Floating Rate Mutual Funds – How, When and Why?

POSTED BY ON March 4, 2010 COMMENTS (108)

Let us say you have 1 Lac rupees and you want to invest for the term of 1 to 1.5 years that can earn a decent interest rate. You thought of investing in fixed deposit in a bank for 1.5 year @ 6% per annum. Just after one month, bank increased it’s FD interest rate by 0.5% and again after 6 months interest rate is increased by 1%. But you cannot avail this benefit since your FD carries fixed interest till 1.5 years. Is there any investment instrument that could work to handle this situation? Of course YES, Mutual fund industry does offer floating rate debt mutual funds to invest in.

Basic Definitions you should know

- Coupon rate: The stated interest rate on a bond or other debt security when it’s issued.

- Benchmark rate: A rate used as a yardstick for measuring or setting other interest rates.

- Expense ratio: A measure of what it costs an investment company to operate a mutual fund.

What are Floating Rate Mutual funds?

These are the Debt mutual funds which invests about 75% to 100% in securities which pay a floating rate interest (bank loans, bonds and other debt securities) while the rest is in fixed income securities. See List of best Debt Oriented Mutual funds

There are two kinds of floating rate funds– long term and short term. The portfolio of the short-term fund plan is normally skewed towards short-term maturities with higher liquidity and the portfolio of the long-term plan is skewed towards longer-term maturities. However, even the longer-term funds are positioned more on the lines of short-term funds and are not very aggressive in nature.

Floating Rate securities vs Traditional bonds

As you may know, that most bonds have fixed interest rates which are set when they are first issued, either by a government or a corporation. That rate of interest doesn’t change for the life of the bond. A floating rate security on the other hand, has a variable interest rate. That means it’s interest rate will go up and down, or “float” to reflect changes in current market rates.

Depending on the particular floating rate security, the interest rate may change daily, monthly, quarterly, annually, or at another specified interval. The rate is generally changed to keep it in line with a particular interest rate benchmark, which is often called the “Reference Rate.” Among the benchmarks used to set the interest rate on floating rate securities are the MIBOR (Mumbai Interbank Offered Rate). Hence, each time the benchmark rate fluctuates; the coupon rate is adjusted accordingly.

Note

The MIBOR rate is the weighted average of call money business transactions done by 29 institutions, including banks, primary dealers and financial institutions. This rate is calculated and disclosed by FIMMDA-NSE. [ Ignore If you dont understand ]

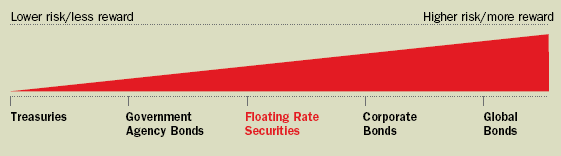

Credit Quality and Risk/Return spectrum

Credit quality is the measurement of a bond issuer’s ability to repay the debt it undertakes. Investment into AAA and equivalent rated instruments, call money market and government securities are the safest and most liquid instruments, while below AAA and equivalent rated instruments reflect downgraded quality and lower liquidity. However, their lower quality results in better returns, albeit at a higher risk.

Example analysis

Let us compare the floating rate, fixed rate debt fund and liquid funds over the years to understand the performance.

| HDFC Floating rate Income fund long term plan (G) | HDFC Floating rate Income fund Short term (G) | HDFC High interest (G) | HDFC Liquid fund (G) | |

| Category | Debt: Floating Rate Long-term | Debt: Floating rate short term | Debt: Medium-term | Debt: Ultra Short-term |

| 1 month | 0.35 | 0.35 | -0.65 | 0.3 |

| 3 month | 1.20 | 1.06 | -0.4 | 0.95 |

| 1 year | 7.68 | 5.0 | 5.53 | 4.68 |

| 3 year | 8.58 | — | 8.2 | 7.17 |

| 5 year | 7.48 | — | 5.98 | 6.77 |

| Expense ratio | 0.25 | 0.75 | 2.25 | 0.5 |

| Exit load | 3% within 18 months | Nil | 0.5% within 6 months | Nil |

Why, When & How

Why to opt for floating rate funds

- The primary advantage of these funds is that, they are less volatile than other types of debt funds. In case of fixed rate bonds, when interest rates in the economy change, the price of the bond adjusts to make up for the fixed coupon of the bond.

- Looking at the performance table over different time frames, floating rate funds have delivered outstanding performance over the years and more importantly, with considerable consistency.

- A look at the performance table also reveals a better consistency in delivering higher returns when compared to other type of funds.

- Credit quality of floating rate funds’ category is more or less similar to liquid funds and ultra short-term funds. Average maturity does not play a very important role in case of floating rate funds as they invest in instruments, that have a variable coupon rate.

When to opt for floating rate funds

- Floating rate funds make better choice when interest rates are set to rise.

- Floating rate fund can be considered to establish emergency fund. In the above case of HDFC Floating rate Income Long term plan (G), one can slowly build up emergency fund and once 18 months are over, you can redeem any time.

- If investment period is 1 to 2 years and liquidity is a concern, then one can look at floating rate funds over fixed rate debt funds. Now banks are coming up with recurring deposits with quarterly revision of floating rates. Always look for alternatives as per your investment period, returns, risk and liquidity.

How to select floating rate funds

- Long term floating rate funds are better than short term considering performance, less expense ratio.

- Select a fund which has proved its performance over a period. (This shows the effectiveness of the fund house in mobilizing the assets under management).

- Select the fund which invests significant % of asset in companies/securities with highest credit rating.

- Select the fund with low expense ratio.

Floating rate funds in India

The primary reason for their lack luster presence in the mutual fund industry has been investor ignorance of the nature of floating rate funds. There is a shortage of sufficient long-term floating rate instruments. Due to this, fund managers divert certain portion towards fixed interest securities. In the present situation of Indian economy money market and higher inflation situation, interest rates are set to rise in near future. Always consider floating rate funds over liquid/ultra short term/debt funds.

List of Top Floating Rate Mutual Fund

Long Term

Short Term

This is a guest post from Srinivas Girigowda who is one of the best contributors on this blog :), Kudos to him. Check out his finance blog Here

My husband has 2 LIC Money back policies taken in 1993 (93-25) and 1997 (108-25) for 25 yrs and SA of 1 Lac each. Maturity is in 2018 and 2022 respectively. My suggestion to him was that we encash these two policies and divert them into Balanced or Debt oriented funds. what do you recommend?

Yes, I recommend that , the other option is to make them paid up and not put more money in that !

One of the good articles I have ever come across about Floating Rate Fund. I have checked the history of both HDFC and Birla FRF and the author’s recommendations are factual. Thanks for posting this detailed article about FRF.

Glad to know you liked it . keep coming !

want to invest for a short term, say for 2-3 months, i have searched than found jm mutual fund money manager super fund its an ultra short term fund… Is it a good choice.. pls suggest???

Rohan

How much money ? If its small sum , then its not worth the hassle . Only complicate it if you are looking for investing 10 lacs or more . else put in FD or a liquid fund

Manish

Manish,

Which type of short term fixed deposit do you think is best ?

I thought of an option where each month you invest some 50,000 amount in a FD for 3 months(monthly payout) so that at the end of 3 months, from the 4th month onwards you invest 50000 and get in return (50000+3 month interest) effectively investing nothing from the 4th month onwards. However, at any point of time you maintain 150000 amount in that bank.

This, i observed is earning better returns than the recurring deposit totaling 150000(12500 each month) in that year but less than a single cumulative FD of 150000 for that year.

The dilemma i am having is that the first option of monthly payout is earning a decent total return but after all i am getting the return in small chunks and not in one big amount. In a cumulative FD, i have to shell out 1.5 lacs in one shot which is a big deal in general.

what do you think ? which option do you suggest ?

Thanks,

Shantharam

Shantharam

How are you calculating returns on both the cases ? I dont think the first option is better .

Manish

Dear Manish/Srinivas,

I wish to invest Rs. 3 lacs for one yr (into safe avenues) and was contemplating your points reg FRF/FRF+STP. But HDFC FRF- long term charges 3% exit load for redemptions/STP within 18 months. Is it then worthwhile to invest in it considering my investment horizon of 1 yr. where else then should I park my money? Please advice.

Rashmi

Rashmi

If you are not looking for great returns and just safety , then do it in FD only , else Liquid funds are good option .

Manish

Fixed deposit is better in your case.

hi manish

i feel that chit business(must be highly trusted one) gives more return s than mfs.chits always gave me atleast 18% cosistently(1.50interest) .i have been in chit group and consistently earned 18%and sometimes24%(re2.00 interst).of course chit doesnot has compounding effect.what do u think so.

I am using them for past 5 months now, extremely convenient

Adding one more thing on my previous response

Complete process is almost online & NRI’s can also open account & start buying & selling MF.

Hi Manish,Srnivas,Hemant & all

I came to know about one website through which we can sell & buy MF free of charge.

No charge needs to be paid by investor .0.5% will be charged from Fund house annually

by FundSIndia.

Can u suggest & give ur opinion shd we go for this option & Is there anyone who

is already having an account with FundsIndia.

Plz go through below link for all information

I think a seperate can be written on this.

Regards

Yogesh

Yogesh

Have a look at the Interview of Srikanth , who is Director of FundsIndia . I dont know anyone personally who has the account there .

Manish

I have been using FundsIndia web site for my mutual fund investment since last 7 months and have found it quite useful and user-friendly. I have also set up SIP for couple of funds. The process is very transparent. The investors get the emails and SMS alerts for all the transactions. The same can be verified by the electronic or paper statements sent by the fund house(s) or the Transfer & Registrar agents (CAMS or Karvy).

Kindly feel free to contact me if you have any queries.

Thanks,

Rajesh

To Author,

Why do you say it is better to invest only if “Interest rate is expected to rise”

Is last 5 year, top 3/4 Floating rate MF, return is 8+%, I think is last 5 year we have seen Low interest rate –>high (2007end 2008 begin)—> low (2009) —> Expected to rise in 2010 .. Enough volatility wrt Interest Rate.. Still return seems to constant … (over 5 yr period) …

So why does you think “Wise to invest only if Int. Rate is expected to rise” .. ?

Due to the inverse relationship of bond yields and prices, when the yields decrease, the price goes up. During falling interest Rates, a Income Fund will outperform Floating Rate Funds.

However, all this depends on the risk profile and whats the expected return to achieve the goals. If that kind of return is sufficient then there is nothing wrong with floating rate funds.

Regards,

Abhishek

Regards,

Abhishek Gupta

Hi Manish,

For a 6 month plus kind of horizon and seeing the volatility in the debt markets, Short Term Debt Funds would be a better choice than a floating rate funds.

Also, there are not many floaters available in the market, hence liquid plus funds would be an obvious choice give a similar kind of return for 1 -3 months horizon.

Regards,

Abhishek

hi Srinivas/Manish,

If some one has already reached 80C limit then no need to invest in ELSS funds.

So what shd be protofolio in that case

4 Euity Diversified funds,1 balanced & 1 debt

or

2 Euity Diversified , 2 balanced & 2 debts.

if 80C is reached with PF and House loan interest/principal, then one can plan other investment with his risk appetite and goal.

It is okay to have 2 Equity diversified, 1 balanced.

no need of debt fund, you can target debt fund as you near your goal and you need to exit the market…it is 3 years before the goal

Hi Srinivas,

thanks for information.

Just curious to know,How u hve insides of bank?Are u working with banks?

Hmm….This is also part of Direct Tax Code.

🙂 I am not working with banks.

hi srinivas,

thanks for information

just curious to know, how u know insides of bank?R u also working with banks?

Hi Srinivas,

Next year onwards, Will bank going to deduct TDS even if interest earn in single year is less than 10K.??

Regards

Yogesh

10k limit still there. but no form submission. the moment 10k is reached tax is deducted. So you will be forced to keep FD in different branch.

Govt is planning to centralize all banks branch as early as possible also…so that people cannot keep FD in different branch and escape from tax.

Nice article.

Probably adding below complete information (taken from value reasearch) to article would be good:

1. Entry Load: 1%

2. Exit Load:

a. Exit load of 0.50% if redeemed within 6 months for investment upto Rs. 10 lakhs and

b. for greater investments 3% if redeemed within 18 months.

I think most of the readers will fall in ( < 10 lakh) category and so will fall in 0.5% category and also its 6 months for that category.

But maybe it needs to verified since this was update from April 2009.

-Praveen

Hi Srinivas,

We have to use all the opportunities .its very true .Then both FR & FD fits.

Moving from developing to developed nation FD will definately cme down.

And one more thing i have notice if bank system or any organization are in crisis situation then also can get good returns.Like Tata few times back it was giving 12.xx% interest on FD.

Hi Manish,

Do you think it is better to put money into FMP or Mutual Fund, if you plan to use the amount after an year. Since it is March time and on FMP u can get double indexation benefit, as well as I think currently stock market is bloated enough that there should be a consolidation in coming months, I am feeling putting money in FMP might be a safer bet with still decent returns. Will you agree?

hey manish..

would like to hear from you on how direct equity investment compares with mutual funds (provided we have nice tips on equity coming frm u)…nd do tell me if u invst thru mutual funds or direct equity..

Ratnmani

I invest through mutual funds , not direct equity , the reason is that I am an impatient person with markets , so I am more of a trader kind of person . So I can not give investment calls , however long term investing does not require frequent calls . its very boring and less action job 🙂

Direct investing is more tough , because then you are becoming a fund manager of your own , it requires more of knowledge, research and time to manage things , with mutual funds you are delegating every decision and paying Fund management charges in mutual fund for the service .

So for a general investor , Mutual funds are the way to go 🙂

Manish

Manish,

That is really honest and good reply. If you watch all the business channels and hear the so called “top of the world intelligent” analysts. One thing that bothers me is that after recommending the stocks and ideas and chewing them and advocating them for full 30 minutes when asked for disclosure. 99.99% replies are ” I do not have any holding in the stocks we have discussed” Now they appear daily on TV (Thanks to the crowd of Business channels) & almost discuss all the stocks & still holds nothing. I wonder then what the hell they buy or they simply dont buy anything but preach everyone to buy everything. Just observe this and other standard disclaimers in MF and Insurance etc. and that can also be a topic for another post someday.

One more thought. We believe proffessionals can manage money better (Fund Managers). A firm hires best of the people from around the world. Toppers of IIMs, Whartons and Harvards of the world were working for it. It manages billions of dollars and when the market crashes !!!!! (oops I cant add background music) . When it came to wealth distruction, Normal lay investor Haribhai, Pramod or Manish did not go broke but the Oscar goes to LEHMAN BROTHERS, CITI BANK, BEAR STERN, MERRIL LYNCH and………………!!! How and Why should we trust the theory that prfessional can manage money better .( One more topic for you & No need to say thanks 🙂 after all we are committed to make this a better place.) Keep it up.

Pramod

Two points

1) regarding disclosers 🙂 . yes u are correct . these analysts make money by recommending things , they work for brokerage firms so what even the season is they give BUY calls , first it brings revenue to brokerage firm , the other thing is that trading is probabilistic, so just buying and selling can be destructive , you need to have descipline to follow your rules in market .

2) Fund manager performance : there are good FM too 🙂 , but when companies like Lehman try to be over smart and get into unneccesary risk like they did , its certain that they will fall apart some day .

Manish

hi manish..

gud work…i really like ur lucid explanation of such complex concepts..if u cud elaborate on that stp concept that u were discussing with sathya..i cud nt get that..

Ratnmani

STP is systematic transfer plan , its kind of sister concept of SIP , in SIP you invest some amount per month in some fund , however in STP the amount is invested in the same way per month , but the difference is that the money will not come from your pocket , but it will come from some other fund . So generally if you have big amount like say 3 lacs and you want to invest in equity , its not advisable to put all your money at one time in equity , better do SIP , but if you have all your money with you and keep investing small chunk every month , the rest of the money will not earn anything , so what we can do is that we can invest all 3 lacs in a debt fund so that it starts earning some return and also start a STP of say 10k per month in some equity fund , this way you also so SIP + earn safe return on rest of the money .

Got it ?

Manish

hi srinivas,

In FD calculation, in Point 2 calculate interest using 6.5 & not by 6%.If u have calculated using 6.5 %then its ok.

I won’t break FD if it increase only by .5%.If there is good margin then only will break.

One plus year back I have done few FDs with 11%..Suppose it was FR then today

I would have come back to 6%..This difference of 5%is much.This is -ve point in FR.

I am still enjoying 11% but actual is 6% or 6.5%.

I am telling this becuase interest rate won’t remain at high for more period but

I do agree with ur analysis & in actual its matter of timings.

I calculated using 6% , because during interest revision, banks may not increase for all term period. though if I consider 6.5% still it is less than FR.

Yes good margin is fine but if bank increases interest by 0.5% every month and penalty of 0.5% then…..you cannot do anything.

I too kept FD 1+ year back for 11%, we have to use all the opportunities. this FD funds can be considered for short term 1 to 2 years in a better way than FD.

If today, interest rate goes high 11%, (FR funds return also high for that year) but over a year, it decreases. I too prefer FD in this case.

In a transition to developing to developed nation, interest rates always decreases over 10+ years. 25 years down the line you can see FD interest rate to 3.5% per year. Nothing surprise…:)

Manish and co.

Just one basic question how FR MF is different form SBI RD and Term deposits, they also give online facility to invest!

Not sure if it follows floating concept! can you throw some light on this.

Cheers

Marshal

Hi Manish&Srinivas & all,

Thanks for ur comemnts..

Suppose insetad of FR we take FD only..Once interest has increased break the FD & again

renew with new rates with same amt(original + interest earned amt) would be better compare to FR.As in FR we can enjoy high interest for short period only.And if we break & renew FD then can enjoy high interest rate

for long time.

Whats ur views?

Yogesh

There are some points here

– How much will you monitor interest rates and how much will you break FD , how many times , i can relate this as interest rate trading where you are trying to time the interest rates .

– from taxation point , FR can be better than FD , short term does not always mean less than a year , it can be 2 yrs also

– what about the less interest rate which you get when you break the FD, what are the penalty for that ?

Manish

@Yogesh,

Thanks for the question. One more thing, I want to make it clear, we are not promoting any funds(don’t feel we are talking in favor of FR funds), I am just evaluating the investment products to suit the individual needs to save every single paisa.

Let me answer your question:

You have 1L now and thinking where to invest. Assume both FR and FD for 1 year are giving 6.5% interest rate.

You decided to keep FD for 1 year and done.

after 3 months, bank increased interest rate by 0.5% (Assume there is no penalty on premature withdrawal ( POINT 1))

Do you know how bank calculate your interest now, it is on interest rate for 3 months at the time of investment, for 3 months interest rate was 3.75%.

you received 1,00,924/- and now to earn more interest you have to keep for 1 year which is 1.3 year in total or keep it for 9 months (POINT 2).

let’s keep for 9 months only, @ 6%. after 1 year you will get 105466/- (i.e., 5466 rupees more)

but that is not the case with FR funds, you still get 6% for 3 months and when interest rate increase you returns also increase, Long term FR funds invest in bonds which matures in 150-180 days (or little more).

in FR case 6% for 3 months and 6.5% for 9 months

which is 1478 + 4882 = 6360/-……..which is more than FD option.

Negative points with FD in this case is :

1. To avoid TDS you cannot keep more than 1.5L in one branch, you save tax if you to run around many branches.

2. If there is a penalty of 0.5% then again more loss in FD option

3. breaking FD and again keeping in daily life schedule….How easy to do for no profit?

I hope, I have mathematically answered and convinced you.

Let me know your thoughts 🙂

How do you derive that you can’t keep 1.5 L in FD to save TDS ?? as per my info 5k is annual interest limit…. Now if you sumit appropriate form TDS will be saved/not deducted

1.5 is just a rough figure. It depends on the bank interest rate for 1 year. The limit to deduct TDS is 10k interest per financial year.

yes. you can submit form 15G/H, but if case you come under tax slab and still submit the form; bank may accept it but IT dept can scrutinize your record from PAN number and send you a letter to pay the tax.

Govt is removing form submission from next year, banks will by default deduct the TDS and you have to claim later and get it back providing sufficient documents.

@yogesh,

As far as I know, Demat you cannot open online.

FR funds are preferred for short term that too when interest rates are set to rise. ULIP is combination of investment & insurance. ULIPs are for long term (10+ years) and to an intelligent investor.

when there are better alternatives to ULIP, why to go for ULIP.

@Manish and all ‘Jago’ readers,

Below is some good stuff for reading…..anyway you have to come back to ‘Jago’ for better understanding and simplicity!

A) Websites

http://www.moneycontrol.com (Read Chat transcripts, follow Mutual Fund Block deals, FII Interviews, Broker Research reports)

http://www.sptulsian.com (Read the result analysis and industry news)

http://www.capitalmarket.com (It analyses stock price movements with stock specific news)

http://www.valueresearchonline.com/toprated.asp (this link provides top rated mutual funds. This website is widely followed for researching Mutual Funds)

http://www.personalfn.com/investment/ms/archives.asp (This link gives some good basics on investment and finance planning)

Register yourself on http://www.etintelligence.com

B. International websites and magazines

http://www.bloomberg.com (You can track global markets on this and read International business news)

http://www.economist.com

http://www.forbes.com

http://www.ft.com

Hope it helps ….Happy investing!!!

@ Manish—>Only few investors are investing in ‘Jago’ way…..why don’t you write same articles in local newspapers. This will be helpful for large number of investors.

With Regards,

Pradip

Pradip

I dont have contacts in local newspapers 🙂 . How to do that ? any contacts ?

Manish

Hi Manish/Srinivas/Hemant,

So there is no workaround for NRI’s?

I have send mail to ICICI bank just now.let see what they reply?

Will update u all.

But in procedure verification is mentioned for which thy will send there executive at home.

To me return from floating rates doesn’t looks better.Instead of FR MF, ULIPS are

better(Considering some one already invest money in PPF).In ULIP also 100% debt(return keep changing) & 100% equity options are there.

Can surpass FR returns easily by switching & also by not using switch option & ULIP has additional advantage.

I have ICICI Life time Gold ULIP & have return more than 8% plus saved tax of 15k(actual amt) in two years.

Why don’t we suggest ULIP instead of FR MF?

Yogesh

We are not suggesting FRMF to everyone over ULIP’s . we are just explaining what is FR MF and how it works , we cant just have one type of things in portfolio , If one wants to buy FRMF considering interest rate are very high now , then ULIP’s wont be of much help there .

Manish

Nice article.

We can have this in protofolio.

Do we need to purchase this through demat account?

Can demat account be opened online?Any idea?

Does any one has opened demat account online?

Yogesh

Demat account has to be opened offline only , you might apply for it online , but for verification , document collection , signature they will come to you in person , you can buy every kind of mutual funds online .

manish

Good Info about ‘Floating Funds’ .

But i personally prefer to rest my cash reserve in to saving account only 🙂 [provided the time frame 1-1.5 years & FD rates were not quite attractive]

Ravii Ch .:*♥*:._.:*♥*: how abt resting cash into saving acnt only.. when FD were not attractive & time frame 1-1.5 yrs

Ravii Ch .:*♥*:._.:*♥*: rather than opting for flaoting funds

Ravii Ch .:*♥*:._.:*♥*: 🙂

manish: hmm.. if its emergency funds , then saving account makes sense

manish: floating rate fund are to be used for investment purpose

manish: when you want money to grow

manish: for short temr

manish: you are right

manish: 🙂

manish: in your comment

manish: I was replying to that one

manish: only

manish: I will copy paste this conversation now

Ravii Ch .:*♥*:._.:*♥*: hmm k

There seems to be some good sectoral funds too like Relian power divarsified or Canara Reb. Infra fund… It will be nice when u have time if you can have a post on sectoral fund.

Anu

Anu

Sure .. will review about sectoral funds in future 🙂 . for now just make sure that you dont understand in it unless you understand the sector or can bet on it confidently . its high risk/return investment option .

Manish

’emotional attyachar’ – I liked that !

Don’t really know what to do. Sometimes the only advantage is that incase something happen to parent, then the bank will pay the remaining premium.. with term ins n stuff they get the money right away n if the kids are too small (like in my case) by the time they grow up the money is already finished by the so called well-wishing guardian…. This is the only fear that i have.

What about investing some into this after the term n MF so it will be well diversified?

Anu

Anu

You have to think it this way . what do Child insurance plans do ?

– they provide lumsum at the end

– If you die , they pay lumpsum and then pay the premium till end and again pay at end .

Now you have to structure your Term plan + investments in the same way .

Take a Term insurance for for an amount which will take care of child when parent die , so that if things go bad in between , the money can be used for child + a lumpsum money can be invested in secure things like FD /PPF/Balanced MF so that child gets required money at the end when they require .

If nothing happens than the investments you are doing per month should take care of end .

What do you feel .

Manish

@Anu

Child Plan are waste of money & emotional attyachaar.

Nice link . I am amazed to see those emotional faces and pictures on the hoardings of these plans , total emotional atyachar 🙂

Manish

Great Article!!…

I have already invested a lumpsum into Reliance floating rate and STP from that to power sector diversified for a period of 30 months…So I think floating rate funds r a good option for investors having a lumpsum amount and want to go into equities, so by this way of STP u can cover market risk too…Wat do u guys say?

Sathya

Thats great .. Doing a STP from floating funds has one advantage that you dont have much of interest rate risk , because if you invest a big amount like 10 lacs and then even if there is a 1% change because of interest rates in a short span , it can be a big amount .

What do you think ?

manish

good point…

all I learnt about personal finance is that, its not an adventure…its a boring automated pre-decided plan which when done with good self discipline can reward you with excess of wealth…

wat do u think abt this philo? 🙂

Sathya

Great thought and very true, Investors from decades have thought that more action = more returns ,which is why a lot of investors end up investing in so many mutual funds , taking every type of policies 🙂 .

However , things which they ignore or are totally ignorant off are the most important thing in personal finance , that is Planning and execution with discipline 🙂

Manish

If STP is done from a floating fund like HDFC Floating rate Income fund long term plan (G), it will have 3% exit load on the money taken out. Any comment? Any other better option ?

Bdeb

Generally there is no exit load in case of STP . only if you redeem them there is load , STP are generally within AMC , so you can do STP from HDFC -> HDFC , in which case there is no sense of load , because money will be within the same family

Manish

@Manish and All,

No, Exit load is applicable if STP also. If units bought are switched out within 18 months then investor has to bear the exit load.

unless otherwise explicitly mentioned in some liquid/short term funds, STP carries exit load if redeemed or switched out before term.

oops .. never knew that 🙂

But it does not makes sense to charge exit load , its illogical .

manish

Dear Manish/Srinivas,

I wish to invest Rs. 3 lacs for one yr (into safe avenues) and was contemplating your points reg FRF/FRF+STP. But HDFC FRF- long term charges 3% exit load for redemptions/STP within 18 months. Is it then worthwhile to invest in it considering my investment horizon of 1 yr. where else then I should park my money? Please advice.

Rashmi

You can use this floating rate fund for slowly building up your emergency fund. After you complete 18 months, if you feel you have more surplus amount in FR funds, you can do STP of units which you bought 18 months back, only for those units no exit load.

I mean let’s say every month 1000 units, on 19th month, you can do STP for 1000 units without exit load, and 20th month for 2nd month units

Manish,

Excellent timing, yesterday my FD matured and i was wondering what to do next. As my earlier FD was at 8.5% but now SBI has automatically reinvested it for 1yr at rate of 6%. I will read more on debt oriented fund and will decide on same.

Marshal

Ok great .. Just make sure you understand the risk , thing can go bad here too ..

manish

Manish,

risk in terms of ?

Marshal

Marshal

Risk does not always mean “loss” , it can be loss of opportunity . When Interest rates are high , at that time , we should rather not invest in Floating rate debt funds , instead we should invest in normal debt funds which are linked to fixed rates , Non-floating debt fund can outperform floating ones in case interest rates are high ..

Manish

manish,

So what am getting here that at present rates are low so better to go for floating.?

Marshal

Marshal

Yes , if you feel interest rates can go up . If it does not, then you are at risk 🙂

manish

manish,

well if i would have known this, i could have possibly running another FP blog.. kidding..:)

give us some guidelines to understand interest rates movements.

Cheers

Marshal

Marshal

I will try to write on this sometime , a lot of things in kitty right now 🙂

Manish

Manish,

One more basic question how FR is different from RD and Term deposits offered by SBI, and we have option to do this online as well via netbanking.

See here

http://www.statebankofindia.com/user.htm?action=print_section&lang=0&id=0,1,19,114

Marshal

Marshal

Didnt we discuss this in article itself , the way they are different is that they are “mutual funds” and are linked to interest rates , so the NAV changes dynamically with interest rates .

RD or Time deposits have predicted rates , in FR we dont .

Manish

ok finally I opted for MOD(multiple options deposit) from SBI for savings account.

In this more than 5k in saving account will earn current fixed rates deposit without any locking period, no paper work and it will be on monthly basis. account will be like a normal saving account and in case of higher withdrawl (more than 5k) there will not be any issues… I think this has an advantage of high liquidity and at the same time more returns than saving also ease of use

Manish

I was asking you for a long time to write about liquid funds

Glad that you have started about FR funds.. Thank you

Please write about other types as liquid funds as well ( including the tax angle )

Dr Mohammed

Sure , i will try to write about it soon .. What are your views about FR funds in a general investor portfolio ?

manish

Could you please guide us about how to open NPS account?

Nilesh

http://jagoinvestor.dev.diginnovators.site/2009/05/nps-new-pension-scheme-detailed.html

Manish

Nice article! Manish

Query 1:

I would like to know the mode of payment whether we can invest in lumpsum or through SIP. Which is the best option?

Query 2:

What is your view regarding Highest NAV guarantee plans?

Vikrant

1 . Yes you can do SIP , but as there is less volatility , SIP wont help much 🙂

2. http://www.livemint.com/2010/01/10211459/Highest-NAV-guaranteed-but-no.html

manish

Very nice article, was not aware of the liquid mutual fund concepts at all

Sphurthy

Thanks , however this was not mainly on liquid funds … Liquid funds are mainly for short term tenure and primary reason is liquidity and not return 🙂 .

How much part of emergency fund should go in liquid funds as per your understanding ?

Manish

Hi Manish,

Very nice article. Thank you very much. What will be a good long term investment to invest 10 lacs or more, that can preserve the principal and provide 8% – 10% return over a 5 -10 year horizon.

Regards,

Manu

Manu

With 10 yrs in mind , the best thing would be to be with equity . If you have more inclination towards safety and your return expectation is not more than 11-12% , do this ..

Put this 10 lacs in debt fund and then start a STP in some balanced fund like HDFC Prudence per month for next 2 yrs .

Do you understand that this process will make sure you are not affected with volatility in markets + your money earns moderate returns .

manish

Dear Manish,

Thanks for the nice article.

Which Mutual Funds should be there in

1. Aggressive portfolio,

2. Moderate portfolio?

The tenure will be 10 years with every year performance review.

Needs your opinion.

Thank you,

Pradip

Pradip

Moderate portfolio : http://jagoinvestor.dev.diginnovators.site/2009/11/list-of-best-debt-oriented-mutual-funds-for-2009-2010.html

Aggressive portfolio : http://jagoinvestor.dev.diginnovators.site/2009/08/list-of-best-equity-diversified-mutual.html

Manish

@Manish,

Thank you for nice info.

With regards,

Pradip

Pradip

You can tell our situation here and fund you have choosen , we can have a look at that and suggest modifications 😉

Manish

Hi Manish,

I am planning to invest in followings with SIP (for 15 years),

1. HDFC TOP 200 -> Rs. 2000 p.m.

2. Reliance Regular Savings Equity -> Rs. 1000 p.m.

3. HDFC Prudence -> Rs. 2000 p.m.

4. Sundaram Select Midcap-> Rs.1000 p.m.

5. DSPBR Top 100 Eqt. Reg. -> Rs. 1000 p.m.

6. IDFC Premier Equity Plan-A -> Rs. 1000 p.m.

7. Canara Robeco Equity Tax Saver -> Rs. 1000 p.m.

8. HDFC Tax Saver -> Rs. 1000 p.m.

9. UTI Mahila Unit Scheme ->Rs. 2000 p.m.

Along with the investment in above MFs, I am planning

A) to invest Rs. 40,000 in PPF every year

B) also, taking Term Plan of 50L (for 25 years) –> SBI Shield (25L) and LIC-Amulya Jeevan (Table no. 190)(25L) for me and my wife.

(The performance of each Mutual Fund to be reviewed every 15-18 months and amount in underperforming fund is to be transferred to the better one).

Please give your valuable opinion.

With Best Regards,

Pradip

Pradip everything else look good except the number of mutual funds you are planning to take , why 9 funds of same kind , just 2-3 are enough

Also , the over all opinion should be given after understanding a lot of things like your future goals , risk appetite , your knowledge , your willingness to be involved etc .

manish

manish

Hi manish,

Good Article (as usual) !

Manish it will be really helpful if you can give your views of ulips that are suitable n especially designed to meet child education. To me HDFC Young star looks good. I can send you some of the materials i have on that. Do let me know.

Ulip bcoz of the insurence cover incase something happens to the parent the policy will still continue.

Thanks – Anu

@Anu

You are also Victim of emotional attyachar (Child Insurance Plans).

Anu

These Child Plans are nothing but normal ulips with some added features which make them look a full fledged tool for managing your child education . You can manage things on your own using Term + MF + ETF + PPF

Manish

Good one again Manish…Thanks for the info!!!

Krish

Do you think you will be investing in these funds ? Do they suit your portfolio ?

Manish

Sure Manish…I do have couple of equity diversified MF’s. Now I have an idea about this. Looking forward to make investment on this too…Once again Thanks for sharing this article!!!!

Krish

I was just asking you .. make sure it suits your requirement , every other product we talk here does not mean that it has to go in your portfolio 🙂

manish

Nice article again buddy, you have explained floating rate mutual funds tremendously well.

Suhasini

Credit goes to Srinivas 🙂 .. What percentage of portfolio do you think can go in these funds ? What is your understanding on Interest rates movement ?

Manish