Convert your Mutual funds into demat form

POSTED BY ON October 28, 2010 COMMENTS (133)

Do you have all your mutual funds investments in different companies and are looking for aggregating them at a common place? If so, there’s some good news for you. Now you can convert all your existing Mutual funds into demat form, which means that you can now have it electronically stored in your demat account, just like shares! Note, that once your mutual funds are in demat form, you can sell them either through stock broker platform (your demat account) or through the normal way of selling it through your Depository participant (like you do, right now.)

Advantages of converting your Mutual funds into demat form ?

1. Centralization : Once you convert mutual funds in demat form, you will then get just a single statement for your holdings. Right now, if you have investments in say 10 AMC’s, you must be getting statements from all those AMC’s. How to choose a good mutual fund

2. Monitoring : Once you have all your mutual funds at one place, you will be able to monitor them better, & you can see the performance at one go. Compare that to when they were at different places; we tend to be lazy to look at all of them and just keep ignoring them.

3. Fast transactions : : If you have all the mutual funds in demat form, you will be able to sell those mutual funds in stock markets whenever you need money. Mutual funds are now, tradable in stock markets, so you can buy and sell them in stock exchange in real-time. If you don’t have them in demat form, selling them would not be as convenient.

Steps to convert your Mutual funds into demat form

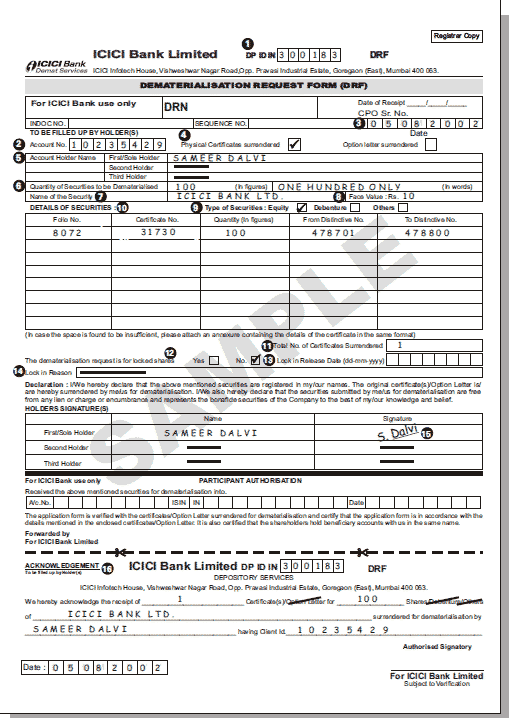

a) Obtain and sign DRF : The first step, is to ask your demat provider (like ICICIDirect, Sharekhan, Reliance Money) for a ‘Dematerialization Request Form’ (DRF) for conversion of mutual funds units held in physical form into demat form. Obtain it, duly fill it and sign it. You should be able to find the DRF form at your demat provider website. [DDET Click here to see a Sample DRF form] [/DDET]

[/DDET]

b) Sign all the statement of Accounts from your Mutual Funds : You will have to collect the statements from all the AMC’s which have the mutual funds names which you want to convert, once you have them, you have to sign it. You will get all these statements in your email box most probably. This step is important to make sure you have documentary proof that you own those mutual funds and have their names, so if you have investments in 5 different AMCs, you should collect all 5 statements.

c) Submit and Acknowledgement: Submit the duly filled and signed DRF along with and Account Statement issued by the Mutual Fund House to the Depository Participant. Acknowledgement will be given by the Depository Participant for the document acceptance, subject to verification.[DDET Click Here to see all Important points before submitting a Dematerialization Request]

[/DDET]1. The investor should check with their Depository participants (DPs) for the dematerialization Request Form to convert mutual funds units held in physical form into demat form.

2. The details in the DRF, i.e. Name(s), holding pattern and signature should match with the details as appearing in the account statement.

3. The form is duly filled and signed by all unit holders as per the holding nature and is complete in all aspects.

4. All the schemes as available in a folio are mentioned in the DRF and the unit balances as specified are matching with the closing balances available in the folio. No partial units or selected schemes available in the folio will be accepted for conversion.

5. Units requested for dematerialization should be should be free from credit hold, lien or any other hold. In case any units are under hold for want of credit status, conversion will be processed only after clearance of such hold.

6. Dematerialization request should not be submitted if the units are lien or locked for any Income Tax or other legal purpose.

7. Rejection letter will be sent by the Depository Participants if the documents are not in order, units are under lock, or rejected by the Registrar during the conversion process providing reason thereof.

8. Investors can check with their Depository Participant on the status of the request if no intimation has been received within twenty-one days.

9. No separate confirmation letter will be sent by the Registrar for successful transfer of physical units in demat form.

10. Post dematerialization of units the investors can only transact through the stock exchange platform. They will have to approach their broker for purchase / redemption of units.

11. Physical requests received by the Registrar of DSP BlackRock Mutual Fund for purchase/redemption of units will be rejected.

Source : http://www.dspblackrock.com/services/dematerialisation.asp

d) Processing : The Depository Participant will process the application for conversion of physical units into electronic form. For this, the DP would sent the request form and Statement of Account to the Asset Management Company (AMC) / Registrar and Transfer Agent (RTA).

e) Confirmation : The AMC / RTA will after due verification, confirm the conversion request sent by your DP and credit the mutual fund units in your demat account.

Selling Mutual funds in Demat form

Note that converting the mutual funds will require you to have a demat account first, so incase you don’t have a demat account , you will not be able to convert them , because unless you have a demat account, how can it be stored . Now once you have converted the mutual funds in demat form , you can sell them through your demat account in stock market , which would attract brokerage as per defined by your Depository participant, however you can also sell your mutual funds through the normal old way where you put a request for sell through a Redemption Form .

Conclusion

This is one of those simple and small steps, towards simplifying your financial life. Once you do this, it can motivate you to take further steps in automating many things which will improve your financial life. Dematerialization of mutual funds will make sure your documentation will improve . Let me know if you plan to do this on comments section .. also lets discuss if anything is not covered in article . Has anyone done this already ?

Hi Manish,

I have an demat account and investing only in mutual funds. I feel I am paying yearly rental unnecessary hence want to close my demat account and transfer all existing mutual fund to offline ( just like paper form based).

Please suggest, if such options are available.

Thanks

Neetu

Hi Neetu

Yes,its very much possible . However the remat process is a bit lengthy and cumbersome. Why dont you sell off your units and then reinvest in non-demat style. Our team can help you with the overall process incase you want. Just let us know

Manish

dear sir ,

I think u hide things or not clear define the money absorb by the broker ….. from my view mf in the demate form will absorb some profit as brokerage charge … also demate charges by broker or sub broker .. and there is money control site oenc you enter n update your folio u can easily track your all funds in one place .. no need to give money to broker..

guys pls bewar n reserch first …

Thanks for your comment panthak

Please open a CAN account. IT is very useful.

https://www.mfuindia.com/CANBenefits

Hi Manish

Is it possible to move funds from one DMAT acct to other {say from ICICI Direct to FundsIndia} if I want to close relation with that DMAT? If yes then what is the process. Do I loose existing SIP then?

I think its possible , but the process would be too complicated !

Dear Team,

I have an demat account in icici direct since March 2012 but I am dealing with SIP mutual funds only currently I am investing 17000 INR per month through SIP. should i continue through ICICI direct or invest through Fundsindia ? please suggest.

regards,

ANy of them is fine !

Hi Manish,

Thanks for the excellent post. Just couple of queries.

I’d invested in SBI MFs some years back via CAMs. I’d forgotten about that and just now I got the account statements over mail after requesting for it. I want to transfer it to my ICICI Demat account so that I can track them better online.

1. So will the account statements as sent via email be sufficient to apply for Dematerialization ?

2. In the account statement, bank details provided is SBI. If I transfer it to my ICICI DP account, will the bank details also be updated ? That is if I were to redeem the units – will the amount go to my ICICI account linked to ICICI_Direct or the old SBI account ?

Please clarify.

You should check this with ICICI direct. They will happily help you on this 🙂

Hi,

Firstly thanks for the amazing content. My question is can I store in my demat (icicidirect) direct mutual funds bought through CAN ?

Yes, you can store it ..

Hi Manish,

Great article!

I have a small query. Kindly help me.

Can i buy Direct mutual funds through Demat accout? If yes than what about benefit i get from lower expense ratio? since i am buying through an online account. I read one of your other enlightening article about Direct plan. The benefits discussed in this article will still be applicable in this case?

Thanks alot for all your efforts.

No , you wont be able to buy that from demat . I am assuming you are talking about the demat accounts we have with ICICIDirect or Sharekhan etc

Hi Manish,

Thank you for your post. I have few questions

1. I have five MFs, do we need fill five DRF forms?

2. I am coverting these MF to ICICI dmat. Do I need to physically go there? Can I send all documents via post?

Please let me know your inputs.

I am not very sure on this . You need to check it with ICICI demat office itself

Recently I purchased MF from one agent, at that time I didn’t knew we can have that in our share trading portal as well, now i wish to get from his associate company to my existing trading portal, whats the procedure for that

Why dont you just sell it and repurchase from demat !

sir,

my father and mother was expired. but i know that he has TCS e-serve shares. folio number is 034884 and there is no demat account. As a legal hair i want materialize those shares . please let me know the complete procedure. how many shares he hold. what is the worth of shares. is there any guinion consultancy for take up shares

You need to check with TCS on this

I have UTIMF Opportunities fund -dividend payout, total 1615.3 units purchesed on my wife`s name and me, 1) VecireddyVeasantha 2) Vecireddy Rajareddy and we have Sharekhan demat account with names 1) Vecireddy Rajareddy 2) VecireddyVasantha. I sent this SOA copy along with filled request form in triplicate and filled and singed TRANSPOSITION FORM for demat to the sharekhan.com but they rejected it with remarks that ” the name of the holders on the SOA should be in the same sequence as in demat account”

Give your sugesion for demat my MF

regards

Rajareddy

Hi rajareddy

The proper reply can be obtained by the company only !

Hi,

I have purchased mutual fund via online through AMC website. This purchased as direct fund(NO Broker) ELSS. I have also given option during the purchase that to credit Unit into my DEMAT account. I have filled the client id and DP Id. But after 20 days it has not been credit in my Demat account(ICICI Direct).

Regards,

Pankaj

Hi Pankaj

This is mostly related to the demat account and you should follow up with the company itself .

Hi Pankaj,

Just wondering if you got those shared transferred to your demat account. This is interesting because ICICI direct does not allow us to buy any “Direct” funds. They only allow to buy “Regular” funds. Now you have bought directly a direct fund from the AMC and are trying to get it transferred to your demat account. ICICI direct will obviously not like this as if it goes through they will not be getting their commission. I wonder if it is similarly possible to sell your units directly through the AMC and by-passing ICICI’s trading platform. This is to save transaction charged. Please reply.

Thanks,

Melwyn

You can also have the DIrect plan view in the ICICI Direct. There is a section in ICICI direct, where you can request for view only purpose those funds which you bought out side of ICICI direct. You need to fill up a form and give to ICICI Direct !

hi

i have transferred my (demat) mutual funds to a new broker , which do not provide a facility to sell MF\’s.

How can I redeem the funds.Is there any other way.

Thanks in advance

You can redeem it from mutual funds office or CAMS office ,see this post – http://jagoinvestor.dev.diginnovators.site/2011/09/mutual-funds-redeemption-process.html

Hi Manish,

My father was holding mutual funds of different AMC’s in which my mother is the nominee. All the MF’s are in physical form. Now after his death what is the procedure for transferring all his MF’s into my mother’s demat account. My mother has a demat account with ICICDIRECT.com

Diwakar

You will have to show death certificate , fill up the claim form and do KYC of your mother ..

I was pondering if dematerialization of FMPs are allowed?

and if yes, would it be possible to liquify holdings in FMP through stock exchange route , are there enough volumes?

Yes FMP are mostly in demat form , because they are just another kind of MUTUAL FUNDs only !

I have approx. MF of 15 lac of different AMCs which I wish to dematerialise to my icici demat a/c.

What charges are involved for same and once demat done, what are the charges for selling through icici demat a/c. ?

What are the disadvantage of dematerialising mutual funds of different AMCs in one demat a/c. ?

Pl guide.

For what reason you want to dematerialise it in demat account. Right now anyways you can do online transactions if you want.. If they are bought by agent, anyways you can open an online account with respective AMC’s and sell them online, or you can consolidate all the funds with fundsindia at one place. Why pay demat account charges 🙂

Hi Manish,

I too hold ICICI direct demat account which holds all my MFs. Do you know if there is a charge from ICICI every time my SIP or SWP executes?

Due to my ignorance I bought lot of MFs through ICICI direct. I understand that i get the benefit of a consolidated view, but do you suggest that I remat them? I generally only buy through SIP and rarely redeem my MFs.

If I buy/sell directly from AMC or CAMS/Karvy is there any charge (apart from entry/exit load)?

Thanks,

Melwyn

ICICI charges per SIP charges of RS 25/30 .

Thank you very much. I was so confused regarding this.

I was keenly looking for such option so that I can use it as a Margin.

Thank you once again.

Thanks

While purchasing it from online platforms like fundsindia or moneysights…

Do we get an option to get it directly in demat form?

If no, then, whether one gets physical form of MFs or what?

Jeetu

It will be in demat form already ! … Dont worry on that aspect

Is it possible to transfer mutual funds from the Karvy DP Account to Angel Trading Account to sell them.

Why not , you can do that !

If you don’t have a demat account already then there is no point to open one just for the sake of converting your mutual funds into demat mode. Demat account is not free. When you open demat account you pay opening charges, when you transact you pay transaction and brokerage charges and you also pay annual maintenance charges. This is extra burden for one who just want to hold mutual funds. Now if you already have a demat account I see the following impact.

When you make a request to convert your mutual fund units into demat mode you are actual giving dematerialization request to your trading account provider. This is similar to conerting some old physical shares into demat mode mode. So you will pay the charges for the dematerialization request.

Both CDSL and NSDL will charge some transaction charges if you add or remove anything from your demat account. That means you will pay these charges everytime you buy mutual funds. If you have SIP then you will pay these charges every time you get new units added to your account. These charges also apply when you sell your units.

brokerage, STT, service tax will apply on anything that is traded in demat account. So if you buy/sell mutual funds using your trading account then you will have to pay these charges.

Generally people holds mutual funds for long term. If you want to close your demat account in future for some reason then you cannot do it unless you sell your mutual funds or convert them into another format. I know a lot of people who closed their demat account because they no longer want to stay on risky markets. Having mutual funds in demat mode will become a constraint if you don’t want to maintain your demat account.

If you have Wipro and TCS shares can you nominate your father for Wipro shares and brother for TCS shares? No, you cannot. That is what will happen for your mutual funds also. You can nominate different people for different mutual funds. You cannot do that once you convert mutual funds into demat mode.

The above may be true for your bank account as well. The bank account on the demat account will become the account for all mutual funds.

The only advantage of holding mutual funds in demat is that you can see them all at one place. If you have same email address on your mutual funds then there are alternative ways to achieve this. Also it is never wise to place all your investments at one place. By doing so you just make it easy for people like IT department, credit agencies etc.

This article is for information purpose .. who ever sees any value , they can take actions , else not !

Dear Manish,

I want to know that, if i purchase funds through demat account (share khan).

Is there any breakage charge (means first take charge by Broker and then fund house) .pls clear it.

thanks.

Girish

I dont think so , but ICICI has it , better ask the community at http://www.jagoinvestor.com/forum

This would be more usefull perticularly for people investing in SIPs. Also once your Mutual fund details are authenticated by your Demat firm, you can rest assured with your financial status for years.

Sensible move get them converted.

Nitin

No always … This is just for info , one has to take the decision depending on their condition

I have Mutual Fund in Sharekhan in “RTA” format and would like to transfer it to SMC Global Securities and close Sharekhan Account.

As per Sharekhan until the shares are in their account they wont be able to close it.

Sharekhan states, since MF is in RTA format, you cannot transfer the share and would have to convert the MF from Online to Offline,

which I don’t thing makes sense.

ShareKhan is unable to provide any good answers.

Avinash

This seems to be unfair practice . there is no reason why they should not be able to transfer it .. but I would recommend you to follow a more simple ting . just sell off all your mutual funds at sharekhan and then buy it again at SMC , are you getting too much profit and taxation issue is there ?

Also do one thing , tell Sharekhan to give what they are saying in writing and put a cc to SEBI email

Manish

Thanks a lot Manish for your quick reply.

Few of my MF are ELSS(locked for 3 yrs), and some of my MF attract exit load of 1%(purchased 10 months back).

Funny thing which ShareKhan stated is that I have all the MF are in RTA format and cannot be converted to DMAT.

Any new MF folio you will open will from now be in DMAT format.

They are really confusing me, and want me to change it to offline.

Could you shed some light on the following

1. Can we convert MF in RTA form to DP form. Any charges ?

2. Can we transfer MF in RTA form from one depository to another in case of account closure with First depository.

3. Is it really required to convert MF to DP form for transfer from one depository to another.

4. In case if I do not like to convert MF to DP form and close the depository account(i,e, directly will transact with AMC), is it necessary to convert MF from online to Offline ?

Answers to the above queries would be highly appreciated.

There is same info on whether you should HOLD MF in DMAT format, which might be also good to read for the investors.

http://www.moneycontrol.com/news/mf-experts/should-you-hold-mutual-fund-unitsdemat-form_538308.html

Avinash

I think you should open a thread on our forum now to get more experienced and better answers : jagoinvestor.com/forum

Hello Avinash,

I am also facing the same issue with Sharekhan. Cannot close account as the MFs are in RTA mode. Did you manage to do that, kindly help me with the process. My email is – gauravagrawaliist at gmail.com Waiting for your reply.

Sir,

At present I do online purchase and redemption. Is it possible to do that after getting them into demat form?

In case of Liquid funds daily dividend reinvestment, what will happen to demat a/c will there be an entry for each day in the demat a/c?

I have all the units in two or three holders name with either or option. In case of demat all the holders have to sign for purchase or sell of units, is that right? In that case it is more cumbersome to deliver the slips daily signed by all the holders.

Is it possible for you to guide us on how the pruchase and part redemption of Demat MF units takes place?

Thanks

Raju

Raju

Better ask it on our forum : http://jagoinvestor.dev.diginnovators.site/forum/

Hello all,

I have a SBI Magnum and a Sundaram Paribas MF.

I would like to consolidate them into my DMAT account ,as explained well in this article.

I have a question regarding this. Will my Mutual Fund agents will be still eligible for the Trail Commission if Im doing so?

In my case I purchased SBI MF from their MF head office and so I guess I don’t have an agent in that deal.Infact i remember them telling that they wont charge anything as agent commission since i bought it directly.

But in the case of Sundaram Paribas, I bought it in an ICICI bank and hence they are agents. Please correct me if I am wrong.

Sooraj

You dont have to worry about trail , because it is part of fund management charge and it is cut anyways , wheather you go by an agent or without agent , so dont worry on that .

Note that dematerialization of MF is just to convert them in Dmat , it does not mean anything else

Manish

Thanks Manish for a very quick response 🙂

But what about buying the mutual funds from their offices itself? Can we really avoid the initial commission..im planning to buy canera robeca MF directly from their office in bangalore, with an expectation that I can avoid agent commission.

Honestly when there are dedicated portals like Jagoinvestor available, I believe I dont want an agent for personal financial planning 🙂

Sooraj

You have to understand first that which commission are you trying to avoid ?

The first commission is paid by you from your pocket to agent , incase you feel he is doing a good job , like to an individual you pay Rs 100 for some work , or you pay ICICI direct Rs 30 for each SIP , thats something you have control on and you can avoid .

but the second kind of commission is trail commission which an agent gets from AMC , which is paid out of AMC charges ,which is cut from NAV , now if you go with an agent ,that agent will get the trail . if you go directly , the trail is with AMC , but for you it is cut always .

Manish

Hi Manish ,

I am about to start investing in Mutual Funds.Is it better to take a DMAT account first and then buy ?I want to take indiainfoline service for DMAT.

Can we take SIP also through DMAT?

Please suggest the best options and ways to invest.

Please suggest some good SIP plans to start.

Ravi

Its not madatory to open demat account for investing in mutual funds . You can do it through directly going to AMC’s and investing by filling up a form there, Also you can hire an agent for this . You can also use FundsIndia .

For some good funds to use : http://jagoinvestor.dev.diginnovators.site/2010/08/list-of-best-equity-diversified-mutual-funds-for-2010.html

Manish

Hi Manish ,

As it is easy to buy and sell MFs through DMAT(as per your article),

I would like to take DMAT first.I came to know that some DMAT accounts dont provide the option to buy all MFs through them. So Can you please suggest some good DMAT accounts for maintaining my MF portfolio?

Ravi

You can go with ICICI direct in that case .

Manish

My sister (since deceased) held units (with me as jointholder) in Principal Mutual Fund under A/c. Nos. 13625814 & 13625771. After her death, I wrote to the MF asking them to delete her name and to send me current account statements. Inspite of writing to them thrice and their promising to send me the statement, they have not done so. Please help me in getting these statement from Principal Mutual Fund.

Janki

Were you a nominee in their Mutual funds account, Its not that easy to just start getting the account statement because its not clear to company that you are the owner of the units, nominee does not mean owner . read http://jagoinvestor.dev.diginnovators.site/2010/10/will-your-nominee-get-the-money-on-your-death.html

Manish

I am the joint-holder of the units….not a nominee. I am merely asking the company to delete the name of the deceased and make the remaining joint-holders the owners. The company says that it has acceded to my request of deleting the name of the deceased…but does not send me hard copiy of the statement of account showing current holdings.

Janki

In that case you should complain to SEBI . Also make sure you go to the branch and complain to them Offline !

Manish

CAMS has started an active statement which consolidates all the MF companies they represent. Along with KARVY and FTML nearly all the major MF companies are covered. Later they plan to start online purchase and sale of units. All this does not incur brokerage.

Dinesh

Thanks for that information 🙂 .

Manish

The best way to track all MF investments is using CAMS or Karvy that provides service for all MFs (Excpet Franlin Templeton). You can have a consolidated view using email id. If you the same email id for all family members, then you can track the entire holdings here. Both of them provides option to cover all folios managed by CAMS and Karvy. You can track transactions, returns, capital gains, etc. The main advantage is you don’t have to key in anything.

https://www.camsonline.com/default1.html

https://www.karvymfs.com/platformservice/

Chidu

Thanks for the info 🙂

Manish

I have mutual funds thru HDFC ISA account (Investment Service Account). It has consolidated portfolio with online buy and sell options along with SIP facility.

Are they said to be in Demat form? I can sell or buy online, what difference it makes from Demat form?

Raj

Yes they are in demat form , just check the charges they are cutting for this service , i guess its Rs 100 every quarter

Manish

Hi,

I have some points against keeping transacting and storing MFs via Demat.

1. Transaction of MFs will attract brokerage charges. In case if you are going through broker you can have it done free. (Atleast in Bangalore, most brokers charge you only if you ask for consultation or advices. If you know which fund to invest, its free.)

2. Even if you don’t transact, you need to pay your Annual Maintenance Charges, which is around 600-1000 rupees.

Alternate options are:

For centralization : You can use online fund stores like fundsindia or fundsupermart.

For consolidated view: you can use portfolio viewers like value research or moneycontrol or rediff moneywiz

Thanks and Regards,

Shinoj Jose

Nice points 🙂

Manish

manish,

please clarify these-

1.concept of trail commission in conversion – this concept of converting physical mutual funds investment to a demat form is gaining push as the demat players get some traill commission,. is it a thing here? if yes who pays for that.

2. I invest my tax saving in SBI mag tax gain and Hdfc tax saver in 2009, in physical form. Can I convert them too and is it needed?

3. If suppose I intend to encash them in physical form a few years later say, would it be feasible? WIll my pancard me good enough to check their databases for records and redemption?

Smiles

Aditya

Aditya

1) Trail commission is always paid by AMC only

2) yes you can convert them , demat converting is not necessary , its just one option you have .

3) yes, if you dont want to convert in demat form , thats fine .. you can always encash it using a redemption form . Even PAN is not required, you just need to have your folio number .

Manish

I really like the service provided in city like Mumbai by Bluechip Investments. You call them over phone. Their boys come to your home and pick up the orders and deliver it the next day to the Fund house. Traditional way but keep some youngsters employed with little commission they get from Fund Houses and they deserve it.

Sundar

Good to hear that 🙂 … do they have branches in all cities ?

Manish

Manish,

I too have been dealing with Blue-chip for several years and enjoyed their services but i prefer online these days. They have offices in leading cities.

Rakesh

Rakesh

ok thanks for info

Manish

Dear Sir,

I have invested in SBI MF through their website and in UTI MF through agent.

I have equity trading and dmat account with SBI.

How to convert my units into dmat form?

Will it be reflected in my dmat statement with SBI?

How to escape the brokerage charges after converting into dmat? I mean, how to apply for redemption (as in the present method)? Is rematerialisation required for this?

Regards,

sriram.m

Sriram

There is no charges for converting the mutual funds into demat form , but when you redeem it through stock exchange ,there would be brokerage , therefore you should redeem it through normal way of giving redemption form to your DP

Manish

I do transaction through Fundsindia. All the units are stored in my account and it is equally easy to handle. For demat account a certain fees has to be paid, while Fundsindia is free (at least for the time being). Opening account and making investement is very easy no broker service required and units are in demat form (we can say that). I am still not clear about the demat advantage.

SS

yea agreed , if its fundsindia, you are in good condition 🙂 .

Manish

why isnt anyone speaking about the demat fees? it will depend on the value of securities..right? so if i have a large corpus,i’ll be unnecessarily paying demat holding charges to the DP.

another problem others have touched upon is brokerage charges.in either case,trail commisions for other buyers will keep getting cut from the NAV.

i really dont see many advantages of demat -given the costs

Pravin

I was not aware of demat holding charges , so if I have 1 lac worth of securities and worth 10 crores , will i pay very different kind of money in both cases ?

If its yes , then it might not make sense to keep it in demat account

Manish

Dear Manish,

I think only ETF’s can be sold through NSE.

If you buy MF’s through Iciicidirect or any other channel partner then you can only sell through them only. You cannot sell them directly with the MF house.

I think here DEMAT means not the DEMAT a/c of our shares. Only dematerialization with the channel partner like Icicidirect.

Can you buy any ELSS schemes through stock exchange?. Pls. clarify.

Pls consider the following point of your post while answering my question. Is this meant for ETF or for all MF schemes?

3. Fast transactions : : If you have all the mutual funds in demat form, you will be able to sell those mutual funds in stock markets whenever you need money. Mutual funds are now, tradable in stock markets, so you can buy and sell them in stock exchange in real-time. If you don’t have them in demat form, selling them would not be as convenient.

Vijay

Note that Demat account is a place where you can store things online in dematerialized from , what you can store depends on what NSDL and CSDL allow , they allowed shares , bonds etc earliar and now they have allowed Mutual funds .

Do demat account does not mean only shares , it means anything which NSDL and CSDL allows

Manish

Hi Manish

Thanks very much for brining this topic.

Can you please provide me details on If I have a Demat account with one Depository Participant and I want to make a switch to another Depositor Participant. What are the charges I have to pay . and what all the things I have to keep in mind in making that switch.

Manu

I am not aware of any “switch” like that , you have to stop one and open another

Manish

Hi Manish,

Currenlty I am investing in 6 MF. All 6 mf are opned with help of a Finanical advicer who is working in a finalicial management company where i am one of the customer. Now I am planning to close my relationship with that company as Customer. I thought to re-deem all my units and close the account of all MF. After seeing this article, i think to do transfer-in to my demat account. In the MF statement, the company name is displaying as Broker, and my name is stated as Owner. Does it mean i am the sole owner and i will able to do transfer-in myself using ICICIdirect demat account(i am having a demat a/c in iccidirect). Or do i need any confiremation/signature from the company(broker). Currently i am investing in all mf via montly SIP. Please suggest.

Regards,

Parasuraman

Parasuram

You should be able to redeem it yourself ,the role of broker is only to get the trail commission every year . Incase you want to cut your hassles short , the best thing would be to sell off the mutual funds (provided you do not have exit load) and then buy it again through your demat directly . (Note that this option is from convinience point)

Manish

Again a nice article Manish..

I have lost my one mf document and the problem for me is its being serviced by karvy.

Camsonline allows you to directly deal with their site.But only trouble i see their is though written switch and redeem you need to forward a print copy of same to their investor service cell for action to be completed.

I hope this demat stuff takes care of all this silly troubles.

Sohil

Yes , demat thing should take care of that.

Manish

Did you know?

Your Mutual Fund units are held electronically and you are not required to keep safe custody of any certificates / statements. It not only provides the facilities and benefits if held in demat form, but MUCH MORE. You can transact at any RTA Service Center, AMC branch or through your advisor at any location or even online. No restrictions of having to deal with one DP or TM for your transactions.

That’s’ not all. There are no separate charges for opening MF accounts, annual maintenance, transaction, duplicate statements, setting a lien or POA registration.

https://www.camsonline.com/diduknow.html

Babu

While thats true for mutual funds investments , dematerialization will help you monitor them at one place and less documentatin , incase thats some thing which excites as person , he can go for it , else not

Manish

FAQ from ICICI site

How do I convert my existing portfolio units to icicidirect’s portfolio?

You can transfer in your existing mutual fund units to your ICICIdirect account by filling a Transfer-in request form which is available on the site. However this facility of Transfer-in can be availed only if you’re a sole holder in the physical units else your request cannot be processed. Transfer In request can be placed through the “Transfer In” link on the Mutual Fund page. Fill in the existing folio number alloted for that scheme. Thereafter you need to take a printout of the duly filled form and forward it to ICICIdirect.

That looks like a different thing .. See my comment above

Manish

Hi Manish,

I think the information in this article is incorrect.

The form attached DRF is used only for shares.

You need to fill in a Transfer in request for getting MF converted to online form. Note this wont be held in your DEMAT account,but just an online way of managing your mutual funds.See the information below from ICICI website regarding transfer in.

http://content.icicidirect.com/mutualfund/mfhelp.htm#q55

———————————–

How do I convert my existing portfolio units to icicidirect’s portfolio?

You can transfer in your existing mutual fund units to your ICICIdirect account by filling a Transfer-in request form which is available on the site. However this facility of Transfer-in can be availed only if you’re a sole holder in the physical units else your request cannot be processed. Transfer In request can be placed through the “Transfer In” link on the Mutual Fund page. Fill in the existing folio number alloted for that scheme. Thereafter you need to take a printout of the duly filled form and forward it to ICICIdirect. In case of transfer-in of dividend schemes, the dividend re-investment option will by default be activated and will appear as “Y”. In case the dividend re-investment option as per your records is dividend pay-out “N”, to change the dividend re-investment option you can use the modify dividend re-investment hyperlink. The units are converted to electronic form within 30 days. You can check the status of your request the TI Book link. Once the units are converted into electronic form, the same will be updated in the Unit Holdings link.

————————————————————-

Thanks

Manish

No , see this statement from NSDL

“NSDL has enabled holding of mutual fund units [represented by Statement of Account] in dematerialised form for its demat account holders. You can use your existing demat accounts for converting your mutual fund units in dematerialised form.”

Also you can see the video given above , regarding the DRF form , I accept it might be only for shares , i got it from an ICICI related website , so may be i made a mistake there , but the article holds true 🙂 ..

Do you still have anything which shows that this information is incorrect ?

Manish

i will not prefer mf in demate form:

presently we all 4 family members have mf folios. for getting yhem i need 4 demate a/cs and 4 trading a/cs , instead of present one demate with trading a/c , which is sufficient .more demate a/c and trading a/c mean more recurring expenses, even you don’t trade.

buy/sale through demate a/c invoves brokerage , i.e. one new load!

in sense, it is not sale, but redemption thrugh the concerned amc at tha particular day’s nav and the money would be credited , as being done now for direct to bank a/c with neft. i can’t buy other amc’s mf scheme or some equity share against sale through demate on the same day.

i think, the platform like mutualfundindia.com is rather better, provided you have accounts in its designated bank. otherwise you need to transfer money first to their account for additional fund/share buy,so not seamless direct dealing to the concerned.

Bharat

It might not work for your situation in which case you should avoid this way of dematerialization .

Manish

I too believe this wouldn’t be so beneficial as you mention. Any wise investor will certainly have a track of his portfolio through different mediums.

Also the point is not clear on the exit load. Will it be a combination of exit load & brokerage or just brokerage? Does fast transaction mean the redeemed amount would be available at the same minute??

Though I am not registered at fundsindia, I feel that fundsindia is a better option because:- A] We can also consolidate our FD’s & NPS too in the same account.

B] Brokerage does not come in the picture.

C] Can manage family members investments too under one ID.

D] Few Fund houses aren’t there, but seems that they are increasing.

The plus point against fundsindia may be that the Broker would be in your own city, incase you need moe support & advice.

@prasanna

one more point against mutualfundsindia.com is that they have not tied up with sbi, the biggest indian bank network. so if you have account in sbi, for new fund insetion, first you have to transfer to their account in icici bank, and then it will go the concerned investment avenue. so not seamless transaction. it may increase the lag between your transfer and actual transaction.

@prasanna,

sorry for my lack of knowledge. does mutualfundsindia allows buying online like other MF platforms?? I went to their site now but couldn’t figure out if they allow buying as you mentioned.

Santosh/Bharat

I guess its fundsIndia and not mutualfundsindia.com 🙂 . am I right or just like Santosh even I am confused 🙂

Manish

@prasanna and@ manish chauhan,

sorry , i am talking @ fundsindia.com for which advt. is at the top. regarding sale/buy , it is same as you are doing with the particular direct amc online, but the order is to be placed earlier than direct, i remember , before 2 p.m. instead of 3 p.m.

Prassana

Brokerage and exit loads are seperate things .. exit loads depend on when you sell your MF and brokerage will depend on your DP charges, its your wish if you can save exit load .

However, FundsIndia is good

Manish

I have started using FundsIndia for online mutual fund investment & tracking as well. This has a setup to track all MFs in one place & they dont charge any unlike other DEMAT account holding services.

How different is this?

Shiva

FundsIndia is a good platform , Nothing new in this

Manish

Mutual funds need not be in demat form. A demat account has an annual maintenance fee of roughly Rs. 500. Demat providers also charge for mutual fund transactions on percentage basis. Hence it is foolish to go for demat account only to enjoy online facility when such a facility is provided free of cost by FundsIndia and others. NSDL is trying to lure people into the trap by giving this option so that brokers can earn money at the cost of investors. Do not fall into this trap.

Not advisable to convert to Demat form for now. Firstly Most brokers are not ready for the same (I checked with my broker) despite making announcements. Secondly trading of MFs in NSE has not picked up. Hence at present the best bet is online transaction facility offered by individual MFs.

Sundar

Which is your DP ? As of now only NSDL has started this , so if your DP deals with CSDL , it might happen that they will not offer it .

Also the trading in MF is low , but should be atleast upto a level where you can sell it off and get money , may be the spread is little wider than expected .

Manish

You are right. I have CSDL. I know that NSDL has started this. Spread in trading also presently not favorable and volumes are very low. We will have to wait till it catches up. I presently prefer online options because there you are sell, switch and buy (with some bank accounts).

Sundar

Ok , thats is a FYI , not a suggestion , do it if it appeals to you

Manish

Just for your information: From yesterday CSDL has also started admitting MF units in Demat form.

Sundar

Great , so now even CSDL offers it ..

Manish

Is there any benefit if one is already transacting thru ICICIDirect or any online platform of a broker??

Santosh

you query is not clear , this article is helpful for people who have bought directly through agents or online websites , they can now convert it to demat account to centralize it . Not sure about what you are asking

Manish

Hi Manish,

I was wondering what value dematerialization would bring to someone who has already been transacting thru ICICIDirect or similar service where are funds are available on single interface.

U answered my question 🙂

Once converted to DEMAT form, will it be possible to online redeem or switch MF units from the respecive MFs online transaction websites ? If not, then this switch to DEMAT form shall be useful only if you have an online trading account too. Else continuing with the respective AMC websites will have to be resorted to . Am I correct?

Hemant

Yes, you will be able to sell it online , however I am not sure about the switch part ? Which switching are you talking about ?

Manish

One important question here. After conversion to demat form, can we get facility of switching of one fund to another or STP or SWP?

Thanks

Gopal

That would depend on DP if they provide that facility or not , like in ICICI Direct or FundsIndia you can do tht

Manish

Hi Manish,

Nice info. I’ve all my funds in FundsIndia.com. So, are these funds in demat form with fundsindia participatory agent? Or should I ask them to do it now?

Jayaprakash

I think they are not in Demat form . Let me clear it with Srikanth ?

Manish

Hi Manish,

Kindly through some light on this question. I am also confused in this case. Do fundsindia.com store mutual funds in demat form or do i need to have a demat account separately?

Tarun

Tarun

http://jagoinvestor.dev.diginnovators.site/2010/04/interview-with-fundsindia-com-podcast.html#comment-16156

How useful is it?