Hindu Undivided Family – Save more tax by creating a HUF in India

POSTED BY ON October 3, 2011 COMMENTS (388)

Do you know how you can use Hindu Undivided Family (HUF) to reduce your overall tax liability? In this article I will give you tips and real life examples on how you can use HUF to save taxes legally.

Before that let’s understand what HUF is.

The concept of HUF says that apart from individuals there is another separate entity called “Family” which can also have its own assets and liabilities and even regular source of income, which should be taxed separately.

For example :

If an ancestral residential property is rented out, then the rent arising would be considered as Family’s income and not as income of individual. In real life this rent is shown as income of one individual and he pays the tax on it, however a HUF can be formed and the rent can be shown as the whole family income (HUF) and it can be taxed separately.

Until a few years, many Indians used to keep multiple PAN cards and used to show Income under different PAN cards and used these tricks to avail the benefit of slab rates by showing themselves as different persons. This however is illegal by law and is a punishable offence as one person cannot have more than 1 PAN Card.

But, one legal way of obtaining an extra PAN Card is to form an HUF. As the Income of an HUF is taxable in the hands of HUF and not in the hands of any Individuals, a separate PAN Card is issued for an HUF and the benefit of income tax slab rates can be availed on this PAN Card.

Formation of HUF

A false impression amongst people is that HUF needs to be created whereas the truth is that an HUF comes automatically into existence at the time of marriage of an Individual and no formal action needs to be taken for the same.

However, in case a person who wants to specifically register for creating an HUF, he can furnish a creation deed on a stamp paper (The Format of Creation Deed can be downloaded from here).

As HUF is governed by the Hindu Law and not by the Income Tax Act, individuals belonging to other religions are not allowed to form HUF except Jain’s and Sikhs who can create HUF even though they are not governed by the Hindu Law. Two entities are extremely important for you to know in HUF are the coparceners and members.

Coparcener is someone who has the right to demand the share of the property of family; coparceners are generally the Karta (Main decision maker of family, usually the Father, but Manmohan Singh had 5 years ago brought an amendment which stated that Females can become Karta & there can be an all female HUF as well), then sons & daughters, grandsons and great grandsons in order of their first right.

Wife of the Karta is not a coparcener or even spouse are not coparceners and hence can’t demand/ ask for any share in HUF, they are just merely members of HUF.

Example of Tax Saving by forming an HUF

As discussed above, the main advantage of an HUF derives from the fact that an extra PAN Card is issued for the HUF. We’ll explain this tax saving benefit with the help of following example.

Lets say there are 4 members in a family

- Husband – Salary 9 lacs

- Wife – Salary 7 Lacs

- 2 Children without Salary

- Additionally, one ancestral property which fetches them an annual rent of 6 Lacs p.a

Now the Question is – In whose hands should this Rental Income of Rs. 6 Lakhs p.a. be taxed? In real life, the most sought after solution is to show the rent as income of wife or anyone who has no income or less income so that the tax liability is least. But is it the best solution?

Let’s see 3 different cases here in which this additional rental income can be shown and how tax can be saved!

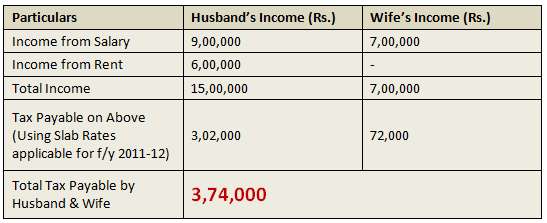

Option 1 – If this Rental Income is shown in the hands of the Husband.

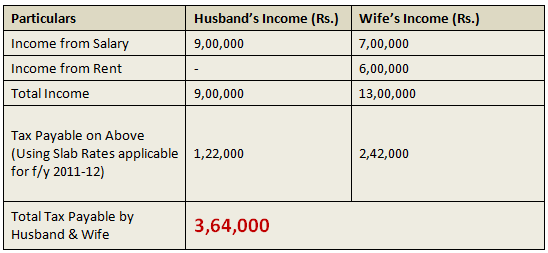

Option 2 – If this Rental Income is shown in the hands of the Wife

As this Income is arising to the family as a whole, the Govt has also extended this option of taxing this Income in the hands of the whole Family. Although very few people in India know this fact family income can also be taxed in the hands of the whole family by forming an HUF.

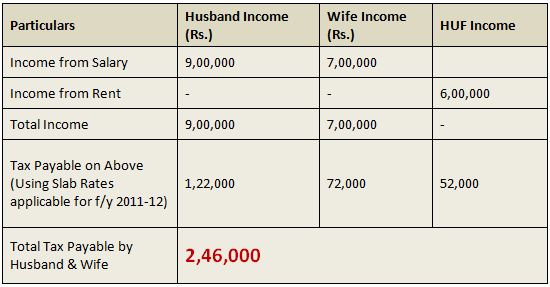

Option 3 – If this Rental Income is shown in the hands of the HUF

The above 3 options clearly indicate that Option 3 is the best option as the least tax would be payable by the family if the Rental Income is taxed in the hands of the HUF.

The tax saved by showing this income in the hands of the HUF is Rs.1,18,000 (i.e. difference between “tax paid if rental income is taxed in the hands of HUF” and the “tax paid if shown in the hands of the wife which is the 2nd best alternative”)

Please Note: For the sake of simplicity, Taxes have been computed without taking into account the “Deductions available under Section 80C“ and “Education Cess applicable on the Tax Payable”

Procedure to create HUF

These are the steps to create capital of a HUF.

- First one should open a bank account with the name of Hindu undivided family like “AJAY HUF” with a stamp, ID Proof and the proof of the members of the family of HUF.

- Important :- While opening a Bank Account in the name of HUF – Banks always ask for a rectangular stamp which states the name of the HUF and also the Karta who is signing it. A round stamp is not accepted as per RBI Circular. The same applies at the time of opening of bank account of Sole Proprietor as well.

- Next is to apply for PAN (Permanent Account Number) of the income tax.

- Now transfer money by gifts etc to HUF capital keeping in view the clubbing provisions and tax on gifts under Income tax act, Remember there is no Tax on gifts in kind though they may attract clubbing provisions in some cases.

3 real life tricks of saving taxes through HUF

1. Saving tax by getting gifts

One way of saving tax is by transferring the money received from strangers or family are taken as gifts in name of HUF. So if Ajay starts his HUF called “Ajay HUF” and he is getting some gifts from his father, friends or anyone else, he can ask them to give it to “Ajay HUF” and not Ajay itself.

That way the gift will be treated as income/asset of HUF and taxed separately.

One important point here, if some stranger is giving gift to HUF, there is a limit of Rs.50,000 on which no tax has to be paid, but actually it can go up to Rs 1.8 lacs as the taxable limit is that much, and if one also has to do investments of 1.2 lacs (total 80c limit), then one can afford to receive up to Rs.3 lacs of gifts in a financial year and there will be no tax liability at all.

2. Assign ancestral properties and wealth to HUF and invest it

If family is going to receive an ancestral property or any wealth, then it’s better to transfer it on HUF name so that whatever earnings happen in future in form of rental income or capital appreciation of assets becomes income of HUF itself and taxed in its own hands.

That way the total tax liability of family can be minimized.

3. Use HUF income for expenses and Insurance for Family

As HUF enjoys separate tax benefit under sec 80C, one can use the income of HUF for buying Life & health insurance for family and the permissible deductions can be availed for tax purpose in hands of HUF, so if the total premiums for insurance requirement of family is Rs.50,000 per year, then It can go from HUF income and also the individual can exhaust his 1 lac limit separately via PPF, ELSS and other tax instruments.

Also family day to day expenses can be used from HUF income and hence it will leave other members with more disposable income which one can use to service higher EMI’s if required.

Watch this video to learn more about HUF and Tax saving:

Some important Points you should know about HUF

- For creating the HUF one need to get married, there is no need to have child or children for creating the HUF.

- An HUF can recieve any amount in gift from bigger HUF’s (HUF of Father, HUF of Grandfather) or any gifts received by the members of HUF (birthday, marriage, etc.) can be treated as assets of HUF , but stranger can gift HUF, not more than 50000 rupees.

- Daughter also continues to be a Coparcener after her marriage of that family whether she also will be a member of HUF of her husband. So that way daughters can be co-parancers in two HUF’s 🙂

- HUF can pay remuneration to the KARTA of family for the interest and expenditure to run the family business.

Be cautious with HUF creation

While all the above points excites people on opening a HUF account immediately and start taking tax benefit, there are some caveats and one has to be little careful. Remember that HUF is a separate entity and represents the whole Family. So once some assets is assigned to HUF, then it becomes part of HUF only and one can be suddenly take money from HUF for personal purpose .

If other co-parceners of HUF demand the partition of HUF only then one can get his/her share of the HUF. Otherwise it will not break. Also for taxation point, a lot of people mislead the tax department buy using fake HUF transactions and therefore, HUF is looked with high degree of scepticism.

If the HUF is not formed properly and if the assets are income are fudged for evading tax, it can get you in trouble, therefore it’s highly advisable to hire a good CA and create your HUF in the best possible manner with right advice. There is no harm in paying 10,000-12,000 to a CA if HUF can give you 5-10 times tax savings.

It would be a great investment, not an expense!

HUF property cant be mentioned in the WILL

Though HUF is very useful tool but one has to use it very judiciously and thoughtfully. Don’t look for tax benefits only , but practical problems also. Be aware that you cannot make a will out of HUF property. Once transferred to HUF, the assets /property becomes of HUF and you no longer have any individual right on it.

To explain with example –

“A”, who has 2 daughters and a son.He long back ago purchased a house in the name of HUF and put that house on rent, so that the Rental income comes to HUF and will not be be added in his or his spouses’s income .

But now , he ‘s retired and wants that this property should be transferred to his son after his demise. But this is not possible as that property belongs to HUF. He can’t even write a WILL for HUF property and with the huge rise in Real estate prices, none of daughter is ready to leave her share in it.

Thanks to Manikaran Singhal to add this point

Who should actually go for HUF

HUF will be extremely efficient for those people who have a higher income and high saving rate and some form of ancestral assets which can be marked as “Family Assets”.

Evaluate if HUF can really give you that kind of tax advantage or not for people who do not have high salary or who do not have a big enough family. So make sure you can get the maximum out of the HUF and understand the limitations of opening HUF before you go for it.

This article has been authored by CA Karan Batra who blogs on charteredclub.com (Content added by Jagoinvestor with inputs from Karan)

Can you share how was the article and did it help you in understanding Hindu undivided Family? Are you going to open a HUF account?

Can government employee creates huf and starts business ?

Hi Sandip

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Sir, u have stated in the first part that wife will be a member and she can’t be a co-parcener, whereas in the last part u have stated that daughter can be co-parcener in two huf? Daughter can be Co-parcener in her father HUF and how she will be a co-parcener in her husband HUF ? pl clarify

Sir,

I want to know “How should I go about forming a company on HUF basis”? What are the things to be done? I have a plan to start a trading company dealing with products for domestic and international markets. I want to know to set up an organization in India which can get funds internally as well as internationally. How much time does it take to start functioning for such a company? and the expenses for the same.

Hi Krishnan

You can go in for legal advise regarding it.

I am salaried and have the following scenario. Let us assume I take out 5 lakhs from my salary income and transfer that to my HUF account, and create a 5 Lakh Fixed Deposit. Now if we assume that this 5 lakh FD fetches me an annual interest of say 20,000/-.

Now, will my tax liability be calculated on 20,000/- or 5,20,000/-.

Because if it is 20,000/- then there is a point for me to open an FD from HUF. But if it is 5,20,000/- then there is no point because I am already paying a tax on that 5 Lakh as TDS from Salary.

Please help.

Thanks

Nitin

Very well written article! I had a query though… I’m a salaried person employed by a firm. However, I do take part time lectures at a college and wanted to know if I can claim tax benefit of this income under HUF?

Hi Dilip

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/solutions/ca-services

Manish

My father had an individual PPF account. I was the nominee of the PPF account. He expired and since I was the nominee, I got the amount credited to my individual bank account. I want to make multiple fixed deposits. Please let me know if I can make these deposits under HUF PAN or my individual PAN.

You can use any PAN to do that. Depends on what is your requirement

Hi

As a life insurance premium for my Mom doesn’t under IT exemption, if I form HUF and shall I pay towards her premium.

Whether am I permissible to do that. Please suggets

I think premium payment for mother comes under IT exemption

Hi team, it was indeed an information served in breakfast plate… i coupd digest it all… 🙂

However i have a small scenario to clarify.

1. My Father had bought two houses at his native AMD now he has passed away and rent is collected by my elder brother bi annually. (obviously on behalf of my mother who’s alive)

2. My elder Brother has bought a House here in mumbai on his own and has rented that and lives in a rented small house himself.

3. My wife and I have also bought a house in navi mumbai now.

4. So overall we have Rent Flowing in from 3 houses and 2 new houses bought on loan from banks.

5. My wife and I earn approx 4 lacs each anually from our salaries and pay taxes as per slabs.

6. Can My Elder Brother (who is actually a Karta of the family) form an HUF and we all (listed below) be members of it, and will it benefit us (brother, my wife n me) in Saving our taxes.

List of Faimly Members:

A. Elder Brother

B. Sister in law

C. Elder daugher of brother

D. Younger daugher of brother

E. Youngest son of Brother

F. Our Mother

G. Me

H. My Wife

I. My Son

J. My Daughter

Awaiting for ur valued guidance or information.

Hi Yogesh

I wont be able to answer that due to limited understanding, Its better to consult a CA on this .

In huf, karta can pay his/her(self) insurance premium for his/her individual policy

suppose me and my wife has an individual income of rupees 7 lacs and 7 lacs each…. now we have formed an huf…

so can we show both incomes are of huf,with 7+7=14lacs income of the huf…..and pay tax of this 14 lacs through huf pan card only…….

Hi shivam

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

hi,

i put my flat on rant a rented person want to create a HUF in my rented property .should i allow him to create huf on my rented property ? pl. advise

No you should not

Please advise whether HUF can take a LIC policy if yes then who will be the beneficiary

I dont think they can take it

Hi,

I have made an HUF. I have a pan card and a bank acc .

I have 3 questions –

1) my father wants to gift some money to my HUF. Some tax consultants told me that this will come under clubbing provision. Your articke says otherwise. Please confirm that the rule is still valid.

2) do i need to prepare a gift deed for every gift that i get? Is there a format? Does it have to be on a stamp oaper? And notarized?

3) i stay in mumbai. Could you suggest a good tax consultant pls.

Gaurav.

I think you should go with the words of tax consultants only. We will not able to comment on this .

We have opened new HUF, whose member are myself my husband and my son. We both are salaried pay my individual income tax. I have a bigger chunk of investment into FD. The interest of the FD increases my tax liability . Can i dissolve the FD’s and move that money into the HUF and then create FD’s in the name of HUF to save tax.

Also what should be the right procedure to transfer the money into the HUF.

Hi Punam

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

We( Me and my wife) sold our apartment last and received funds which was put in bank FD’s. The apartment was bought under our individual pan cards.

We got our HUF pan card few days ago and wanted to understand, if we could transfer the FD funds to HUF and then create FD’s in HUF & save on taxes?

Thanks

Yes, you can do that

Were you able to transfer funds from your individual accounts to the HUF? Did you do this using gift to HUF or how exactly you moved your individual assets (the FD money)to HUF. I have a similar situation to handle , hence wanted to understand.

How do I apply for a Credit card on my HUF PAN?

I am not sure if thats possible

Dear Manish

can me and my wife open and HUF together without adding our sons.

If yes can my wife continue this HUF account after my death also?

srrk

I am not sure on this , talk to bank

I would like to understand from Life Insurance point of view. What if HUF is in the name of Father and members include his wife and daughter(got married). What if Insurance took in name of Daughter and premium is funded from the HUF Fund and after the death of Father what will be the status of HUF. 1. Will it be dissolved? or Continue. 2. Will the 2nd eldest person being mother be a Karta of the HUF in her Name? 3. Can Being a Female after death of Husband she can continue her HUF like after her death next Karta is her Daughter. As per Manmohan Singh new law only female members can form a HUF. Daughter dont have HUF at her in-laws side and she wants to continue with HUF in her name after the death of her mother (2nd eldest member after her father death).

B) If insurance is given on life of member of HUF (Wife & Daughter) funding is being done from HUF fund and as long as father is alive premium would be funded from HUF Fund after his death will the funding would discontinue?

As HUF is involved, I think you should consult a good CA on this

Hi,

Me and my wife both are working, and we dont have any extra income from ancestral property etc.

Will it help to open an HUF account, So far looks like HUF is good only if we have extra income directly in name of HUF, but in this case me and my wife both has separate income.

Please elaborate if there is any benefit of HUF in this case and if so, then what are those specific benefits.

Thanks in advance.

Hi Ashish

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

My father had a Huf account, now after he expired i am operating it in addition to my individual pan and drawing income in both. Please note i am not married yet. My question are:

1. If i transfer the income recieved directly in to HUF ac to my/other family member account for various purpose like paying bills, premium,.etc. Whose income will that be considered?

2. I have not informed IT dept. about transfer of HUf ownership except the bank .Is it ok?If not plz tell what to do?

3. Is tax limit for HUF is more then an individual?

Also a piece of advice your captcha code is far more difficult for humans forget about machines.

Hi kapilanand

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

Dear Kapil

1. Its better if you directly pay the expenses from HUF Account rather than transferring to your personal account.

2. You should inform this to the Tax Dept as well as the Karta will change.

3. The tax benefits for HUF are not more than the tax benefits to individuals.

I have a rental income 50% in my wife’s Name & 50% in my name. Can I transfer this rental income to my HUF.

Other than above , what other income can I transfer to HUF

By transfer if you mean you will take the income in HUF account directly, Then yes its a good idea . You can do that

If the property is in your name and the Rent is being received in the name of the HUF, this is a clear case of avoidance of tax and provisions of clubbing of income will apply in this case.

However, if the property is in the name of the HUF, then provisions of clubbing of income will not apply.

Hi, I would like to know is it compulsory to open a HUF account?

Is there any other benefit apart from tax savings if I open a HUF account?

Please clarify.

Regards

Rajiv

Hi RajivAPunjabhi

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

The other benefit of opening a HUF Account apart from tax saving is that all the family members have a right over the assets of the HUF

Some consider this as an advantage whereas others consider this as a disadvantage

Based on my salary and bank interest, I pay tax at 30% level. Wife is not serving and only daughter is married. No income from ancestral property. Will it be helpful to create HUF with my wife and daughter? Regards.

Hi TKGhosh

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

Can I transfer my monthly salary money to my HUF account and then will it qualify for tax exemption ?

No

How can I benefit from HUF PAN, in case of my wife doesn’t have any income? I am professional employee, but my wife doesn’t have any job. We have 2 girl kids, will I get benefited from In-laws land properties transferred to my HUF account?

Hi suri

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

If, for every question you are referring to CA then what the use of this group ????

Hi Sanjeev

This blog purpose is to spread knowledge about the points at basic level. Some queries can be complicated and only a CA has a deeper understanding, hence I say that one should connect with them. I can answer those complicated queries, but I would be mostly wrong, because I have limited understanding in few areas.

I think at times, some people mistake the blog comments section as customer care center 🙂

Manish

Dear Sanjeev

Manish is a Financial Planner and one of the best financial planners in India. He also has good knowledge of Income Tax.

However, for the kind of query asked – you need a CA to answer it.

I hope I have tried to resolve your query about HUF

Yes, you will get the benefit.

If the properties of your in-laws are transffered in the name of the HUF, the rent arising from the properties would be taxed in the hands of HUF and not in your hands.

This will reduce your income tax liability

How huf dispersed? Can daughter remain member after her marriage? Can she claims after marriage from huf wealth? Can huf karts or member utilizes money of huf. Does he had to return that money to huf with or without interest?

Yes

Daughter will be member after marriage also . She can claim after marriage .

Can equity shares in the name of the Karta (on individual basis) be transferred in the name of the HUF? What are its tax implications?

Hi ARUP

Your cases is a bit complex and I think we are not the right people to comment on it.

My suggestion would be hire someone who is professional in this area and consult them

Manish

I want to open an account in bank on behalf of HUF.

Bank authority told me account will be open only current but i want to open it saving account.

Is it mandatory to open Current account ?

Yes, because Saving account opens only for HUMANS . For business or entities, its current account

My father (as kartha) is holding HUF PAN card and paying taxes. I am the only son.

I am married now and i want to create HUF for me & my wife. Can i do this? Can my father still maintain the HUF?

Can i still continue to be a member in my father’s HUF?

Please advice…

Yes

We are four brothers and one sister. All are married. Entire property acquired by my father is in my mother’s name. Father is no more. My mother wish to transfer her entire property to a HUF wherein all my brothers will be member. Can such a HUF be formed. What will be tax implication ( in any form) on transfer of her property to HUF ? Kindly help.

Thanks a ton sir for very prompt and lightening speed response. I would check and get back if I find something on how to do this. In the meanwhile would it be possible for you to share some links etc. where I can read more about this?

Hi Nishu , No links as such . BEtter get in touch with a CA on this

Dear Sir,

Me and my wife both are working and salaried persons. Have 1 minor daughter.

My question is straight forward.

We have recently created an HUF PAN with an objective of tax savings etc.

We are looking to purchase a car which is 11 Lakhs value.

Would there be any benefit if I purchase it in name of HUF and not in my own name. If yes, how should I do it? Should I first purchase in my wife’s name and then transfer or should I directly purchase in HUF name and even after car is in HUF name, how can it benefit me i.e. should I take it on loan or down payment etc.. etc..

Can you please enlighten benefits from this angle of car purchasing in HUF name?

Eagerly awaiting your response.

Directly purchase in HUF name. I think you should check with a CA on the details of how to do it and how to avail the benefits !

Sir,

are the cash withdrawals allowed in HUF? Which means from HUF bank account the Karta has been withdrawn some cash and utilized to meet his expenses. Is it allowed, Kindly explain me.

Thanking you

Regards

ANTONY

Hi Antony Raj

Yes you can do that. Anyways who will stop ?

Can a female member (for example , Mr A, Mrs A, Mrs A is having an ancestral property of which she is having rent income) Mr A has a son and daughter in law in family. So is there any scope of HUF creation ? Kindly advice

Hi Rashmi Agarwal

Your cases is a bit complex and I think we are not the right people to comment on it.

My suggestion would be hire someone who is professional in this area and consult them

Manish

The concepts regarding HUF were actually eye opener…… thanks for the same

Welcome .. Glad to know that rahul singh ..

I am new to HUF world and want to grab as much information i can. My consultant that members of HUF can give gift to HUF not more than 250000 per year. if they gift more than this limit than this is liable for Tax. but when i read on internet it says HUF members can give any amount and it will not be liable for tax.

Hi Ritesh Modi

The question asked by you is beyond our scope. Its suggested that you hire an expert on the issue and pay them for the advice.

Manish

Hi Manish,

Just Had few questions:

1. How many HUF a male member can create or be part of? Ex. one could be his parents HUF & other can be made his wife . Is that possible.

2. Say if i gift say Rs. 5000 to HUF account than does that mean that it become tax free for me i.e. i dont have to pay tax on that Rs. 5000 & if yes, than what is the upper cap to same.

1. He can be part of any number of HUF

2. No tax benefit for giver EVER !

Hi Manish

Good article and forum for discussion about HUF. Thanx alot

Some others like Srinivas has also cleared many points.

Mine point is that I have only two daughters which can be coparceners and mine wife which can be only member. If I open an HUF from my father’s(already deceased) property(immovable and other assets), Then I will be the karta of HUF with two minor coparceners(daughters) and a member(wife). My query is that If in future I decide for the full partition of HUF before my daughters got the age of 18( major) then

1. who has the power of deciding for full partition and % share of all of us????

2. what will be the % share????

3.What maximum share can be transferred to the karta’s individual income if all other coparceners are below the age of 18????

Thanx & Rgds

Gorav Kumar

Hi Gorav

The question asked by you is beyond our scope. Its suggested that you hire an expert on the issue and pay them for the advice.

Manish

Apart from my salary (30% tax bracket) I earn money from FnO (Derivative). Any way to save tax for income from FnO.

I am single, my parents are also in 30% tax bracket individually. I don’t own any shares, trade only FnO on NSE.

I think you should hire a CA for this. He can help you on this

Won’t you even give a hint??

I would end up paying 30% tax on my income in FnO.

Hi Shikhar

Its not like I want to avoid answering it. But the point is , I am not qualified to talk on this matter and I lack knowledge in that area. Only a CA can comment propery on that

Manish

Ok, Thanks

Dear Sir,

i would like to know if Grandfather can pay PPF of Granddaughter from his HUF and claim the same in 80C Deduction ???

Hi Jigar

No , is the answer

Hi,

Mr. Manish I would like to ask you that Can HUF be a proprietor of coaching class? I mean to say that can HUF run the coaching class as a proprietor by employing the teachers and other staff? The revenue generated, will it be the income of HUF ?

Thanks

Hi Dipak Choudhari

The question asked by you is beyond our scope. Its suggested that you hire an expert on the issue and pay them for the advice.

Manish

Hi,

I have some queries w.r.t to the above topic. I did some research but still i was not happy with the result.

1. One of the basic criteria of a HUF is that members of it must consist of unmarried daughters. What will happen to her once she gets married?

2. The recent judgement and amendment of Hindu law act 2005, held that married daughters are eligible for share in the ancestral property. Is the judgement given a retrospective or prospective effect?

3. I have a lot of confusions about the differences b/w a coparcener and a member. I failed to understand it despite several efforts.

4. IT Act was amended and as per Sec56, members of a HUF were considered as relatives to the HUF. So, in this regard what will happen once the daughter gets married? Will she suffer tax when HUF gifts her?(not sure if she will continue to remain the member of her father’s HUF)

5. I also came across facts where if the HUF made gifts to the married daughter, the gift amount would be exempt in the hands of the daughter, but the income from such gift would be taxed in the hands of the HUF.

I appreciate the patience put in for having my doubts clarified.

Thank you

Hi Puttarauju S

The question asked by you is beyond our scope. Its suggested that you hire an expert on the issue and pay them for the advice.

Manish

aggriculture income from my personal name farmland ‘,income from crop production income can i take in huf income in huf account

Hi mahesh patel

The question asked by you is beyond our scope. Its suggested that you hire an expert on the issue and pay them for the advice.

Manish

if i and my wife are earning same… assume 7 lac per year, then the whose PPF account will be more tax saver??? mine or my wife’s???

I have no idea what is your question ?

can govt employee become a member of HUF, where HUF is doing some business actovities??.

Facts:

Karta of HUF is an employee of Non Govt Org. Other than Karta all are Govt employee.

Govt employee can’t engaged in any business activities, wheather forming an HUF business activities can be done.

I am not very sure on that !

Hi my salary package is 7.8 per year. and nearly 13000 is deducted for tax from my salary.. and i m not married. so can you suggest me any idea that i can overcome the tax?

I dont think you have any escape out of it !

hi, I am working as a labor job contractor with one company under sole proprietorship. If I form HUF, then income from same source can be bifurcated into my personal as well as HUF account.

Please suggest

form a HUF deed and open a bank account, tell ypur customers to pay HUF portion of income to that new account.

I and my wife with two minor childerns want to farm a HUF , I purchased one Commercial Site and constructed Building, now it is started to earn Rent of Rs.5,00,000/ per Month Can I farm a HUF, and save tax liablility. I and my wife are not working. And is it I will be a kartha, can i Gift my own property to my own HUF ?

I think as the amount is large enough, you should get a consultation from a CA on this

Hi Manish,

Can you validate the below that “An HUF can consist of just two members, one of whom is a coparcener. However, for tax purposes, the income of such an entity would not be taxed in the hands of the HUF; it would be taxed in the hands of the sole coparcener. For an entity to be taxed as an HUF, it should have at least two coparceners. Thus, the income of an HUF consisting of a husband and wife would not be taxed in the hands of the HUF, except in cases where the husband has received funds on the partition of a larger HUF.”

Hi Rakesh

This article has been quite old now .. I am not sure of the current rules change .

Hi Manish,

For creating HUF, can you let me know the following:

Ques:1. My wife will be considered just a member or coparcener

Ques:2. What will be the status of following gifts(money) to HUF (Will it be treated as income/exempt from income)

a) From my Father to HUF

b) From my Father-in-law to HUF

c) From my Wife to HUF (will there be any clubbing of income)

d) From myself to HUF(will there be any clubbing of income)

Ques:3. Once HUF is created, how can be disolved?

Ques:4. What happens to the money when we get it after the HUF is disolved, does it becomes taxable or is inheritence

Hi Rakesh

I think a lot of rules have changed in between . Better to consult with a CA on this now

Hi Manish,

I have a question to ask. Can paying 15000 Rs per month( from my salary) to the HUF account (me & my wife) as monthly domestic expense which my wife needs per month , be treated under income tax act? Can I get income tax benefit on my personal income on account of this payment which is a real case indeed?

Regards,

Subhashish

No you cant !

Hello sir , can I open my huf account as I’m married and father of two kids , and loan some shares to huf so that it can do some trading and at the end of year it will give back me my shares , that way my shares long tearm capital gain won’t get used and income created by huf so text liabilities also will remain with it only .

This is a complex thing overall , better take a CA suggestion on this

Very informative article!

Just one query: Lets say A(karta), B(wife) are part of a HUF.

Can B give the gift to HUF? If yes, lets say B gives 100,000 to HUF and HUF invest that money in FD. Will the interest earned be clubbed to the income of B?

Thanks!

Yes B can give the gift and after that it becomes property of HUF and income earned on that will be HUF income only

Dear Manish,

1. My mother was expired in 2012, my father can form a HUF,

2. I m a divorcee, can I form my own HUF

Rgds

Nitin

If you do not have a family, then I dont think HUF exists anyways .

Hi Manish,

I am unmarried and my father is having an HUF account and he is the karta & member are my mother and sister for that account. Can he open another HUF account having only male member (i.e) father & myself

No he cant, its not opened like this, it automatically exists the moment he was married .

please help me to know is nomination allowed in mutual funds for the investment made under the HUF status .

second in the death of the karta can the proceeds be transfered to the wife with the nOC from the other coparcerners

Nominations are always allowed in mutual funds ..

I want to open HUF a/c.Mainly because my son in US has a house here,which is rented.The rent is being credited to SB joint a/c with my son and my wife. Now tenant is asking for giving the PAN card number. Can i give my wife’s PAN number or my son(NRI) PAN number. My friend suggested to open HUF a/c and HUF PAN card and give this HUF PAN number to the tenant. Please advise. Your article on this subject is excellent and made me think twice/thrice whether to apply for HUF PAN card or not.

Being a bit technical, I suggest you open this question on our forum http://www.jagoinvestor.com/forum

True.

However, HUF can take loan from a relative at a reasonable rate and invest the same, for its advantage.

Another point to be noted while routing funds to HUF.

HUF can recieve only upto Rs 50000 per year without any onsideration. If the inflow is in exess, tax incidence will happen.

One way to mange this is tak loan from relatives and pay nominal interest. For example, I can take a loan from my mother, then pay back 8% per year which she normally gets in any FD. I inturn can invest for better returns amd the balance can be inom of HUF.

Thanks for sharing that, I think that 50k limit is the gift tax limit !

Dear sir,

My parents are quite old & brought them to hongkong resently where i live.My father has a huf property in his name & i am the only son.He want to gift this property to me,because he does no want me to face all the problems in india after he dies as I do not know about taxes in India.

Can you pls advice me about this matter .

regards

Prafful Surana.

Whats the advice you need in this case, its straight forward now . Just visit back India and ask your father to transfer things on your name (I mean HUF should transfer, your father will take actions as KARTA) .

Thats all .. If this is not done right now, then later you will have to execute a WILL or things will happen as per Hindu succession act . Given that HUF is involved here, I suggest that better complete things right now to avoid running around later!

Also get in touch with a good CA also

Manish

Many Thanks for nice article and useful information. I have a few questions.

1. I have a joint flat with my wife which I want to sell. Can I create a HUF (me & my wife) and transfer the Capital gain amount to HUF to minimize the taxes?

2. Will the creation of HUF make the joint property part of HUF (as HUF members will be me and my wife)?

3. If the HUF account is not transacted for long time, is that a problem? Any inactivity threshold by banks?

4. Can I continue to put our LIC, health insurances under HUF. I think yes.

Thanks

Rishant

I forgot to mention that my wife is not working.

Thanks

Rishant

Hi Rishant

These are deeper questions in respect to HUF , I suggest you meet a CA and discuss these with CA

I am an NRI and had contacted Central Bank of India reg opening of HUF account but the Manager declined to open the account saying “According to our Bank’s practice HUF accounts are not opened for NRI. Please be guided accordingly”. Please note that I am the Karta and including me all members of HUF are NON-RESIDENTS. Is it possible for someone to pls provide the RBI circular or any such govt notice so that I can again go the branch with this info. I tried searching for this on RBI website myself but could not get it. I hope someone could help me with relevant info.

I guess you already asked this on forum ?

Hi Manish, I have asked this in the forum but so far unfortunately no responses.

You mean you asked on http://www.jagoinvestor.com/forum ?

Yes, Pls see link below for the same ques I had asked in Jagoinvestor forum : http://jagoinvestor.dev.diginnovators.site/forum/can-nris-open-huf-bank-account#.UoIsz5Fg6jI

So far no replies

Hi

I have asked a CA friend to answer on this . I am ignorant on that !

Hi,

I am a divorcee with a child. Would like to understand whether I can create an HUF.

Thanks!

Hi I am not very clear on this, can you raise a thread to discuss this on our forum – http://www.jagoinvestor.com/forum/

greetings for the day,

kinldy clear my doubts.

I am a salaried person along with service I plan following.

I want to start a manufacturing business with the use of some machinaries ….worth 5 lacs …appx…

shall I purchase my machines on the name of an HUF – as a properitor firm and start a small business ?????

What are your long term plans and revenue potential . It would be a good idea to consult a CA on this

My father has FD for around 5 lacks. He has expired. Now can I trasfer those FD into my HUF.

Thanks

Pavan

Dear Pavan, yes is the answer.

thanks

Ashal

Only if you can prove to be the sole legal heir .

very clear interpretation of HUF. Views from all angles have been brought out. Wish you write many articles on taxation.

Welcome Suresh !

I am US citizen, Patel by cast, my father is on Death bed. I do not have HUF at present. Can my father give his property in favour of my HUF? Do I have to offer tax on income generated from such property to US tax authorities?

Darshit

We have no idea about US tax laws

Thanks Manishji;

What about 1st half of the question? Can my father provide in will to transfer his assets in his absence to my HUF (which not existing at present and I wish to create the same by will only)? I am married Hindu having citizenship of USA.

Dear Darshit, as you are married, your HUF is already in place. Regarding the taxation of USA on the father’s property transferred to HUF, please check with US Tax professionals.

Thanks

Ashal

Hi,

Great article and a wealth of information from the comments below as well.

Can you please answer one question: I have a vehicle in my name, which I would like to transfer to my HUF. This vehicle would be used for commercial purposes and the income earned would go to the HUF.

Is such a transaction allowed and for the transfer to take place, what documents would be required?

Would a gift deed describing the details of the vehicle sufficient; or do I need to get the vehicle transferred from the RTO in the name of the HUF with a change in the Blue Book / Registration Cert. as well?

An answer would be extremely helpful.

I dont know this answer truely speaking .. but I am sure you will get it from our forum – http://www.jagoinvestor.com/forum/

Dear Ajeeo o Gareeb, if you are transferring the vehicle with out any price consideration from HUF to you, it ‘ll not be accepted by Income Tax people. So better to sell your vehicle officially to HUF & then only earn income from this vehicle.

Thanks

Ashal

Hello

Me and my wife are salaried. My wife has a shop on her name ( taken from my mothers selling of land – after she died ) and we also have another shop on my name and her name. Can we transfer both these shops to HUF ? If we can transfer , then how does one do it ? The shops agreement papers are still on diff names . Do we have to re – register it ? Or do we have to sell it to HUF by creating a NEW agreement ?

Regards

Kiran

that would not be such an easy thing to explain here , better meet a good CA for this

Can I as Karta of A HUF withdraw money from HUF account for the purpose to meet with any other members personal expanses / education / marriage ?

You can do that .. If the member is the part of HUF , it can be shows as a regular expense , but not sure if you will get any benefit on tax front ..

Please can you confirm if the HUF can pay premium or invest in PPF in the favor of the member / karta

Please confirm who will receive the Tax benefit for the same.

I am looking at investing in PPF account of my Mother from the HUF account

If HUF is investing and only HUF can claim the benefit , not the member

Dear dhaval, in your query, are you talking about your own HUF or your father’s HUF which is going to invest money in to Mother’s PPF account? the answer ‘ll be different for each case of HUF.

thanks

Ashal

Sir,

My wife who is a coparcener in my HUF .Is it possible for her to become a Karta for her ancestoral properties?

Dear Arun, what’s the current status of your wife’s maternal HUF? is there any Male member in it or not?

Thanks

Ashal

Sir, I stays in my own flat in Delhi. A per my company norms I have signed a self lease with my company and getting a rent from my company. As a result I pay double tax on Rented income i.e. 1st as perquisite and 2nd 30% on total rent as owner.

Can HUF help in saving tax?

do I need to re-sign a self lease between HUF and my company?

Please advise.

Regards,

Sanjeev Garg

Sanjeev

A better answer will come from our forum for sure, please start a thread there – http://www.jagoinvestor.com/forum/

Can i open new PPF account in name, this year and deposit money? I was given to understand that money cannot be deposited in PPF account after 15years, is it true?

You cant open a new PPF , one person can open just 1 PPF account. Regarding what happens after 15 yrs, check this out – http://jagoinvestor.dev.diginnovators.site/2012/06/ppf-account-rules-after-maturity.html

since the discussion was about PPf account – What i meant was, whether i can create new HUF with my wife or myself as karta, and then open a new PPF account?

I don’t have old PPf account.

Yes, thats possible

One Question

Can gift give Anil Kumar to Anil Kumar Huf for New Huf file creating,

means self can give to self karta for new huf file.

thanks

Yes

I don’t think it is possible as clubbing provisons will come into the picture. Better get a gift from someone else such as your father/mother/Brother etc…

We are not talking about clubbing provisions here .. its the question of whther the tax is paying on the amount recieved as gift !

Dear sir, Thanks for your article.

I have a doubt. My grandfather alive having ancestral property. But my father was died without any huf. So can I open Huf account by receiving gift from my grandfather instead of father

Yes you can do that

Sir I have a question

Can HUF do business in the another name?

What do you mean by another name ?

yes it can,

Does it makes sense for a married couple to form a HUF if both of them are in 30% tax bracket but don’t have any ancestral asset ?

Depends on your complexity . Meet a CA and he will show you how it will help you or not help you . Just because one is married, they should not get into HUF !

The family members who are not included/declared (such as married daughters and not part of the family) in the form while opening the HUF account will also be considered as members/coparceners??

Not sure on that ..

I am planning to open a ice cream parlour on my father’s name. he is retired & comes in 20% slab. We wan’t to open an HUF on his name. We have applied for HUF pan card. Now for registration of HUF, does he need any gift cheque from his father or big brother to be shown as gift amount? If yes, then is there any alternative for that.

Why will he need it from his father ? Who is contributing the money into the HUF ? You need the contribution form that person

Manish, great article. I have a question. I have a house. I would like to rent it out. But i don’t want to pay enormous amount of tax on that. So I was going through the various ways of tax planning to save tax on rental income. I was thinking of either creating a HUF or forming a Company. There are lots of issue in opening a HUF, what, if later on,one party asks for his or her share. I want to avoid all these issues. So, is it better to go for formation of company and plan accordingly?

You cant avoid those issues if you do a HUF, thats why most of the people dont make it 🙂

Can I form a HUF with the self acquired house (asset) with my wife and married son? What will be rental income look like? Will be as my income, being Karta – or, will be of HUF’s? To my understanding, with the inputs from this informative forum – it will be HUF’s income and to be seperately filed. Question remains – how the expense of household can be accounted for?

You can do that, but then you will have to assign the house to HUF . It will be HUF income

I wanted to ask whether HUF can give cheque in the name of person from whom Karta is getting his business items i.e. Karta’s creditor.

Yes why not

respected sir

sale of property by huf having long term capital gain can be used to buy a residential property or not ??????? noida authority does not allow it ????? kindly help asap

They do not allow what ? The sale !

Hi Manish,

First of all thanks for the info. I have some doubts. My father opened HUF bank account just for the sake of income tax purposes. He has earned money and tranfered to HUF. Later on he purchased some property from the HUF account. Here I would like to mention that there is no ancestral contribution to his income except that he got a little land from his forefathers. Now the Q is will that property becomes HUF even though he self-acquired it and who inherits the property?

Its a HUF property and all the members of the HUF will get it , you are also part of the HUF . You can ask for your share whenever you want

Hi Manish,

I am planning to apply for a HUF PAN Card. I have a few questions:

i. What would be date of incorporation? Can I put it as 01-01-0001 if I am unsure about it?

ii. After getting PAN card and opening a bank account, Can I put around 6 Lakhs cash in the account (assuming 1.5 lakhs tax-free slab amount for 4 years) for 2009-10 to 2012-13? Source of income is agricultural income from 25 acres of land.

iii. If I have paid an LIC term loan policy of Rs 112000 p.a. for last two years from my individual account and have not claimed it under 80C, can I add another 224000 Rs to the account?

Thank you.

thank u

I suggest you take help of a CA on this , he will guide you with internal issues like these

Manish, i am working as a Home loan credit manager in MNC Company.

i received a home loan request from HUF for the same i have to collect Annexure 5

Please tell me about annexure 5 and please send me the Annexure 5 format to me … i am very great ful if i get today ….

thank u in advance

Radhika

I am not aware about that.. but I am sure someone from our forum will have knowledge on that – http://jagoinvestor.dev.diginnovators.site/forum/

If I have an HUF account at a bank and wish to deposit cheques/income recieved in my personal name as Karta or that of my coparceners in my HUF account, can my bank refuse this? If yes is it because its a totally different entity from me and my family members? Any RBI clarification on this available?

As far as I know , in this recent budget, HUF members can contribute money from their side in HUF .

Dear Sir,

Compliments.

I stared helping my father helping financially at the age of 13 years by milking and selling milk, at the age of 16 joined Indian Army as a boys Apprentice in 1979, I stated giving money to my parents and did not open my self -bank account to keep my earning separate. I left the Army in 1991 and handed over Rs. 86000/- to my parents this includes the commutation of my pension for 15 years.

We are 5 siblings 3 brothers and 2 sisters. I am the eldest among brothers. I married at the last in the family. My younger brothers are well settled and are happily married.

During time my youngest brother and his working wife has purchased their own flat in Delhi. At he partisan and distributing the property the whole property worth were 30 lacs. This does not includes the worth of the property they have purchased on their own name. In our family we were having 2 flats and some agriculture land. And the total value was 30 lacs.In 1999, my father divided the share my brothers got a flat each and I was to give 10 lacs but my father deducted 3 lacs from my share. Out of which 2 lacs my youngest utilized to pay for the instalment of the flat they have purchased. And 1 lac was utilized by my younger brother.

On being not satisfied i left the home along with my wife and one son in Jul,2000. In Sep, 2001, my father gave me a cheque of 4lacs and 95thousands . This is the only share I got from my father. When I asked my parents abut my share in the flat my youngest brother has purchased living in a joint family, my parents says he has earned the flat from his own earned money, and I had no right to claim on it. When I told them that I have also handed over Rs. 86000/- to you at the time of my retirement from the Army, if I would have also purchased the flat from this money, and now the the coast of that flat could have been 80 lacs now.

In between my respected father expired in the last May, 2012.

He had not written any WILL.

Is there any law as to how i can claim my share from the flat from my younger brother.

Pls advise.

Regards and thanks

Yours truly,

Ramesh

Ramesh

Sorry to say but law does not have any place for emotions and good ness you did . As your brother has bought the flat on his own funds and your father divided things in start itself (and by now I am sure the flat must be on his name) , I dont think legally you stand any chance of getting anything .

I must say you must have thought about yourself more than others at some point of time.

Manish

Dear Manish,

A very basic question….In case there is no ancestral property then how HUF can earn income? Can I (being Karta) transfer a certain amount in HUF a/c and that can be considered as a income of HUF?

Thanks.

The transfer will not be income, it will be an asset, the asset if earns anything after that will be considered as income

Perfect and Thanks…..But am I right in concluding that if I transfer 100,000/- per year to HUF a/c…..that will be considered as an asset for HUF and HUF has to pay tax (according to limits) for whatever earnings made on that asset/investment???

And let me tell you Sir, that you ROCK. Even after googling so much time, Your article was the only one which gave me maximum clarity on HUF!!!

Welcome , spread the knowledge !

Sir….the question remains……am I right in concluding that if I transfer 100,000/- per year to HUF a/c…..that will be considered as an asset for HUF and HUF has to pay tax (according to limits) for whatever earnings made on that asset/investment???

Yes .

Dear Manish

From your above article i have some quary..

I was took in last year FY11-12 Rs. 2,75,000 as gift from my mother and made a HUF with my wife and kids…

Q1. is ther any direct gift tax on above amount?

and

i have made tax saver bank deposit of 5 yeras of Rs. 1,00,000 for 80C

Q2. now finally how much tax i want to pay?

and if same thing do for the current year? then…….

Milind as of now now after 80C investment , the taxable income is just 1.75 lacs , which is not taxable finally. If you do the same thing this year , then again same thing will happen

Please tell me can a HUF buy a car in name of the karta from the funds of HUF or it is to be bought in name of HUF only??

It should be bought in HUF name

Thanks Manish for sharing the informative article. But please consider this point:

A Daughter after marriage continues to be the co-parcener of her Father’s HUF and becomes a member of her Husband’s HUF. So this way, she is the co-parcener of only 1 HUF during her lifetime and not of two as stated in the article.

A women can be co parancer in two HUF , that is valid

hi, i heard someone say that according to new rules members of huf can contribute towards huf.

also please tell me how can i create new huf if my parents donts have a huf.

thanks

Yes thats true .. for creation of HUF, meet a CA

hi, need one clarity..should one open a bank account first or have a PAN card first?

Siddharth

You should generally get a PAN card first, but if opening bank account is neccessary, better do it first !

HOW TO APPLY FOR PAN (HUF) AND WHICH DOCUMENTS ARE ATTACH WITH PAN APPLICATION.

Better ask this on Forum – http://jagoinvestor.dev.diginnovators.site/forum

sir,

my father expired last year leaving behind a anscestaral property on which he was getting rental income. we are four brothers and sisters ( mother deceased) and we converted it into HUF with my elder brother as kartha. IT returns was also filed and taxes paid as per huf. the rental income is being shared amongst us. kindly enlighten how the rental income of the huf property should be shown in our individual IT return. is it to be shown or not?. in case if we want to show the monthly earnings ( salary and rental income ) to the bank authorities for loan purpose how to go about it? your advice and suggestion will be much appreciated

regards.

meera vallabh

Is the rental income distributed to all the members , if yes , then you will have to show it as income , But the better thing was to show it as rental income of HUF only, that way you will save on the tax part !

thanks very much for the guidance

regards

meera vallabh

It was a very good article. I have few questions. Please respond.

I have my wife and 2 daughters. Both daughters are married. If I want to start HUF ,

1. who will be the members.?

2. Can i include both daughters as members?

3. If I want to include either one only as member is it possible?

4. Can I restrict the HUF to only to me and my wife?

5. Can i transfer the house purchased a year back to my newly created HUF and bring the rental income into the HUF?

SR

1. All family with daughters

2. Yes

3. No

4. No

5. Yes

Thank you sir. Your information will be very useful for me.

Welcome !

Thanks Manish the informations are very usefull. Still your cmments will help me.

I have HUF with my wife and two sons. I purchased an old house in 2004 with my savings. Now i want the old house to be demolished and merge the vacant plot to my HUF. My both sons will bring money equally for new contruction.

My questions are.

Is it sufficient if I make an affidevit on stam paper to that effect and notorise or registration is required.

should my sons pay the builder directly?

If they deposit money in HUF a/c and then money to be paid to Builder will that will taken as income of HUF and taxed in the hand of HUF.

The rented income will be taxed in whose hand?

Do you want to make this on the name of HUF ? In that case your sons can gift the money to HUF and then the payment can be done on HUF name , then property will be HUF’s and rent too !

Yes Manish you are right.I want to merge this property ( after demolishing only plot left) with my HUF ( me being karta). Now question comes

1.What is procedure to tranfer the plot to HUF.

2. The money gifted to HUF will not be taken clubing with income of my sons?

3. Any CA in chennai who can guide me correctly?

You should meet a CA now , we are not aware about any CA here !

Dear Manish,

Thank you for your reply. To apply for Pan card for HUF, is the affidavit required on plain paper or stamp paper and is it required to be notarised?

Can you provide me with any sample which can be used to make the affidavit?

Thank you and regards,

Pooja

Pooja

I am not sure on that, whatever bank says will be applicable , better take help from our forum too : http://jagoinvestor.dev.diginnovators.site/forum/

Hello,

I found your site and this link very informative. We are an NRI couple who are planning to open an HUF File. We do not have any ancestral property. It would be very much appreciated if you could kindly clear my following queries and doubts.

1. With recent announcement in budget, I understand my husband and myself can contribute to open and inflate the HUF corpus. Is there any limit to the amount we can pump in each year?

2. Will clubbing provision apply in this case? I understand if I transfer say 20 lacs to HUF and invest it say in FD for a year, the interest on this 20 lacs will be taxable in my hands in first year. Thereafter on renewal of FD this income will be taxed in the hands of HUF. Is this correct?

3. Are there any don’t in how HUF funds can be used by the HUF members?

4. I received say Rs. 1 lac and jewellery during my marriage several years ago. Can I show this as HUF asset and how?

5. Will gift received from my parents to our HUF where my husband will be Karta be subjected to the limit of Rs. 50,000? Can this gift be received in cash?

Many thanks for your valuable time and guidance,

Pooja

1. You can put the money to HUF , there is no limit to it

2. NO , you can gift the money to HUF , there is no tax on it and it will then become HUF property. Even in the first year the interest will be for HUF only

3. There has to be justification for it , a member can just not take it out and buy something for himself. it has to be for HUF only

4. NO , not right now

5. Yes it can be recieved in cash .

Better meet a CA on this

Manish

Hi,

Excellent article. I wanted to understand the HUF since long.

1. If HUF is created. Can Karta start withdrawing the amounts or transfer interest received to his own individual’s account? Can this be challenged?

2. If karta has one daughter(elder) and and one son(younger) both married and having children. Who will become Karta after Karta’s death? and who can ask for partition of the HUF?

Krina

1. It cant be transferred just like that , there has to be a reasoning .

2. Son will be the next karta , anyone can ask for partition as both son and daughter are both co-parancer !

I want to give some money to my wife and mother as gift. Now my questions are:

1. How can I show that a particular money is gift?

2. If they invest that money and earn some profit, will that profit income be taxable to me under the provision of clubbing of income?

Ankur

1. You will have to make a gift deed .

2. Yes for WIFE , no for Mother

Kudos to all how have contributed to this section.. well I have a question though

My father had an HUF in his name and after his demise i have become the Karta.

Now, before my father passed away he wanted me to have an HUF in my own name since i m married and have a kid.

Can one individual become Karta for two huf and what happens if one has even his grandfather’s HUF

Can anyone shine some light on the same

Thanks you

Yes you can have your own HUF , your grandfther HUF can also be there and you can be part of that too

I am working and my wife is housewife.

I am in 30% income bracket,

1. I understand that I can gift money to my wife and then she can invest and earn income which will be taxed in her hands? Is it correct? What is the procedure to gift? Anything to be done legally to show something is gifted?

2. If that does not work, can I loan money to my wife and then she can invest and earn income which will be taxed in her hands? Is it correct? What is the procedure to loan? Anything to be done legally to show an amount is given on loan?

3. If I create a HUF with my wife, and I (and not HUF) get some ancestral property from my father, does it becomes property of HUF or of me alone? Can my father give this property to my HUF also?

Can I divide our HUF before our children become major, with agreement of wife? If done so, how the distribution of property will be done? Does some part goes to my children also who are minor? Whatever part I get, will it be taxable or income from it taxable in my hand?

Hi Karan, This is definitely a very interesting and informative article. Explained very well, kudos to you!!

I have a question though regarding the creation of HUF. I had actually been talking with my CA and he told me that HUF can only be created after having a child (as opposed to just after getting married). I am married, but don’t have a child yet – can I create an HUF?

I did more research and found out some conflicting reports – for instance I came across an article on TaxGuru http://taxguru.in/income-tax/meaning-formation-taxation-membership-and-partition-of-huf.html.

It states that the HUF can be created with two members and just one coparcener, but the income in the hand of the entity would not be taxed in the hands of the HUF but in the hands of the sole coparcener. Thus for the income to be taxed in the hands of the HUF, it needs to have two coparceners.

Can you please clarify this issue?

Thanks,

-Abhas

PS: I can’t understand the legal jargon very well. But this is what he reports-

In Dr Prakash B Sultane v CIT ([2005] 148 Taxman 353) the Bombay High Court held that that the property does not lose its character merely because at one point of time there was only one male member or one co-parcener.

In this case , the assessee was a doctor by profession assessable in his hands as an individual. The assessee was a member of a bigger Hindu undivided family which was partitioned on January 1, 1972. At the time of partition and right up to January 22, 1980 the assessee was a bachelor. During these years, the income from assets on partition was assessed in his hands as his individual income.

When the assessee got married on January 22, 1980, he claimed that the income from assets received on partition is assessable in status of the Hindu undivided family consisting of himself and his wife.

The Assessing Officer observed that the decisions referred to by the assessee were considered in the judgment of the Madhya Pradesh High Court in CIT v. Vishnukumar Bhaiya (142 I.T.R. 357). Relying upon this judgment, he rejected the application of the assessee and continued to assess his income from the Hindu undivided family property in his individual capacity. In the above case also, the assessee had obtained his share on partition before his marriage and, on his marriage, had claimed the status of Hindu undivided family. His claim was rejected on the ground that “until a son is born the status of the assessee would continue to be that of an individual. However, the High Court ruled otherwise and upheld the contention of the assessee that once HUF property always HUF property”

I would say take the CA more seriously than the blog article , its a detailed concept , and I would not like to challenge what a CA has said

dear sir,

first of thanx for sharing such info. however i can understand that their are some limitation at the time of sale of property , which was trf as gift from individual, after such trf it was made the family’s property, and in such condition if some family person want to sale it and other want remains and conflict in right.. then in such case what is the final conclusion ? please help me in such….. and thanx in advance…..@

I didnt not understand your question at all

Thanks Manish! Thanks for response!

I have few more questions:

Question 1 :

If I settle in US and I create HUF post my marriage, How can HUF benefit to me Indivdual once I is settled in US and start paying Taxes in USA ?

As an Individual, I will be declaring all the income earned in India and that will be clubbed in my Income earned in US, but how HUF income will be treated ?

Question 2:

As on today, property in jointly my name and my mother name and I get rent divided in my Name and my Mom name, can I ask Tenant to issue me Rent Cheque in name of HUF of my share ?

Do I need to do anything before I ask tenant to issue rent cheque in the name of HUF ?

Question 3:

Can an Individual be Karta of two HUF ?

As per Law, Eldest Son get the Karta role post the father death ?

Can Eldest Son still maintain his HUF (Self, Wife and Kids) which was opened when father was Karta of his HUF ? I mean to ask, can he maintain HUF Opened by father as Karta as well as Karta of HUF created by self ?

My father deceased recently. We have neither a HUF bank account nor a HUF PAN card. We received an anscestral property. Can I apply for a HUF PAN card now with me as Kartha and my younger brother as co-parancer.

If HUF was not present , then right now there is no score of using HUF PAN and all .. Why are you looking at HUF angle at all in your case !

Thanks for prompt reply.

I learnt HUF is automatically created on the time of marriage. So my father has technically an HUF. But my father hasn’t used it by creating any HUF account or HUF pan card.

Suppose after my father deceased we received some 15 lakhs from ancestral property.

Is it now possible to create an HUF account which my father has?

So that we can use for tax purpose as my mother along with us has other source of income exceeding minimum tax slabs.

No it cant be done like this , only if the House belonged to HUF , then it can be done . An HUF account was supposed to be there

Thanks for reply.

I searched in internet and found this information in a site “There is no formal procedure for creation of a HUF as it is automatically created. To form a HUF, the family must have at least two members, of which at least one person is to be male. A HUF can also consist of female members, being the wives and unmarried daughters of the male members.

It has to be created in the name of Karta, the manager / head of the family. Hence, after demise of father, it is not possible to create on his name. It can be created on the elder male member of the family.”

Please suggest the validitity of the above statement. I am confused 🙁

Also As per my understanding the source of HUF need not be only through an HUF. Then how come the first HUF get created.

thats about existence , but you have to anywyas register a HUF and get a bank account or create a PAN card . The existence of HUF is just automatic

Thanks for taking your valuble time. I am relieved that I can create an HUF in my name instead of my father as I am the eldest member.

Yes ,but only for your immediate family

Hi,

Who all can be member of HUF ?

1. My Family has 6 members (Father, Mother, Brother, Sister-in-law, nephew and me).. When we will create HUF, will all six members details will need to be shared with Bank or where-ever required, if we open HUF in my father name ? or it will be just 4 members (Father, Mother, Me and Brother)

2. I understand my DAD can have his HUF, my brother can have his HUF with its family.

3. I got divorced, with Divorcee status, can I still create HUF ?

Sachin

1. You can have HUF with 4 person as mentioned , father and sons

2. Yes

3. No

Thanks Manish!

I have few more questions:

Question 1 :

If I settle in US and I create HUF post my marriage, How can HUF benefit to me Indivdual once I is settled in US and start paying Taxes in USA ?

As an Individual, I will be declaring all the income earned in India and that will be clubbed in my Income earned in US, but how HUF income will be treated ?

Question 2:

As on today, property in jointly my name and my mother name and I get rent divided in my Name and my Mom name, can I ask Tenant to issue me Rent Cheque in name of HUF of my share ?

Do I need to do anything before I ask tenant to issue rent cheque in the name of HUF ?

Question 3:

Can an Individual be Karta of two HUF ?

As per Law, Eldest Son get the Karta role post the father death ?

Can Eldest Son still maintain his HUF (Self, Wife and Kids) which was opened when father was Karta of his HUF ? I mean to ask, can he maintain HUF Opened by father as Karta as well as Karta of HUF created by self ?

HUF will not be helpful in US

Thanks Manish Once Again!

Question :

As on today, property in jointly my name and my mother name and I get rent divided in my Name and my Mom name, can I ask Tenant to issue me Rent Cheque in name of HUF of my share ?

Do I need to do anything before I ask tenant to issue rent cheque in the name of HUF ?

Question :

Can an Individual be Karta of two HUF ?

As per Law, Eldest Son get the Karta role post the father death ?

Can Eldest Son still maintain his HUF (Self, Wife and Kids) which was opened when father was Karta of his HUF ? I mean to ask, can he maintain HUF Opened by father as Karta as well as Karta of HUF created by self ?

Sachin

Is HUF account there at all ? If yes , then you can take the rent reciept in name of HUF.

A person can be karta of 2 HUF , why not .. like a son , who will have his own HUF after marriage and he will also be part of his father HUF , but after whose death he will become the karta

Hi Manish,

Thanks for the prompt response!

I need clarification, I can ask rent of my share inmy HUF i.e. SACHIN (HUF), even if property is in jointly held equally in name of my dad, mom, me and my brother and property not in name of HUF ?

Yes i think that should be possible

Thanks Manish, you are doing excellent stuff to help people understand comples stuff in easy way..

I really appreciate your help!

Thanks Sachin

useful detail of HUF….very informative

Thanks Ankur

Dear Manish

i have a query,

i have ancestral agri land the income of which is shown in my return. Now suppose i form an HUF, can i transfer this land to my HUF ? and show agri income in my HUF return. If it is possible what is the procedure to do the same?

Thanks in advance & looking forward for your expert opinion.

Manish

Yes .. with recent budget , an amendment was done and said that any contributions can be done by HUF members to the HUF and it will not be taxed . once you gift the Land to HUF , the further income will be HUF income only

Thanks a TON!!!! for your valuable time & advice. Looking forward for more informative & handy tips on Tax Planning from u.

Would try my best to do that

Hello, This is very informative.

If you are aware of the IT Act / schedule where HUF members are allowed to make a gift to their HUF, please let us know.

And to extend this point further, if I am Karta of my HUF and I have some shares in my DMAT account, can I gift these shares to my HUF? Will the Depository allow me to transfer the shares to HUF? And will there be any tax liability on me or HUF?

Thanks

RG

Rajesh

IN this budget now this point is allowed, you can gift it to your HUF , there is no tax liability

Please advise:

Facts of the Case:

(i) I am having 1 share for one apartment in cooperative group housing society at Gurgaon. For which I have taken a home loan from IDBI bank in the year 2004 by depositing the original share certificate with the bank .I am availing tax benefits for the interest paid and principal amount . The same apartment is also rented out and i am showing the rent received in my income tax returns.

(ii) No conveyance deed of the flat has been carried out by me till date.

(iii) There is as scheme floated by central government under the aegis of CGEWHO for housing project at Noida in which there is one condition that central govenment employee must not have any flat/house etc in NCR.

(iv) I have made PAN card of my HUF with name VIVEK JAIN (HUF) and with the help of this i have also opened a Bank Account for my HUF.

Questions:

(i) Whether the status of property will be changed if I blend my self acquired property to HUF? Whether the same is accepted in the eyes of law? whether blending will make me eligible for participating in the scheme. legally.

(ii) Legal procedure to do the same.

Vivek

Your case seems to be little complicated, better ask it on our forum : http://www.jagoinvestor.com/forum/ or meet a good lawyer !

Dear Mr. Manish

A HUF gets contribution from its members to buy a property and puts this property on rent. My question is, in whose hands this rental income will be assessed. In HUF’s hands because the property is in its name or in member’s name, because indirectly it is the money of the members which is fetching the rent?

Thanks

It will be HUF income only as the property is in name of HUF

Manishji,

Then what about clubing provision?? I think Rent will clubbed to the income of contributor.

Not in this case , as the property belongs to the HUF , the rental will just be HUF income only

Dear Manish,

My father had taken an insurance policy, where the policy holder is the HUF? Does this means that the lives of all the members of the HUF are insured by this policy?