Review of Portfolio management softwares in India – MProfit, Perfios, Intuit

POSTED BY ON August 10, 2011 COMMENTS (185)

Which Portfolio Management Softwares do you use ? Some of the Portfolio Management Softwares in India are MProfit, Perfios, Intuit and Investplus and we will see a detailed review of these portfolio trackers in detail. Portfolio Management & monitoring is an important part of managing a good financial life and if your financial life has different components like Real Estate, Loans, Life Insurance Policies, Mutual funds, stocks and ULIP’s. You can also track your portfolio using Excel and there are lot of templates also, but it can be a tedious task to monitor which part of your financial life is doing well and how much worth do you have at each level using an excel template for Portfolio management. Hence, you can use portfolio management software which suits your needs. There are tons of Free portfolio management softwares which you can start with

![]()

There are many paid as well as free portfolio trackers available in the market which you can use to track and manage your financial data. I really recommend using one of these so that you have all the data at one place and you don’t need to struggle every time to find out your own information. Once we put all the information at one place, we get a clearer and a complete picture, which we don’t get otherwise… We are amazed to see our clients find out that they are worth so much or worth so less once we start discussing with them their financial life data.

Some important features of Portfolio management softwares

Now we will discuss some of the most important aspects of portfolio management softwares in India . These points are top level concerns of customers.

Data Security of Portfolio Management Softwares

A very big concern which most of the people have is where will their financial data be (example) ? Will it be on their local computer or will it is at third-party server and this becomes a big blocking point for them to go for those products which stores their data at their end itself. Here I am not talking about the login & password, but the actual numbers of their financial details. A lot of people don’t want their info to reside on other servers. I personally don’t buy that argument, but that’s a big concern for a lot of people. In a survey done by JagoInvestor last month, the number one concern which people had was data security, ahead of pricing and features.

Regarding the security of login credentials, with the advancement in technology and strong security advancements, it has become virtually 99.999% secure if not 100%. A lot of solutions also give an option for users to link their bank accounts, credit card and other online accounts by providing the passwords. A lot of people do not know how it works internally…

An online money manager will work well only if you provide online access to banking accounts for a one-time setup. This raises security concerns, but here is how it works. The login username and password for individual online banking accounts is used to retrieve read-only data. The ‘transaction password’ for online banking should be different from the ‘login password’ for greater security. You don’t have to reveal your ‘transaction password’. Customers do not have to give any personally identifiable information, making the process safer. Moreover, the account is completely anonymous and requires only a username and password. All the banking accounts are linked to provide consolidated data. In the consolidation process, vendors will have access to your financial records on a read-only basis, but privacy policies of these entities should prevent abuse of information. – source : moneylife

Features provided

I was surprised to see that in our survey, most of the people voted for high features and less on simple features. I personally thought that most of the people will love to have something which provides them less, but rich data. But actually people look for lot of features giving them number of reports and graphs. It’s very important for someone using the software getting more analysis and suggestions on what one should do in their financial life rather than just getting some plain info which they would have done on their own. Most of the software providers give good analysis along with different type of reports and charts which you can download in excel formats.

Easy to use

It’s extremely important that the softwares are easy to use because no one would put a lot of time to feed the data at the start and on ongoing basis. A lot of players provide statement upload facility where you can just upload your Bank Statement, Credit card statement or other demat statements and the software will put out the information and feed it automatically, thus reducing your work. Some softwares like Perfios allow you to link your accounts with them so that they can pull your information and feed it themselves (read only).

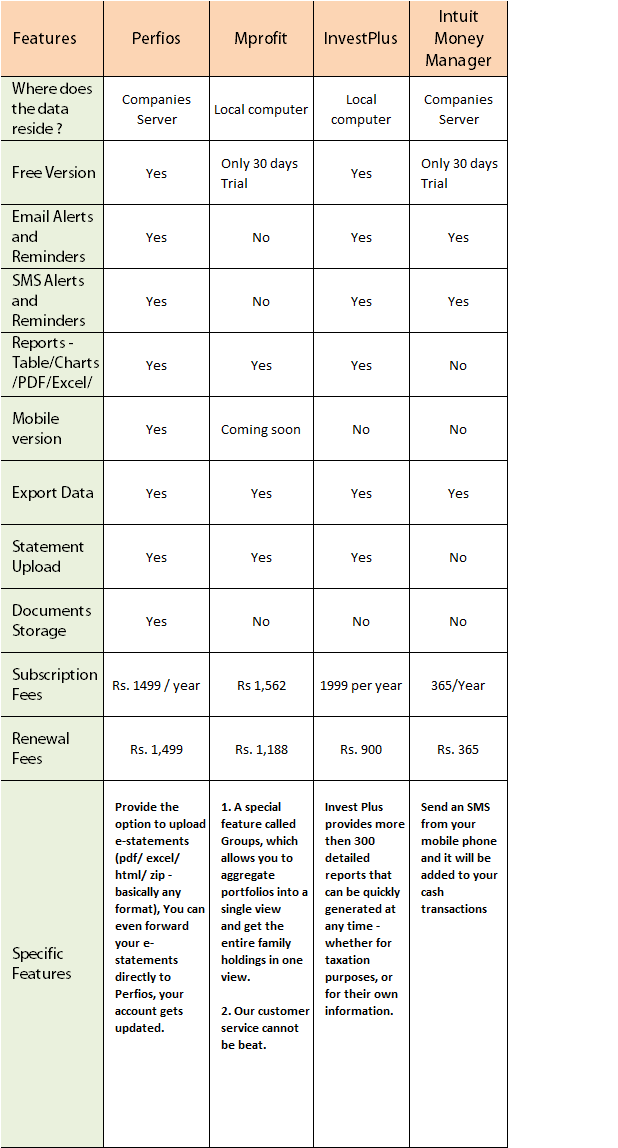

Below is a comparison of 4 major Portfolio management software’s in India market and used by thousands of people (you can read their reviews on their website). They are Perfios, mProfit, Investplus and Intuit MoneyManager

Look at the above video done by me and Manish Jain from Mprofit .

Free and Trial versions

I would say you should take advantage of Free and Trial versions of softwares, Like Mprofit gives away a full functional 30 days trial, where as Perfios and Investplus have free versions which are good enough. If you don’t want to use any software, you can manage your finances at very basic level in an excel sheet, but you will have keep updating the values etc from time to time as the situation changes, which is not the case with softwares, as they auto-update the values.

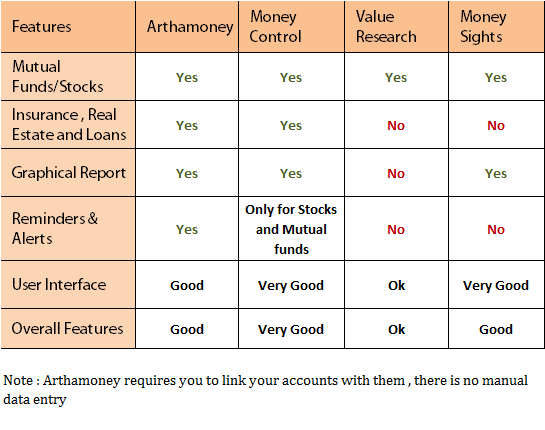

Free tools for Portfolio management

A lot of people don’t go for advanced tools and use free tools available in market which does a good enough job. Tools like money-control tracker and Valueresearchonline tracker are used by lacs of people to track their mutual funds and stock holdings. But they do not give you all the functionalities which fully fledged software’s give to you. Below is the chart explaining Arthamoney, Moneycontrol , Valueresearch and Moneysights portfolio trackers. I hope liked this review of Portfolio management softwares !

I would say you should definitely try out some softwares which provide a free version and also explore the free options, there is lot they provide free of cost and all you need is to put your data there. Some other tools which you can use are rediff money (only for stocks and mutual funds, but I like the UI), myirisplus, yodlee and rupeex.com. Please share what more do you look from these softwares and what do you think about the value you get out of these management softwares?

6 Free Portfolio Management Software Licence from Perfios

Update 12 Aug : The 6 winners are selected and this giveaway is not valid now

Perfios is willing to give away 6 free Platinum licences to Jagoinvestor readers for the first year (worth 1499). The first 10 commentators who share this article on their Facebook profile will get those licences (just cc manish at jagoinvestor dot com) (to share it on Facebook, just “like” this article below and put your comment in the box which opens).

hi,

its a great article.

do u plan to update this article with the new softwares available in the market, grandfathering & supporting various asset classes (bonds, equities, insurance, fd’s etc) with their corporate actions?

YEs its a pending task, will do it .. but not sure when because there are so many things on my todo list!

Hi Manish,

I have tried MProfit free version for stocks, MFs, FDs and bullion. But I found that it only gives an accounting average price of your stocks. Say I buy 100 shares of X at 100 and process goes to 200, so I free up my investment by selling 50. Now my actual average is 0 but MProfit still shows it to be 100 since that’s accounting average. Any software which can give me both?

I have no idea on that.

How would you rate the new breed of softwares/ facilities given by Economic times, or Google finance or Yahoo. agreed that they all have your data at their mercy and some people may not be comfortable doing it.

Hi Dilip Kulkarni

I have not checked it myself !

Queries asked to hdfc customer care around Aditya Birla Money myuniverse integration with HDFC, as it has only a single password, though some transactions are OTP protected.

1. Do they have a formal tie-up with you?

2. Is the integration with them reviewed by HDFC security teams?

3. Is it safe to use my login credentials on their site?

4. Will they have only read-only access to my account?

Response:

We request you to use our Net Banking website for the safer transaction

Myuniverse customer care mentions they do store the login credentials encrypted on their US servers.

Any thoughts?

Any thoughts

I think you can go ahead with them . It totally depends on your personal comfort level with these things ..

If i do not want to track the value of my portfolio,but just want to do accounts of my family by uploading contract notes of angel broking …. Which will be the right software for me.

I am a portfolio advisor and handle HNI clients .

I think MProfit is a good choice , they have a advisor version also

Excellent review,

I have decided to purchase Mprofit Software. I searched on their site for pricing details, but it was not available there. If you are aware about the price list of their 3 version of softwares please give me one reply and help. Enthusiastically waiting for your reply. thank you.

Its not here .. Contact them on their website !

Thanks for the review. Working in a large financial institution I am paranoid about how the financial data can be misused.

Case 1: Online upload by providing credentials

By providing credentials to a third party software the users may be potentially exposing themselves to a great risk with no legal options, when the terms of use of banks and other institutions clearly state that passwords and PIN’s should not be disclosed to anyone.

Example,

http://www.icicibank.com/online-safe-banking/internet-password.html

“ICICI Bank is NOT liable for any loss arising from your sharing of your user IDs, passwords, cards, card numbers or PINs with anyone, nor from their consequent unauthorized use.”

Does the software instutions have any agreement with the financial institution regarding exchange of data in a secure way and who assumes the fallout case in case of data loss?.

Case 2 – Offline upload of statements

Even the statement uploads the following “personally identifiable” data like name, address, telephone, PAN, Folio numbers, bank account numbers, credit card numbers. .etc can be extracted and stored in remote database. Even if they give all the claims about using all industry certifications we as ousiders do now know or cannot verify what level of internal data protection processes or mechanisms are used within the company. Even large companies experience data theft and loss. In other countries there are rules like HIPPA, DPA, PCI DSS, but here there is none and in case of data loss nothing can be done.

Any person armed with this information can target the users or their family with spear phishing, and get all the remaining information to swindle your hard earned money. Heck a lot of the information is even available online – you just look at electoral roll which is publicly available to get your name, address, family and date of birth. You may be divulging a lot of information in your facebook or twitter accounts. Just think in a telephonic call with the bank what information they require to authenticate you and how much of that is freely available online. In case of PMS software you may be exposing your entire financial information in one shot.

Solution: I recommend masking (replace characters with a logic of your own) all the personally identifiable information in statements before uploading to these software. I have verifired this works in perfios.

For Protected PDF statements, you need to decrypt it, edit it and then use the same. Excel statements are more easy to mask.

Thanks for sharing this information !

I have tested Perfios, it still needs enhancements. They have not built the logic correctly for the bonds program.

Thanks for sharing your review !

I am very pleased with your detailed article and insight.

I recently found one more portfolio application which is rich in feature and performance is also good, you can study this also and compare it with others.

http://www.askkuber.com/Portfolio/Home

Parvesh

Thanks for sharing that

Very useful article, Manish.

I started using mprofit and it had helped me a lot in managing my finances.Thanks again

ashish

Thanks for sharing that !

Hello Manish,

Any software that tracks Gold & Silver prices online along with Stocks & Mf”s? I mean Gold & Silver physical prices not ETF’s.

Hello Manish

This is a great article and a step in the right direction for people to learn to manage their finances. I am curious if anyone has had any experience in tracking bonds traded on NSE/BSE e.g. lets say I had bought NHAI bonds in 2011 and now I want to see their present value on the exchange. I find that most software only allow stock values to be tracked. I have not seen any software so far which allows this to be done. Any inputs appreciated

Not aware of this .. Let me check with Manish Jain of Mprofit . he might know this .. hold on ..

Hello,

We currently don’t track these bonds in real-time. Our MProfit users enter the transaction under Bonds, then manually up date the price from time to time.

We are planning to offering a delayed price feed for these instruments but can’t really give a timeline for when it will be implemented.

Hello Manish Chauhan and Manish Jain Thank you for your response clarifying the bond holdings. Can you please give info on where one can get the latest value of tax free bonds e.g. NHAI as mentioned in the earlier query. Thanks

One of the best resources on the web is located at:

https://www.edelweiss.in/Debt/default.aspx

Dear Manish,

Thank you for guiding us on the available software. Indeed very helpful. Can you suggest a tool that can support multiple currencies? I am trying my hands on Quicken Premier 2013 and it serves the purpose. However, it doesn’t differentiate between USD and INR when you connect your Indian bank account. Also, the investment part does not download the stock prices. In the end, I have to do everything manual when it comes to Indian bank account and investment.

Thank you for sharing your thoughts in anticipation.

Try Yodlee

Thank you Karthik. I will try my hands on it. Will give my view once I am done.

You should try http://www.myuniverse.co.in which offers both usability as well as personal finance management.

MyUniverse is a unique solution which offers its customers an opportunity to manage their scattered finances through an integrated online money management platform. The unique platform enables customers to aggregate their bank accounts, investments including gold and real estate, credit cards, loans, incomes, expenses in a highly secure environment. The platform gives customers a single window view into their financial universe thereby helping them evaluate their actual net worth and provides advice on money management.

Thanks for sharing that .. are you from Aditya birla company ?

I tried the free version of perfios. it has integration channels to obtain your investment information with most of the banks / insurane firms etc. which is a real food feature. That way it is useful. but the GUI was not very good. It could have have been made simpler on while and black. it looks decorative like an entertainment site.

Yes.. agree to that 🙂

Thanks for putting up this.. I migrated to intuit with moneycontrol sometime ago. Now that they have asked to download our data since from 28-Feb they’d close the service. But they’d continue with ICICI.

Have felt some accounts that dont have linkage (Ex. LIC now… ) makes it difficult since we get used to uto syncing rest.

Find Perfios linking more sites than intuit that I used.

Its good to see Perfios can be totally free.. May give it a tray soon before 28 Feb!

Thanks.

Yea .. just have a look at it , there is a free version of it and pretty good one !

Hi Manish,

Thanks for the information on above topic.

I have just started with the financial planning and was desperately looking for some tool like this.

Tried Arthamoney and Perfios, but Perfios is much better.

In Arthamoney we have to update the accounts detail or some of the information manually, we even unable to upload the statements directly from pdf.

Thanks currently using Perfios free version.

-Abhinav

Good to hear that .. Perfios basic free version is good enough !

Dear Manish,

Its nice article on portfolio manager. Is it safe to link accounts with podtfolio manager sites such as arthamoney

Its about your trust, better do it with more famous companies!

Kindly suggest more famous companies. Thanks.

I am not aware of more .. you can ask here http://jagoinvestor.dev.diginnovators.site/forum

Dear Manish,

Its nice article on portfolio manager. Is it safe to link accounts with podtfolio manager sites such as arthamoney.com

Dear All,

All of the above one more software is there in market since 2000, i.e MoneyWare 2000, the software maintaining Shares/Debt., MFs, Bonds, FDs and other investments including accounts. That means all your account part of tranaction will be in single entry book keeping in that software. Reports like Short-Term Gain Loss, Long Term Gain-loss, Speculation, Notional Gain-Loss. Automatic download of stock price at FOC. Above all it is marketed in 3000 INR with no yearly renewals. Rs. 3000 for life time subscription. Take it all

Have you used it ? Can you give some review !

I am a proud user of MoneyWare 2000 since 2009 and it seems a very good investment software for my personal investment including my family details in it.

Hi Manish,

I am using it myself since a long time. Its a single entry book keeping method used for all accounts. MoneyWare 2000 use the FIFO method to all investment transactions i.e. Equity, MFs, Bonds and all. Reports are in Windows and DOS mode as well. Reports can be export to excel/notepad od PDF. I Thing its a good software for Family/Group as well as personal individual.

Good to hear that .. will give it a try !

Manish,

This is very nice article. I have used Athamoney and Perfios. Till now I am very much happy with Perfios, but there are problems with Arthamoney. I also use Excel sheets to track my all financial transactions like, stocks, MFs, Bank accounts, Daily expenses etc. And also I am making changes to improve them as and when I feel. But your article has given good overall idea about this topic. Thanks on behalf of everybody reading this.

Abhijit.

Good to hear that Abhijit .. keep it up !

Hi,

Very nice article and information on one page. I also want to share my experience regarding intuite and perfios. I am using intuite since last two years and its very excellent in all manner. Perfios required so many changes and they are trying on same. Regarding MProfit I dont see any menu for recurring deposite. elase everything is fine.

Thanks for sharing your personal experience Yashesh

Hi Yashesh,

Thanks for sharing your experience but Which one are you using Moneycontrol-Intuite or ICICI Bank – Intuit ?

I don’t see the Auto update of the Broking contracts in INTUIT whereas perfios takes care of this wonderfully.

Please let me know how are you tracking your share market Investment details in INTUIT.

Thanks – Siva

Hi Siva,

I am using Intuit Money Manager from money control for last one year. It is the cheapest safest simplest personal finance software available. It works excellent for me. For stocks,mutual funds I keeps my moneycontrol portfolio. Also added fixed sources like NCD,InfraBonds in moneycontrol portfolio. The rest bank, insurance , credit card accounts are linked seamlessly by IMM. For 365 rupees a year, its worth every penny. Highly recommended. I have used Moneysights in the past. It was OK though it gives algorithm based recommendations.

Cheers

Aneesh

Very good Article on Money management. good for people like me who’s money management exceeded Excel. All the above software are worth for money. some good software even for few hundred rupees. In fact I’ve downloaded investplus and doing trials with Myirisplus, perfios, etc.

Murali

Good to hear that you are trying few of them .. let others know what you likes and disliked in them

Manish

Manish,

I try Perfios. It is nice site. But I am also scare to share information like bank accounts, loan information etc. on site.

It has good feature in compare to other site.

Please send me free license for perfios for know more feature.

Nikunj

I dont have a free license

Manish

I dont need daily and real time updates of my assests, so I maintain an excel tracker with all investments/assets/liabilites/receivables etc. and manually update it quarterly or on need basis.

Good work on this article, but seems this is not for ppl like me who can spend a day’s time quarterly or so to update in excel tracker manually.

Chitanya

Yea .. if you are not going to check it regularly , then excel will do the job

Manish

Dear Manish,

I came to know about you few days back.

I need some OFF LINE data management software for my family members investments like FD in various banks, NSC, KVP, Company FD, NCD, Stocks, LIC, Bonds ect…

No need for on line update.

If I ask how much FD my wife has in IDBI then software should show FD of IDBI only and if I say all FD then it should show all FD’s including IDBI. Say IDBI, HDFC, HSBC, ICICI…..etc.

If I ask how much LIC i have , thus software must show details of my LIC policies with maturity date, premium date….. etc.

I tried Perfios free services, but INTERNET is must for all the time….which is not possible for me so i need off line software.

One of the member has developed such type of the data management software in Excel. I request to mail me the same on my e.mail ID pnjani123@gmail.com

Daily up date for stock is NOT require for me, so i need offline of local software.

Expected the response.

Thanks and regards.

Hi Manish,

Great article as always.

I have tried using InvestPlus family edition for now because it stores all the data in local computer. I am not sure if I will ever be comfortable with such a program which stores all my financial information in the company’s server.

Though this program has a great User Interface and a easy learning curve I am a bit skeptical to use it – not sure why exactly but sill.

I would like to point out an excellent free ware alternative to these softwares.

Name: GNUCASH

This was not available for windows some time back but now it can be used. 🙂 It is based on double entry mechanism and is completely customizable. Though it has a steeper learning curve than most softwares but I would say that its worth it.

Thanks,

Rajat

Good article. Let me know if I can get a free perfios account as well.

Pradeep

Perfios account is reserved for another article now ..

Hi Manish,

Great Article and a fantastic website. I use simple Excel sheet to track my finances but I will definitely try the free ones suggested to improve my Excel sheet. Online security has always been a debatable issue and hence the arguments can go on forever.

As a basic user of Excel, I would appreciate if the users tracking via Excel can upload their sheets so we could improve on the ones prepared individually. Also how could we update stock / mutual funds details on our sheets automatically rather than update it manually.

Once again great work.

Thanks

Sunil

Sunil

Thansk for your feedback . I will work on some sharing option using which others can upload their files

Manish

hi manish, is it safe to keep bank accounts details with these softwares like perfios?

Rajiv

Yea .. pretty much .. what is your fear ?

manish

Looks everyone is using either online tool or excel. Are there no popular desktop applications for personal finance/portfolio tracking? (MS Money is the only one listed in these comments.)

I tried using Money control and Valueresearch trackers, both are online tools. Problem is they only track Equity and MF (last tried some 2 – 3 years back… not sure, if there are any further improvements).

Sometime back I tried gnucash (www.gnucash.org), licensed under GNU. Looks good and provides many accounting as well as portfolio tracking options. It also provides, automatic updates of the equity/MF values, but never tried. Nothing specific to indian markets, but worth trying it. A lot better than simple excel sheet.

Hi Kumar,

There are many desktop applications available depending on the exact needs. There is Investar for technical equity information. MProfit and InvestPlus are of course portfolio managers. Also, Easylife is another product you can take a look at as well.

Manish Jain

MProfit

Manish has tabulated the cost related to the desktop applications available but one does not find the details of Easylife. A search of their website at http://www.easylife.in does not give pricing details. They seem to be particularly shy of revealing the annual fees to be paid for data updation

Raman

yea .. that does not look professional on Easylife front !

Manish

Is any of you facing problems with moneycontrol portfolio manager. I had added a monthly SIP last month in HDFC TOP 200. It was 7th July. SIP date was mandated as 10th August & so on. Instead of one (1), two (2) Purchase entries were made. It looked like I had a SIP of Rs. 2000 but actually I had only done Rs. 1000 SIP. So it is making double entries. I had heard this from a colleague too but didn’t believe him and now I am experiencing the same.

Singh

It might be some bug , but the best people to comment on this would be from moneycontrol only ..

Manish

I am using the following to track my investments in Mutual Funds and Equities:

1) Moneycontrol – Quite good and easy to use but doesn’t have XIRR reporting.

2) Value Research – User inerface is probably not as good as Moneycontrol’s but provides XIRR for both MFs and Equities. MF reports and research are quite detailed as well.

I am using an Excel Template as well to update and monitor my MF investments. This Excel template is available ‘Free of Cost’ on http://chandoo.org/wp/

Download link: http://chandoo.org/wp/2009/12/28/mutual-fund-tracker-excel/

Thank you Chandoo for the free Excel Template!!

Happy Independence Day to all!!!

Hi Manish,

Very nice selection of topic. I am regular visitor to your articles and have found them excellent.

You didn’t compare it with ICICIDIRECT or any leading site that also offer detailed portfolio tracking? So if we are doing all our investments through ICICIDIRECT, do you think it’s still valuable to visit one of these portfolio management services?

Hi Manish,

Great article!

I believe the underlying purpose is to have a tracker which has documented all your investments, be it in Excel, web service, s/w or even a well organized paper folder.

For past 7-8 years I have been using my own Excel (10+ sheets with macros) which has all the info. The file is encrypted and backed up at several places. So far it has served me well. For tracking I use data from Yahoo and VR. VR even gives me market cap split.

If you can build ur own and customize it as per our reporting need, there is nothing like that.

As for Perfios, I tried the free account and I must say honestly that I am not very impressed. And for a cost definitely there is no value add. Though they have good interface, but its more like if ICICI or any other brokerage firm spend a little time on their UI, they will more likely have similar one. Data wise it is alike. Most of the reports are merely simple aggregations that one can do on ICICI Direct or using the data from it and putting it in Excel.

The real value of this tool is if you have multiple brokerage account or several AMC accounts, then such tool are excellent for you even at a cost.

A/c security seems as good as any web service and it is pretty much up to you to trust or not.

I definitely loved the auto account update, takes away lot of hassle for someone who doesn’t have any tracking tool and is sitting with several accounts.

A big disappointment was with MF information reports. They are not custom to your information neither do they help you in decision making. I have tried Money Sights based on Jago Investor’s advice and I absolutely love it. It goes far and beyond on what is available in your brokerage account. Though they lack in capturing other assets classes and having a better data entry mechanism, I hope Santosh Navlani is reading.

I haven’t tried other tools, but I believe this was best of the lot and still have miles to go. But surely an excellent tool if you haven’t got anything.

Hi Deepash,

Good to read your feedback on the product.

Wondering if you wouldn’t mind sharing your XL..!? with us…

If you don’t, please mail me harshaskm a t yahoo.com

Regards,

Harsha.

Please share the same excel sheet at gopal.agrawalla@gmail.com. I am searching for excel sheet base tool

Deepesh

Good to hear that you are already tracking it and with your own tool . Nothing like it .

I will try to make a tool soon and lets see at what level I can make it 🙂

Manish

I certainly need one. Those who already track using Excel, it would be nice if they can share their tools without their data & may be with some hypothetical data.

Hi Deepesh,

Thanks for the nice words. Yes, we are listening. And we will do our best to address this for you in time to come. As you said, we have miles to go before we say, we have “simplified” investing for everyone. Keep using & feel free to write any feedback you may have anytime on hello@moneysights.com

Thanks!

—

Santosh Navlani | moneysights.com

Hi Manish

what difference or constitute in portfolio of all classes of debt (i.e FMP, Gilt Medium & Long Term, Gilt Short Term, Income, Liquid , Ultra Short term, GSec) . In detail If possible ,

Thanx

James

Its not just the condtitute difference , but the way they work , they way they invest, difference in the kind of securities they invest .

Manish

Hi Manish,

I have a question, even the banks are MF houses provides view only access, the same can be missused if the login credentials are on the wrong hand. Once our sensitive personal information (like DOB, PAN number, account number, balance, address etc) are shared, the same can be missused in many places, not only with the account from which it was shared. We need to keep this risk in mind while using these softwares.

Hi Manish,

Could I ask what you use for yourself?

Best Rgds,

Harsha.

Harsha

I used excel till now and nothing else and the excel was very simple one .. nothing fancy , I dont track investments on regular basis so I dont need something which gives me daily or weekly updates

Manish

Hello Manish

Now HDFC Mutual Fund & also Birla Sun Life Mutual Fund allows us to invest online through two modes – one which requires PIN & other which doesn’t require the same. Can you please differentiate the two processes or are they similar?

Singh

What is PIN here ? Is it folio number ?

Manish

No Manish, PIN = Personal Identification Number which is provided by AMC. You can go to HDFC Mutual Fund website & go to e-services link. There 2 options exist. I just want to know whats the difference between 2 processes.

Hi Manish

Thanks for the excellent article!

Can you please give a view on online transaction and CRM platforms for IFAs…thanks.

Abhinav

Abhinav

Thats something i have not explored much myself .. Will have to look into this .

Manish

Abhinav,

We are close to releasing a “Startup Guide for IFAs” that talks about platforms for IFAs. if you are interested you can email me directly at mjain at mprofit.in and I can send you the document.

Manishji,

If you can come across a good excel sheet to manage portfolios, please share with us…

thanks

Naveen

I’ve used paid version of Intuit for over a year, but now switched to Perfios Platinum.

Intuit is more user-friendly and has simple, but very useful graphical reports, but I find they are very slow to add new features.

Perfios is relatively complicated, but offers lots of options. It is also more attuned to Indian users. Used their tax-filing wizard – it generates all data for ITR forms very easily. They also regularly add new features.

Both of them offered great support, I believe both are worth the money.

Have a good day,

Anoop

Anoop

Thanks for sharing your experience , it will help many to take their decisions

Manish

Manish,

An excellent and relevant article as usual

If a bank (e.g.-HDFC) has a combined login/transaction password system would there be a possibility of the security being compromised, unlike banks that have separate login & transaction passwords

Philips

Thanks .. I am not very clear of your doubt , can you repose it

Manish

Hi Manish,

In HDFC bank, there is no separate transaction password. Once you are logged in to HDFC bank website, you can add third party accounts and make transactions as well. There is no secend level of authentication/ authorization for transaction.

Ram

Hi Manish,

Thanks Ram for explaining my doubt.

Ram

Not sure then .. because most of the banks have two level authentication . my icici has that

Manish

HDFC has only single-password security, which is a pity considering it is considered the “safest” private bank.

ICICI has password+transaction passwd+”grid”-based card

SBI has password+transaction passwd+sms-based authentication

HSBC has password+hardware device authentication

One thing I noticed was that HDFC did not allow online 3rd party payments, except for Indian Railways…its my experience, I could nt find any specific written matter on this.

Hi,

Has anyone tried Microsoft Money? Looking for best money manager software brings up MS Money also on the internet.

Regards,

Bhupendra

Bhupendra

I am not even aware of it , looking for people to share about it

Manish

Hi Manish,

I have been visiting your site as jago investor.

I would like to say that Microsoft Money is one of the best money manager software. You might be aware that Microsoft has End of Lifed the Software but for the community they have released sunset edition which does not do online updates but is a great tool. I have been using it since 2001/2002. It is excellent piece of software.

Here is the link for your esteemed readers:

http://www.microsoft.com/download/en/details.aspx?id=20738

It tracks everything under the sun.

Happy Blogging and Happy Independence Day.

Regards,

Anjani Singh

Anjani

Wow .. this looks good , let me download it and see how is it . Would you love to do a review for other readers with bold points on each thing ?

Manish

Yes, I have been using it for more than 3 years and it rocks !!!

Microsoft money is sunset now and available as sunset version with no support.

Hi,

Have liked your article and recommended that on Facebook as well… Let me know if i m lucky enough for the Perfios software 🙂

Vinay

No , you were not amongst the first 6 . I have 4 more licence to give in one of the later articles .. may be you will be lucky that time .. I will put your name on priority

Manish

Hey Manish,

Regular reader of your Blog…. I ensure that before I sleep i visit your blog to be updated 🙂

Vinay

Great to hear that 🙂 . Keep reading and sharing

hi

i am using MProfit but some of the features are not good in this software.

Amit

Hi Amit,

We are constantly adding new features, is there something in particular you are not happy with?

Manish Jain

Great consolidation of information. Will definitely try few trail versions.

Atul

Thanks .. please share it with as many people you can

Manish

Manish,

Please write one article on which pension fund manager to select under NPS?

-Srinivas

Srinivas

Yea ,. willl look at it , for now you can use our forum for asking anything related to that

Manish

Yodlee (link provided in a previous comment) is usually the back-end engine for a number of the online portfolio management software listed in this article. It is free, but if you run into any issues in updating your account, they will take their time in solving it.

I use it to track networth, expense analysis and cash flow. I can use it to track my Citibank, HDFC, StanChart and ICICI SB accounts, ICICIDirect, ICICI Pru and Birla Sunlife ULIPS.

It also alerts me by SMS and email if there is any significant withdrawal or deposit.

Anoop

Even i used Yodlee for some time .. How do you know that its a backend for many softwares ?

Manish

Let me start by saying that your articles are amazingly lucid and I’m glad that I stumbled across your site while searching for personal finance blogs a year ago. A Big Thank you to you for your blog! Now, related to the article: Which of these support the F&O Transactions? I checked out the free version of Perfios and don’t see the support for Futures & Options transactions. I think Investplus does have it. However, not certain about it. I believe the Pro version of Investplus automatically imports the transactions for F&O but the free one requires manual entries. I haven’t checked out the other tools mentioned but will definitely check them out. I’m mainly looking for F&O support in these tools.

Yes Neelesh,

I am using Invest Plus in Mumbai. They have good tools & support.

You can use Invest Plus Pro version.

All the best Invest Plus team.

Thanks

Jayesh

Neelesh

As Jayesh said , InvestPlus supports F&O transactions and you can use their free version .

Manish

Hi Manish,

Good article,

I am using Intuit money manager , (11 months over ).

money control for MF and stocks tracking .

but in intuit only problem is ICICI account is not refreshing..

we need to refresh manually, ( due to One time password).

rest every thing UI, reports, trends, alerts every thing is good..

Thanks

Ramanji

Ramanji

I think thats ok .. anyways you will open the tool to check things 🙂

Manish

I forgot to add this. If anyone thinks of just maintaining cash transactions in their local machine, Easy cash manager will be one of the best options. check this : http://www.moor-software.com/cash/page.php?lang=0&page=welkom

Mathu

thanks for the link . what all features does it provide ? Is it better than excel based template ?

Manish

I wont say it is much better than excel. You can prepare charts, category-wise reports and bar diagrams. It can be used as readymade alternate to Excel.

Thanks for sharing your views . I appreciate it

Manish

Manish,

Good compilation. I have been using valueresearch for many years and am very satisfied with their service.

Rakesh

Rakesh

Good to hear that .. dont you track other things ?

Good Analysis. I have been using Perfios, Moneycontrol and Valueresearch for quite a some time. Though perfios gives the best 360 degree information and reports, i found for mutual funds, value research is best, especially their “Analysis” section and updating SIP is very easy and it allows you to change SIP date every time. similarly Moneycontrol is best for Stock portfolio like you can easily view transactions under each stock line and particularly their alerts and news/reports about the stocks in our portfolio is excellent.

And about the storing of user credentials in Perfios, they have an option to backup the credentials in their server which will be encrypted again with a password.

Mathu

Thanks for sharing your experience with all the options .. I will try out VR in detail for stocks and MF’s

Manish

I use perfios free version since sometime (which i find good enough) and i think there is some confusion on ‘where does the data reside’ column for perfios.

If you are taking about the credentials like login of different a/c’s, it’s stored on the local computer. http://www.perfios.com/index.php/security .

Regards

Raja

Raja

No , I am talking about the main data , data about investments and other details .. I understand that the user credintials will be on local compluter only .

Manish

Well I never tried any of these softwares, but I can give it a try.

And BTW I didn’t get any popup on liking the post via the FB button 😀

Ahmad

Did you see a dialog box opened when you “liked” the article at the end of the article .. it should happen , try it now ..

Manish

I used to use MoneyCOntrol for stocks/MFs, but used it for limited purpose. Mostly i ended up using a excel sheet for doing all my financial planning, and YES it is a tedious activity 🙁 I will move to one of the softwares suggested above. Thanks for sharing this article.

Ashwin

IN that case you can use a free perfios version , it does not cost anything and does the basic job for oyu

Manish

This is for software engineers…..

How about creating your own tool in VBA Macros, Java, REXX etc…

Abhishek

Are you talking about developing it as an independent software or on top of excel ?

I think you can code things in excel to a good extent and make your own tracker

Manish

Good one. I have tried Value Research and Money Control and liked them but it required lot of manual work since it did not support any upload.. (when I tried an year back)

hi Vishnu,

You may want to try moneysights.com. Though, we do ask users to enter data manually, but unlike the sites you have tried, entering data on moneysights is simple & quick. We don’t ask for info-fields like average unit price, no. of units, etc. that we can calculate on our own. Many JagoInvestor readers have tried & like it…i’m sure you will also benefit.

Thanks!

—

Santosh Navlani | moneysights.com

Vishnu

Did you try moneycontrol.com or moneysights ? I liked both of them .. you can give both try and see which one you like most .

Perfios also support uploading data if you email them the documents .

Manish

Excellent Findings, I always wonder how do you manage to cover almost all the topics in personal finance…. Your articles are very Easy to read and understand….for a Common Investor as well…

And no Need to ask for posting it on my FB page….. I do that without fail… on the Wall as well as on my Group… Thanks …Keep it Up…

Harshit

Thanks for appreciation , covering most of the topics is my job 🙂 and my committment towards the community as well 🙂 . thanks for sharing it on FB , let me see if I can get your a free licence from perfios for a year

Manish

Thanks Manish….. Waiting for the Free License From Perfios 🙂

Harshit

I have choosen you and just mailed perfios about winner list , you will get the communication from them on this . Let me know if you face any issue

Manish

Hey,

Thanks for the Wonderful Gesture, Really Excited to Use this one. As a Return gift, I promise to give you a Detailed Report on the Pros & Cons of the Software !!

Thanks Again.

Harshit

Good to know that . I would love if you can post a detailed review for each of their features

Manish

Hi Manish,

Though never commented I have been a regular reader of your side via Google reader.

Personally I am very much scared to link bank accounts to such online managing sites. I have tried intuit manager , i really liked it. But i fear that data can be misued. There were many cases where call centre guys have misused data. I have not seen cases for portfolio managing sites, but just relating to it.

However I maintain my portfolio in a excel(secured with password) having these tabs

1. salary and its components (This i have seperate for me, my dad and my wife)

2. fixed deposits

3. shares. this shows profit/loss as well, linked to online

4. Mutual funds

5. external cash flow

6. summary showing graphs and pie charts of expenditure, charts having shares classified on basic of mid/small/large caps, present value and by sector and for shares i have conneted to yahoo finance api for automatic updating value of shares

For expenditure i track on daily basic logging them into excel and i classify on basis of type

Since i feel i maintain it good already(may be overconfident). I am actually thinking what other benefit can online managing sites actually offer

Hi.. Can u plz let me know how can we link our excel sheets with yahoo finance as mentioned by you so that our share rates get updated automTically..

Thank you.

I have pasted sample query below. You can use them in excel to load the data from the web. You can keep on adding the stock code at the end.

http://download.finance.yahoo.com/d/quotes.csv?s=timex.bo,TATAPOWER.BO,TATAGLOBA.NS,mirc.bo

Is it possible to share the excel wheet with us

Ravi

There are many sites which link your accounts like Yodlee and arthamoney . I cant comment on them using your data , but its your personal choice if you dont wnat to use them .

Regarding your personal tracker . Do you think you can share it with me so that I can give it to more people ?

Manish

Yes Manish. Sure. Please let me know how to share

Ravi

Just send it to me at manish at jagoinvestor dot com

I had earlier also requested for an offline tracker used by Manish. Hope you can share the tool with me. It would be really helpful. My id is singghg[at]gmail[dot]com

Please share the same excel sheet to me at gopal.agrawalla@gmail.com

I was going thru the page and looked very interesting. Request you to share the excel templates of Ravi at atopdar@gmail.com.

Thanks

Hi Manish,

Is it possible to share this spreadsheet with me ?

Thanks in Advance..

Ashish

I never got any spreadsheet from anyone

unfortunately none of this software works on a Mac!!!

I also read about Vault. good reviews on the same.

Ravi can you email me your personal tracker. Thanks

Ram

the online tools should work right ? As they are browser based tools

Manish

Nice description about Portfolio management software..

Sameer

Thakns .. do you use any tracker ?

Manish

Excellent home work to compare softwares.

Kishor

Thanks a lot . How do you track your investments at the moment ?

keep sharing this article with your friends .

Manish

Very useful article, Manish.

I will try the free things first. I have shared it on fb also.

Nagarajan

Thanks .. You stand to win a licence from perfios . I will send them your email with cc to you .

Manish

Thanks.

I use perfios, and I like the fact that it stores the credentials of all the accounts on local machine. You should have taken this factor too in your comparison.

Hemant

I was talking about the actual user data about investments , not the credentials .

Manish

Good article. I used ArthaMoney for sometime and currently use excel to track my portfolio. Let me try the free licence if i get one.

Thanks,

Raj

Rajkumar

Are you ok Arthamoney linking your accounts , that means sharing your credentials . nothign wrong in it , but its good that you are fine with that .

I dont see you sharing it on your facebook , Also you never sent me any mail as required in article (see the article) . So let me check if there are more people before you who met the criteria or not

Manish

Liked on FB with my comment but half of it got swallowed 🙂

Here is the full comment:

I have used the free version of Perfios and it is good. Am not sure if they store the data in their server – guess they do it on local PC. Login details are for sure not stored in their server.

BTW, one more tool is Yodlee’s Money Manager. https://moneycenter.yodlee.com/. Their authentication is too complex and make you remember your great grand father’s maternal great grand mother’s name & all 😉

In any of these the biggest problem is that people are not disciplined to review / add / edit some details [Not everything comes up automatically]. If someone were that disciplined, he would use an XL sheet and be happy with it 🙂

BTW, looking forward to the platinum account from Perfios 🙂

Karthik

I have used Yodlee and it really has a complex authentication method . Did you try perfios ?

You win a free licence of perfios , I will send your email to them along with cc to you . Congrats ! .. Watch out for Action month on 16th Aug for the biggest event in the history of personal finance blogging 🙂 .. see you there ..

Manish

i have used acemoney and it uses local computer for storage, you can track stocks, MF, etc. It also have nicely done reports including graphs and all.

Marshal

I can see its a paid product ($30) … What all does it provide which a free version of some tools dont provide ? Perfios has a free version , you can try that .

Manish

Good summary. I use excel sheet as of now.

will try one of the softwares above.

Anand

Good to hear that … you can download the free trials of investplus and also try mprofit trial to see which one you like .

What tracker are you using in excel ? how advanced it is ?

Manish

will try that.

As of now, the excel sheet uses the URL http://www.amfiindia.com/spages/NAV1.txt for open ended MFs and http://www.amfiindia.com/spages/NAV2.txt for closed ended MFs. Then using using excel functions, I can extract NAV of any scheme. It is automatic. You just need to refresh the page and all the NAVs and XIRR values get updated automatically.

Great

I was aware about these links … Didnt knew about NAV2.txt file .. I will make a excel tracker soon using this 🙂

Manish

Hi Manish,

Is it possible to share the excel wheet with us

Regards

Gopal