India and specially salaried class end up paying more than 40% of there salary in the form of Tax..one form or another. There is a great proposal of a group of people to abolish all the Taxes and only keep 2% transaction tax that will fetch more than double of todays total Tax to govt without spending a single rupee to collect tax. Please read more detail here http://www.arthakranti.org/proposal

Wow .. thats really a great way to tax everyone , but not sure how much comfortable people will be with this ?

I think we have tax rates starting from 3-5% upto 35-40%. This way the taxes collected will be same.

Plus another thing in India is black money. Be it purchasing land or flat, 99% of the times you need to give some money in cash to the builder which some way or other goes to “party FUNd”. Now if this were to be brought under white money(as most of the IT professionals have TDS), then we wont need to hanker on this tax slab.

Again the bottom-line (for all most all problems in India) – REDUCE/Eliminate CORRUPTION.

Yea thats a valid point , these are some of the issues which make tax collection less and less . Making more transparancy between transactions will help increase the tax collections . thanks for your views

Hi Manish,

Frankly speaking, this article does not have any head or tail. You started with favoring 89% but you still wanted them to be taxed (or AXED).

What problem would the Govt have if they remove 89% from being taxed. They did that for Filing of the returns where they made that those whose income is < 5 Lac and are only salaried need not file the tax. Similarly I believe this could easily be done.

Was it just written for the sake of writing ?

No Sundeep

It was written for discussion . It is for debate that should govt consider removing tax for less than 5 lacs income or not , and then a reason was given that why govt is hesitant in doing so . What are the pros and cons of doing so .. so each article can not be for education , some of them are for discussion purpose also .

Manish

Now Income tax website and online filing of Tax is in correct mode and the ITO can locate errors and evades immediately. A true citizen must pay tax politely, whether it is through TDS or self assessment. In case of Income tax limit up to 5 lakhs, it is only a distant dream which can expect after one or two decades.

Once the DTC is into picture , I think within few years income earners above 5 lacs wont be taxed

Manish

Instead of tweaking the percentage of tax. Government should bring in better mechanism to make sure the tax evaders is caught . There is no point in living out salaried class as you mentioned its easy money for government.

One of the main place to start would be real estate,i don’t know why a PAN is not mandatory while doing real estate transaction. Our PAN number can be effectively used to track and crack many tax evaders.

It wont be over night but definitely possible if right steps are taken.

The current tax slabs of 30%,20% and 10% are good enough and doesnt need any change in my view

Real estate should really get PAN mandatory, but I am sure the RE Mafia will make sure it does not happen very soon

Dear Friends, When I started my earning life, the zero Tax limit was a Grand 50K Rs. Yes you read it right, 50000 Rs. Now after 12Y or so, the limit is 2L Rs. So that 4 fold increase. Interestingly the Cost Inflation Index indicates just the double within these 12Y.

So in my opinion, Govt is actually doing good. In fact better than expectation. As far as higher taxation on high income earners then low income groups, beyond a point, this exercise is not going to help but ‘ll only increase tax evasion. Online Tax return filing & linking almost all financial transactions with your PAN, Govt is filling the gaps silently. I do have with me at least 2 clear cut example where this very PAN based tracking, help the income tax official to nab the big time Tax evaders.

Thanks

Ashal

Thanks for your views Ashal

IT people should include various tax slabs. It should have different tax slabs. Like single, married(if spouse working/not working), number of kids. The taxes for people with more responsibilites should be less. I have seen this type of system in Malaysia and is very good.

Additional tax discounts should be given on childrens education and also peoples health care if undergone any major surgeries

Yea .. its one of the topics i wanted to write on !

Manish,

Countries like Australia do have tax slabs based on marital status and number of kids. This allows people (somewhat) to manage their expenses as per family size.

lower the tax collection will be more whether it in lower/higher income bracket(slab) just taxing high income payee is not the solution

May this lowering the tax rates can increase the revenue because more and more people will start paying the taxes

Manish

if the tax is less why people will try to avoiding taxes instead pay the tax.

10-20-30% tax sounds some thing BIG……., previously govt. had limited options to generate revenue but now there are many options like service tax(which is one of the biggest tax collection source),tds(lot of amount still unclaimed) & so on……

I think, the IT slabs should have some dynamic component which can be adjusted as per inflation so that people can manage their household expenses as well as able can save reasonably. To tax people with salary above 2 lakhs with current cost of living doesn’t look justified. Also the with housing prices increasing considerably, the quantum of housing loan interest that can be exempted from tax has to be increased or govt should control housing prices to be within reasonable values.

To compensate for such reductions, they can tax more on higher slabs above 30%.

Yea Mani

That idea makes a lot of sense .. but one has to see how much it justifies for maximum number of people

This is good.But i want to say something that a govt employee has no way to hide their income. So they have to pay income tax. If an employee earn annual salary of Rs 300000/PA ,and now he will have to save Rs 100000/ to save from paying tax.

How can an employee manage his life under 2lacs for a year.

Yes Umesh

Agree with you .. Thats the reason I say that there should be ways to calculate income tax taking into consideration someone’s family status also

That is exactly what the original draft of the DTC had proposed, very low income tax rates hoping that compliance would increase but sadly it has been delayed and changes have happened, what happens is this, if Slab is increased to 5 lakhs suddenly you will start having people declaring incomes close to 5 lakhs so as not to pay any tax or pay marginal tax, if exemption is taken to 8 lakhs then more people will start declaring incomes close to 8 lakhs and so on. Finally everyone has to pay their taxes except the politicians and those whose income falls under the category of AGRICULTURE wherein NO TAX is payable!

Good comment 🙂 . Agree that income declared will be close to the taxable limit, but still the impact on total tax collection will be very very less .

Manish

My opinion is that EVERY Indian should pay tax (albeit at a small rate – say 5%) on ANY income earned. This makes everyone more interested in how the money is spent by our government in irresponsible schemes and looted by scamsters. Increasing the highest tax band does more bad than good, as was experienced by the Black Money culture which was born as a result of having tax bands as high as 90% during Emergency regime.

I agree with you, every body should be taxed small or big, so that they feel they are contributing to the country and ask questions for developement.

HArish

Idzap

How much will it impact if the tax rate is imposed on income earners above 5 lacs only

Manish

Right every one should pay IT. So every one feels /wants to question the bad management.

We had a similar scene 90 % of the time of a/c officers were spent in checking the 10 % of travel expenses due to high number of junior officers.We shifted to flat daily allowance and only seniors bills are now processed.

For not providing services of power and water the govt has no right to even seek I.T.

They give nothing free, not even school education , hospitals, roads… why tax then ???

They should stop wastage by govt dept and make them accountable , dismiss corrupt officers… then and then only the people can live with what they earn.

.

Thanks for your views and comments on this topic

Famous people are afraid of saying in public but the truth is “NO ONE LIKES TO PAY 30% OF THEIR HARD EARNED MONEY AS TAX”

My view is max tax rate should be 15% and govt better improve their revenue management.

Thanks for your views and comments

Yes, that’s a great idea! Let’s just tax salaried employees at 75% (because they cannot do anything about it) and forget about businessmen, corporates, politicians and black money guys.

salaried person is penalized. businessman can hide their/manipulate their earning and even book high expenditure in the business, which they have not even incurred………………ye sub ko jalse hai.marta hai bichara aam aadmi……………

Thanks for putting your views !