2 big reasons why markets are falling?

POSTED BY ON March 16, 2020 COMMENTS (24)

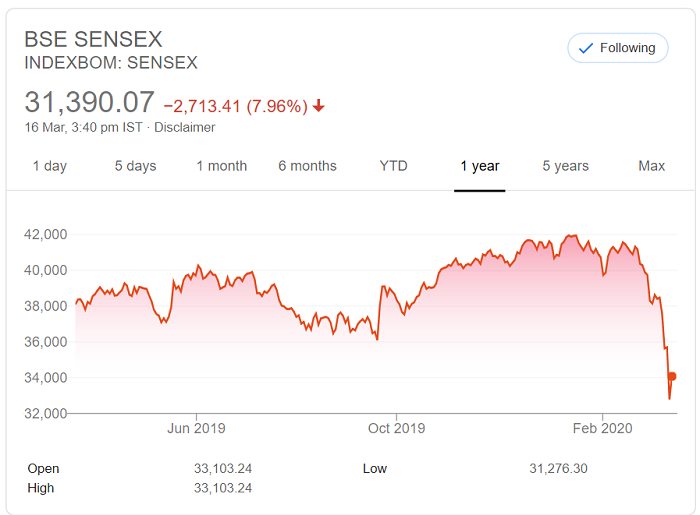

Sensex is down by 7.96% today

In the last 1 month alone the markets have corrected by 23% and it was one of the fastest and steepest declines ever in the history of stock markets in India (and globally)

A lot of equity investors are very new to this game and many might be wondering what is going on and why markets are falling?

So in this article, I will just jot down 2 big reasons which are contributing to this steep fall.

Reason #1 – Fear and Panic because of Coronavirus

The biggest reason and the trigger of this huge market falls from the last 1 month is because of the coronavirus.

The entire world is fearful about the spread of this virus and its impact on the world.

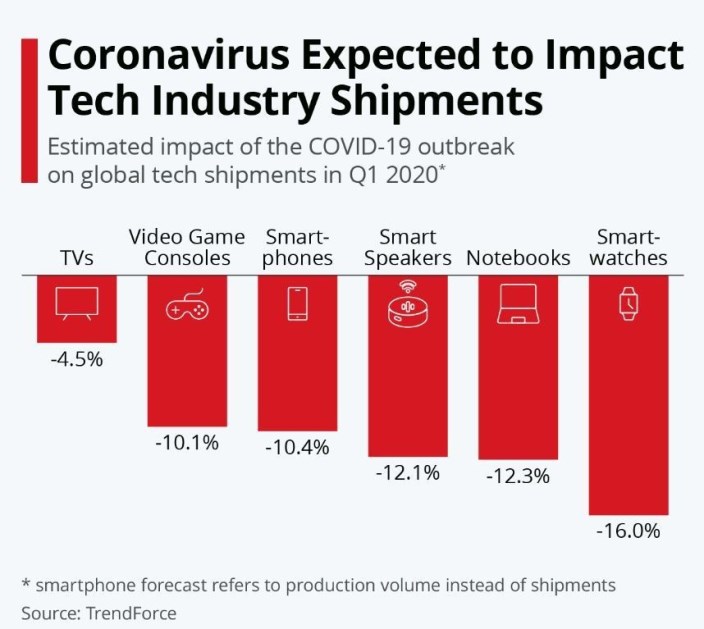

In the entire world, the businesses are hugely impacted because of coronavirus. Because of this virus and the fear around it, various factories are shut down and work is stopped. Other companies which needed raw material are not getting it and production is down. Overall manufacturing is HIT.

Which also means that consumption is down and will be down in the near future also and it will only go up slowly over time.

One very simple example is APPLE. Its products get manufactured in China and because China factories is shut down, the apple stock is down because it’s going to hit their profitability.

One more way of understanding coronavirus impact on business is simple meat/poultry businesses especially in India. The demand for Chicken/mutton or other similar items have drastically gone down. No one is buying it. Now imagine the job losses, no sale of associated products like poultry feeds by poultry farms..

Another example is the tourism industry. People are not going on vacations, or booking very less flights, etc. which is directly going to impact so many companies on at a deeper level.

So in general various businesses around the world are impacted and as you might be knowing stock markets chase earnings. Because the future earnings of companies across the world are going to be impacted, the stock markets are just reflecting that today.

Markets are desperately looking for news where we develop some medicine or vaccine for coronavirus which gives some kind of assurance that we will be able to control this virus and further damage.

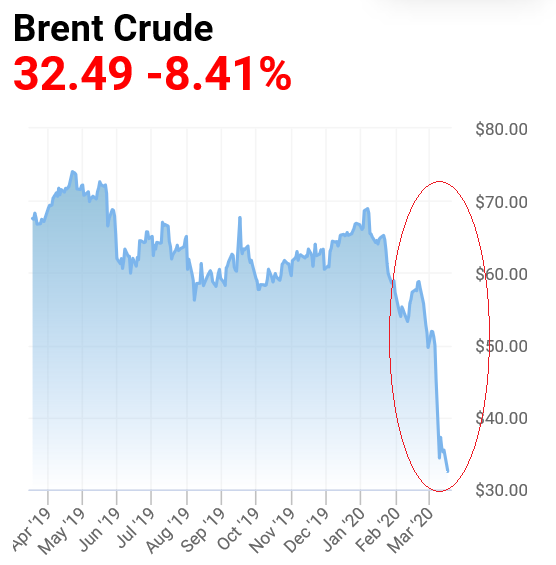

Reason #2 – Crude Oil Price Crash

Crude oil in international markets has crashed badly.

The oil price was a few days back fell by almost 30% in one single day and hit around $30 per barrel (Oil price in 1947 was $28 per barrel)

This was $120-130 around 10 yrs back and just 2 yrs back it was in $60-70 range.

The huge drop in oil prices also indicates huge slowdown and low demand, even though it’s amazing news for India because we import oil and it’s going to save us billions of dollars in oil bill.

Why is it happening?

Well, its extremely complicated thing for a retail investor like you and me, but for now you should know that there is a price was going on between Russia and Saudi Arabia which has triggered this oil crash. Russia did not honor its promise as per its OPEC promises and now Saudi Arabia is kind of punishing it for going against OPEC and have crashed the prices which as per some analyst is not going up very soon.

You can either read this article or watch this excellent YouTube video to understand about oil crash.

Conclusion

For the last many months, there was a correction expected but the sudden rise of coronavirus has added a new level of fear among investors and the crash happened before people even realize what is happening.

Markets have corrected by a good margin and now we have officially entered into a bear market (above 20% fall is bear market). While no one can catch the bottom and can’t guarantee that more down fall cannot happen, this is surely not the time to sell off your long term money. If it was your short term money, it should not have been there in equity markets at all.

One of the suggestions right now would be to partly invest some money which you don’t need for the next 8-10 yrs and be ready with some cash incase the market falls further from here.

Disclaimer: This is a highly complex topic and I do not claim to be an expert on this matter. I have shared my opinion and my limited understanding, so please feel free to correct me on any point.

Always great insight.

Nice information

Thank You

Nice article, I think we should continue our SIP’s because after 2 to3 years there will be rebound and in this bear phase we got more units. Can we invest in gold

Yes, I also think so ..

GOLD, yes you can invest if you want to diversify !

What you think that, how much more the market will fall? Its already fallen from 41K+ to 27K+.

For small investor like me who have just entered market some time back, its very heart breaking to see investment going negative. In case we invest in bank FD, PPF, PF etc……. every quarter or yearly we accumulate the interest and that sum becomes the principal for next year. But in stock or mutual funds, this is not the case.

Arun

As you have started, I know its can be very shocking to see that markets are falling. Its like a bad start ..

I can only suggest right now is to experience what is happening .. Its not the right time for me to preach and educate because it will not work

Manish

Money is not everything in world. Learnt to live a healthy and Dharmic life.

Good point !

It may not be everything, but it is quite a lot as long as we exist in the physical, natural world.

Dharmasya moolam Artham, as was said aptly by Acharya Chanakya!! The basis of all “dharma” is “artha” or wealth. So, I seriously doubt that a good healthy Dharmic life can be lived without taking care of Artha.

First of all have sufficient emergency fund seeing the current situation and future jobs cut and then plan for investment

Yes, one has to have sufficient emergency fund into a safe place!

No one in India will accept for a 8- 10 year,, but some billionaire investors will do,,,, my suggestion is can invest partly now and wherever it goes down invest some. So they can average . But the things is choosing a good stock is important .

Yes, right point in my opinion!

I have been investing in mutual funds through SIP since 2016. While starting SIP’s, my aim was to continue till at least till 2030-2032. But markets are falling very sharply since last few days which is making me very nervous. What should I do? Shall I continue my SIP’s?

If you have not taken any action few months back, then this is now a time to just continue as the fall has already happened by a big margin .

Hello,

Good article that is needed for investor to know about the market crash. What should we do as investor? and should we buy some equity stocks or not as price slash for long term perspective? How is it impact on the amount invested through SIP?

I have personally added some more investments after the fall and will continue it .. I think in 4-5 yrs it will make good enough profits

Being a regular reader of your articles, i have waited to hear from you people and expected more precise suggestions on dos and don’s in the current turmoil in the market with suggestions on specific stocks which are attractive to buy now for long-term.

Hope you get me and request you to do so.

We don’t give any tips at stock level. But the stocks like HDFC bank is surely a must buy .. Buy on further dips.. a big downfall has already happened .. fall has been sharp, recovery will also be !

Hi

Your artical is very nice. We can expect still market down fall will continue ? Until invented vaccination for COVID-19. It’s right time to invest or we can wait some more time ?

Hello Mr. Nag,

If you want you can partly invest some money which you don’t need for next 8-10 yrs and be ready with some cash incase market falls further from here.

Thank You

Anuradha

I think 8-10 years is too pessimistic. If we can control this virus spread over the next few months, the economy will rebound back 8n 2-3 years if not less.

Given the timing, yes that part of money which one puts right away may give good returns in just few years time, but in equity we always suggest long term to be 8-10 yrs …