iCare : new online term plan from ICICI Pru

POSTED BY ON October 7, 2011 COMMENTS (236)

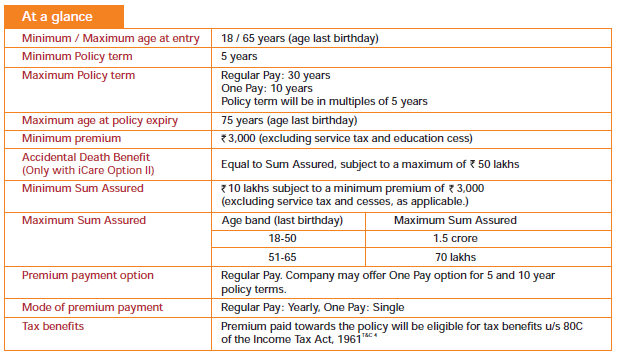

ICICI Prudential has launched their new online term plan called “I-Care”, which will replace its old term plan called the “i-Protect” (read iprotect review). This new i-Care term plan has some interesting features like no medical examination till the age of 50 and up to 1.5 crores of sum assured can be taken.

Features of I-Care Term plan

The biggest surprising feature of i-care term plan is that there is no medical examination for customers who are up to 50 yrs old. For all the health related information the company will depend on the declaration made by the customer as there won’t be medical tests applicable. This will make sure that the policy is accepted as soon as possible as there is no medical examination in between. Also there is something called “Policy acceptance” in i-care, which means that once you submit the application online and make the payment, it will be reviewed and finally it will be accepted, after which your insurance coverage will start. Some other features of i-care policy are as follows.

Additional features

- There will be high cover available to those people who have active home loan in their name.

- The premiums once declared will not be increased later, as there is no medical exam later.

Riders in i-care term plan

There is only one rider in i-care term plan just like iProtect had and its accidental death rider. So here are two options one can go for while buying i-care term plan.

iCare Option 1 – Sum Assured

If you take option 1, then you just have a basic sum assured cover which will be paid in case of death. Even if you die in accident you will still get the basic sum assured.

iCare Option 2 – Sum Assured + Accidental Death Benefit

In this option, if one dies due to accident, then the nominee receives extra money equal to sum assured (subject to maximum Rs 50 lacs). This means that; if a person has taken second option with sum assured of 80 lacs, then he will get 80 lacs on death if the death is due to anything other than by way of accident. But if the death is due to accident, then nominee will get Rs 1.3 crores (80 + 50)

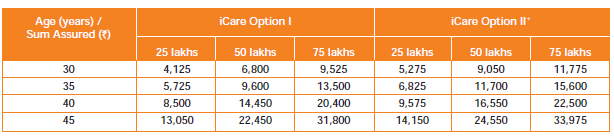

Below are the indicative premiums for both the options.

Note : Please make sure you read the terms and conditions properly (mentioned in the 5th and 6th page of the embedded doc above).

Hello sir,

I am 49 year old govt officer. I want to take online term plan. No medical issues. Which policies can be bought without medical test. Is there any amount upto that no tests are required. I have one LIC term plan. Please advise.

Once you cross a certain age limit like 40 or something , the medicals are always there. What you can do is leave your details with us and we will help you on this . http://jagoinvestor.dev.diginnovators.site/solutions/buy-life-insurance-plan

Hello Manish, I am 38 years old and have hypertension, however all other tests (including Renal doppler, Echo Cardiogram and Tread Mill test) have confirmed that there is no other problem. I am taking medication and also changed my lifestyle completely so I am healthy now. Is it okay for me to go for a non-medical online policy? If so, which one would you suggest – my thought was HDFC online policy. Your advice would be great. Thank you.

Hi bala

I can see that you are thinking of buying a term plan. ALl you need to do is leave your details at http://jagoinvestor.dev.diginnovators.site/solutions/buy-life-insurance-plan

Our team will get in touch with you

Manish

I am 45 years old. I applied for ICICI Pru IProtect Smart Term Plan for 1cr. Initially the premium was Rs. 31500. They had a medical test. Now they have enhanced the premium to Rs.45000, with the reason that elevated enzyme levels reported in my medical test. please suggest me what should I do now, bcz since last 25-30 yrs I never admitted for any medical treatment. I am surprised to see all these. Please suggest what should I do now.

Regards

Hi DrMKVerma

You should accept the proposal and go with it, atleast you are getting the policy !

Manish

Dear manish

Can hiv positive take this policy

Hi Rajveer

Thanks for asking your question. However, I dont think I am eligible to answer your query as its either out of scope of my knowledge or its not related to money matter directly

Manish

I purchased ICICI pru I protect smart term plan 50 Lk SA. Company issue me policy without medical , is it OK with out medical

Yes, its ok . If you are young enough and have good health, then not having medicals is fine

Thanks for reply, my age39 is this plan is good & not worry company not medical tests

Yes, you can just go ahead with this. Why are you not opting for HDFC ? We suggst that policy and we can also help you schedule a call with their team as we have special tie up for our readers.

Manish

Dear Mr.manish,

I am meganathan.working in Saudi Arabia,

1) I am planning to buy 3cr term plan insurance. Unfortunately I cannot come for medical.

Is there any term plan with out medical in any insurance company?

2) if medical I can do in Saudi Arabia some insurance company(like Bajaj Insurance) but the mention tests are not available in Saudi(computerized treadmill test) .

Please advize me.

Note: I approached by policy bazaar and I paid premium in HDFC. Now they are telling medical can done in india only. Now they cancelled my insurance two days before. Return pay not yet received).

Please advise me…If min amount insurance I can select (like 2cr or 1 cr)

No , without medicals you wont get it

A Tip who want to Buy ICICI iProtect Smart Plan

I am a 36 year Smoker and when I calculate my premium on ICICIPrulife.com for 75 Lakh for 31 year policy it was around 21000/-

Now Tip time for those having bank account in ICICI

if you have account in ICICI

click on the link which is there in ICICI bank account after login screen ( Insure Online)

Click on the banner iprotect plan

Calculate your premium now.. for mine it came down to 15000 from 21000

I bought the policy (Smoker) for 31 year with 75Lakh Sum Insured buy paying premium 15K

Now Surprise time….. I got smoker policy issued with No Medical Test required in 13.5 K and 1500 is showing as Advance premium.

Saving of almost 6.5 K annually.

Glad to know that ali ..

Hi Manish,

I have a question here…After new rule Section 45 companies are doing Medical Test as mandatory for all even though for 50 Lakhs Premium amount(Earlier there was no medical test for 50 Lakh)

But in my case they issued policy without any Medical Test…will it put any negative effect in future at the time of claim(In case of death) ?

No it will not have any impact on you

Hi Manish,

I am 32yr old, living in UAE, want to know if this plan (icici pru smartlife – all in one option) is available for NRIs.

I am unable to get any clarity from the website.

Kindly assist.

Its available for everyone !

Hi Manish thanks for provide imp. l information. I already have a ICICpru Icare term plan with option 1 with 75 lac sum assured, & premium of 11543, now I find that for the same sum assured icicipru iprotect is having premium of 8332 with additional benefit of terminal illness, & waiver of premium on disability. I am thinking to shift to this new plan , since it will save money in premium & 30yrs coverge will start afresh. What is your suggestion. please reply

Yes, I think you should shift !

Hi..Subbu..i was trying to buy icicipru I protect too but I faced two hurdles.. One is icici is not providing defined space to answer all questions in health questionare .2nd they had removed old policy details column from application form..&been advised me to write a mail with all details to icici but that mail won’t be part of policy document..i also got multiple lipoma condition..So I ask you to reply me with your experience with me on manish 505@list.ru..also to manish for help in deciding to purchase or not. Thanks

HI

i am planning to take I care II.i was therein dubai for 5 years.Now i am working in chennai.Iam planning to take a policy in within few weeks.in future if i got a job again in overseas i will move.Whether policy is active when iam moving to some other country for work.if any thing happens outside india, whether policy will cover, nominee will get full amount.please clarify

Yes, nominee will get full amount

Dear Manish,

There is one query, would really appreciate if you can throw some light in context of ICICI Pru iProtect plan (it would require a medical test before policy issuance):

The health questionnaire asks for cancer/tumor/cyst or any kind of growth the applicant is aware of. If for a person the answer is YES –not due to cancer or tumor, but because of Lipoma (deposit of fat under the skin, which is non-malignant and non-cancerous and doesn’t require any treatment), then will the application will be simply rejected? or they would first conduct a medical test and then take the decision?

Also, if a company rejects the application, then can it affect chances of getting insurance from other companies as well, since various company ask the question about rejection of the application and the reasons?

Thanks in advance.

Every company will ask for the same thing and yes, if rejected, it will become a blocking for getting it from other companies also . Regarding the question you have asked, I think its more of a underwriting level question and I am not qualified to comment on it . Try customer care of the ICICI and they will help you on that

Manish

Thanks for your advice Manish. I went ahead an applied for the policy and ICICI has asked me to get a test done, which requires a small surgery. This looks too much of an effort for purchasing a policy. Is it possible that to circumvent this test I propose to get some cooling period clause included in the policy? Is it a practice to get some clauses included in such cases when applicant is not willing to go through such tests?

Please provide your kind advice. Thank you very much.

What about the icici pru iProtect plan? Does it still exist? what about medical test in that case?

Yes iProtect plan still exists and medical tests are necessary!

Dear Sir,

I had proposed for ICICI Prulife II online policy for which i paid the premium and undergone the full medical. But now they have said that my policy is not accepted and can apply again after 6 months. No other reason is mentioned.

1. Can I apply for another policy through other company

2. what are the chances of getting rejected again

3. Can i avail any offline policy.

Worst part is that the doctor who conducted the medical test was a fresher Homoeopathic Doctor. An error probably in taking my BP has probably cost me a lot. Because I have declared that I have BP and I am on medication. Unfortunately I was as truthful as possible.

I suggest you apply only after 6 months now . You can look at HDFC as an option . Talk to us if you want that in future, we can connect you to our HDFC contacts !

Thanks a lot sir. Pl Let me know the details of the HDFC plan and connect me to to the relevent person if any.

Hi Manish,

I have some queries arising in my mind which is stopping me to go further for taking Term Insurance from any company…

If you can give answers with (Yes or No) also it will be very helpful to me.. and They are :

1) Claim Settlement can be happen for this below kind of Deaths :

If insurer died due to any of these Viruses such as : Flu, Swine, Corona, Ebola, chicken guniya, etc… any new dangerous virus/Flu comes after policy taken…

2) While taking policy Insurer is Non Smoker, No Alcohol Drinker & No tobacco addicted; if later on he started and died…

based on medical reports during death time and company found that he is smoker or Drinker or Tobacco addicted, so claim settlement will happen or rejected..

3) While taking policy Insurer is with NO disease or illness :

If any disease or illnes happens later on after 1 or 2 yrs, and insurer died with the disease, so claim will be settled or rejected

Will Term Insurance cover all this below kind of deaths :

– If insurer died due to any of the disease such as : Diabetes, Cancer, Heart attack, etc..

– If insurer died due to Body Organ failure or Non Proper Functionality such as : Lungs, Heart, Kidney, Brain, Intestines, Spinal cord, etc…

– If insurer died due to Illness such as : Blood Pressure (High or Low), Hyper Tension, Obesity, diabetes, kidneys, heart, etc..

– If insurer died due to accident Illness before or after 6 months..

– If insurer died due to Suicide after 2-3 yrs after policy..

– If insurer died due to accident while driving a car and later police or court stated that its driver mistake ??

– If insurer died while swimming in Lake, River or Sea…??

– If insurer died due to any type of Murder ?

– If insurer died due to some one pushed him from height ?

– If insurer died after having continious illness for more than 6 months, 1 yr or 2 yr…

– If insurer died being hospitalized for some months due to any of the disease, surgery, etc… claim will be settled or rejected ??

To claim settlement :

– With Normal dead, weather dead body has to go through with “Post Martum” mandatory ??

– Natural Death or due to illness death, in both of the conditions weather dead body has to go through with “Post Martum” mandatory .. and needs report for claim ??

Informing to Insurance Company :

– Weather Nominee need to inform Company immediately as and when insurer died, for future claim settlement ??

– Nominee or his dependents were not in a position to inform Insurance company immediately after insurer death..for atleast a month, what is the maximum time to inform company ?? to claim insurance..

Its important that Nominee need to inform Insurance company before funeral of insurer for future claim settlement ??

– Insurance company investigation team need to be available or presence before funeral of insurer, to stat that nothing hidden with his death ?

Accidential Death : AD means what kind of Deaths comes under this category..can you list down some of them…

I will be very happy if you clear some of this above questions…

1. You will still be covered

2. You can start drinking/smoking later . No issues

3. All kind of deaths are covered .

Please Help

age 25, smoking drinking occasional, please suggest

1) what if rather than 1 Cr. i take a term policy for 50 lacs each from 2 diff companies/same company?

2) Some companies provide upto gaining 75 year of age or for 30 years, in general sense which is more appropriate for a person of my age?

3)I am into adventure sports like skydiving, scuba diving etc does the policies generally cover death due to these activities and /or any change in premium?

4)The claim settlement ratio till what extent is it relevant because if i m looking at a long term plan the companies who are new in market and providing good options but not great claim settlement ratio as of now but well known world wide,dnt you think with time their statics will eventually improve? so investing in these is more beneficial?

I am targeting Aegon religare i Term plan in general any reviews and feedback will be highly appreciated ! Thanks .

1. You can look at HDFC aviva ..

2. It does not make sense to go for that tenure . Take till 60 yrs

3. If you are TOO MUCH into it, then its better you disclose it !

4. Claim settlement ratio does not matter !

Manish

Can you please help / guide me to built my finance portfolio.

My age is 32, Married, 1 year child.

My Salary : 15 lac per annum ( including tax)

Current investment :

1) Apart from company PF : I add 50K to PPF annually Since last years.

2) 40 thousand EMI – home loan

3) Invested in HDFC life progrowth plus (ULIP) couple of month back for 15 years ( basically for child plan)

4) Currently have LIC policy – Jeevan Saral but I am planning to surrender next years since it will complete 5 years and I should get 100% paid premimum amount back.

5) Planning to buy life insurance term plan and accidental riders policy.

Can you please suggest if I am missing anything or need to add/remove from my profile.

Thanks

Rohan

I think you need to look at things goals wise, is your life goals properly addressed ? List down them and then assign your investments to them .

You can take our support to take health and life insurance if you want –

http://www.jagoinvestor.com/services/health-insurance

http://jagoinvestor.dev.diginnovators.site/services/life-insurance

Hi Manish,

I want to know whether death happened due to AIDS is covered in term plan or not?

Hi Himanshu

I am actually not very sure on this . If you already have a term plan, then its better to talk to company and ask for it

Manish

Hello Manish,

very good efforts for this blog.

I am 33yr old, non-smoker, social drinker, and working in Finland since last 5 years. I would like to get a life insurance policy for myself (1 Cr, 30 yrs long). I would like to stick to the reputable ones.

Is there any Pure Term insurance policy for NRI offered by LIC, HDFC, ICICI or SBI? I checked about HDFC click2protect policy, and there is no information if NRI can purchase that or not. Also, no information about LIC online-term insurance plans? do you have any suggestions

Thanks,

Pradeep

LIC has no term plan at the moment. there was news of one coming up some time soon, but you cant just wait for it .

Coming to next, SBI offline term plan is given to NRI’s , even HDFC might give it to you . The best thing you can do is enquire with all these companies customer care on their website and tell them you will visit INdia some time soon . See what is the response from their end !

Can I take icare in the name of my father who is wholely dependent on me (i.e., he doesnt have any source of income and I alone support my family)

I am not sure you will be able to take very high sum assured for your father. Company will deny it

Dear Mr. Manoj,

We will be glad to help you with your query. If it is ok please share your phone number and we will get our customer service representative to speak to you on priority.

Regards,

ICICI Prudential Life Insurance

Application for Icare-II is pending issuance for me with Application No: OB00388860 saying Contract created: 19109141 – 50 lacs for 10 years

I need an update on this.I received some calls from Mumbai nos(022 code) but could not speak to them and reverting them was not possible for one way nos.

when would the policy be issued?

RanaBose

Did you talk to customer care ?

Hi Manish,

Thanks for the valuable information.

I have a doubt in icici i care online option. It asks for home loan account, I already have insurance on home loan account, do I still have to select that option.

If i select that option it says i an selecting insurance to cover home loan, that is not correct. I am really confused by this question.

Thank you,

Manoj

JUst leave that option in that case !

Hi Manish,

I have a complex situation here. (I know this might be a simple thing for others, you can simply say be honest.)

I am earning well, working in IT company, but i some how got TB two years back. Now I want to have term insurance for 50 lakhs SA and 50 lakhs ADB as I was married and had a family. I fear i will be rejected from acceptance of policy, if i stated i have TB 2 years back. I don’t mind an increase in premium. But, if they reject, I cannot apply for others also, as every one will definitely ask whether rejected from other companies.

Actually, I tried icici i care, and genuinely informed that I had TB once, so they rejected even accepting the application online. I think icici i care is only for persons who do not have any previous medical problems or for cheaters.

So, my plan is to take icici i care online without informing about TB. This will cover me ADB at-least without rejection (I have seen documents required, if death by accident. they do not have any info of medical history). After 5 years I will apply for SBI, inform that I have TB. If they accept, I will cancel icici.

What you suggest Manish. Is there any chance that they will accept even now, if i inform genuinely as icici online already rejected.

Your suggestion is very valuable to me. Please shed a light on me.

Thank you,

M

Its a little tough for you to get term plan because of TB . As an insurance company point of view, you as a client is not profitable . So from business angle they might not be insuring you .

You can try with some more companies, but all you can do is – tell them about your TB and hope that they accept your case with loading ! .

Manish

I agree with you, but my point is as you said, there are high chances of rejection.

But, by not telling them the truth i will at-least get covered with accidental policy and other deaths like heart attack etc, i hope they will reject only if they found death is because of TB which is pre-existed.

So, i will be covered by all deaths except death caused by TB.

No that is not the case. If they found fruad at any place, its breach of agreement and no payment will be made !

In this page they informed about claim settlement ratio which is 96.29%

http://www.iciciprulife.com/public/Life-Claims/Claims_Documents.htm

Here is more info provided by them

Claim settlement numbers: 14393

value of settlement: 256.40 crores

Now my question is what is average settled amount per individual, i.e. 25640/14393 = 1.7 lakhs

I cannot believe this, it is very low for insurance. I think this includes all claims. It will be helpful if actual claims settlement in term insurance is provided by IRDA.

Yes, these claims are including simple investment products, not pure life insurance policies. IRDA does not issue pure term plan settlement numbers, which is heavily demanded 🙂

Manish

So what is the point in showing those numbers by IRDA, even IRDA fooling the customers. I think IRDA is trying to mislead customers.

This is very very bad.

Hi Manish,

Please could you let us know whether the claims are settled in case of death (normal) of the the policy holder of a term insurance policy only after completion of a medical test or post mortem report by the insurance company subject to their satisfaction …for term insurance policies from Aegon Religare / ICICI/ HDFC/ Kotak/SBI etc….Does the legal heirs or relatives of the deaceased have the responsibility to inform the respective insurance company immediately after the death of the insured ? If the post mortem report content has deviations from the facts mentioned by the insured at the time of policy approval , which may be due to the changes in health condition of the insured (i.e. as age increases) from the policy enforcement date till his/her death, then there is every possibility that the claim can be rejected….What recoursewould the legal heirs have in these scenarios whether the term insurance policies are approved with medical tests or without medical tests?

I am a bit confused after going through all the Q&A and the pros & cons especially for term insurance policies without medical tests.

Good job….keep up the good work going in future also……

Regards

Ravindranath

Ok , lets understand this thorugh points

1. Term insurance will be paid only after the medicals are done . Obviosuly one has to investigate how the person died, and if the person is same who is taken the policy 🙂 . Its a business and processes are there.

2. When one takes a policy, they have to disclose the facts which are there at the time of taking policy. There should not be any lies ! . BUt things can deviate later if some developments happen later . For example. When I take a policy , I was not a smoker , So i told them I was not a smoker , I told them truth , Now later I start smoking and die because of smoking, so in this case , the money will be paid by company , because I never said anything wrong and nothing was hidden . Even the medicals will give the proof that I only started smoking few years back.

But imagine I smoke already , then I take policy and hide the fact that I smoke. Then I do something wrong . I should have paid high premium due to being a smoker but i didnt given right info . Now if I die later and company finds out that I cheated them, the claim will be declined.

So what matters is that policy was taken without any hidden facts or not . If not there is nothing wrong, money will be paid, Note that anything which happens after taking the policy is covered ,thats the concept of INSURANCE, you cover the future unexpectedness

I hope it answered your query , If not , please get back with more queries !

Manish

Hi Manish,

Thanks for your time & reply….Appreciate , if you could provide for all of us in detail the steps or sequence of activities /tasks to be performed by the legal heirs & the insurance companies in the case of unfortunate death of the insured (i.e. normal / accidental death) like the responsibilities of either parties , the documents that needs to be submitted etc. till the claim is settled….

Please clarify whether incase of normal death also, the post mortem of the insured deceased has to be performed mandatorily? Does the family members of the deceased has to oblige to the post mortem request from the insurance company in the normal death cases ? Does the insurance companies have any specific definition for normal death for issuing term insurance policies?

It would be very useful & helpful for all the term insurance policy holders to educate their family members on the same before hand in case of any eventuality.

Thanks & Regards

Ravindranath

No , not in that case , only if there is an accident, suicide or something like that, A FIR + medical post mortem is required. However death certificate will be needed for sure .

Manish

Manish,

One another thing, I take the policy and in future if I get settled in U.S and become a permanent resident there – will the insurance still be valid ? Can my family claim the insurance in that case ? Please clarify.

Thank you.

Bharat

I dont think so , you need to be resident of India for that, But Please confirm this once from the company .

I have just got confirmation from insuranceclub and AVIVA folks that – as long as you pay the premium, it doesn’t matter in which country you stay.

But then it might be specific to Aviva.

Could be Manish. Thanks for all your help !!

You have been of great help to many !!!

Also, how what is the ideal Term period I should choose ? I’m 31 and working for a software company – should I be choosing the max period available with the insurer or just choose 60 or 65 ? Can you throw some light on this, please ?

This article will help you – http://jagoinvestor.dev.diginnovators.site/2013/04/why-you-should-not-take-term-insurance-till-75-yrs.html

Hi Manish,

Fist of all, I would like to commend the efforts you have put in and are putting in to educate the Junta. Excellent service to mankind !! 🙂

I’m 31 year old, and I was a smoker till 2 years back. and a very occasional drinker (twice a year) From what I read, I will definitely come under SMOKER & DRINKER (?) category.

I’m looking for 1 crore Term insurance – like to choose 2 (each to cover 50 lakhs) – can you help choose two among these three for me, please ? HDFC (Click to protect), Aviva – iLife & Kotak e-Preferred Term

Also, my big dilemma is whether to choose any riders or not at all ? Is it wise to choose separate plan to cover for Accidental death ? If so, can you recommend a good one, please ?

Regards,

Yet to be insured

If I were at your place, I would choose HDFC with riders if any available

Thank you, Manish. But I wanted to take 2 policies of 50 lakh each.

Since HDFC is one of them, I’m planning on taking one from AVIVA or Kotak.

There is one thing with Aviva on 50 lakh cover – that we don’t need to undergo any medical exam – the reason why I mention this is I spoke to the executive from Aviva directly and also investorclub.com has confirmed that if I have not been smoking for one year then I can choose the plan as ‘Non-Smoker’ for premium, but I will have to mention the smoking history in the details to be filled. The representative also says that once the policy is approved, it doesn’t matter whether I smoke or not after the policy is approved, and that I don’t need to mention in future that I have resorted to smoking again. He however mentioned a point that if I declare as being a non-smoker based on the fact that I haven’t been smoking for atleast an year, the company may still ask the applicant to undergo the medical examination if the history of the smoking mentioned in the form warrants them to do so.

I understand that a couple of thousands shouldn’t be the focus while choosing term insurance, but AVIVA seem to have a solution for smokers who had quit smoking an year ago. Can you comment on this please ?

I think you should mention yourself as SMOKER . What will you do if at the time of claim this point comes ? You will not be there in world to fight on this

Hi Manish,

I want to go for an online term plan. I have shortlisted ICICI i care and SBILIFE E shield. I am m32, smoker category. Premiums are almost same , am opting for 40 Lacs for 25 years. Both plans dont need a medical test (a cons for me).Can you please tell me which one should I select and why!

Thanks in advance..

There is no specific reason for choosing one . Its your trust , It cant be same as mine . I am fine with ICICI icare , are you ?

Dear Sujoy,

Thank you for considering ICICI Pru iCare. ICICI Pru iCare can easily be purchased online and allows you to get a cover of upto Rs. 1 crore without any medical tests. To know more visit: http://bit.ly/15pbB0V

Consumers have chosen ICICI Pru iCare as Product of the Year 2012 in the Life Insurance Category based on survey of over 30,000 people by Nielsen.

Regarding claims, we are committed to honor all claims quickly and fairly. In its annual report for FY12 by the industry regulator IRDA, ICICI Prudential has a healthy claims acceptance ratio of 96.5%. You can access the report by clicking http://www.irda.gov.in/ADMINCMS/cms/frmGeneral_NoYearLayout.aspx?page=PageNo1848

Please understand that we only offer suggestions based on your requirements, however choosing a policy most appropriate for you remains at your discretion.

Warm Regards,

Life Insurance Help

ICICI Prudential Life Insurance

Manish, you are doing a good job of spreading the knowledge and helping people in taking informed decisions! Cheers!

I am an NRI. Can I buy any term insurance policy without going through medicals AND online? My next visit to India is after quite a long time. I want to have a cover for my family back in India just in case any eventuality happens, today.

Thanks again.

S

You will have to be present here in India for medicals !

Hi Manish,

For a male person aged 34 (Teetotaler/Vegetarian), SA=1 Crore and 35 year period policy, which is the best Pure Term Life Insurance available in the Market today (as on July 2013) ?

I have read several articles and references, but confused between ICICI iCare, HDFC Click2Protect, Aviva iLife and Aegon Religare. I do realise about the importance of Low-premium/Claim settlement ratio and benefits (riders etc), but still not able to reach a confident decision. Please help.

Thanks

HDFC is a good option

Thanks Manish for your response.

I will go ahead with HDFC Click2Protect policy for SA=1 Cr over 30 Year period

I was taken the hdfc term insurance policy i.e I life

i am taking Alchohal from past few years the same has been mention in the prposal form…

After the time of medical done in the reports the LIVER ENZYMES desease came in to report…

So the HDFC team decided to postpone the policy for 3years…

This is the first time when i came to know i have this type of desaese…

Then i came to know about the icici i protect where no medical required..

at the time of seeing the prposal form there is no any question about the liver enzymes…

Should i go for icici i protect policy…

will the comany issued the policy

So can i provide this liver deases information provide seperetaly through mail…

pls help

Abhishek

You will have to declare all desiease of yours in the policy when they give. Its a declaration policy . So if its not asked, it does not mean that you can hide it .

Hi Manish,

I like to know one thing about online-term insurance specially for this ICICI product. Say, the website calculate the premium amount based on my details and the yearly premium is Rs. 10000/-. My question is, would this amount fixed for the 30 years (My term tenure)? Or it would increase based on my age/some other factors? I have called their CC but they are also not aware of this. Please let us know your knowledge on this.

Thanks!

Its FIXED !

Thanks 🙂

Hi Manish,

I have taken HDFC Term Policy recently through online and got the bond. but in the bond, instead of adding the period between last name and first name, its printed the period between first name. I have checked with the agent and he given one document on letterhead without stamp stating that is a mistake and added the actual name. Is it fine or better to request for the bond again?

Name sequence should not be of a concern .. but get it checked if you are so much worried

Ok, Thank you.

Hi Manish,

I appreciate you for your valuble suggestions, i gone through your blog regularly. i am 36 years old. and want to take the term policy, i ve 3 questions now

1) what is the difference between on-line policy and off line policy? why the premium is that difference in every company.

2) i ve occasionally smoking and drinking shall i come under smoker or non smoker? if smoker what if in future if i stop smoking this ocationally also? and vice versa?

3) shall i go for ICICI and AVIVA both for diversifying the risk for 50 lacs sum assured?one is for offline and the other one is on_line.

i do not have any health issues yet today and we have medi_claim provided by our companies.

i wanted to take the two policies one is my name and the other is my wife name.

Kindly guide us which policy is better for us.

thanks a lot

rgds

1. Online term plan does not involve a lot of costs like commissions and other overheads

2. You are a smoker then .

3. You can do that if you wish , there is no compulsion

How do I decide whether to take Accidental cover or not with iCare? Does it make sense to club accident rider with a term plan (and pay higher premium), or should I prefer a separate accident cover? I do not have any term plan yet, and the only health cover I’ve is the one provided by my company.

Its a personal choice . I can only say from my own perspective . If would prefer to take it seperately !

Thanks for the reply, Manish. I understand it’s a plethora of choices and confusions out there when it comes to financial planning. I can only hope I make a right choice!

how much is the effect of being diabetic on premium amount ? I am confused becuz while I know the premium in I-care (no medical test), I cannot compare as I don’t know the premium in other online or offline policies from other companies> Can you help please

There is a wide range .. which can depend from company to company. It can range from 30% to 100% also ..

Manish

I have some confusion about icici I-Care Term plan is that without medical how they offer a term plan for above 50L. Is there some hidden Condition

I am 34 year old salaried person can i go for ICICI i-care

No there is nothing hidden, but their premium is high

Manish,

I am 33 yrs old,with 2 kids.If i take it in my name and give my son as nominee. the policy term says 75 yrs is maximum age for expiry,will I get my money back after 75[policy expiry] or will my son get it if my death occurs after 75?

pls clarify?

Only your son will get it after your death , you dont get anything on maturity from term plans .

Hi Manish,

i read thru the ICICI term Plans, I Care, I Protect and Pure protect,, which one do you advise is a better deal

Tx

iCare

Is it possible to take i-Care term plan for housewifes

please advice me….

Yes, but only if she is earning !

Hi Manish,

This is first instance I visited this blog.

I really appreciate your efforts in educating people who are confused and lost among variety of products from lot of companies.

I had certain querry in my mind bt going through the discussion many of those clarified.

Thnks for good work & good luck.

Shekhar Deshmukh

Thanks for the appreciation Shekhar !

Hi Manish,

I have applied for online term plan from aviva india. They are increasing the premium by 200 % saying medical reasons. In that case is it fine if they deduct the cost of medical if I refuse to take the policy at higher rate. what is the IRDA rule for return of premium.

Thanks

Jyoti

Jyoti

I think its clearly mentioned and must have been confirmed with you also that incase you refuse the policy, the medical costs will be cut

Hi Manish!

1. I am confused with ICICI iCare / HDFC / LIC. LIC Online Term Plan is still not out. So which one of above you think is the best term plan for 50 L cover. I am 28+ non-alcoholic, non-smoker, no such disease known till date.

2. Further, is it worthwhile to go with accidental cover rider especially considering the fact that deaths due to terrorist attack etc. are not covered however premiums does increase.

Sushil

What exactly is your “confusion” , its more of a trust factor now . I would recommend any of them , you can also go for Aviva or Kotak

To keep my query simple just I mean to ask that if you had to pick one amongst ICICI iCare / HDFC / LIC only which one it would be ? I understand that specifying the name of one company on a blog is difficult but still tell me just one.

I assure you that I won’t ask any further query in this regard or any reasons for your pick.

Sushil

Then I am picking a random name .. go for HDFC , just make sure you give all the right information and make sure you read their terms and conditions

Dear Manish,

If i had a problem of Kidney Stone around 5 years back.. Should i mention this during taking the policy. How will it effect. Will it increase the chances of rejection of policy or will it increase the premium.. Please explain

Rahul

Yes , you should mention this and it can impact . It can be rejection or premium increase. you cant be sure on that.

DEAR MANISH THANKS FOR REPLYING. WE HAVE ALSO DECIDED TO FILE A CASE AGAINST ICICI LOMBARD. ONCE AGAIN THANKS.

DEAR MANISH, THANKS FOR REPLYING. THERE CUSTOMER CARE PEOPLE SAY YOU UNDERGO A TRANSPLANT, THEN WE WOULD PAY. THE TRANSPLANT COSTS CRORES OF INDIAN RUPEES , PROVIDED WE GET A SUITABLE LUNG DONAR.THE CLAIM IS OF FEW LACS ,. WHAT CAN BE DONE. THIS IS A COMPREHENSIVE, LUMP SUM BENEFIT PLAN. TILL NOW ALSO, ALL THE MEDICAL EXPENCES, HOSPITALISATION, CT SCANS, BRONCHOSCOPY HAD BEEN PAID FROM OUR OWN POCKET.NOW THEY ASK FOR A TRANSPLANT. NEITHER WE WOULD HAVE CRORES OF RUPEES NOR THEY WOULD HAVE TO PAY THIS CLAIM. kindly help…

Rakesh

Is it mentioned in Policy documents that the claim will be paid only when you undergo the treatment ? If its not written like that you can file a case against them !

dear sir, one of our relatives was diagnosed with one lung collapse .they had an icici lombard criticall illness policy(HOME SAFE POLICY). they say that we would pay up only after the patient undergoes a lung transplant. kindly give us proper guidance. IN short there policy reads, ( one of the following organs, heart, lungs, liver, kidneys, due to an irreversible end stage failure) . LUNG COLLAPSE IS IRREVERSIBLE.

You should check their policy document if what they are saying is mentioned in the agreement ?

DEAR MANISH, thanks for replying. THEY ARE VIOLATING POLICY TERMS.WHAT SHOULD BE DONE? THERE SALES PEOPLE SAY GETTING THE TRANSPLANT DONE IS NOT NECESSARY. BUT THERE CLAIM SETTELMENT PEOPLE SAY, WE WOULD PAY AFTER THE TRANSPLANT ……

Rakesh

If its mentioned in policy terms, you can claim it , go ahead with it and talk to their customer care !

hi manish .

i was planning to take a life insurance based on term plan for a cover above 1Crore+ rider benefits and i came to find iterm plans are the cheaper ones. Icici pru i care plan, aegon religare i term plan,aviva i life and barathi axa e protect plan are the the plans i came across.Out of the above list i found aegon religare a better plan as it gives the maximium policy term for 40 yrs compared to other policies. can u please advice me on how reliable is aegon religare company and how is there claim settlement ratio. IF you had to advice on buying a term policy which one would you advice me to go for?

Its ok , the claim settlement number earliar was bad , but now it has become better, if you have trust issues, then go for LIC or SBI

manish ,

I am confused among 3 term plans -aviva, bharti axa and icici , which plan to choose , kindly help !

Go for Bharti Axa , I am telling you this, because you need a name to act, if I tell you that choose any it will not work , so just go with Bharti Axa

Thanks Manish,

I regret that i found your blog pretty late.Wish i was reading this from Day one.Pretty useful and valuable information!

A month back i m not aware of CIBIL,Term Insurance(many other things).

And now i already got my CIBIL report with 820+ ,applied Credit Car for my wife as she dont have a Credit Report and i am getting term insurance (2-3 days)from ICICI for 1CRore.

I wish you all the best in whatever you pursue and thanks from my bottom of my heart!

Thanks

Sethu

Good to hear that .. you are pretty fast on action side, a lot of people come , learn and forget , but you implemented 🙂 . Congrats to you ! . Keep commenting on the blog in future too !

Manish – I was about to pay my premium thru credit card and i backed out at the last minute today as i m not sure whether payment by credit card is valid for tax exemption?

I know there was a rule some years back and heard from few sources that now its discarded.But still would be good if you/anyone clarify the above and provide pointers to that?

Thanks

Sethu

That rule was before 1st April 2009 , before that you could pay only by Cheque .

BUt now you can make payment by any mode OTHER THAN CASH . You can make payment by Credit card, there is no issue , go ahead !

Dear manish,

I have a ICICI Pru protect plan – elite for INR 50 lakhs which i had bought a couple of years ago. premium with accidental cover of INR 25 lakhs is approx INR 14k. I had also undergone a full medical checkup at the time of getting the policy. Infact I was told that the policy will be issued subject to me clearing the medical tests. Even today the premium for a similar plan is somewhere around INR 15k

Now this ICICI Icare is providing the same term plan at roughly half the cost without any medical tests. Somehow this seems to be too good to be OK.

Will you be in a position to help me with the difference between the two policies. I need to buy another INR 50 lakhs of term cover and will like to really thrash out any differences between the two policies.

Also are the premiums low only for the fact that there is no agent involvement in the icare product …. There cannot be so much difference.

Will request your help on this.

Sidharth

The premiums are down for 2 reasons

1. Agent is not there

2. The product is new and hence the pricing is as per new data , the old one’s will continue to have high premium

Sorry for wrong sentence.

Hi Manish,

I want to go for a term plan. Firstly i thought that LIC is the best options because it is reliable and very old in this business. But after comparing LIC and ICIC-icare term plans i am confused. I have some queries please try to resolve.

1: ICICI has no medical test at the time of login. Suppose i mentioned all the details like smoking, drinking and any disease which are in my knowledge. Now suppose something wrong will happen to me after two years then company will ask the medical reports or you can say postmortem report before releasing the sum assured to my family. If there is any disease come in report which is not declared by me then the claim will rejected or what?

2: who will responsible for approving the claim? I mean the agent will help in clearing the claim or there is a standard process for this. Because i have heard that the agent will help in that if agent is not good then there will the chances of claim rejection.

Thanks.

Tinny

1) You are paying higher premium because of the bad habits and illness already , hence they are covered . The claim will be rejected only when you do not disclose it and death happens because of these issues .

2) You , only you will be handling the claim process (I mean your family) . Agent is only to assist in buying process, nothing else . Agent has no role in claim process

Hi Manish,

I have LIC policies which are not term plans. Can I avail this icare product or will I be rejected.

Sachin

you can apply for it !

I am 33 years old. Do not smoke or drink. All the health related questions are ‘No’ , height-weight ratio everything is good.

Still at the end it said “We cannot offer it to you”

Quite perplexed why would it reject for me as I am pretty low risk candidate.

Will explorer Kotak and Aviva now.

BTW, was looking for 50L with accidental benefit.

Nikhil

What is your income or the job category ? Are you involved in any risky job ?

I am in IT having a good income. RSI (Repetitive Strain Injury) is pretty much the only risk my job carries 🙂

Finally I went ahead with HDFC Term Plan. This one was also suggested by PolicyBazaar person. And I also wanted to go with a more established brand.

NIkhil

then go for LIC in few weeks once their online term plan is there

Manish

Thanks for the brilliant blog.

A couple of questions:

a)Do you have any updates about when the LIC online plan is being launched? Because probably it makes sense to take a policy with them if the price of their online plan is cheaper than their offline plan (which is kinda obvious) and only a few thousand more than the iTerms.

b) Assuming it is launched and the premium falls between the iTerm and LIC offline, would you still recommend splitting the insurance into two – one from LIC and the other from the iTermish family?

Suresh

a) No dates are out , they have said that the product is ready and will come “soon” . Now “soon” is totally dependent on them

b) Splitting has its own advantages , which a lot of people feel are not that important . Its your personal choice now , if you dont want to , thats totally ok .

Manish

Thanks for the quick reply. I hope the online effort at LIC is not stalled by the “establishment” since it doesn’t serve their interest 🙂

Ok, the best argument for splitting could be that, as you yourself had mentioned many times, you can decide to close one of the policies off in future.

Suresh

True , that the most important one

Hi Manish,

Thanks for your review on this product.Acutally I planned to buy this plan online and I filled all the information.Later,I saved my info and I decided to buy this plan after one week.Meanwhile I got few calls from customer care to buy this plan.I asked few questions to the customer care representative and the answers are very unclear .The following are my question

Question) Now I dont have any medical problems and I had never gone to any medical tests.So for all the questions I mentioned No.If I found any existing disease after the policy is inforce and any eventuality happened will you pay the money to my family-

Answer for this question from icici people) – No problem Sir, we will give money to your family.Because you don’t know whether you have that disease at the time of filling the application.

Question) Based on above answer I asked them how do you know that whether I intentionally hide this information or really I dont have any idea about this disease

No answer from customer care.

Base on above conversation I doubt about taking online term insurance policies with no medical tests.

REgards,

Satya

Satya

fine .. good that you didnt go through it . However the answer is that the medicals are not there because they will not look at the medicals at the time of cliam , they will only look at that part which might be developed after you have taken the policy . and it will be depending on the doctors report . The premiums for this plan is higher because the medicals are not done in this case and it purely depends on your declaration.

Manish

Hi Manish,

I am 1986 born , non smoker and non alcoholic with not known of any decease. I Just want to confirm that is this policy is good for me. or is there any other good recommendation from your side for term plan. and what about no-medical test?? does taking policy with no medical test cause any obstacle in claims?

Deepak

You can go for this , but better you go with Kotak or Aviva or HDFC , those must be more cheaper option

Manish

Thanks a-lot Manish :).

Hi Manish,

Truely appreciate your help and support in spreading your knowledge all across. Believe me there must be a number of people gaining advantage from these discussions.

Coming to my dilemma, I am a bit confused in selecting the best term plan from 50L-30yrs. can you please help me know the leaders in claim settlement ratio. Where does SBI stand? Kotak/Aviva/SBI/ICICI- the order for CSR.

Regards,

Ays

Ays

You can get it from the latest IRDA report

Thanks a lot for your reply Manish . Can I go ahead with ICICI icare online or else can you suggest the BEST life term policy in the market ?

Sangeeta

You can go with Icare , but I hope you know that there are no medicals in this plan and the premiums are higher than other options (mostly because of no medicals) .. If you prefer to buy a policy which does medicals , then you can skip this plan. Go for Aviva or Kotak and take the term plan for more than 50 lacs sum assured

Manish

Hi Manish,

I submitted my post on rupee guru & from last 1 month their agent are forcing me to buy ICICI pruicare …and they are advising me to take 25 lkh for me & my husband each ….Please guide whether to go for this policy or not ? our premium is coming 11668 in total for both the policies …I’m in dilemma ..plz help wch is the best life term policy in market ?

Sangeeta

I am more afraid for the pressure they are putting and the way they are pursuing and not giving you space .. Better tell them you got a policy from Aviva or Kotak .. And then buy ICICI iCare or anything else online

Hello Manish

I want to go for the ICICI Pru iCare Term Insurance Plan as it is convenient to purchase Online, but at the same time worried about the medical tests not being done.

I do not have any disease for all their questions and would select a no for them, I am a smoker 2-3 cigarette sticks per day and drink a beer or 2 pegs per month.

I case some who took the policy and answered ‘No’ to all their questions as he do not have any disease at the time of taking policy and for instance If he gets any of the disease for the question he said ‘I do not have that disease’ to their questions, but he got the disease for eg: after a month or an year, and died due to that disease or for with some other disease, would his claim be rejected?

OR, if he do not have any disease at the time of taking the policy, but he got this after 3 months or an year and eventually demised, would his claim be rejected? Is there any time period after which the disease is valid for claim without rejection after taking the policy?

Satish

At the time of taking the policy , If you do not have any illness, that will always be covered ,even if you get it later, your claim will not be rejected

Manish

Thanks a lot for your prompt reply !

Please respond your view on the below…

But in this case of ICICI Pru iCare Term Insurance, they do not have any medical test being done and believes what we declare online. Here if someone who for eg: already have cancer or any of the disease what they asked in their heath questions but declared as ‘NO health issues’, and eventually dies and his nominee may say het that disease only after taking the policy, would it be valid.

And in case while declaring they may be true but may got that disease acquired after a month/week, how do they distinguish between these 2 Genuine and fake case

Hi Manish

Nice thread and really informative discussions. Really I appriciate.

I have two questions. First is I consulted my ICICI relationship manager and he suggested to go for ICICI icare online term plan which is obvious but he added to go through his advisor code.About premium amount I can check if it varies between without Putting his code and with code. Wts his version was he will fullfil some target nothing else..is it true or something fishy ??

Secondly Q is :I am planning for 50Lac SA and after going through ur mails decided to split into two. 25 Lac with Accidental Cover from ICICI and another 25Lac from Kotak e preffered. Is it good or what you suggest ?

Expecitng your comments

Mohan

MOhan

Yea regarding his targets , he must be right that he is having sales pressure with targets and hence requesting you to buy it .

Now a days term plans are so cheap that one should really not take less than 50 lacs cover with one company , so better take just one policy of 50-60 lacs or take 50 lacs from 2 companies each

Manish

Hi All,

Yesterday i met an ICICI relation ship Manaher.He advised me that it is better to go for Off line Term Insurance rather than Online(ICare) because it does not have any medical tests and the chnaces of rejection of claims will be more.I know that he has suggested Offline only for his commission but at the same time he is true.I think it is better to go with On Term Insurances that have Medical Tests. We may feel that it is combursive process right now.But if we take that risk now then our dependents will not face any problems during cliams(Incase some thing happens to us (Policy Holder)).Based on this i feel that it is better to go KOTAK and AVIVA as both of them have Medical tests.

Manish please provide your inputs,also correct me if i am wrong.

Thanks

Narasimha

Narsimha

He is not right .. only ICICi Pru icare plan does not have medical tests , all the other online term plans have medical tests ..also medical tests are also not there in case of offline term plan incase your Sum assured is small like 5-10-20 lacs .. So the basis that it will be rejected just because medicals are not done is not right .

One thing which is in favour of offline term plan is that good agents will be there for after sales service and incase you are not around will help your family members at the time to claim settlements .

Manish

Thanks Manish ..

They have to re-phrase some of the questions & also provide more options to choose. Some of the questions at least I feel should be changed as the chances of proposal getting rejected is more due to such questions & options given.

1. Do you consume or have ever consumed tobacco?

My view: What if a person had quit smoking 5 years ago? I can’t mention the same anywhere in the proposal form. What it allows me to choose is the number of cigers per week if my answer for the question is “YES”. How do I convey that I had quit smoking and a non-smoker currently?

2. Do you consume or have ever consumed alcohol?

My view: Same as above. What if a person had quit 5 years ago? I can’t mention the same anywhere in the proposal form. What it allows me to choose is the number of pegs per week if my answer for the question is “YES”. How do I convey that I had quit and not consuming currently?

3. Do you have or ever had diabetes or blood sugar disorders or sugar in urine?

My view: Sugar levels keep fluctuating based on our life style. If you exercise regularly, it will be within the range, if not may go beyond. What if a person’s sugar levels are normal at present (while filling application), but was bit above (113 mg/dl) the reference range (60-110 mg/dl) in the past? What it allows me to choose is when was the diabetes confirmed or something like that. Should not they consider the current state rather than past?

4. Do you have high cholesterol?

My view: Same as above. Cholesterol levels also keep fluctuating based on life style.

Manish,

When I gave these details in the online application while the customer care executive was guiding me over phone, (funny, she herself was not clear what has to be filled based on my information provided above) she has informed me that the application will be rejected (without even submitting the application). Can’t they just increase the premium based on the risk rather than rejecting the proposal?

Please let me know whether I should go ahead with this ICICI icare or some other company.

Another funny part here is that if my proposal gets rejected, it may affect my proposals with some other company also as almost every one has a weird question in their proposal application “has any of your proposals with the same or some other company been rejected in the past?” :).

This is based on my experience. Someone might have experienced the same with other questions.

Thanks in advance.

Eshwar

1. There is no distinction of “Smoker NOW” and “Smoker Earliar” .. If you were smoker at some point of life , then you are SMOKER

2. Same as above

3. Same as above , Incase it was messed up at any point of time , you have to fill “YES”

4. Same as above

Yes , they should increase the premiums , but it will happen only if your case is considered them at all .. I mean tehre are cases where they totally reject it and some where they increase the premiums .. I would recommend going with Aviva or Kotak .. Its not mandatory that your proposal will be rejected at all companies

Manish

Yup, got the policy in hand. I don’t have any known major medical history, but still went ahead with this policy. Now I don’t know if I will be proved a fool in future for taking this policy — but going by ICICI’s claims history vs. say Aegon Religare, I’m a little confident.

Krish

If you have filled your info correctly , you dont have to worry much

Manish

Hi Manish,

Though most of the comments here tells us to avoid iCare plan, I went ahead and took a 50lac cover. There were around 22 odd Questions related to medical history and I felt these were pretty straight forward questions.

For a healthy male who is a smoker and drinks and doesn’t have any known major illnesses, guess it’s a breeze to fill up this form as it is not asking for your blood pressure or urine sample!!

I had looked at Kotak’s questionaire and it went into too much details and I was confused — it even had questions like your parents Date of Birth, Brothers/Sisters DOB etc!!

ICICI Icare Questionnaire:

Do you consume or have ever consumed tobacco?

Do you consume or have ever consumed alcohol?

Do you consume or have ever consumed narcotics?

Do you have or ever had any heart related chest pain or other cardiovascular conditions like angina, heart

attack, heart tumors, heart murmurs, aneurysms, narrowing of the arteries, irregular heart beat, rheumatic

fever, or undergone coronary artery bypass graft (CABG), percutaneous transluminal coronary angioplasty

(PTCA) or pace maker insertion or any other heart condition not mentioned here?

Do you have or ever had stroke, paralysis, blackouts or other neurological (nerves or brain) conditions, e.g.

Parkinson’s disease (shaking/tremor disease), Alzheimer’s (dementia, senility–severe loss of memory, or loss

of ability to reason), etc.

Do you have or ever had cancer, tumor, cyst or growth of any kind?

Do you have or ever had diabetes or blood sugar disorders or sugar in urine?

Do you have or ever had high blood pressure (Hypertension)?

Do you have high cholesterol?

Do you have or have you ever had thyroid disorders – like hypothyroidism or hyperthyroidism?

Do you have or have you ever had epilepsy?

Are you suffering from or ever suffered from any chronic kidney disease or received a renal transplant?

Do you have or have you ever had a kidney stone?

Do you have or have you ever had asthma or tuberculosis (TB) or chronic obstructive pulmonary disease

(COPD) or sarcoidosis?

Do you have or have you ever had jaundice or ulcerative colitis or pancreatitis?

Do you have or have you ever had any psychological conditions (like: depression, anxiety neurosis,

psychosis, panic attack, attempted suicide)?

Do you have or have you ever had any disease or disorder of the blood (like deep vein thrombosis (DVT),

sickle cell, thalassemia major and intermediate thalassemia) and bleeding disorders, rheumatoid arthritis,

systemic lupus erythematosus (SLE) or any other auto immune or connective tissue disorders?

Have you or your spouse ever been tested positive for HIV/AIDS or any other sexually transmitted diseases?

Do you have any physical disability or deformity?

Do you participate in any high risk sports (e. g. contact sports), hobbies or pastimes which may expose you

to a higher than average risk of injury (e. g. motorized speed contests, aviation, diving, bungee jumping,

skydiving, mountaineering, etc.)?

The question is to be answered only if the life to be assured is a female:

i. Do you have or have you ever had any previous (past) abnormal pap smear or abnormal mammogram results

Krish

All the comments are personal in comments section .. if you have gone ahead , then congratulations . I appreciate you noting the convinience involved for those who have some kind of medical history . Did you get the policy in hand ?

Manish

Hi,

I have a term care plan from one company which covers for 50 lakhs and 30 years. I am into the first year of the plan. I am a 32 year old male, use tobacco, and a 2 year old son. Now I want to buy another policy worth 1 cr and discontinue the previous one as comparatively the premium on the 1 cr plans is far less than this 50 lakhs. If I do not disclose to the new insurance company that I have an existing policy and simply discontinue it after the completion of 1 year of the existing policy (which has about 5 months left for the 1st year to end) how would the new company find out if I have a policy or not and can they cancel my policy proposal or should I simply tell them what is true and let them guide me.

Your comments would be greatly appreciated.

Sunny

Thats a risk you are taking , its NOT DISCLOSING THE FACTS . How will they find it out ? I think rather than finding the answer , you should ask , what if they did ? There is a risk if you say .. “I am pretty sure they wont find and go ahead” .

Better take a new term plan and discontinue the old one

Manish

Something very ridiculous has happened with us. Me and my colleagues tried to buy this plan by providing answers to very simple questions asked in the proposal form like annual income, past policy details, names and address etc. At the end we got the following message “We regret to inform you that based on the details you provided we can not issue this online term plan. Please try our other products for online insurance.” I called their customer care officer but he refused to divulge any specific details as to why they rejected the proposal. Do you have any idea why this is happening? How they can decide just on the basis of basic details whether to accept or reject a proposal.

You provided ur contact details etc while filling up the form?

Amit

It might happen , they might have an internal process which takes your basic data and rejects your claims like if you are in Bangalore and have high income , but also past history of medical illness, then they can reject .. this is just an example ..

Dont feel too much about it , move on to other

Manish

Hi, I have bought ICICI Pru iCare with SA of 50L + Accident Rider of 50L for an annual premium of Rs 12905. And also bought Aviva i Life with SA of 50 L for an annual premium of Rs 5853. Both the policies were bought on Saturday 15-Oct-2011. I have uploaded all the relevant documents thru their website link.

Now the fine print : I got call from ICICI CSR on monday i.e 17-Oct-2011 for relevant information verification and the policy is now in force.

However I am yet to receive a call from Aviva. Lets wait an wait.

Pradeep

yes .. i think you should wait a little more .. you will surely get a call from them

Manish

Hi,

SBI Smart Shield plans cover Terrorist attack death as well it has rider of Permanent Disability rider as its Government company it plays lesser gimmicks then private ones. or else wait for LIC online Term plans.

This is absolute trap product. PLEASE AVOID IT..!!

ICICI is pushing the risk to consumer..!

Having a medical test is in the interest of the consumer. Not Having medical test will be advantageous to the ICICI. Why? ICICI can simply reject your claim citing a slight discrepancy it can find in your stated application and you will not be there to dispute it..!!!

With Medical test at least 70% of discrepancies can be iron out ahead of policy issuance.

Another scary scenario arises – Let us say a 35 yr old takes policy in 2011 and he is not diabetic today and states as such in application form. Unfortunately if he becomes diabetic let us say after 15 yrs and dies of a health problem, ICICI can theoretically reject claim saying there is a discrepancy in application..!!!

Avoid ICICI and go for other options..!! Remember, things should be simple, straightforward and upfront in Term insurance.

You are very much right. If there is no medical test at the time of issue then there should not be any medical test at time of claim settlement. Otherwise it is nothing but trap.

I would like to thank Manish for giving all these reviews.

Personally, I am still trying to finalize a plan for myself. I’ll take LIC online when it comes as the second plan.

About this, NO Medical tests –

Pro: Save 10k now, pay 1k per year and be unsure of claim settlement

Con: Spend 10k now, save 1k+ per year and have more surety of claim settlement.

(10k is for the medical test and 1k per year is the extra premium for not taking a medical test)

I am 27 year old non somoker/non drinker and i dont have any medical issues.

I need a term plan of 50 L sum assured, out of all the current term inusrence policies in the market, which one is the best. I dont want to rush and take a wrong policy.

Rgd,

Shashaank

Is it make sense to take accidental death rider, when i am taking cover of 10 times of my anual salary? Because Basic sum assured amount is sufficient….

Or fundamental/thumb rule is different, like take a lower sum assured value and take rider…,

I have a query regarding term plan premium, say my age is 30yrs and i got i-care policy of 50lacks with 30yrs, by 9050/- per year, will this premium amount will change every year, as age is getting changed…if so is it like as shown in table?

Or through out the term annual premium will be same i.e. 9050/- per year?

Ashok

Premiums for term plans dont change .

thank you for your quick reply.

very good article, regarding exclusions like war or terrorist attack, kindly give comparision of all online plans like aviva,aegeon religare, metlife, icici etc, and even just give information on whether online plans or traditional term plans of same insurance companies have different exclusion norms or criteria.

Thanks in advence.

Manish

for now please look at it yourself , i will doit later

Medical test is always better. Let the insurer verify what they want to know about you before issuing a policy. If only the word of mouth is not going to be enough during claim settlement, then why should that be given importance while issuing a policy. There is a possibility that people may not even know if he has any specific ailment without a medical test. He may end up giving incorrect information to the insurer though he my be correct based on his believe and knowledge. For example, how many people get to know about his tendency of high blood pressure or sugar or even cancer at the very early stage without any medical checkup? I consider this kind of policies as a trap which would hopefully be proven by the high claim rejection ratio in future. My suggestion would be to stay away from this kind of policies.

Agree with you Ram.

No medical test is a TRAP.

wonder how “No med test” is a trap.The e-form asks you to fill up YOUR Data.While a person may have cancer while filling up his form and not know about it,that isnt his fault and he writes “Not suffering from cancer”.Say two months later he is diagnosed for cancer (theoretically,presume he felt no discomfort in his body at the time he was filling up his form).Company may reject his claim if he dies in due course but it is his first diagnosis date that will prove that he wasnt aware of it.

Well, he always has recourse to the ombudsman if his claim is rejected.

Further, when they say medical test MAY be taken (other Companies) it doesnt mean that they WILL take a med test.What if they dont take and this man dies of cancer .wont his claim get rejected ? Same line of action.

By the way,google and find out the littany of complaints against the online term plan with the lowest premium.

If a person buy a term policy and gone abroad for long term or short term assignment and expired. And all premiums were paid and policy is in force. Will the person’s family get sum assured value?

Pradeep

Yes

Dummy post!! Please ignore. There just does not seem to be a way to subscribe to the comment thread unless I post something (or I missed?).

Hem

was your comment just to subscribe or was it a real comment on the article 🙂 . the problem is the wordpress plugin requires at least one comment from the person who wants to subscribe to an article , its a CMS requirement and not put by me personally . there is a feed for the comments which will send you all the comments if you want but in a single mail : http://feeds.feedburner.com/JagoInvestorComments

Manish

Manish,

I just wanted to subscribe to the comments through e-mail and I like it that way. I do not use any feed reader.

Btw, the background color of the website is changed to black and I think it is for green cause!!

Thanks,

Hem

HEm

Actallt the feed url which I gave you also sends you all the comments through email , but it sends all the list of comments after few days .. See if that helps you or not .

Manish

Health Insurance is an important allocation of your monthly expenses in the terms of your need for different kinds of insurance .Medical care is expensive and if you are admitted into the hospital due to an illness or an accident you may have an expensive bill to pay.

As usual…ICICI made fool of me again….

I just filled the whole form accurately..once I click the submit button I got a display saying “Based on the information entered, we cannot provide you online term policy”

Now the problem I have here is….It asked me all sorts of data name,fathers name, contact, emailid, profession, health history…etc.etc….

Now I guess these cheats will sell the data…..

Did u retry?

Abhishek

Its business .. they will have a criteria based on your data . I dont think they wull be selling your personal data

I suggest try Kotak or Aviva

Manish

Now I know how I get those pesky calls from ICICI. 🙂

Its all business….

believe me PHI data is very expensive…..they definitely sell this data…

If you are young , no diseases and doesn’t smoke/consumer alcohol..this plan will be costier for you..lookout for other insurers like kotak/aviva/metlife

I am not quite sure whether not having medical check is good for the customer. In fact I would be more comfortable having a medical check so that later in an eventuality my family wouldn’t need to face a rejection of claim based on medical grounds. So not having medical checkup would make me feel more uncomfortable.

Also I don’t think this policy is very attractive at price point. For a 1 Crore coverage for a 33 year old male for 30 year, Rs.18000+ is not very competitive in the current market. Aviva gives coverage at <10K.

To summarize my understanding

Pros

Online, ease of taking policy

Cons

Not very highly competitive price in current market (Compared to even old iProtect, rates are high).

Concern

No Medical check up – reasons for claim rejections could be high.

Prajith

I think the absense of medical checkups are pushing the price up , So the deviation of cost has come down and spread evenly for all kind of customers . Customers who might be having bad health will be getting less premium thorugh this

Manish

When compared to old iProtect, the premiums are heigher in iCare.

Eswar

For what age and tenure did you check ?

Mansih

I checked for 37 yrs male, non-smoker for 30 yrs term

I was about to mention this point. I checked the iProtect just a week back. The premium for 1Cr, 20 years, non-smoking male at age 40 was 17100, here in iCare, its showing 25369!!!

Suddenly ICICI Pru realised that they are very cheap in the market…quickly changed the name, simply showed carrots and quietly hiked the premium…(whopping 48%).

Let’s check for 50L with the same personal details. Its Rs 13953 Vs Rs 9650 (45%)

Is this the true color of ICICI? Amazing is it not?

Veng

The increase in pricing should have taken place because of no medicals , hence its advisable that you go with some other plan

Manish

Hi All,

Sad news is that NRI are not eligible for this plan like Iprotect.

Why they are not eligible?Any idea?

Yogesh

Giving insurance to NRI makes things complicated for compnay as they need address and income proof in India ..

Manish

Hi All,

Sad news is that NRI are not eligible for this news like Iprotect.

Why they are not eligible?Any idea?

This is a revolutionary plan and will give other Insurers run for their money.The best feature is NO MEDICAL Examination till age of 50.This plan will bring paradigm shift in Life Insurance industry.If this trend continues we shall see EXTINCTION of so called TRADITIONAL plans and AGENTS

Naina

time will tell that .. not having medicals is one thing which is not liked by many customers

Manish

To readers,

In this plan proposal is written by the client. Submitted by the client. The question asked by us whether i use alchol i am not addict of drink habit but as and when i go a very special party of my close friends i use it, unfortunately while come back to home some thing worst happend postmortem report says that i am driving the car or driver driving a car with alchol. In that state company clearly reject the claim saying either we reject this claim due to this reason what will happen.

In nut shell we indian are some time say very true and some time very false according to our advantage, company run by rule i think the policy has so many loop holes in it to reject claim of a jenuine person

Rahul

Yes .. in that case company will reject the claim , because the case you mentioned comes under “illegal driving” . Which means the person was careless enough . If you were an insurance company , what would you do ?

Manish

The instance cited can be rejected by any insurance company. It is to be understood that insurance company is not a charity and any company entertains only the most genuine cases.

Also a user can protect oneself from such eventuality by paying the premium pertaining to the concerned criterion. However this doesnot absolve the claimant of the illegality(Drunk driving in this case) as Manish highlighted.

But then their are policies which cover sucide as well after first yr of policy. Then this drink nd drive must be covered under sucide I guess ?? 🙂

Siddharth

All the term plans cover suicide after 1 yr , DRINK and DRIVE is a clear case of breaking law , so it will be rejected .

Manish

I will not buy this policy. I had doubts on their iprotect plan and am sure there would be some loopholes in this policy too.

Rakesh

This clearly shows that customer is the KING and he knows that. Hey ICICI Guys work on people’s experience with ICICI

Rakesh

Are these loopholes specific to icare plan or is it general to all companies ?

Your family gets the sum assured if the death happens with accident. Having rider or not having rider does not apply to your basic sum assured (cover)

With insurance or without, with rider or without rider one of the thing we tell to all is BE a responsible citizen all the time at all the places

Hi Manish,